The global market for the Digital Experience Platform is anticipated to develop at a compound annual growth rate (CAGR) of 13.3% throughout the course of the forecast, to reach USD 30.41 billion by 2030.

.jpg)

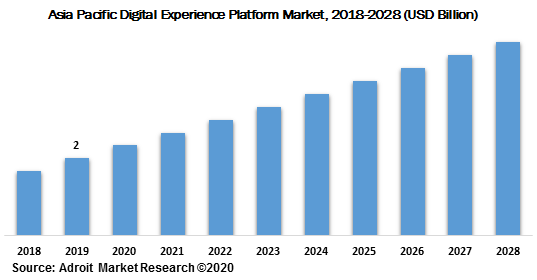

The market size for the global digital experience platform (DXP)is anticipated to reach USD 16 billion by 2028. The factors such as assistance in understanding the instantaneous requirements of the customer, increasing deployment of the cloud-based platform, decreasing the consumer churn rate, along with a growing demand for big data analytics, is responsible for the growth of Digital Experience Platform Market

The increasing implementation of DXP for handling customer queries through automatic response processes and providing consumers with real-time feedback on the requests raised is likely to spur the market demand at exponential levels. On the other hand, the need to handle enormous data and evolving technologies, such as Artificial Intelligence (AI), cloud computing, data analytics outsourcing, and the Internet of Things (IoT) testing, are projected to offer immense market prospects for digital experience platform providers in the coming few years.

Digital Experience Platform Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 30.41 billion |

| Growth Rate | CAGR of 13.3% during 2020-2030 |

| Segment Covered | Component,Deployment, Application, End-use, Regional |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Adobe Systems, SAP, IBM, Microsoft, Oracle, Salesforce, SDL, Sitecore, Acquia, OpenText, Jahia, Episerver, BloomReach, Liferay, Squiz, Kentico, and more. |

Key Segment Of The Digital Experience Platform Market

Component (USD Billion)

• Platform

• Services

Deployment, (USD Billion)

• On-premise

• Cloud

Application, (USD Billion)

• Business-to-Consumer

• Business-to-Business

• Others

End-use, (USD Billion)

• BFSI

• Healthcare

• IT & Telecom

• Manufacturing

• Retail

• Others

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

In the past few years, the consumer experience has evolved as an important competitive differentiator for enterprises owing to the inclination towards an omnichannel approach and enhanced digitization, Businesses are implementing digital experience platforms to connect with customers throughout multiple touchpoints using customized and dynamic content based on customer’s product preferences or specific needs.

Moreover, the competency of the digital experience platforms to analyze and collect the consumer buying behavior and integrate customer data obtained from several points of interaction to build a centralized view is also a key factor backing the industry growth. Also, incorporation of evolving technologies, such as big data, Artificial Intelligence (AI), and Machine Learning (ML) have facilitated key solution enablers to upgrade their DXs, thus triggering the demand for digital experience platforms within multiple applications.

Component Segment

The global Digital Experience Platform Market contains both platform and services segment. The services segment has a maximum revenue share within the global Digital Experience Platform Market in 2019. This is predominantly owing to the wide implementation of digital experience platforms across service providers and enterprises, thereby generating demand for professional services and managed services throughout the globe. The platform segment is anticipated to hold a significant market share from 2020 to 2028.

Deployment Type Segment

Based on the deployment segment, the market is bifurcated into two sub-segments that are on-premise, and cloud. In 2019, the on-premise segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. However, the cloud segment is anticipated to grow at a substantial growth rate over the forecast period. The cloud enables organizations with a unified platform with SaaS-based services providing improved security.

End-User Segment

Based on the end-user, the market is segmented intoBFSI, retail, travel & hospitality, healthcare, manufacturing, IT & telecom, media & entertainment, public sector, and others. The retail segment to hold a considerable market share in 2019due to the factors such as customer-centric approach along with a rising focus on enhancing customer retention and engagement, implementing a consumer specific pricing strategy, and delivering personalized products. The digital experience platforms are leveraging evolving technologies, such as AI, ML, and data analytics to analyze consumers’ search, purchasing and browsing histories, and social media interactions.

The global Digital Experience Platform Market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the digital experience platform end-users, owing to an outsized presence of organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the Digital Experience Platform Market in North America.

The major players of the global Digital Experience Platform Market are Adobe Systems, SAP, IBM, Microsoft, Oracle, Salesforce, SDL, Sitecore, Acquia, OpenText, Jahia, Episerver, BloomReach, Liferay, Squiz, Kentico, and more. The Digital Experience Platform Market is fragmented with the existence of well-known global and domestic players across the globe.