DevSecOps is an abbreviation for development, security, and operations. DevSecOps activities are focused on developing innovative strategies for complicated product development processes through an agile environment. Its purpose in the enterprises is to provide cyber security protection to execute protection decisions and actions at the same level as DevOps decisions and actions. DevSecOps is a cloud-based or on-site implementation service that can be used through BFSI, IT & telecommunications, retail, and consumer goods, among others.

The global DevSecOps market is expected to develop USD 23.16 Billion by 2029, at a compound annual increase in price (CAGR) of 31.5% throughout the forecast period.

.jpg)

This can be attributed to a growing appetite for highly secure networks and an increasing emphasis on security in organizations. Besides, increasing security breaches, awareness of DevSecOps platforms, the need to improve SDLC by reducing the time spent, and increasing investment activities are also boosting global DevSecOps market growth.

However, the lack of skilled professionals and the organization's resistance to the use of new tools and technologies is likely to hamper the market growth.

DevSecOps Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 23.16 Billion |

| Growth Rate | CAGR of 31.5% during 2019-2029 |

| Segment Covered | Deployment Type, Component, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Broadcom (U.S.), IBM (U.S.), MicroFocus (U.K.), Synopsys (U.S.), Microsoft (U.S.), Google Inc., (U.S.), Check Point Software Technologies Ltd. (U.S.), Palo Alto Networks (U.S.) |

Key Segment Of The DevSecOps Market

Deployment Type,(USD Billion)

• Cloud

• On-Premises

Component,(USD Billion)

• Solution

• Services

Organization Size,(USD Billion)

• Small and Medium-Sized Enterprises

• Large Enterprises

Vertical,(USD Billion)

• BFSI

• IT and Telecommunications

• Government and Public Sector

• Retail and Consumer Goods

• Manufacturing

• Energy and Utilities

• Media and Entertainment

• Healthcare and Life Sciences

• Others

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

DevSecOps is a theory of developing innovative methods for complicated product development processes through an agile environment. It minimizes the frequency of safety bottlenecks, and there is no need to wait until the production period is finished before security tests are carried out. Such factors improve the speed of distribution of the items. It also helps cross-conventional differences between IT and infrastructure while maintaining a stable and quick delivery of the file. The growing adoption of different tech applications amongst companies and customers has unlocked new avenues for hackers to hack data that contribute to a lack of protection in terms of coding or configuration. DevSecOps is expected to play a critical role in ensuring security by partnering with different agencies at the initial level of product development.

Component Segment

In terms of components, the market is bifurcated into solutions and services. In the year 2020, the solutions segment gathered the major growth and it is likely to keep its position throughout the forecast years. The companies with DevOps platform to implement DevSecOps solutions to provide a higher level of security and reliability in their applications is driving the adoption of DevSecOps solutions.

Deployment Segment

In terms of deployment, the market is bifurcated into on-premises and cloud. The cloud segment is expected to record the highest CAGR because of its potential to boost the technology of enterprises by providing scalability and increased business efficiency. Moreover, the on-premises segment is expected to register significant growth in terms of revenue as it reduces third-party interference and provides direct access to conventional business-critical data.

Enterprise Size Segment

Based on the enterprise size, the market is segmented into small & medium, and large enterprises. The large enterprise segment leads the market growth in 2019 and it is anticipated to hold its position during the forecast years. The market growth of this segment is mainly attributed to the A increasing awareness of the advantages of DevOps and cloud solutions, the emergence of risks and vulnerabilities that cause companies to expand their emphasis on the protection of their software, and the globalization of industry by multinational vendors. On the contrary, the small & medium enterprise segment is projected to accumulate major growth in forthcoming years.

Industry Vertical Segment

In terms of the industry vertical segment, the market is segmented into BFSI, Government, IT & Telecommunications, Public Sector, Manufacturing, Retail & Consumer Goods, Energy & Utilities, Media & Entertainment, Healthcare & Life Sciences, and Others. In 2019, the retail and consumer goods segment accumulated the major market share and it is expected to do so over the forecast years. This is mainly attributed to the high adoption rate of DevSecOps solutions and services in the retail industry, as they benefit from increased operating efficiency and competitiveness, a stable and safe IT environment, quicker time-to-market, and enhanced consumer experience.

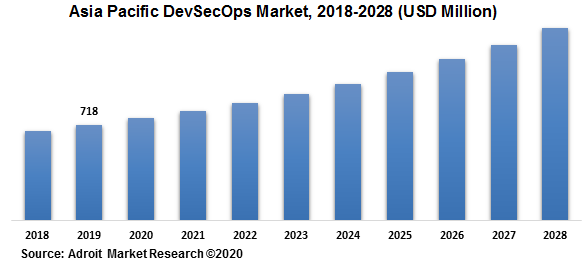

The Asia Pacific region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2018-2028. Also, the region is anticipated to gather the highest growth over the forecast years. The market growth in this region is mostly ascribed to the Rapid advances in cloud computing, IT infrastructure systems, and the Internet of Things ( IoT) have driven many companies to implement DevSecOps technologies and services. With the growing introduction of cloud computing and the growing need for enterprise functions for IT, the introduction of stable software creation and implementation solutions is expected to grow rapidly throughout the forecast period.

The major players of the global DevSecOps market are CA Technologies, IBM, MicroFocus, Synopsys, Microsoft, Google, Dome9, PaloAltoNetworks, Qualys, and Chef Software. Moreover, the market comprises several other prominent players in the DevSecOps market that are Threat Modeler, Contrast Security, CyberArk, Entersoft, and Rough Wave Software. The DevSecOps market consists of well established global as well as local players. Also, the previously recognized market players are coming up with new and advanced strategic solutions and services to stay competitive in the global market.