Market Analysis and Insights:

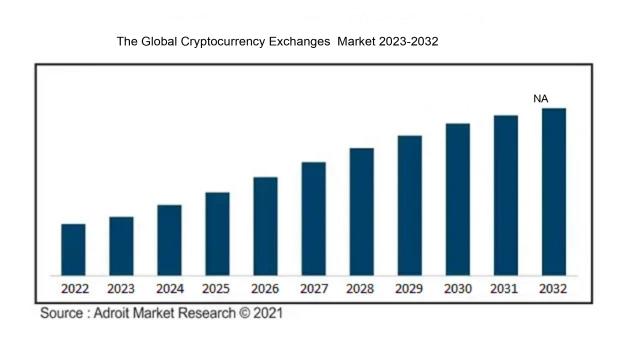

In 2023, the worldwide cryptocurrency market achieved a valuation of around USD 2.43 billion. Between 2024 and 2032, a CAGR of 17.9% is predicted for the market for cryptocurrencies worldwide.

The global cryptocurrency market is anticipated to grow significantly over the coming years. Before investing in cryptocurrencies, however, it is critical to understand the market problems. Although Bitcoin remains the most recognised and expensive cryptocurrency, its supremacy is waning. Ethereum is the next most popular cryptocurrency, and it is starting to gain traction as a DeFi and other application platform. Alternative cryptocurrencies, or altcoins, are gaining popularity. Solana, Avalanche, and Polkadot are three of the most popular altcoins. Stablecoins are cryptocurrencies whose worth is defined by the intrinsic worth of a fiat currency. Investors use them to hold value and hedge against the volatility of other cryptocurrencies. Cryptocurrency institutional use is expanding. This is due to hedge funds, asset managers, and other monetary institutions becoming more aware of the potential advantages of cryptocurrencies. Although the Global Cryptocurrency Market continues to be in its infancy, it is fast expanding. We must remain current on market shifts and developments to make well-informed decisions.

Cryptocurrency Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD NA |

| Growth Rate | CAGR of 17.9% during 2024-2032 |

| Segment Covered | By Type, By Application, Region |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Bitmain Technologies Ltd., Xilinx, Inc., Intel Corporation, Advanced Micro Devices, Inc., Ripple Labs, Inc., and Bitfury Group Limited are examples of such companies., Ledger SAS, Nvidia Corporation, BitGo, Xapo, and other |

Market Definition

A virtual or digital currency that is secured by cryptography is called a cryptocurrency. Cryptocurrencies are impossible to forge thanks to this security feature. The distinguishing feature of cryptocurrencies is that they are usually not granted by a centralized authority, which presumably shields them against interference or manipulation by the government. Cryptocurrencies are frequently exchanged and accepted as payment for products and services on decentralized exchanges. The fact that cryptocurrencies are unregulated by financial institutions or the government is one of their most significant features. In cryptocurrencies, cryptography is employed to protect transactions from counterfeiting. If a public blockchain is used, all cryptocurrency transactions can be tracked because it is a distributed ledger that is accessible to everyone. Cryptocurrency may be sent and received globally, even without the need for middlemen. A few of the most well-known and widely used cryptocurrencies are Dogecoin, Litecoin, Ethereum, and Bitcoin. The topic of cryptocurrencies is controversial; some people think they can revolutionize the banking sector, while others think they are a scam. Before investing in cryptocurrencies, one must conduct independent research.

Key Market Segmentation:

Insights on Key Types:

In the global cryptocurrency market, Bitcoin holds the largest market share. The biggest market capitalization and highest value among cryptocurrencies is Bitcoin. Having made its debut in 2009, Bitcoin is also the most established cryptocurrency.

Transactional Cryptocurrencies: The original purpose of these digital currencies was to be used as a means of exchange. The use of transactional cryptocurrencies as a means of payment is growing, especially for cross-border and internet transactions. However, both organizations and consumers still do not fully understand transactional cryptocurrency.

Platform cryptocurrencies: These digital currencies are designed to serve as development platforms for smart contracts and decentralized applications (DApps). The most popular cryptocurrency platform is called Ethereum. As the basis for DeFi and other applications, platform cryptocurrencies are beginning to gain traction. DeFi is a ground-breaking financial colud that allows users to get financial services directly from suppliers, thanks to blockchain technology.

Utility cryptocurrencies: Cryptocurrencies classified as "utility" ones are meant to be used for specific purposes, such as making purchases on a particular network or platform. Filecoin is a utility cryptocurrency. Although utility cryptocurrencies are still in their early stages of development, they have the power to completely change how we communicate online. For instance, utility coins can be used to obtain exclusive access to content and services as well as to pay for goods and services on decentralized platforms.

Insights on Key Applications:

The Global Cryptocurrency Market's most popular application is payment processing. The most common use case for cryptocurrencies, given their increasing popularity, is payments. This is because cryptocurrencies have so many benefits, such as low transaction costs, fast settlement times, and global accessibility.

Payments: Payments for goods and services can be made with cryptocurrencies both online and offline. Bitcoin is now being accepted as payment by more companies, including well-known merchants like Microsoft and Overstock.com. Although they are becoming more and more well-liked, cryptocurrencies still need to be a commonly used means of payment. This is being fueled by a surge in the number of businesses that accept cryptocurrencies as well as an increase in the number of customers using them.

Remittances: Using cryptocurrencies, money may be sent and received anywhere in the globe quickly and affordably. This is particularly helpful for people who reside in countries with high remittance fees or unstable currencies. Particularly attractive as a remittance alternative are cryptocurrencies due to their speed, affordability, and security. This is particularly helpful for people who reside in areas with expensive remittance costs or unstable currency exchange rates.

Investment: Cryptocurrencies can be traded on exchanges for a profit. A volatile asset type with significant potential returns is cryptocurrency. A volatile class of assets with significant potential rewards are cryptocurrencies. This has led to a wider range of investors showing an interest in the Bitcoin space.

Decentralized Finance (DeFi): DeFi is an entirely new financial system built on blockchain technology. It provides clients with access to financial services like borrowing, trading, and lending without the need for middlemen. DeFi may only be starting, but it already has all the tools necessary to completely transform the financial industry. DeFi has all the necessary components to completely transform the financial system even if it is still in its infancy. DeFi's influence on the Bitcoin market is starting to increase, and in the years to come, its reputation is predicted to rise.

Non-fungible tokens (NFTs): Non-fungible tokens (NFTs) are distinct digital items that are not replicable. NFTs are frequently used to prove ownership of digital goods, such as collectables, music, and artwork. Although NFTs are a new asset class, they have the power to alter how we interact with technology. NFTs are a comparatively new asset class that is gaining popularity quickly. NFTs have the power to transform how we communicate in the technological sphere and are now being used to prove ownership of a wide range of digital goods.

Insights on Regional Analysis:

North America controls the majority of the global bitcoin market. North America has the most established bitcoin market in the world. The United States is North America's largest cryptocurrency market, followed by Canada. A lot of reasons drive the North American cryptocurrency business, including strong adoption rates, favourable government laws, and the existence of large cryptocurrency exchanges and organisations.

Asia Pacific: The Asia Pacific bitcoin market is the world's fastest expanding. China had Asia Pacific's largest cryptocurrency market, however, it outlawed cryptocurrency trading in 2021. Japan is now the Asia Pacific region's largest cryptocurrency market, accompanied by South Korea and India. Several variables, including strong internet penetration rates, ened curiosity in DeFi and NFTs, and a huge population of young people, are driving the Asia Pacific cryptocurrency sector.

Europe: The European cryptocurrency industry is expanding, although it is still less developed than those in North America and Asia Pacific. The UK is Europe's largest cryptocurrency market, which is surpassed by Germany and France. A lot of factors are driving the European cryptocurrency sector, including rising business and consumer acceptance, favourable government legislation, and the presence of significant cryptocurrency exchanges and enterprises.

Company Profiles:

The Global Cryptocurrency Market's high competitiveness forces enterprises to focus on various strategic initiatives to increase their market positions. Bitmain Technologies Ltd., Xilinx, Inc., Intel Corporation, Advanced Micro Devices, Inc., Ripple Labs, Inc., and Bitfury Group Limited are examples of such companies., Ledger SAS, Nvidia Corporation, BitGo, Xapo, and other market participants are focusing on creating and delivering a variety of mining

hardware and software solutions.

COVID-19 Impact and Market Status

The COVID-19 outbreak severely impacted the Global market. The market fell sharply in the initial stages of the pandemic, as investors sold off riskier assets. However, the Global Cryptocurrency Market swiftly regained and has since reached fresh all-time highs. The epidemic had both positive and negative consequences on the Global Cryptocurrency Market. On the plus side, the pandemic has spurred interest in cryptocurrency as a haven asset.

Cryptocurrencies are viewed as a hedge versus inflation and financial turmoil, both of which increased as a result of the pandemic. On the negative side, the epidemic reduced consumer spending, which had a negative influence on cryptocurrency demand. The pandemic also slowed the development and implementation of cryptocurrency-related goods and amenities. Overall, the Global Cryptocurrency Market was impacted by the COVID-19 outbreak in a mixed manner. The market had both good and negative repercussions, but overall, the impact was beneficial. The market has grown in size and

maturity since the epidemic, and it is likely to expand further in the future years. The Global Cryptocurrency Market is still in its early phases, but it is expanding rapidly. The previously mentioned trends are anticipated to continue affecting the industry in the coming years.

Latest Trends and Innovation:

? El Salvador makes Bitcoin legal tender in 2021.

? The United States Securities and Exchange Commission (SEC) certifies the first Bitcoin futures ETF (2021).

? Meta (previously Facebook) reveals intentions to create a cryptocurrency-powered metaverse (2022).

? PayPal introduces a cryptocurrency payment service in 2022.

? Visa and Coinbase collaborate to allow customers to spend cryptocurrency at retailers worldwide (2022).

? Microsoft will accept cryptocurrency payments for Xbox content and services in 2022.

? Terraform Labs and its CEO Do Kwon have been charged by the SEC with fraud and unregistered

securities sales in connection with the collapse of the TerraUSD (UST) stablecoin (2022).

? The European Union adopted the Markets in Crypto Assets (MiCA) regulation, which establishes a comprehensive legal framework for cryptocurrencies in the EU by 2022.

Significant Growth Factors:

Businesses and customers all over the world are increasingly accepting cryptocurrencies as payment. This is owing to the numerous advantages that cryptocurrencies provide, such as minimal transaction fees, quick settlement times, and accessibility worldwide. DeFi is a ground-breaking financial system based on blockchain technology. It enables customers to obtain the availability of financial services such as lending, borrowing, and trading instead of the involvement of intermediaries. DeFi is growing in popularity because it gives customers greater control over their finances and larger returns than

conventional financial solutions. A variety of governments throughout the world are starting to recognise the potential advantages of cryptocurrencies and have adopted initiatives to encourage their use. El Salvador, for example, has made Bitcoin legal cash, and the Securities and Exchange Commission (SEC) of the United States has authorised the first Bitcoin futures ETF. The blockchain technology at the heart of cryptocurrencies is continually evolving and improving. This is resulting in the creation of new and novel cryptocurrency applications, that are fueling the market growth. Since their supply is limited and they are not vulnerable to government control, cryptocurrencies are considered as a hedge against inflation. This is increasing the appeal of cryptocurrencies to investors, particularly in nations with strong inflation rates.

Restraining Factors:

Cryptocurrencies are notorious for their volatility, which indicates that the value of them can swing dramatically. As a result, investors and businesses may find them less desirable. The regulatory framework for cryptocurrencies is still changing, and some jurisdictions lack clarity. Businesses may find it challenging to function in the bitcoin industry as a result of this. Cryptocurrencies are subject to theft and hacking. This has resulted in certain high-profile occurrences, which have reduced market trust. Despite their growing acceptance, cryptocurrencies are not frequently recognised as a payment method. This is because of a variety of issues, including a lack of understanding, technical difficulties, and security concerns. Cryptocurrencies are extracted using powerful computers that need a lot of power. This has generated concerns about cryptocurrency's environmental impact. These are only a few of the issues plaguing the worldwide Bitcoin market. Because the Global Cryptocurrency Market appears to be in its early phases, these obstacles are expected to endure in the short future. The Global Cryptocurrency Market, however, is likely to develop dramatically in the future years as the sector matures and these difficulties are addressed.