The market size for global cognitive collaboration is anticipated to reach USD 4,235.8 million By 2028.

.jpg)

The factors such as the growing need for cloud collaboration and mobility along with easy integration with the already prevailing environment and are responsible for the rising demand for cognitive collaboration market.

The global market for the Cognitive Collaboration is anticipated to develop at a compound annual growth rate (CAGR) of not information% throughout the course of the

The cognitive collaboration integrates artificial intelligence (AI), natural language processing (NLP), and advanced algorithms in hardware, software, and cloud analytics. It facilitates new content intelligence levels along with insights to enhance human management as well as teamwork. Cognitive collaborations assist businesses by offering contextual insights to users during their business communications. The growing requirement for collaborations and mobility creates a favorable industry scenery for the vendors active in the cognitive collaboration industry over the forecast period.

Cognitive Collaboration Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 4,235.8 million |

| Segment Covered | Component, Organization Size, Deployment, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Cisco, Slack Technologies, Microsoft, Softweb Solutions, LOOP AI Labs, CognitiveScale, Intec Systems Limited, Bluescape, Collaboration.Ai, Chanty, Ku Zoom.ai, Resemble Systems, iotum, Konolabs, and more |

Key Segments of the Global Cognitive Collaboration Market

Component Overview (USD Million)

- Solutions

- Services

Organization Size Overview (USD Million)

- SMEs

- Large Enterprises

Deployment Overview (USD Million)

- On-premise

- Cloud

Application Overview (USD Million)

- BFSI

- Telecom & IT

- Healthcare

- Energy &Utilities

- Education

- Retail

- Others

Regional Overview (USD Million)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global cognitive collaboration market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global cognitive collaboration market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the cognitive collaboration industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on organization type, component, deployment, and application. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global cognitive collaboration market. The report will benefit:

- Every stakeholder is involved in the cognitive collaboration market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the global cognitive collaboration market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global cognitive collaboration market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

The demand for the cognitive collaboration market globally to witness considerable growth in the coming five years. It includes the practice of implementing thinking and behavioral preferences to create an environment encouraging high quality as well as frequent collaboration. It incorporates enterprise content, artificial intelligence, and data insights along with analytics to offer contextual significance to the organizational meeting, team collaboration, calling, and contact center communications. Cognitive collaboration uses cloud and deep analytics to facilitate new levels of insight and intelligence to enhance teamwork and human engagement.

However, complexity in countering eDiscovery may obstruct the industry growth. On the other hand, the incorporation of artificial intelligence in business processes is anticipated to showcase substantial growth prospects for the key industry participants operating within the cognitive collaboration industry over the forecast period. Various organizations have started adopting cloud-based deployment for supporting businesses to operate easily and enhanced agility. It delivers more scalability functions compared to the on-premise solutions, which has improved its adoption by various enterprises. Such increased adoption is predicted to fuel the global cognitive collaboration industry demand.

Component Segment

The global cognitive collaboration market contains both solution and service segments. The solution segment has a maximum revenue share within the global cognitive collaboration market in 2019. This is predominantly owing to the capability to integrate with present systems that include data analytics, social media assistance, facial recognition, and availability of deployment alternatives for various mobile devices. The services segment is anticipated to grow at a significant growth rate from 2020 to 2028.

Organization Size Segment

Based on the organization size segment, the market is divided into two segments that are small & medium, and large enterprise. In 2019, the large enterprise segment gathered the largest market revenue and it is anticipated to govern the cognitive collaboration market throughout the forecast period. However, the small & medium segment is expected to grow at a good growth rate over the forecast period.

Deployment Segment

Based on the deployment segment, the market is divided into two on-premise segments, and cloud. In 2019, the on-premise segment has the largest market share and it is expected to dominate the market throughout the forecast period. However, the cloud segment is anticipated to grow at a substantial growth rate over the forecast period. The cloud enables organizations with a unified platform with SaaS-based services providing improved security.

Application Segment

Based on the application, the market is segmented into BFSI, telecom & it, healthcare, energy & utilities, education, retail, and others. The market for the telecom & IT sector is anticipated to possess the largest market share in 2019 since the Tech companies today are developing to match the user specification. Moreover, the industry’s rising need for streamlined business processes coupled with enhanced customer satisfaction, as well as advantages such as risk management, and customized solutions are some of the factors responsible for the cognitive collaboration demand.

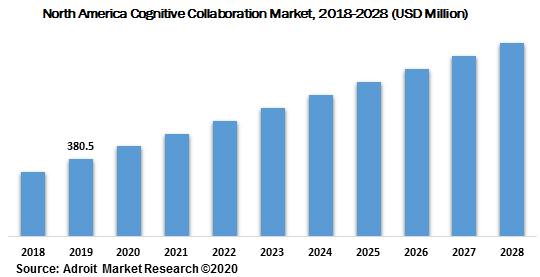

The global cognitive collaboration market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the cognitive collaboration applications, owing to an outsized presence of an organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the cognitive collaboration market in North America.

The major players of the global cognitive collaboration market are Cisco, Slack Technologies, Microsoft, Softweb Solutions, LOOP AI Labs, CognitiveScale, Intec Systems Limited, Bluescape, Collaboration.Ai, Chanty, Ku Zoom.ai, Resemble Systems, iotum, Konolabs, and more. The cognitive collaboration market is fragmented with the existence of well-known global and domestic players across the globe.