Market Analysis and Insights:

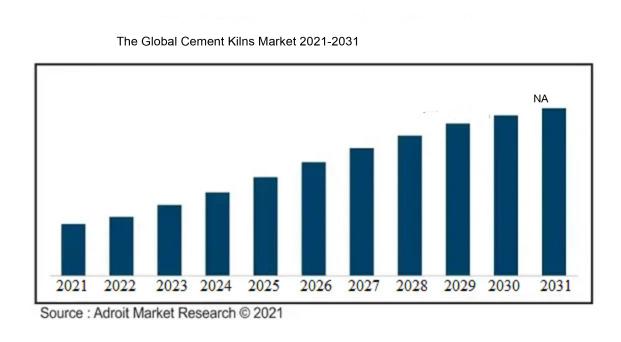

According to estimates, the market for cement kilns will be worth USD XX billion in 2021. It is estimated to increase from 2021 to 2031 at a compound annual growth rate (CAGR) of XX%, reaching an anticipated value of USD XX billion in that year.

There are numerous important reasons that are the driving forces behind the cement kilns market. First and foremost, the market is expanding due to the rising demand for cement and building supplies, particularly in emerging nations. As urbanization and infrastructure development projects continue to grow, there is an increasing need for cement kilns to boost the pace of cement output. Additionally, environmental regulations and sustainability goals are also influencer the market, with cement kilns being increasingly required to adopt cleaner and more efficient technologies to reduce emissions and waste. This has led to a rise in the implementation of advanced kiln systems that use alternative fuels and raw materials. Furthermore, the technological advancements in cement kilns, such as the development of pre-heater and pre-calciner technologies, are enhancing the energy efficiency and productivity of the kilns, further propelling the market growth. Overall, the driving factors of the Cement Kilns Market revolve around the increasing demand for cement, environmental considerations, and technological advancements in kiln systems.

Cement Kilns Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | NA |

| Growth Rate | CAGR of NA during 2021-2031 |

| Segment Covered | by Type,By Application, By Distribution Channel ,By End User,by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | CRH plc, Buzzi Unicem, Votorantim Cimentos, and China National Building Material (CNBM). |

Market Definition

Cement kilns are large industrial furnaces used in the production of cement. They are designed to generate high temperatures to heat and chemically transform raw materials into cement clinker. Cement kilns are an integral part of the cement manufacturing process and play a crucial role in the construction industry. In these kilns, raw materials like clay and limestone are transformed into clinker, which is subsequently processed into fine powder to make cement.

The importance of cement kilns lies in their ability to meet the growing demand for cement, which is a fundamental smart building material used in the construction of infrastructure and buildings worldwide. The kilns provide a reliable and cost-effective means of producing large quantities of cement consistently, ensuring a steady supply for the construction industry.

Moreover, cement kilns also contribute to sustainable development by utilizing alternative fuels and raw materials, reducing greenhouse gas emissions, and minimizing the use of natural resources. This not only makes the manufacturing process more environmentally friendly but also helps in the efficient utilization of waste materials. Overall, cement kilns are essential in meeting the global demand for construction materials, while also promoting sustainable practices and reducing the environmental impact of cement production.

Key Market Segmentation:

Insights on Type

The More Than 5000ton/day Segment is Accounted for the Highest Share

In the global cement kilns market, the subsegment of the type that is expected to dominate is the more than 5000ton/day segment. This is mainly due to the increasing demand for cement from the construction industry and infrastructure projects. The higher capacity of these kilns allows for greater production output, thereby meeting the growing demand for cement in large-scale construction projects. Additionally, the advancements in technology and automation in these kilns contribute to their efficiency and productivity, further driving their dominance in the market. With their ability to handle large volumes of cement production, the more than 5000ton/day cement kilns are likely to capture a significant share of the global market.

Moving on to the other subsegments, the less than 2000ton/day segment also holds a substantial share in the global cement kilns market. These kilns are typically suited for smaller-scale cement production, making them suitable for niche applications and regional markets. The flexibility and affordability offered by these kilns make them popular among smaller construction projects and local cement manufacturers.

The 2000-5000ton/day segment is another significant subsegment in the market. These kilns strike a balance between production capacity and cost-effectiveness, catering to medium-sized construction projects and cement manufacturers. These kilns are a popular option for a variety of cement industry applications because of their adaptability and efficiency.

Overall, while the more than 5000ton/day segment dominates the global cement kilns market, the less than 2000ton/day and 2000-5000ton/day subsegments also play crucial roles in meeting the diverse needs of the construction industry, infrastructure projects, and other end users. The distribution of market share among these subsegments reflects the varying requirements and preferences of different customers in different regions.

Insights on Application

The Dry Cement Production Segment is Accounted for the Highest Share

Among the subsegments of the application in the global cement kilns market, it is expected that the dry cement production subsegment will dominate the market. Dry cement production is a widely adopted method in the cement industry due to its advantages such as reduced energy consumption, high production efficiency, and lower environmental impact. The demand for dry cement production is driven by its ability to produce high-quality cement that meets industry standards. With the increasing focus on sustainable and energy-efficient cement manufacturing processes, the dry cement production subsegment is likely to witness significant growth in the global cement kilns market.

Moving on to the other subsegments, the wet cement production subsegment also holds a substantial market share in the global cement kilns market. Wet cement production is a traditional method that involves the use of water in the grinding and mixing process. This approach is frequently employed in areas with abundant water supplies and lax environmental restrictions. The wet cement manufacturing subsegment is used in a variety of infrastructure and building applications.

Insights on End Users

The Construction Segment is Accounted for the Highest Share

The construction industry is a significant consumer of cement, particularly for the production of concrete, which is the most widely used construction material. Global residential and commercial construction projects, infrastructure development, and increasing urbanisation all contribute to the need for cement in the building sector. The construction industry's requirement for cement is anticipated to fuel the growth of the cement kilns market.

Lastly, the "others" subsegment, which includes sectors such as oil and gas, agriculture, and mining, is expected to have a smaller share in the global cement kilns market. While these industries may have specific requirements for cement, their demand is comparatively lower compared to the construction industry and infrastructure projects. However, the diverse range of applications in these sectors ensures a steady demand for cement kilns in the global market.

Overall, while the dry cement production subsegment is predicted to dominate the global cement kilns market, the wet cement production subsegment, construction industry, and other sectors also play significant roles in shaping the market dynamics.

One subsegment of the End User that is expected to dominate the Global Cement Kilns market is the Construction Industry. The construction industry plays a crucial role in the consumption of cement kilns for various applications like the production of concrete and mortar. With the increasing demand for housing and infrastructure projects worldwide, the construction industry holds a significant share of the global cement kilns market. Urbanization, population increase, and governmental efforts to upgrade infrastructure are the main drivers of the construction industry's growth, particularly in emerging nations. As a consequence, it is anticipated that the construction industry's need for cement kilns will continue to dominate the market.

A sizable portion of the worldwide cement kilns market is held by the Infrastructure Projects subsegment in addition to the Construction Industry's dominant subsegment. In order to build infrastructure projects like roads, bridges, airport lighting, and railroads, a significant amount of cement is needed. This subsegment is expanding as a result of quick urbanization, industrialization, and government expenditures on infrastructure. The increasing need for better transportation facilities, modernization of existing infrastructure, and focus on sustainable construction techniques further drive the demand for cement kilns in infrastructure projects.

The other subsegment of the End User segment, Others, includes industries and applications beyond the construction and infrastructure sectors. This subsegment includes industries like manufacturing, oil and gas, and commercial applications where cement kilns are used for various purposes. In manufacturing industries, cement kilns are utilized for the production of cement-based products, such as tiles, blocks, and precast concrete elements. The oil and gas industry utilizes cement kilns for wellbore cementing during the drilling and production processes. Additionally, the commercial sector may require cement kilns for specific construction projects or maintenance purposes.

Overall, while the Construction Industry subsegment is likely to dominate the Global Cement Kilns market, the Infrastructure Projects subsegment holds a significant share as well. The Others subsegment encompasses various industries and applications where cement kilns are utilized, extending the reach of the market beyond construction and infrastructure-focused sectors.

Insights on Distribution channel

The Direct Sales Segment is Accounted for the Highest Share

In the distribution channel subsegment of the Global Cement Kilns Market, it is expected that direct sales will dominate. Direct sales allow cement kiln manufacturers to establish a direct relationship with customers, enabling effective communication and customization of products and services. This approach ensures the manufacturers have direct control over the sales process, while also minimizing distribution costs and allowing for competitive pricing. Direct sales also provide manufacturers with valuable customer feedback and insights, which can be used to continuously improve and innovate their products. Overall, the direct sales subsegment is anticipated to have a strong presence and dominate the Global Cement Kilns Market.

In addition to direct sales, the distributor subsegment of the distribution channel is also expected to play a significant role in the Global Cement Kilns Market. Distributors act as intermediaries between manufacturers and end-users, facilitating the distribution process and ensuring wider market reach. They have established networks and relationships with various buyers and can effectively promote and distribute cement kilns to different regions. This subsegment offers manufacturers the advantage of utilizing the existing distribution infrastructure and expertise of distributors, thereby reaching a larger customer base. Collaboration with distributors can enhance market penetration and boost sales of cement kilns in various regions.

Furthermore, manufacturers can also explore other distribution channels such as online sales, which have gained significant traction in recent years. Online sales provide convenience and accessibility to customers, enabling them to browse and purchase cement kilns from the comfort of their homes or offices. This subsegment has the potential to tap into a global customer base and expand market reach beyond traditional brick-and-mortar stores. Online sales can provide manufacturers with a competitive edge by offering a seamless buying experience and leveraging digital marketing strategies to target specific market segments.

While direct sales, distributorship, and online sales are expected to dominate the Global Cement Kilns Market, it is important to acknowledge the role of other distribution channels as well. These may include strategic partnerships or collaborations with construction firms, infrastructure project developers, or cement production companies. Such partnerships can offer manufacturers the opportunity to align their products with specific projects and cater to the unique requirements of these end-users. By diversifying distribution channels and leveraging the strengths of each subsegment, manufacturers can maximize their market presence and cater to the diverse needs of the Global Cement Kilns Market.

Insights on Regional

The Asia Pacific Region is Dominated the Market

Due to a number of factors, including increasing urbanization, population expansion, and infrastructural development in nations like China and India, this area is predicted to dominate the industry. Cement is in great demand in these nations for the construction of residential, commercial, and industrial structures. Additionally, governments in the region have implemented several initiatives and policies to promote infrastructure development, further driving the demand for cement kilns. Further, it is anticipated that the Asia Pacific region will dominate the worldwide market due to the presence of significant cement kiln manufacturers in this area, technical developments, and expenditures in research & development.

In contrast, the market for cement kilns is anticipated to increase moderately in the European area. This may be ascribed to elements like stricter environmental laws and a move towards environmentally friendly building techniques. Europe has made a concerted effort to lower carbon emissions and support alternate methods of producing cement. As a result, the demand for cement kilns may observe a progressive drop. Nonetheless, a number of European nations are making investments in cutting-edge technology and putting circular economy ideas into practise, which may eventually increase demand for cement kilns.

Similarly, North America is anticipated to experience steady growth in the cement kilns market. The region is characterized by a prominent construction industry and the presence of major players in the cement manufacturing sector. The market for cement kilns in North America may, however, be limited in its expansion by elements including growing reliance on alternative construction materials and environmental concerns.

Finally, it is anticipated that the market for cement kilns would expand significantly throughout the Middle East and Africa. This can be attributed to massive infrastructure projects, urbanization, and population growth in countries like Saudi Arabia, the UAE, and South Africa. The region's abundance of natural resources, including limestone and shale, further supports the growth of the cement kilns market. However, challenges related to political instability and economic uncertainties in some countries may pose a hindrance to market growth.

Company Profiles:

1. Given that they are in charge of producing and delivering cement to satisfy demand from a variety of building projects globally, cement producers are essential to the global cement kilns industry.

2. Environmental regulatory bodies play a crucial role in the global cement kilns market by monitoring and enforcing environmental regulations for emissions and waste management, ensuring sustainable and eco-friendly operations.

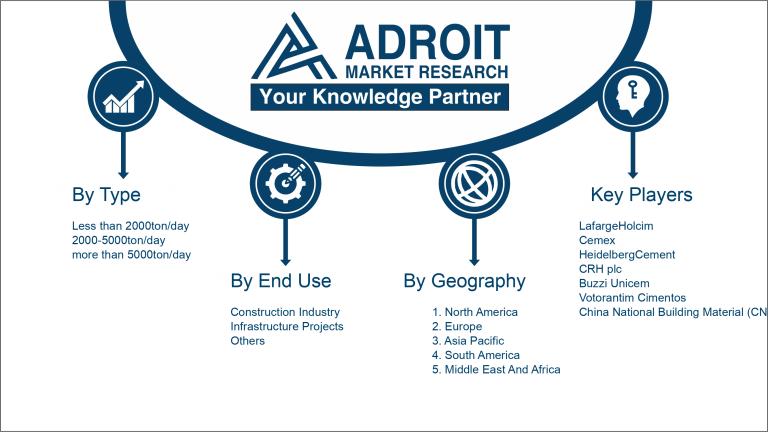

The market for cement kilns is a cutthroat one, with a number of major competitors propelling its expansion. Some of the prominent names in this market include LafargeHolcim, a global leader in building materials, which operates cement kilns in various locations worldwide. Another major player is Cemex, a multinational building materials company that owns and operates cement kilns across different regions. HeidelbergCement, one of the world's largest integrated building materials manufacturers, is also a key player in the cement kilns market. Other notable names include CRH plc, Buzzi Unicem, Votorantim Cimentos, and China National Building Material (CNBM). These companies possess extensive experience and expertise in the cement industry and play a crucial role in shaping the market through their production, distribution, and customer reach. With their competitive strategies and commitment to sustainability, these key players continue to drive innovation and contribute to the overall growth of the cement kilns market globally.

COVID-19 Impact and Market Status

The COVID-19 epidemic has had an effect on the global cement kiln market, reducing sales and output due to a drop in demand for building materials. Longer project timelines and greater costs have also been brought about by disruptions in supply networks.

The COVID-19 epidemic has had a major impact on the cement kiln industry. The widespread lockdown measures and restrictions on construction activities to control the virus's spread have resulted in a decline in cement demand. This has led to reduced production and utilization of cement kilns. The market has also been damaged by the interruption of supply networks and logistical difficulties. Cement usage has decreased as a result of the pandemic-related closure of building sites, infrastructure projects, and commercial structures.

The market for cement kilns has also been impacted by a decline in investment in new construction projects as a result of the economic uncertainties brought on by the epidemic. However, as countries begin to ease restrictions and resume construction activities, there is a gradual recovery in demand. The trend towards sustainable development and the promotion of green initiatives may also present opportunities for cement kiln manufacturers to adapt and integrate environmentally friendly technologies. Overall, the COVID-19 pandemic has significantly disrupted the cement kilns market, but there are signs of recovery and potential for growth in the future.

Latest Trends and Innovation:

? There have been several recent developments by companies operating in the Cement Kilns Market. Here are some notable ones:

1. LafargeHolcim: LafargeHolcim, one of the largest cement producers in the world, has been actively investing in research and development for sustainable cement kiln technologies. They have introduced several innovative solutions, such as low-carbon fuel usage, waste heat recovery systems, and alternative raw materials, to reduce carbon emissions in cement production.

2. CEMEX: CEMEX, a global building materials company, is focusing on digital transformation in cement kilns. They are implementing advanced sensor technology and data analytics to optimize kiln operations and improve energy efficiency.

3. HeidelbergCement: HeidelbergCement is actively working towards decarbonization in cement production. They have initiated various projects to develop carbon capture and utilization technologies for cement kilns. By leveraging these technologies, they aim to capture and utilize carbon dioxide emissions, ultimately reducing overall carbon footprints.

4. CRH plc: CRH plc, an international building materials company, has been focusing on sustainability and circular economy principles in cement kiln operations. They are incorporating alternative raw materials, such as industrial by-products and recycled materials, into cement production, thus reducing reliance on traditional raw materials and promoting waste valorization.

5. Buzzi Unicem: Buzzi Unicem is investing in the development of advanced control systems for cement kilns. These systems optimize kiln operations, improve product uniformity, and reduce energy usage via the use of artificial intelligence and machine learning algorithms.

These are just a few examples of recent developments by companies in the Cement Kilns Market. The industry as a whole is striving to adopt more sustainable practices, reduce carbon emissions, and improve energy efficiency in cement production.

Significant Growth Factors:

The growing need for cement in construction and infrastructure projects is driving the growth of the cement kiln market.

A number of key reasons are contributing to the huge growth of the cement kiln market.

First off, the demand for cement and the expansion of cement kilns are being driven by the brisk urbanization and infrastructural development in emerging nations. Additionally, the increasing population and rising disposable incomes are leading to an increased demand for housing, commercial buildings, and public infrastructure, further contributing to the growth of the cement kilns market. Moreover, governments across the world are investing heavily in various construction projects, such as roads, bridges, airports, and dams, to promote economic growth, which is expected to boost the demand for cement kilns. Additionally, the adoption of energy-efficient and environmentally friendly cement kilns is driving market expansion due to the implementation of severe environmental laws and the requirement for sustainable development. The integration of advanced technologies, such as automation and digitization, in cement kilns is also driving market growth, as it improves operational efficiency and reduces energy consumption. Likewise, the growing trend of using alternative fuels, such as biomass and waste materials, in cement manufacturing is further positively impacting the growth of the cement kilns market. Overall, these factors are creating a favorable environment for the growth of the cement kilns market globally.

Restraining Factors:

Limited availability of raw materials and stringent environmental regulations pose restraining factors for the cement kilns market.

The cement kilns market faces several restraining factors that hinder its growth and development. Firstly, environmental concerns surrounding the high levels of emissions and pollution from cement kilns have led to stricter regulations and policies, making it more challenging for companies to operate. Additionally, the high cost of implementing new technologies and equipment to reduce emissions can be a significant financial burden for cement kiln operators. Furthermore, changes in the cost of the raw materials used in kilns, such as coal and petroleum coke, can have an impact on the market's overall profitability. The availability and accessibility of alternative construction materials, such as recycled aggregates and green concrete, also pose a challenge to the growth of cement kilns. Furthermore, the slow pace of infrastructure development in some regions can limit the demand for cement, affecting the market's expansion. Despite these restraining factors, there are positive developments in the cement kilns market. Energy consumption and emissions are being decreased with the use of technological innovations and creative kiln designs. Research and development expenditures are being made by governments and industry actors in an effort to create sustainable solutions, such the use of eco-friendly raw materials and renewable energy sources. Furthermore, the market for cement kilns is expected to expand due to the rising need for infrastructure development in emerging nations. By addressing the restraining factors and harnessing these positive aspects, the market can overcome challenges and thrive in the future.

Key Segments of the Global Cement Kilns Market

Type Overview

• Less than 2000ton/day

• 2000-5000ton/day

• More than 5000ton/day

Application Overview

• Wet Cement Production

• Dry Cement Production

End User Overview

• Construction Industry

• Infrastructure Projects

• Others

Distribution Channel Overview

• Direct Sales

• Distributor

Regional Overview

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• France

• U.K.

• Spain

• Italy

• Russia

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• South Korea

• ASEAN

• Australia

• Rest of Asia Pacific

Middle East & Africa

• Saudi Arabia

• UAE

• South Africa

• Egypt

• Ghana

• Rest of MEA

Latin America

• Brazil

• Argentina

• Colombia

• Rest of Latin America