Market Analysis and Insights:

The market for Antibiotics was estimated to be worth USD 2.8 billion in 2024, and from 2023 to 2032, it is anticipated to grow at a CAGR of 17.3%, with an expected value of USD 11.2 billion in 2034.

.jpg)

The antibiotics market is influenced by a variety of significant factors, notably the rising incidence of bacterial infections and ened awareness regarding antimicrobial resistance (AMR). With the prevalence of antibiotic-resistant bacteria increasing, there is an urgent need for the discovery and development of innovative and effective antibiotics, propelling research and development within the pharmaceutical industry. Furthermore, the growing elderly population, which is more prone to infections, contributes to this market's expansion. The improvement of healthcare infrastructure, particularly in emerging economies, increases access to antibiotics, while governmental efforts aimed at promoting judicious antibiotic use are designed to address AMR. Additionally, breakthroughs in biotechnology and genomics are essential for the creation of new antibiotics and alternative treatment modalities. Together, these elements shape a vibrant antibiotics market, fostering both demand and continued investment in research to find new therapeutic solutions.

The Antibiotics Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2034 |

| Study Period | 2023-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 11.2 billion |

| Growth Rate | CAGR of 17.3% during 2024-2034 |

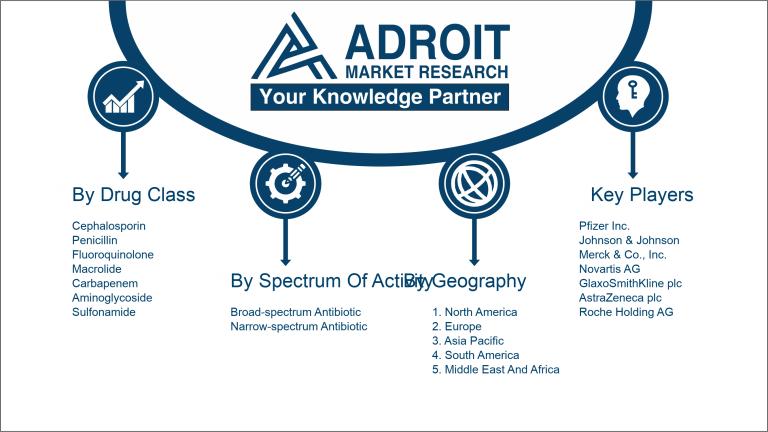

| Segment Covered | By Drug Class, By Application, By Action Mechanism, By Spectrum, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Novartis AG, GlaxoSmithKline plc, AstraZeneca plc, Roche Holding AG, Bayer AG, Sanofi S.A., Teva Pharmaceutical Industries Ltd., Abbott Laboratories, Bristol-Myers Squibb Company, Eli Lilly and Company, Biogen Inc., and Amgen Inc. |

Market Definition

Antibiotics are pharmaceutical agents formulated to destroy or hinder the proliferation of bacteria, playing a crucial role in the management of bacterial infections. Their mechanism of action involves focusing on particular cellular functions or components within bacterial cells, thereby contributing to the relief of ailments induced by these microorganisms.

Antibiotics are essential in contemporary healthcare, providing effective treatment for bacterial infections that can pose serious risks to life if not treated. They function by either stopping bacterial growth or directly destroying the bacteria, allowing the immune system to clear the infection. The advent of antibiotics has significantly lowered death rates from illnesses once deemed lethal, including pneumonia and tuberculosis. Furthermore, they are integral to numerous medical interventions, such as surgical operations and cancer therapies, where they help safeguard susceptible individuals from infections. It is crucial to use antibiotics judiciously to combat the development of resistance, preserving their effectiveness for future use.

Key Market Segmentation:

Insights On Key Drug Class

Penicillin

Penicillin is expected to dominate the global antibiotics market due to its historical significance, widespread use, and effectiveness against various bacterial infections. As the first antibiotic discovered, it set the stage for later developments in antibiotics. Penicillin maintains a substantial share of the market, primarily due to its effectiveness, affordability, and extensive applications across healthcare settings. Current clinical practices continuously leverage penicillin for treating a range of infections, including those caused by gram-positive bacteria, making it an indispensable option for healthcare professionals. Additionally, as antibiotic resistance becomes an increasing concern, the renewed focus on effective, time-tested antibiotics like penicillin contributes to its sustained demand in the market.

Cephalosporin

Cephalosporins have gained significant traction in the antibiotics market owing to their broad-spectrum activity and effectiveness against both gram-positive and gram-negative bacteria. These antibiotics are frequently used in hospital settings and outpatient care for infections such as pneumonia and skin infections. The classification has multiple generations, each providing a wider spectrum of activity, which has further enhanced their appeal among healthcare providers. As there is an increasing incidence of infections caused by resistant bacteria, the demand for cephalosporins is likely to grow as they offer robust alternatives for treatment.

Fluoroquinolone

Fluoroquinolones continue to hold a notable place in the antibiotics market primarily due to their effectiveness against various bacterial infections, particularly in outpatient settings. Their broad-spectrum activity enables them to be prescribed for conditions such as urinary tract infections and gastroenteritis. However, due to growing concerns regarding potential adverse effects and resistance patterns, their usage has been monitored closely. Despite this, the ongoing need for effective oral antibiotics keeps fluoroquinolones relevant, as they cater to patients requiring convenient treatment options while ensuring efficacy in their applications.

Macrolide

Macrolides are popular antibiotics known for their effectiveness against several bacterial pathogens, particularly in respiratory infections. These drugs are widely used due to their favorable safety profile and ability to treat atypical pathogens causing pneumonia and other upper respiratory infections. Their bacteriostatic action, along with anti-inflammatory properties, makes them essential in treating a diverse range of infections. As public awareness continues to increase regarding bacterial resistance, the demand for macrolides is expected to grow, particularly in outpatient and community settings, as they offer a reliable choice for clinicians.

Carbapenem

Carbapenems are a critical class of antibiotics known for their robustness against resistant bacteria, including multidrug-resistant strains. They are often reserved for severe or complicated infections, especially in hospital settings, reflecting their importance in modern antimicrobial therapies. With a narrow focus on serious infections, the market for carbapenems is driven by the rise in complicated infections alongside increasing antibiotic resistance. Consequently, healthcare providers rely on carbapenems as a last line of defense, ensuring that their presence will remain significant in addressing critical health threats prompted by resistant pathogens.

Aminoglycoside

Aminoglycosides are particularly effective against gram-negative bacterial infections and are often utilized in combination therapies to enhance treatment efficacy. Despite their nephrotoxicity and the need for monitoring, the unique action of aminoglycosides makes them vital in treating severe infections such as sepsis. Their legacy in combination therapies—often employed for synergistic effects—continues to uphold their position in the market. As antibiotic resistance escalates, aminoglycosides also remain an essential option for specific infections, maintaining their relevance in clinical practice.

Sulfonamide

Sulfonamides, though less frequently utilized than in the past, still have a role in the antibiotics market as they were among the first synthetic antibiotics discovered. They are effective against a variety of bacterial infections, particularly those caused by gram-positive and some gram-negative organisms. Despite competition from newer classes, sulfonamides remain a cost-effective treatment option for specific infections, especially in resource-limited settings. Their persistent utility in certain conditions, such as urinary tract infections, keeps them relevant, although their overall market share may be overshadowed by other broader-spectrum antibiotics.

7-ACA

7-Aminocephalosporanic acid (7-ACA) serves as a crucial intermediate in the production of cephalosporin antibiotics. While it does not directly impact market dynamics in terms of therapeutic use, its significance lies in its role in the manufacturing of broad-spectrum antibiotics. This compound enables the pharmaceutical industry to create various cephalosporin derivatives, promoting the availability of effective treatments against a range of bacterial infections. As the demand for cephalosporins continues to rise, the role of 7-ACA will be pivotal in ensuring sufficient supplies of this essential antibiotic class.

Insights On Key Application

Respiratory Infections

Respiratory infections are expected to dominate the Global Antibiotics Market, driven by the rising prevalence of conditions such as pneumonia, bronchitis, and other related diseases. The increasing incidence of bacterial infections, especially post-COVID-19, has ened the demand for effective antibiotic therapies. Moreover, the growing awareness among healthcare practitioners and patients regarding the need for timely treatment for respiratory issues contributes significantly to the market growth. Advanced therapeutic options and ongoing research and development in this area further support the surge in antibiotic utilization for respiratory infections, making it a critical focal point in the overall antibiotic market.

Skin Infections

Skin infections represent a notable category in the antibiotics market. These infections, often caused by bacteria such as Staphylococcus aureus, are increasingly common due to factors like urbanization, changing lifestyles, and a rise in sports injuries. The demand for topical and systemic antibiotics to treat conditions such as cellulitis and impetigo drives this sector. Increased awareness and health-seeking behavior among the population have also contributed to the growth in antibiotic prescriptions for skin-related issues, establishing it as a key area of focus within the healthcare landscape.

Urinary Tract Infections

Urinary tract infections (UTIs) constitute another vital within the antibiotics market. UTIs are prevalent, especially among women, and are often caused by E. coli bacteria. The increasing incidence of UTIs, fueled by demographic factors such as age and sexual activity, promotes the demand for antibiotics. Additionally, the advent of antibiotic resistance necessitates ongoing research and innovation to develop effective treatments, providing substantial growth opportunities for this area within the antibiotics market.

Ear Infections

Ear infections, particularly otitis media, form an essential part of the antibiotics market. These infections are commonly seen in children but can also affect adults. The relatively high incidence of ear infections adds significant demand for supportive antibiotic treatment to relieve symptoms and address bacterial causes. The growing understanding of the importance of timely intervention in respiratory and ear-related healthcare further emphasizes the need for targeted antibiotic therapies in this space.

Septicemia

Septicemia is a critical condition resulting from severe infections that spread to the bloodstream, which also plays an important role in the antibiotics market. The urgency of treatment for septicemia underscores the necessity for rapid diagnosis and effective antibiotic intervention. The increasing incidence of hospital-acquired infections and the rise of antibiotic-resistant bacteria highlights the crucial demand for advanced antibiotic therapies targeting septicemia, thereby driving growth in this .

Gastrointestinal Infections

Gastrointestinal infections are another noteworthy component of the antibiotics market landscape. These infections, often caused by various pathogens, can lead to severe conditions requiring antibiotic therapy. The frequency of issues like foodborne illnesses and antibiotic-associated diarrhea highlights the need for effective treatment options. The ongoing efforts to improve food safety and sanitation also contribute to the demand for antibiotics in managing gastrointestinal infections, reflecting its importance in the overall market.

Insights On Key Action Mechanism

Protein Synthesis Inhibitors

Protein Synthesis Inhibitors are expected to dominate the Global Antibiotics Market due to their wide application and efficacy against various bacterial infections. These antibiotics, such as tetracyclines and macrolides, target the synthesis of proteins critical for bacterial growth and reproduction. The increasing prevalence of antibiotic-resistant bacteria has ened the demand for effective alternatives that can overcome these resistance mechanisms. As a result, the ongoing innovation in this category, particularly the development of novel agents that circumvent resistance, positions Protein Synthesis Inhibitors as a leading force in the market.

Cell Wall Synthesis Inhibitors

Cell Wall Synthesis Inhibitors play a crucial role in the antibiotics landscape, as they effectively disrupt the formation of bacterial cell walls, which is essential for their survival. This group includes well-known antibiotics like penicillins and cephalosporins, which have been historically significant in treating bacterial infections. Despite facing competition from newer classes of antibiotics, the established effectiveness and safety profile of Cell Wall Synthesis Inhibitors continue to sustain their demand, particularly in hospitals and outpatient settings. Their penetration in both the human and veterinary medicine sectors further solidifies their importance in the antibiotics market.

DNA Synthesis Inhibitors

DNA Synthesis Inhibitors have gained traction in the antibiotics market, particularly through drugs like fluoroquinolones. These agents work by interfering with bacterial DNA replication and repair processes, making them effective against a range of Gram-positive and Gram-negative bacteria. Their usage has expanded due to their efficacy in treating complex infections, such as those caused by multidrug-resistant organisms. However, concerns over side effects and increasing resistance profiles may hinder their growth in comparison to other classes, thereby influencing their overall market presence.

RNA Synthesis Inhibitors

RNA Synthesis Inhibitors, such as rifamycins, are vital in the antibiotics arena, specifically for tackling resistant strains like Mycobacterium tuberculosis. These agents target bacterial RNA polymerase, effectively preventing transcription and thus halting protein synthesis. While their niche applications are effective, limits in their usage for broader bacterial infections and potential side effects can affect their market share. Nonetheless, their importance in treating specific infections ensures they remain relevant within the antibiotics marketplace.

Mycolic Acid Inhibitors

Mycolic Acid Inhibitors are critical in the treatment of mycobacterial infections, notably tuberculosis. Drugs like isoniazid are specifically designed to inhibit the synthesis of mycolic acids, essential for the unique cell wall structure of Mycobacterium species. While their application is limited primarily to specific infections, the ongoing challenges of drug resistance continue to mandate the development of new therapies within this category. As public health initiatives focus on controlling tuberculosis and other mycobacterial diseases, Mycolic Acid Inhibitors hold a significant, yet specialized, position in the antibiotics market.

Others

The Others category includes various antibiotics that do not fit into the main classifications. This may encompass newer agents or combinations that have emerged in response to evolving bacterial resistance patterns. While they are generally less prominent in the market, advancements in research and development could lead to the introduction of innovative compounds that could significantly impact therapy options in the future. Their role in addressing specific conditions or resistant strains maintains their presence, albeit as a supportive component in the overall antibiotics market landscape.

Insights On Key Drug Origin

Synthetic

The Synthetic category is anticipated to dominate the Global Antibiotics Market. This shift can be attributed to the increasing prevalence of drug-resistant bacteria, which necessitates the development of new and effective synthetic antibiotics. Advances in pharmaceutical technology enable the creation of synthetic drugs that can be tailored for specific bacterial strains, enhancing their efficacy. Furthermore, the substantial investment in Research & Development (R&D) by pharmaceuticals focusing on synthetic options is fostering continual innovation and expanding the accessibility of synthetic antibiotics in treating a wide range of infections. This growing reliance on synthetic creations against antibiotic resistance is a critical driver for its dominance.

Natural

Natural antibiotics, derived from biological sources, exhibit profound therapeutic properties that have been utilized for centuries. Though this category holds historical significance, its market share is increasingly challenged by the rise of synthetic versions designed to target specific bacterial mechanisms. Limitations in the availability of new natural compounds and challenges in regulatory approvals further constrain market growth in this area. Moreover, the complex extraction processes and inconsistent supply of raw materials affect their scalability and ongoing utilization in modern medicine, which hinders their expansion in the competitive landscape of the antibiotics market.

Insights On Key Spectrum Of Activity

Broad-spectrum Antibiotic

Broad-spectrum antibiotics are expected to dominate the global antibiotics market due to their ability to target a wide range of bacteria, making them particularly useful in treating polymicrobial infections. Their effectiveness against both gram-positive and gram-negative bacteria allows for immediate treatment, especially in urgent medical situations where quick action is paramount. The growing prevalence of infectious diseases, coupled with the rising incidence of antibiotic resistance, has further ened the demand for these versatile drugs. Additionally, broad-spectrum antibiotics are often the first line of defense in hospital settings, which adds to their market dominance. The increasing use of these drugs in various therapeutic areas continues to drive their sales and prominence in the industry.

Narrow-spectrum Antibiotic

Narrow-spectrum antibiotics focus on specific types of bacteria, making them essential for targeted treatments. Their use is particularly prominent in outpatient care and for infections where the causative agent is known, leading to improved patient outcomes and reduced side effects. The growth in molecular diagnostics and microbiological testing supports the utilization of narrow-spectrum antibiotics, allowing healthcare providers to prescribe the most effective treatment options. Thus, while they may not dominate the overall market, their importance remains significant in specific therapeutic contexts.

Insights On Key Route of Administration

Oral

The oral route of administration is anticipated to dominate the Global Antibiotics Market due to its ease of use, patient compliance, and cost-effectiveness. Oral antibiotics can be taken conveniently as pills or liquids, making them appealing to patients and healthcare providers alike. This method not only simplifies the treatment process but also contributes to higher adherence to prescribed regimens, thereby improving therapeutic outcomes. Additionally, the availability of a wide range of oral antibiotics in various formulations enhances their market presence. Given the growing number of antibiotic-resistant infections globally, the demand for easily administered antibiotics is expected to rise, solidifying the oral route’s leading position.

Parenteral

The parenteral route of administration, while not the leading choice, plays a crucial role in the Global Antibiotics Market. This administration method is often favored in hospital settings for patients requiring immediate therapeutic effects, especially in cases of severe infections. Parenteral antibiotics provide a direct entry into the bloodstream, enabling rapid antibiotic action, which is critical in emergency situations or when oral intake is not possible. Furthermore, the rise in surgical procedures and the prevalence of serious bacterial infections have increased demand for injectable antibiotics, ensuring a significant presence in the overall market dynamics.

Summary

In summary, the oral administration of antibiotics is favored for its practicality and compliance, while the parenteral method is vital for acute care settings requiring fast interventions. Each route has its unique advantages, contributing to the market's growth from different angles.

Insights On Key Distribution Channel

Online pharmacies

Online pharmacies are projected to dominate the Global Antibiotics Market due to the rapid growth of e-commerce and increasing consumer preference for convenience. The accessibility of prescription medications through online platforms is becoming increasingly appealing to consumers who wish to avoid the challenges associated with visiting physical locations like retail pharmacies or hospitals. Additionally, the rise in mobile health applications and telemedicine has propelled online pharmacies forward by enhancing consumer trust and reliability in purchasing medications online. This trend is expected to continue as awareness about the efficiency and immediacy of online purchases expands among the population.

Retail pharmacies

Retail pharmacies play a significant role in the distribution of antibiotics, as they are often the most accessible option for consumers and provide the advantage of face-to-face consultations with pharmacists. Many patients prefer to purchase medications through local outlets where they can receive personalized advice and support. However, although they are a trusted and traditional channel for purchasing antibiotics, they face stiff competition from the growing online pharmacy sector, which offers greater convenience and often competitive pricing. As such, while retail pharmacies will maintain a strong presence, they may see slower growth compared to their online counterparts.

Hospitals

Hospitals serve as crucial points for antibiotic distribution, particularly for patients requiring immediate and intensive care. Hospitals have pharmacy departments that offer a wider range of antibiotics typically prescribed during hospitalization, and they often deal with more severe infections requiring stronger antibiotics. However, this channel mainly focuses on inpatients rather than prescriptions for outpatient use, which limits its overall market share. The requirement for specific prescriptions and hospital-based treatment can also discourage use outside the hospital environment, thereby reducing the potential growth in this relative to others.

Clinics

Clinics represent an essential distribution channel for antibiotics, primarily serving patients with non-emergency needs who require quick assessments and prescriptions. Healthcare providers in clinics can diagnose conditions and prescribe antibiotics in a more efficient manner than hospitals. However, the scope of this channel may be restricted due to limited operating hours, specialized services, and higher patient volumes leading to increased waiting times. Consequently, while clinics address important healthcare needs, their impact on the overall antibiotics market is less significant compared to retail and online pharmacies.

Insights on Regional Analysis:

North America

North America is poised to dominate the Global Antibiotics Market due to a combination of factors including advanced healthcare infrastructure, high investments in pharmaceutical research and development, and a growing prevalence of bacterial infections that necessitate antibiotic treatments. The region benefits from a robust regulatory environment that is conducive to innovative drug development. Additionally, the presence of major pharmaceutical companies enables rapid market introduction of new antibiotics, and there is a sustained focus on combating antibiotic resistance, further cementing North America's leadership position in the global market. The combination of high awareness among healthcare providers and patients regarding the use of antibiotics also significantly contributes to market growth.

Latin America

In Latin America, the antibiotics market continues to grow but faces challenges such as limited access to healthcare services and variability in the regulation of pharmaceuticals. While countries like Brazil and Mexico show potential due to increasing healthcare investments, the market is still relatively fragmented, impacting the growth rate. Awareness campaigns on antibiotic use are being implemented to combat over-prescription, but the region still struggles with high levels of antibiotic resistance, affecting the overall market dynamics.

Asia Pacific

Asia Pacific presents a mixed picture for the antibiotics market, with a rapidly growing demand driven by populous nations like India and China. However, the region encounters significant challenges such as the overuse of antibiotics, which has led to alarming rates of antimicrobial resistance. Despite the increasing healthcare expenditure and government initiatives targeting antibiotic misuse, the market is often fragmented, affecting the timely introduction of innovative therapies. Nevertheless, increased urbanization and changing lifestyles are set to drive growth in this region in the longer term.

Europe

In Europe, the antibiotics market is characterized by stringent regulatory frameworks and a strong focus on antimicrobial stewardship programs. The region showcases a high level of awareness surrounding antibiotic resistance, resulting in careful monitoring and regulation of antibiotic prescriptions. Countries such as Germany, the UK, and France lead in market size due to extensive healthcare systems that promote research and development of new antibiotics. However, the overall growth may be subdued due to ongoing efforts to reduce antibiotic use and a shift towards alternative therapies in some s of the population.

Middle East & Africa

The Middle East & Africa region is likely to experience slow but steady growth in the antibiotics market. Factors such as increasing healthcare expenditure and rising awareness about bacterial infections contribute to this growth. However, challenges persist, including limited healthcare infrastructure in many subregions and insufficient regulation regarding antibiotic use. Despite such obstacles, improvements in healthcare access and efforts to combat antibiotic resistance are expected to create growth opportunities in the long run. The increasing prevalence of healthcare-associated infections may further drive demand for antibiotics in this diverse and evolving region.

Company Profiles:

Leading entities in the worldwide antibiotics industry, particularly prominent pharmaceutical firms, stimulate innovation by actively engaging in research and development, which secures a consistent availability of potent therapies. Moreover, these companies are instrumental in overcoming regulatory hurdles and meeting public health demands by pursuing strategic partnerships and expanding their market reach.

Key participants in the antibiotics sector comprise Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Novartis AG, GlaxoSmithKline plc, AstraZeneca plc, Roche Holding AG, Bayer AG, Sanofi S.A., Teva Pharmaceutical Industries Ltd., Abbott Laboratories, Bristol-Myers Squibb Company, Eli Lilly and Company, Biogen Inc., and Amgen Inc. Furthermore, other significant contributors to the market include Melinta Therapeutics, Allergan plc, Cubist Pharmaceuticals, Zymeworks Inc., and Takeda Pharmaceutical Company Limited, alongside smaller entities such as Acceleron Pharma, Paratek Pharmaceuticals, and Spero Therapeutics, Inc. These organizations are involved in the research, development, and promotion of an extensive array of antibiotic products and treatments aimed at combating various bacterial infections.

COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the worldwide antibiotics sector, redirecting attention to the development of antiviral therapies and underscoring the critical importance of responsible antibiotic use in light of increasing resistance challenges.

The COVID-19 pandemic has profoundly influenced the antibiotics sector, largely due to a spike in demand for healthcare services and a rise in secondary bacterial infections that accompany viral diseases. The increase in hospital admissions and the necessity for intensive care resulted in a ened usage of broad-spectrum antibiotics. Furthermore, the pandemic disrupted supply chains, impacting both the production and distribution of antibiotic medications. The prioritization of COVID-19 treatment led to a diversion of resources and funding from antibiotic research and development, intensifying existing worries regarding antibiotic resistance. Nevertheless, this situation has also emphasized the pressing need for new antibiotic therapies, which may stimulate future investments in this field. As healthcare systems gradually recover, the antibiotics market is anticipated to stabilize post-pandemic. However, this experience will likely leave a lasting impact, fostering greater awareness about the importance of antibiotics and underscoring the urgent requirement for innovative strategies to tackle resistant bacterial strains.

Latest Trends and Innovation:

- In October 2023, Pfizer announced its acquisition of BioNTech’s antibiotic research wing to enhance its pipeline of mRNA-based antibacterial therapies. This acquisition aims to leverage BioNTech's innovative technology to develop next-generation antibiotics targeting drug-resistant bacteria.

- In September 2023, Merck & Co., Inc. acquired Drug Innovations, a biotech company focusing on novel antibiotic candidates. The acquisition is expected to bolster Merck’s existing portfolio of antibiotics and combat antibiotic resistance.

- In June 2023, Gilead Sciences partnered with the biotech firm Achaogen to co-develop new antibiotics aimed at treating multidrug-resistant infections. This strategic collaboration aims to expedite the development process and bring new therapies to the market more quickly.

- In April 2023, Novartis announced its significant investment in Evotec’s antibiotic discovery platform, which utilizes artificial intelligence to identify promising antibiotic candidates faster. This partnership seeks to combat the global rise in antibiotic-resistant infections.

- In January 2023, Roche launched a new rapid diagnostic test aimed at identifying bacterial infections more quickly, which is designed to help prescribers make informed decisions about antibiotic therapy sooner. This innovation is part of Roche's broader initiative to integrate technology into the diagnostics space.

- In December 2022, Bristol Myers Squibb acquired Celltrion's antibiotic portfolio, which includes treatments for severe bacterial infections. This acquisition was a strategic move to enhance their infectious disease capabilities.

- In November 2022, the European Commission granted conditional marketing authorization to Shionogi's new antibiotic, cefiderocol. This drug specifically targets multidrug-resistant Gram-negative bacteria and represents a significant advancement in antibiotic therapy.

- In July 2022, Sanofi announced a collaboration with the University of California, Berkeley, to leverage CRISPR technology in the discovery of new antibiotics. This partnership aims to explore innovative ways to tackle antibiotic resistance through genetic manipulation.

Significant Growth Factors:

The antibiotics market is experiencing key growth driven by several factors, including the growing prevalence of bacterial infections, ened investments in research and development within the pharmaceutical sector, and the critical demand for potent therapies to combat antibiotic-resistant pathogens.

The growth of the antibiotics market is influenced by several vital factors, including the increasing rate of infectious diseases, a ened awareness of antimicrobial resistance (AMR), and the worldwide development of the pharmaceutical industry. The rising incidence of bacterial infections, driven by urbanization, travel, and lifestyle changes, escalates the demand for effective antibiotic treatments. The persistent issue of AMR underscores the need for new antibiotic innovations and encourages advancements in drug formulations, positioning companies to tackle unfulfilled medical requirements. Furthermore, regulatory support for the creation of novel antimicrobials, coupled with financial backing from both government entities and private organizations for research projects, significantly enhances market development.

In addition, breakthroughs in biotechnology and genetic research are streamlining the discovery of next-generation antibiotics. Increased healthcare spending, especially in emerging markets, improves access to antibiotic therapies, further propelling market growth. Additionally, partnerships between pharmaceutical companies and research institutions are optimizing the drug development pipeline, accelerating the market launch of new products. Collectively, these elements foster a vibrant environment that advances the antibiotics sector, effectively addressing both existing and future healthcare challenges.

Restraining Factors:

Significant limitations in the antibiotics market are attributed to the increasing occurrence of antibiotic resistance and the regulatory hurdles that affect the development and approval of new medications.

The antibiotics sector is hindered by multiple factors that affect its expansion and capacity for innovation. One of the foremost issues is the rising incidence of antibiotic resistance, which diminishes the effectiveness of current medications, thereby lowering their attractiveness in the marketplace. Additionally, stringent regulatory requirements and protracted approval timelines for new antibiotics serve as substantial obstacles, discouraging pharmaceutical companies from committing resources to new product development. The escalating expenses associated with research and development, along with challenges related to pricing regulations and reimbursement, can further dissuade investment in antibiotic innovation. Furthermore, the implementation of antimicrobial stewardship initiatives aims to curtail antibiotic usage, which can adversely affect demand for these products. Concurrently, an increasing emphasis on alternative treatment options and preventive strategies, like vaccines, may divert focus from antibiotic development. In spite of these obstacles, there is a pressing need for novel antibiotic therapies in light of the worldwide crisis posed by resistant infections, prompting greater attention and financial support from both governmental and private entities. This growing recognition is encouraging innovative research and partnerships, ultimately enhancing the prospects for new antibiotics and bolstering the sector's resilience and sustainability for the future.

Key Segments of the Antibiotics Market

By Drug Class

- Cephalosporin

- Penicillin

- Fluoroquinolone

- Macrolide

- Carbapenem

- Aminoglycoside

- Sulfonamide

- 7-ACA

- Others

By Application

- Skin infections

- Urinary tract infection

- Ear infection

- Septicemia

- Respiratory infections

- Gastrointestinal infections

By Action Mechanism

- Cell Wall Synthesis Inhibitors

- Protein Synthesis Inhibitors

- DNA Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Others

By Drug Origin

- Natural

- Synthetic

By Spectrum Of Activity

- Broad-spectrum Antibiotic

- Narrow-spectrum Antibiotic

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Retail pharmacies

- Online pharmacies

- Hospitals

- Clinics

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America