Zero Emission Vehicle Market Analysis and Insights:

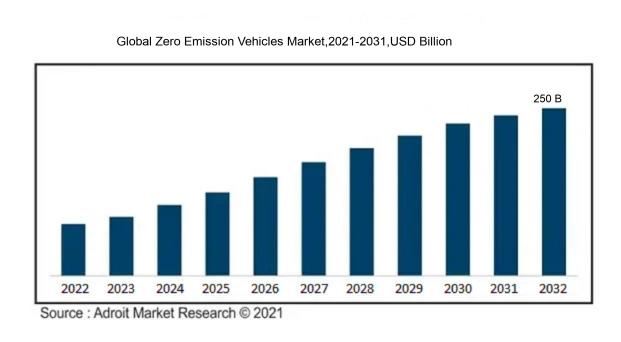

In 2023, the size of the worldwide Zero Emission Vehicles market was US$ 194 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 20.1 % from 2024 to 2032, reaching US$ 250 billion.

The market for Zero Emission Vehicles (ZEVs) is fundamentally fueled by rigorous government policies designed to diminish greenhouse gas emissions and address climate change concerns. Programs offering tax breaks and subsidies incentivize consumers to embrace electric vehicles (EVs) and hydrogen fuel cell technologies. Furthermore, progress in battery technology has significantly enhanced vehicle range and lowered production costs, making ZEVs more attractive and attainable for the average consumer. There is also a noticeable rise in environmental consciousness among individuals, which drives the demand for eco-friendly transportation alternatives. Additionally, a worldwide transition towards renewable energy sources bolsters the establishment of EV charging infrastructure, further propelling market growth. The automotive sector is experiencing significant investments as manufacturers pivot from traditional combustion engines, thus broadening the variety and availability of ZEV options. Collectively, these elements foster a favorable landscape for the proliferation of the Zero Emission Vehicle market.

Zero Emission Vehicle Market Definition

A Zero Emission Vehicle (ZEV) refers to a mode of transportation that generates no exhaust emissions while in use, thereby aiding in the decline of air pollutants. This category commonly encompasses battery electric vehicles, hydrogen fuel cell vehicles, and various alternative technologies that do not release harmful emissions.

Zero Emission Vehicles (ZEVs) play a vital role in minimizing air pollution and addressing climate change challenges. By eliminating emissions from exhaust, ZEVs reduce both greenhouse gases and other harmful pollutants, which enhances air quality and benefits public health. The integration of ZEVs helps facilitate the shift towards sustainable energy, as many of these vehicles depend on renewable sources for their charging needs. Furthermore, the rise in ZEV usage can lead to economic advantages by generating green employment opportunities in areas such as manufacturing and infrastructure development. As governments globally implement more stringent emission standards, ZEVs emerge as a fundamental strategy for achieving carbon neutrality and promoting a cleaner, healthier environment for generations to come.

Zero Emission Vehicle Market Segmental Analysis:

Insights On Type

Battery Electric Vehicles

Battery Electric Vehicles (BEVs) are expected to dominate the Global Zero Emission Vehicle Market due to their increasing efficiency, advancements in battery technology, and growing consumer preference for fully electric transportation. BEVs operate solely on electric power, providing zero emissions and appealing to environmentally conscious consumers. With rising government regulations promoting clean energy and automaker investments in infrastructure such as charging networks, BEVs are positioned for substantial growth. The decreasing costs of lithium-ion batteries and expanded range capabilities further enhance their attractiveness, making them a compelling choice for both urban and long-distance travel, ultimately solidifying their leading position in the market.

Fuel Cell Electric Vehicles

Fuel Cell Electric Vehicles (FCEVs) are an alternative option that utilizes hydrogen to generate electricity, offering the advantage of quick refueling and longer ranges compared to their battery counterparts. FCEVs are especially promising for heavy-duty applications and in regions where hydrogen infrastructure is being developed. However, their growth has been hindered by the current limitations in hydrogen production and distribution networks. While not as dominant as BEVs, FCEVs hold potential, particularly in commercial sectors like buses and trucks, where rapid refueling is beneficial.

Plug-in Hybrid Electric Vehicles

Plug-in Hybrid Electric Vehicles (PHEVs) offer a middle ground between traditional internal combustion engines and fully electric vehicles, combining electric motors with gasoline engines to extend range and convenience. PHEVs have found a niche market among consumers who are hesitant to fully commit to battery electric vehicles due to range anxiety or limited charging infrastructure. Their flexibility in using both electric and gasoline power helps ease the transition to cleaner alternatives. As battery technology improves, PHEVs are still likely to play a significant role in the market, especially for users requiring long-range travel capabilities and optimal efficiency.

Insights On Vehicle Class

Passenger Cars

Passenger cars are expected to dominate the global zero-emission vehicle market due to the growing demand for electric vehicles (EVs) worldwide. Increasing environmental concerns and stringent government regulations promoting cleaner transportation have led manufacturers to invest heavily in electric passenger vehicles. Furthermore, advancements in battery technology and charging infrastructure enhance the attractiveness of EVs for consumers. With more people opting for personal vehicles in urban settings and the rising middle-class population looking for greener alternatives, the passenger car is well-positioned for sustained growth and market presence.

Two-Wheelers & Three-Wheelers

The two-wheelers and three-wheelers is witnessing significant growth, especially in emerging markets where compact and cost-effective transportation solutions are highly sought after. This category includes electric scooters and rickshaws that not only cater to daily commuters but also help in reducing traffic congestion and air pollution. With government subsidies and incentives aimed at promoting electric mobility, this is gaining traction. players are introducing innovative and affordable models, further enticing urban consumers looking for quick short-distance travel options.

Commercial Vehicles

The commercial vehicles sector is gradually evolving with respect to zero-emission technology, driven by increasing pressure to reduce carbon footprints in logistics and transportation. Although traditional diesel-powered units dominate this category, companies are beginning to transition towards electric or hydrogen-fueled commercial vehicles. Such advancements are essential in complying with environmental regulations and Corporate Sustainability Goals. Nevertheless, this is growing more gradually compared to passenger cars, primarily due to the higher costs associated with electric commercial lineup and the extensive changes needed in existing freight infrastructure.

Global Zero Emission Vehicle Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Zero Emission Vehicle market due to a combination of rapid urbanization, government policies, and technological advancements. Countries such as China and Japan are heavily investing in electric vehicle (EV) infrastructure and manufacturing, which drives market growth. The sizeable consumer base in urban areas coupled with environmental awareness initiatives also further propels the demand for zero-emission vehicles. Additionally, aggressive targets set by national governments to reduce carbon emissions enhance the attraction for both manufacturers and consumers. As a result, the Asia Pacific region is positioned as the primary market leader in the zero-emission vehicle sector.

North America

North America has emerged as a strong contender in the Global Zero Emission Vehicle market, primarily driven by the United States. Government incentives, tax rebates, and stringent emission regulations have encouraged consumers to shift to electric vehicles. Moreover, notable investments from major automotive companies in EV technology and infrastructure have further escalated the market. The growing awareness of sustainable practices among consumers also bolsters the demand for zero-emission vehicles. However, while North America shows significant potential, it still trails behind the rapid advancements seen in the Asia Pacific region.

Europe

Europe continues to be an important player in the Global Zero Emission Vehicle market, marked by strong regulatory frameworks and ambitious emissions targets set by the European Union. Nations like Germany, France, and the Netherlands are at the forefront of electric vehicle adoption, aided by substantial investments in charging infrastructure. European consumers are increasingly favoring sustainability, contributing to the growth of zero-emission vehicles. Despite this progress, the region faces stiff competition from the Asia Pacific, which has rapidly accelerated its production capabilities and technological innovations.

Latin America

Latin America is gradually beginning to explore the Global Zero Emission Vehicle market, spurred by increasing interest in sustainable transportation and supportive government policies in countries like Brazil and Mexico. However, the region is still in the early stages of EV adoption, facing challenges such as limited infrastructure and higher initial vehicle costs. The growing awareness of environmental issues among consumers could potentially catalyze market development, but significant investments and advancements are needed to compete with the dominant players in Asia Pacific and North America.

Middle East & Africa

The Middle East & Africa region has been slow to embrace the Global Zero Emission Vehicle market, mainly due to the prevalence of oil dependency and the lack of infrastructure for electric vehicles. However, there are emerging initiatives in countries like South Africa to promote electric mobility. The factors hindering growth include economic constraints and inadequate government support. Despite a growing recognition of climate change, it remains critical for the region to establish a more conducive environment for zero-emission vehicle adoption to be competitive on a global scale.

Zero Emission Vehicle Market Competitive Landscape:

Prominent figures in the worldwide Zero Emission Vehicle sector, such as manufacturers, battery producers, and developers of charging infrastructure, are instrumental in fostering innovation and promoting the use of electric vehicles. They achieve this by advancing technology, sustainability practices, and improving accessibility for consumers. Their joint efforts influence regulatory policies and market dynamics, striving for a substantial decrease in global carbon emissions.

The major players in the Zero Emission Vehicle sector encompass Tesla, Inc., Nissan Motor Corporation, Chevrolet (part of General Motors), BMW AG, Ford Motor Company, Hyundai Motor Company, Kia Corporation, Volkswagen AG, Audi AG, Mercedes-Benz (Daimler AG), Volvo Cars, Rivian Automotive, Lucid Motors, BYD Auto Co., Ltd., Polestar, Fisker Inc., Rinspeed AG, Lordstown Motors, Stellantis N.V., and Aion (part of GAC Group). These organizations are leading the charge in the innovation and production of electric vehicles (EVs) and various zero-emission technologies to cater to the increasing demand for eco-friendly transportation alternatives worldwide.

Global Zero Emission Vehicle COVID-19 Impact and Market Status:

The Covid-19 pandemic intensified the transition to the Global Zero Emission Vehicle market by underscoring the urgency for more sustainable transportation options, which in turn led to greater governmental backing for electric and alternative fuel vehicles.

The COVID-19 pandemic had a profound effect on the market for zero-emission vehicles (ZEVs), creating a unique landscape of challenges and potential growth. Initially, widespread lockdowns and interruptions in the supply chain resulted in a significant decline in vehicle production and sales, as consumers redirected their focus towards essential goods. Nonetheless, the crisis also amplified concerns regarding air quality and climate change, igniting a stronger interest in eco-friendly transportation options. In response, governments across the globe introduced various incentives for electric vehicles (EVs) to aid economic recovery, which in turn led to an uptick in ZEV demand. During this time, the development of infrastructure such as charging stations progressed rapidly, providing additional support for market expansion. Furthermore, automakers adapted their strategies, placing a greater emphasis on electric and hybrid technologies in anticipation of a consumer shift towards more sustainable choices. In summary, the pandemic served as a catalyst for a significant evolution in the automotive industry, highlighting the critical importance of sustainability and adaptability within the ZEV sector.

Latest Trends and Innovation in The Global Zero Emission Vehicle Market:

- In September 2023, Rivian announced a partnership with Amazon to enhance its delivery network using electric trucks, aiming to significantly expand its fleet of electric delivery vans by 2024.

- In August 2023, Tesla unveiled significant advancements in its battery technology during its annual shareholder meeting, promising to reduce battery costs by 50% and increase vehicle range significantly by 2025.

- In July 2023, Ford Motor Company acquired Electriphi, a charging management startup, to strengthen its electric vehicle charging solutions and improve customer access to charging infrastructure.

- In June 2023, General Motors and LG Energy Solution expanded their joint venture, Ultium Cells, to include new battery cell manufacturing plants in the United States, set to produce batteries for various GM electric models by 2024.

- In May 2023, Hyundai Motor Company launched the Ioniq 6, which achieved an EPA-estimated range of up to 361 miles per charge, further solidifying its position in the electric vehicle market.

- In April 2023, Volkswagen Group announced plans to invest €180 billion ($200 billion) over the next five years to accelerate its transition to electric vehicles and enhance battery production capacity.

- In March 2023, BMW unveiled its sixth-generation electric vehicle architecture, known as "NEUE KLASSE," with plans to start production in 2025, featuring modular designs to optimize manufacturing.

- In February 2023, Volvo Cars pledged to become a fully electric car brand by 2030, outlining a strategy that includes boosting its electric vehicle offerings and reducing CO2 emissions across its operations.

- In January 2023, Mercedes-Benz revealed its EQ series electric vehicles with a new generation of battery technology that emphasized fast charging and longer battery life, aiming for an extensive electric lineup by 2025.

- In December 2022, Lucid Motors announced the opening of its first European studio in Munich, Germany, as part of its plan to expand its market presence in Europe with the Lucid Air electric sedan.

Zero Emission Vehicle Market Growth Factors:

The expansion of the Zero Emission Vehicle sector is fueled by innovations in battery technology, ened governmental support, and a growing consumer preference for eco-friendly transportation options.

The market for Zero Emission Vehicles (ZEVs) is undergoing remarkable expansion, influenced by several critical elements. Stringent governmental regulations and incentives aimed at curbing greenhouse gas emissions are accelerating the embrace of ZEVs, as numerous nations have established bold carbon neutrality objectives. Furthermore, breakthroughs in battery technology are enhancing vehicle range and decreasing charging times, making electric vehicles increasingly attractive to consumers. Growing public consciousness regarding ecological concerns, alongside the escalating costs of fossil fuels, encourages potential buyers to explore sustainable options.

Moreover, significant investments in charging infrastructure are bolstering consumer assurance in making the switch to ZEVs, effectively mitigating worries about range limitations. The automotive sector is undergoing a transformation, with a greater number of manufacturers prioritizing ZEV models and adopting innovative production strategies to reduce environmental impact. Collaborations between automotive and tech companies are improving connectivity and operational efficiency within ZEV networks. Additionally, the rise of urban mobility issues, combined with corporate sustainability initiatives, further fuels the demand for cleaner transportation alternatives. Collectively, these interrelated factors are shaping a vibrant and evolving zero-emission vehicle industry, ensuring its sustained growth in the future.

Zero Emission Vehicle Market Restaining Factors:

The Zero Emission Vehicle market faces several significant challenges, such as inadequate charging infrastructure, elevated upfront expenses, and consumer concerns regarding range limitations.

The market for Zero Emission Vehicles (ZEVs) is confronted with multiple challenges that could impede its expansion. One of the primary obstacles is the elevated initial cost, as electric and hydrogen vehicles often come with price tags that surpass those of traditional internal combustion engines, even though battery prices are gradually declining. Moreover, the scarcity of charging stations, especially in rural and underprivileged regions, contributes to consumer hesitation driven by range anxiety. Another significant issue is the availability of essential raw materials for battery production, such as lithium and cobalt; disruptions in the supply chain can lead to rising costs and delays in manufacturing. Additionally, fluctuating regulations and inconsistent government incentives may create uncertainty, undermining consumer trust and deterring investments. Concerns regarding the environmental footprint of battery manufacturing and their disposal at the end of lifecycle further complicate the sustainability narrative surrounding ZEVs. Nevertheless, progress in technological advancements, a growing public consciousness regarding climate change, and robust governmental backing for eco-friendly initiatives are encouraging promising growth in the ZEV sector. Continued innovations in battery technology and renewable energy development indicate a bright future for the ZEV market, contributing to a cleaner and more sustainable transportation system.

Segments of the Zero Emission Vehicle Market

By Type

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Battery Electric Vehicles

By Vehicle Class

- Two-Wheelers & Three-Wheelers

- Passenger Cars

- Commercial Vehicles

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America