Whey Protein Ingredients Market Analysis and Insights:

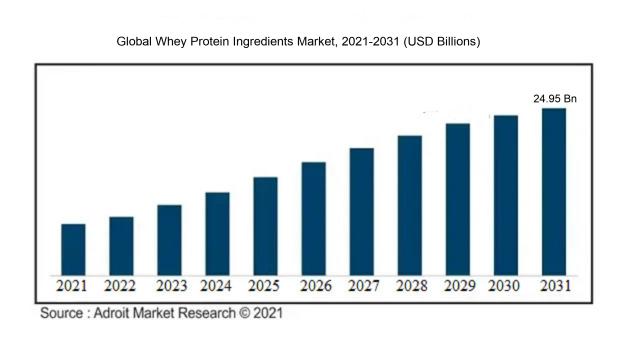

The market for Global Whey Protein Ingredients was estimated to be worth USD 12.73 billion in 2020, and from 2021 to 2031, it is anticipated to grow at a CAGR of 7.18%, with an expected value of USD 24.95 billion in 2031.

Several factors are driving the growth of the Whey Protein Ingredients Market. One key factor is the rising consumer demand for functional and nutritious food products, which has increased the need for whey protein ingredients. Whey protein is widely recognized as a high-quality protein source, containing essential amino acids, and has become popular among health-conscious individuals and athletes. Another factor contributing to market growth is the increased awareness of the health advantages associated with whey protein, such as its role in weight management, muscle recovery, and immune system support. The market has also expanded due to the growing trend of plant-based diets and veganism, leading to the development of plant-based alternatives to whey protein. Additionally, the rapid growth of e-commerce and online retail platforms has made it easier for consumers to access a variety of whey protein products, thus boosting market reach. As the focus on personal health and wellness continues to grow, the whey protein ingredients market is expected to see sustained growth in the future. However, environmental sustainability and ethical sourcing practices will be critical in shaping the market's future direction.

Whey Protein Ingredients Market Definition

Whey protein, a widely sought-after nutritional supplement, comprises the necessary amino acids present in milk. This product is sourced from whey, the residual liquid resulting from the curdling and straining of milk in the process of cheese manufacturing.

The significance of whey protein components stems from various aspects. Firstly, whey protein is classified as a complete protein due to its comprehensive array of essential amino acids crucial for the regeneration and maintenance of bodily tissues. Its high digestibility and rapid absorption rates make it a preferred option for individuals engaged in physical activities and seeking to enhance muscle mass. Moreover, whey protein has demonstrated diverse health advantages such as enhancing the immune system, ameliorating cardiovascular well-being, and contributing to weight loss efforts. Additionally, incorporating whey protein into one's diet can enhance feelings of fullness, curb cravings, and serve as a valuable asset for managing weight effectively. To summarize, the significance of whey protein constituents lies in their capacity to supply essential amino acids, facilitate muscle recovery and growth, enhance overall well-being, and support weight management goals.

Whey Protein Ingredients Market Segmental Analysis:

Insights On Type

Whey Protein Concentrate (WPC)

Whey Protein Concentrate (WPC) is expected to dominate the Global Whey Protein Ingredients Market. WPC is the most commonly used type of whey protein due to its high protein content and cost-effectiveness. It contains a moderate level of lactose and fat, making it suitable for a wide range of applications. WPC's versatility and affordability have made it a popular choice among manufacturers of sports nutrition products, dietary supplements, and functional foods.

Whey Protein Isolate (WPI)

Whey Protein Isolate (WPI) is another significant sector of the Global Whey Protein Ingredients Market. WPI is produced by further processing WPC to remove more lactose, fat, and other non-protein components. This results in a higher protein concentration and a lower carbohydrate and fat content compared to WPC. WPI is preferred by individuals looking for a purer and faster-absorbing protein source, such as athletes and bodybuilders. It is widely used in the production of protein powders, beverages, and clinical nutrition products.

Hydrolyzed Whey Protein

Hydrolyzed Whey Protein is a player that holds its place in the Global Whey Protein Ingredients Market. This type of whey protein undergoes enzymatic hydrolysis, breaking down the protein into smaller peptides and amino acids. Hydrolyzed whey protein is highly digestible and rapidly absorbed by the body. It is often utilized in formulations targeting athletes and individuals with special nutritional needs, such as the elderly or those with compromised digestion. The hydrolyzed form offers advantages like quick absorption and enhanced muscle recovery.

Demineralized Whey Protein

Demineralized Whey Protein is a noteworthy sector in the Global Whey Protein Ingredients Market. This type of whey protein undergoes a process known as ion exchange or ultrafiltration, which removes a significant portion of the minerals, particularly calcium and phosphorus. Demineralized whey protein is often used in infant formula, as it provides a protein source with reduced mineral content that is more suitable for babies' immature digestive systems. It is also utilized in specialized nutrition products for specific populations with certain mineral restrictions.

Others

The Others category within the category Type in the Global Whey Protein Ingredients Market comprises various less common types of whey protein, such as whey protein hydrolysate, whey protein powder blends, and whey protein derivatives. Although they may have niche applications or limited market shares, these parts are not expected to dominate the market compared to WPC, WPI, hydrolyzed whey protein, and demineralized whey protein.

Insights On Application

Dairy

The Dairy application is expected to dominate the Global Whey Protein Ingredients Market. Whey protein is widely used in the dairy industry for the production of various dairy products such as cheese, yogurt, ice cream, and milk-based beverages. It is a key ingredient due to its high nutritional value, functional properties, and ability to enhance organoleptic attributes. The increasing demand for dairy products, especially in emerging economies, coupled with the growing awareness regarding the health benefits of whey protein, is driving the growth of this part. Additionally, the rising trend of incorporating high-protein dairy products in daily diets and fitness regimes further contributes to the dominance of the Dairy application in the Global Whey Protein Ingredients Market.

Bakery & Confectionery

The Bakery & Confectionery application holds significant potential in the Global Whey Protein Ingredients Market. Whey protein is increasingly being incorporated into bakery and confectionery products to enhance their nutritional profile and meet the growing consumer demand for healthier options. It offers various functional properties, including emulsification, binding, texture improvement, and moisture retention, making it an ideal ingredient for baked goods and confectionery items. The rising consumer inclination towards healthier snacks and the growing popularity of protein-fortified bakery and confectionery products augur well for the growth of this part.

Frozen Foods

The Frozen Foods application is an emerging player in the Global Whey Protein Ingredients Market. The demand for frozen foods has been on the rise, driven by factors such as busy lifestyles, convenience, and the increasing preference for ready-to-eat meals. Whey protein finds applications in frozen food products such as ready meals, frozen desserts, and snacks, as it helps enhance their nutritional value and texture. With the growing awareness about the importance of a balanced diet and the inclusion of protein in meals, the "Frozen Foods" part is expected to experience substantial growth in the Global Whey Protein Ingredients Market.

Sports Nutrition

The Sports Nutrition application is a key driving force in the Global Whey Protein Ingredients Market. Whey protein has long been recognized as a valuable ingredient in sports nutrition products due to its superior amino acid profile and fast absorption rate. Athletes and fitness enthusiasts often consume whey protein-based supplements to support muscle recovery, enhance performance, and meet their protein requirements. The increasing focus on healthy lifestyles, rising participation in sports and fitness activities, and growing awareness about the benefits of whey protein drive the dominance of the "Sports Nutrition" part in the Global Whey Protein Ingredients Market.

Beverages

The Beverages application is expected to witness significant growth in the Global Whey Protein Ingredients Market. Whey protein is increasingly being used in the production of various functional and fortified beverages, including protein shakes, smoothies, and flavored milk. With the growing demand for healthy and functional beverages, consumers are seeking protein-enriched options as a convenient and nutritious choice. The versatility of whey protein, along with its ability to improve flavor, texture, and nutritional content, makes it an attractive ingredient in the Beverages application.

Meat Products

The Meat Products application is a niche but evolving in the Global Whey Protein Ingredients Market. Whey protein is being utilized in meat processing to enhance the nutritional content, improve texture, and increase water retention. As consumers focus on incorporating a balanced diet and seek for protein-rich options, the addition of whey protein to meat products aligns with these preferences. Additionally, utilizing whey protein as a functional ingredient in meat products provides an opportunity for manufacturers to innovate and differentiate their offerings in the market.

Medicine

The Medicine application represents a small but potentially impactful in the Global Whey Protein Ingredients Market. Whey protein has gained attention for its numerous health benefits and is being explored for its potential applications in medicinal formulations. Research suggests that whey protein may have antioxidant, anti-inflammatory, and immune-modulating properties, making it a valuable ingredient in pharmaceuticals and nutraceuticals. As more studies are conducted to understand the therapeutic potential of whey protein, the "Medicine" part could witness growth and contribute to the broader market.

Others

The Others category encompasses diverse applications of whey protein ingredients that do not fall under the major categories mentioned above. These could include niche industries, specialized dietary products, and unique formulations that require the functional properties of whey protein. While the specific s within "Others" may have limited market shares individually, collectively, they contribute to the overall demand for whey protein ingredients. As the market continues to expand and evolve, the "Others" part may witness growth based on its ability to cater to specific consumer needs and niche markets.

Global Whey Protein Ingredients Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Whey Protein Ingredients market. With a growing population, rising disposable incomes, and increasing health consciousness among consumers, the demand for whey protein ingredients in Asia Pacific is on the rise. The region has a strong presence of food and beverage manufacturers who are incorporating whey protein ingredients into their products to cater to the growing demand for functional foods and beverages. Additionally, the booming sports nutrition industry in countries like China, India, and Japan is further driving the demand for whey protein ingredients in the region. Furthermore, the increasing popularity of plant-based alternatives is also contributing to the growth of the whey protein ingredients market in Asia Pacific.

North America

North America is another significant region in the Global Whey Protein Ingredients market. The region has a well-established health and wellness sector, with a high demand for protein supplements and functional foods. The United States holds a major share in the North American market due to the presence of key players and the growing consumer awareness about the health benefits of whey protein ingredients.

Europe

Europe is also a prominent player in the Global Whey Protein Ingredients market. The region has a well-developed food and beverage industry and a high demand for fortified and functional products. The increasing consumer focus on sports nutrition and protein-rich diets is driving the demand for whey protein ingredients in Europe. Additionally, the growing popularity of organic and clean label products is further boosting the market growth in the region.

Latin America

Latin America is witnessing steady growth in the whey protein ingredients market. The region is experiencing a rise in health and fitness awareness, leading to an increased demand for protein supplements and functional foods. Brazil and Mexico are the key markets in Latin America, with a growing number of gyms, health clubs, and fitness centers driving the demand for whey protein ingredients.

Middle East & Africa

The Middle East & Africa region is also showing potential growth in the whey protein ingredients market. The increasing disposable incomes and changing lifestyles are driving the demand for protein supplements and functional foods in this region. Saudi Arabia, UAE, and South Africa are the key markets in the Middle East & Africa region.

Global Whey Protein Ingredients Market Competitive Landscape:

Prominent stakeholders within the worldwide Whey Protein Ingredients sector hold significant responsibility in the production and delivery of premium whey protein components to satisfy growing needs across diverse sectors like food and beverage, sports nutrition, and pharmaceuticals. These entities allocate resources towards research and development to introduce novel offerings, enhance their supply chains, and engage in strategic partnerships to uphold a robust market presence amidst the fiercely competitive landscape of whey protein ingredients.

Primary companies within the worldwide whey protein ingredients sector encompass Arla Foods, Glanbia plc, Fonterra Co-operative Group, Kerry Group plc, Hilmar Ingredients, Milk Specialties Global, Maple Island Inc., AMCO Proteins, Leprino Foods Company, and Grande Custom Ingredients Group. These enterprises actively engage in the manufacturing, circulation, and promotion of whey protein ingredients, serving various sectors including food and beverages, sports nutrition, and dietary supplements. They are committed to satisfying the escalating demand for top-tier protein offerings through continuous investments in research and development, quality assurance, and pioneering initiatives, consolidating their status as pivotal participants in the industry. Their extensive global footprint and robust distribution channels guarantee widespread accessibility of their whey protein ingredients to a diverse clientele across the globe.

Global Whey Protein Ingredients Market COVID-19 Impact and Market Status:

The global market for whey protein ingredients has faced notable repercussions as a result of the Covid-19 pandemic. Supply chain disruptions, shifts in consumer behavior, and hindrances to market expansion have been key areas of impact.

The whey protein ingredients market has been significantly impacted by the COVID-19 pandemic. The global outbreak and resulting lockdowns have disrupted production, supply chains, and demand within the food and beverage industry, affecting the whey protein market as well. The closure of fitness facilities and sports venues due to social distancing measures has reduced the demand for whey protein products, especially among athletes and fitness enthusiasts. Additionally, the economic downturn following the pandemic has led to decreased consumer spending, influencing buying decisions and purchasing power. On the supply side, manufacturing and logistics in the whey protein ingredient market have faced challenges due to transportation restrictions and workforce availability issues, resulting in increased prices and limited availability of whey protein ingredients. In summary, the COVID-19 pandemic has caused a decline in demand, supply chain disruptions, and rising costs in the whey protein ingredients market.

Whey Protein Ingredients Market Latest Trends & Innovations:

- In April 2020, Glanbia plc, a global nutrition company, completed the acquisition of Foodarom, a Canadian flavor design company, to enhance their flavor capabilities in various applications including whey protein ingredients.

- In August 2019, Arla Foods Ingredients, a global supplier of whey protein ingredients, announced the launch of a high-protein pre-workout drink concept based on their Lacprodan® HYDRO.365 whey protein hydrolysate.

- In January 2019, Fonterra, a New Zealand-based dairy company, collaborated with Apollo Hospitals, a chain of hospitals in India, to launch a new range of whey protein products with added health benefits for consumers.

- In June 2018, Glanbia Nutritionals, a leading whey protein ingredients manufacturer, acquired Isopure, a US-based sports nutrition brand, to expand their product portfolio and strengthen their position in the market.

- In November 2017, Kerry Group, an Irish food and beverage company, acquired Ganeden, a leading probiotics company, to enhance their offerings in the functional ingredients market, including whey protein products.

- In April 2016, Arla Foods Ingredients launched Lacprodan® HYDRO.PowerPro, a hydrolyzed whey protein ingredient designed specifically for sports nutrition applications, providing improved muscle recovery and growth.

- In October 2015, Hilmar Ingredients, a US-based whey protein manufacturer, launched Nutrilac® WheyHi, a high-protein ingredient suitable for a wide range of applications such as bakery, beverages, and dairy products.

- In February 2014, Glanbia Nutritionals acquired Nutramino, a Danish sports nutrition brand, to expand their presence in the European protein beverages market and strengthen their position in the whey protein ingredients.

Whey Protein Ingredients Market Growth Factors:

Factors contributing to the expansion of the Whey Protein Ingredients market comprise escalating consumer knowledge regarding the health advantages associated with whey protein, surging interest in functional food items, and the expanding utilization within the sports nutrition industry.

The whey protein sector is currently undergoing notable expansion for several reasons. First and foremost, the ened focus on health among individuals is fueling the need for nutritional supplements and functional foods, where whey protein components hold substantial relevance. Recognized for its exceptional amino acid composition and superior digestibility, whey protein is favored by athletes and fitness enthusiasts alike for its effectiveness in muscle development and recovery. Furthermore, the surging prevalence of chronic conditions like obesity and diabetes has accentuated the importance of wholesome dietary habits, further stimulating market growth. Additionally, the increasing market demand for protein-enriched items such as beverages, dairy goods, and infant formulas is driving the expansion of the whey protein sector. The integration of whey protein into weight management regimes and the rising popularity of vegan or plant-based diets are creating new avenues for market expansion. Moreover, the advent of advanced processing techniques and the introduction of cutting-edge products such as whey protein isolates and hydrolysates are attracting a wider consumer demographic. Nonetheless, challenges like elevated costs and potential allergic reactions linked with whey protein consumption could somewhat impede market progress. In summary, the whey protein domain is poised for substantial advancement in the foreseeable future, given factors such as escalating health awareness, ened demand for protein-enhanced goods, and ongoing technological innovations within the industry.

Whey Protein Ingredients Market Restraining Factors:

The market growth is constrained by the scarcity of high-quality raw materials and the fluctuating prices of whey protein ingredients.

The whey protein ingredients market encounters various impediments that could potentially hinder its advancement. Initially, the elevated cost of whey protein isolates in comparison to alternative protein sources restricts its accessibility to consumers who are price-conscious, thereby limiting market expansion. Furthermore, the lack of widespread knowledge regarding the numerous advantages of whey protein among the general populace serves as a substantial deterrent to market growth. The constrained availability of essential raw materials, such as whey, in certain regions also contributes to inhibiting market progress by escalating production expenses and disrupting supply chain operations. Additionally, apprehensions regarding potential side effects or allergic reactions linked to the consumption of whey protein might dissuade prospective buyers from investing in whey protein products, impeding market growth. Lastly, the competitive landscape stemming from alternative protein sources, such as plant-based proteins, presents a formidable obstacle to the whey protein ingredients market as consumers explore alternate options based on dietary limitations or personal choices. Despite these challenges, the whey protein ingredients market remains promising, fueled by the burgeoning demand for sports nutrition products, the increasing embrace of healthy lifestyles, and the expanding market for functional food and beverages. These trends offer opportunities for the whey protein ingredients market to surmount these barriers and sustain its growth momentum in the foreseeable future.

Key Segments of the Whey Protein Ingredients Market

Type Overview

- Whey Protein Concentrate (WPC)

- Whey Protein Isolate (WPI)

- Hydrolyzed Whey Protein

- Demineralized Whey Protein

- Others

Application Overview

- Bakery & Confectionery

- Dairy

- Frozen Foods

- Sports Nutrition

- Beverages

- Meat Products

- Medicine

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions (FAQ) :

Major Market Movements

- Sports nutrition expected to herald promising growth opportunities for whey protein ingredients

- New Beverage disruptions such as sparkling water format creates ripples as non-alcoholic beverage preferences remain soaring

- Industry stalwarts invest in taste diversification aiming to offset characteristic bitterness from whey protein ingredients

- Mature economies such the Americas and Europe to remain atop global growth trajectory owing to greater consumer adoption and persistent product diversification in whey protein ingredients

- Studies suggest whey protein ingredients markedly induces muscle regeneration amongst older adults, hence finds ample usability in clinical nutrition

Key Study Deliverables

• Market valuation in terms of value and volume of the global natural rubber market through the forecast span, 2019-25

• Comprehensive market evaluation across major regions based on market segmentation

• A thorough rundown on market dynamics such as drivers, threats, challenges, opportunities

• A clear analytical review of competition spectrum, highlighting industry forerunners, company as well as product portfolios

• Major highlights on winning marketing strategies adopted by leading players.