Well Testing Services Market Analysis and Insights:

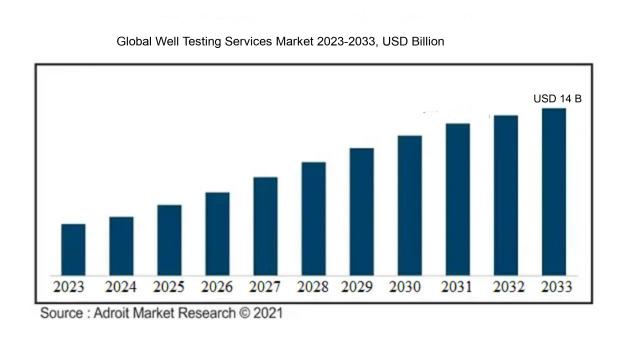

The Global Well Testing Services Market was estimated to be worth USD 6.3 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 6.5%, with an expected value of USD 14 billion in 2033.

The market for well testing services is primarily propelled by the escalating need for exploration in the oil and gas sector, as enterprises aim to enhance production efficiency and optimize resource utilization. Technological innovations, such as real-time data analysis and automated testing systems, enable more precise evaluations of well functionality and reservoir properties, leading to improved operational productivity. Additionally, adherence to regulatory mandates and environmental considerations significantly influence this market, prompting organizations to utilize well testing services to comply with rigorous safety and ecological regulations. The rising focus on extracting unconventional resources, such as shale gas and tight oil, further amplifies the demand for detailed well testing to evaluate recovery potential and financial feasibility. Increased investment in offshore exploration and production endeavors also fosters market expansion, while the transition toward sustainable energy solutions encourages the development of testing techniques that minimize environmental footprints. Together, these elements shape the dynamic environment of the well testing services sector.

Well Testing Services Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2033 |

| Study Period | 2023-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 14 billion |

| Growth Rate | CAGR of 6.5% during 2024-2033 |

| Segment Covered | By Well Type, By Stages, By Application, By Services, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., Superior Energy Services, Inc., ASL Energy, Inc., JDR Cable Systems Ltd., Pruitt Energy Services, LLC, and Expro International Group Ltd. |

Well Testing Services Market Definition

Well evaluation services encompass the methodical analysis of oil and gas wells to assess their production rates, pressure levels, and general efficiency. Such evaluations are essential for enhancing resource recovery and guiding decisions related to reservoir management.

Well testing services play a crucial role in evaluating reservoir functionality and fluid dynamics, which are key for enhancing the extraction of oil and gas. These evaluations yield important data on the initial output and pressure management of wells, assisting operators in refining their drilling and completion strategies. Moreover, well testing can uncover challenges like reservoir depletion or connectivity problems, allowing for prompt measures to boost recovery efficiency. Ultimately, these services are integral to achieving cost-effectiveness, effective resource utilization, and reduced risks in exploration and production activities, enabling operators to optimize their investments while adhering to environmental safety protocols.

Key Market Segmentation:

Insights On Key Well Type

Horizontal

The Horizontal is expected to dominate the Global Well Testing Services Market due to its increasing adoption in unconventional reservoirs and deeper drilling applications. Horizontal wells enable enhanced oil recovery by providing greater access to subsurface formations compared to traditional vertical wells. The shift towards unconventional oil and gas extraction, particularly in shale plays, has substantially increased the demand for horizontal drilling techniques. Investors and operators are recognizing the efficiency and yield potential of horizontal wells, prompting an uptrend in well testing services tailored specifically for this type. Additionally, technological advancements and cost optimization strategies in horizontal drilling further drive this ’s dominance.

Vertical

The Vertical type remains crucial in the Global Well Testing Services Market, particularly for traditional oil and gas extraction methods. This approach is often preferred for simpler and shallower reservoirs where operational costs can be minimized. While its usage may be declining compared to horizontal methods, vertical wells are still essential for specific applications, especially in mature fields. Vertical wells also undergo testing to ensure regulatory compliance and efficient resource management. Operators often rely on these wells for field monitoring and production optimization to extract remaining reserves efficiently.

Insights On Key Stages

Production

The Production stage is expected to dominate the Global Well Testing Services Market due to the increasing demand for efficient extraction and management of hydrocarbons. As production activities intensify to meet evolving energy needs, well testing services become crucial for optimizing production rates, ensuring safety, and complying with regulatory requirements. The focus on enhancing production efficiency while managing costs drives investment in well testing technologies. Moreover, the ongoing expansion in oil and gas production globally, along with the challenges posed by aging infrastructure, necessitates advanced well testing services that can provide real-time data and improve overall operational performance.

Exploration

The Exploration stage is vital for identifying and assessing potential drilling locations. As companies strive to discover new reserves amid depleting resources, well testing plays a critical role in evaluating geological formations and estimating recoverable volumes. Although this phase is not as dominant as production, it remains essential for companies looking to expand their asset bases. With the growing interest in unconventional reserves and offshore exploration, investment in well testing services in this phase is expected to see moderate growth. Advanced technologies in well testing are enabling more accurate assessment during exploration, making it a significant but secondary player in the overall market.

Appraisal and Development

The Appraisal and Development phase is necessary for confirming the viability of exploratory findings and planning the subsequent drilling activities. While this stage is important for informing production decisions, it is often overshadowed by the criticality of production itself. Well testing services during appraisal focus on detailed evaluation of field data, which is essential for understanding reservoir capabilities and planning development strategies. Though it represents a smaller share of the market, its importance cannot be overlooked, especially as the industry pushes toward intelligent development strategies in an increasingly complex operating environment. Enhanced well testing technologies in this facilitate informed decision-making critical for project success.

Insights On Key Application

Offshore

The Offshore category is anticipated to dominate the Global Well Testing Services Market. This surge is primarily driven by the substantial investment in offshore drilling activities, especially in regions rich in hydrocarbons like the North Sea and the Gulf of Mexico. The increasing energy demand globally, combined with the push for deeper and more technologically advanced drilling operations, has created a ened need for well testing services in offshore environments. Additionally, environmental regulations and safety standards associated with offshore operations necessitate rigorous testing protocols, contributing to the strong demand within this, which is expected to outperform its counterpart in the coming years.

Onshore

The Onshore has traditionally held a significant share in the well testing market due to the high prevalence of onshore drilling activities. It benefits from the relatively lower costs associated with operating onshore compared to offshore rigs. However, while it may not dominate the market, it continues to see steady demand driven by ongoing drilling in shale reserves and other lucrative resources. The advancements in exploration technology and production techniques further support this sector's growth, maintaining a solid position in the market landscape.

Insights On Key Services

Real Time Testing

Real Time Testing is expected to dominate the Global Well Testing Services Market due to its increasing demand for immediate and accurate data needed for decision-making in drilling operations. The ability to monitor well performance continuously and to obtain rapid insights into reservoir behavior allows operators to optimize production and reduce costs effectively. As oil and gas companies focus on maximizing output while minimizing downtime, the continued investment in enabling technologies that harness data analytics and real-time processing will further prop up this category, making it the leading service in the market.

Downhole Testing

Downhole Testing is crucial for understanding reservoir characteristics at depth. This service involves the use of specialized tools and equipment that gather data on pressure, temperature, and fluid composition directly from the wellbore. As exploration becomes more focused on complex formations, downhole testing provides the necessary insights to optimize well placement and completion strategies. The demand for high-precision measurements in challenging environments is likely to enhance the relevance of this service in the coming years.

Surface Testing

Surface Testing plays a significant role in evaluating well performance by examining fluids and gases as they emerge at the surface. This method is vital for identifying flow rates and determining the necessary treatments or interventions for enhancing production. Advances in surface testing equipment that allow for better separation and analysis of different phase components are likely to stimulate further adoption. As the industry gears towards more efficient operations, this testing service will continue to hold relevance.

Reservoir Sampling

Reservoir Sampling is essential for obtaining fluid samples from a reservoir to analyze its quality and behavior. This service helps operators understand the potential yield and characteristics of hydrocarbons present, which is vital for planning extraction techniques. As reservoir properties can vary significantly, accurate sampling techniques remain crucial for informing asset development strategies. Increased attention to enhanced oil recovery methods will likely drive demand for effective reservoir sampling services over the next few years.

Hydraulic Fracturing Method Testing

Hydraulic Fracturing Method Testing assesses the effectiveness of fracture creation in wells to enhance production. This technique is integral in unconventional resource plays like shale gas and tight oil. As companies aim for ened extraction rates from previously inaccessible reservoirs, testing services that optimize hydraulic fracturing will grow in importance. The focus on sustainability and efficient resource recovery also necessitates the continual refinement of this service, ensuring it remains a vital component in well testing.

Multi-Phase Flow Meter

Multi-Phase Flow Meters are increasingly employed to measure the flow rates of oil, gas, and water simultaneously in production headers. Their importance is marked by the need for real-time data regarding the composition and flow of mixed phases, which aid in managing reservoir performance. The integration of sophisticated technologies within multi-phase flow meters enhances accuracy and reliability, making them essential for operators striving to maximize output. As demand for precise flow measurements increases, the relevance of this service will continue to rise.

High-Pressure High-Temperature

High-Pressure High-Temperature testing is essential for evaluating wells that operate under extreme conditions. These testing services are critical for understanding the behavior of reservoirs under stress and determining the viability of production operations. With the exploration of deep-water and high-temperature reservoirs on the rise, this service’s relevance is magnified. The increasing complexity of extraction operations will drive further advancements and incorporation of High-Pressure High-Temperature testing in well testing services.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Well Testing Services market due to its significant investment in oil and gas exploration and production activities. The presence of established companies engaged in advanced technology and methodologies is driving the demand for well testing services. Furthermore, regulatory requirements in the region necessitate comprehensive well testing, which is further enhancing the market growth. The region benefits from a mature infrastructure and readily available skilled labor, enabling efficient execution of well testing services. Moreover, the focus on enhancing productivity and maximizing recovery rates from existing wells makes North America a focal point for well testing operations.

Latin America

Latin America holds potential for growth in the well testing services market, particularly driven by its vast natural resources. Countries like Brazil and Venezuela are rich in oil reserves, and ongoing developments in offshore drilling activities amplify the need for well testing solutions. However, political instability and regulatory challenges may hinder consistent growth, impacting the overall speed of market expansion. Stakeholders emphasizing sustainable practices and technological advancement are likely to capitalize on opportunities while navigating regional challenges.

Asia Pacific

The Asia Pacific region exhibits a rapidly growing demand for well testing services driven by increasing energy consumption and exploration activities. Countries like China and India are investing heavily in their oil and gas sectors to meet elevated energy demands, thus fostering the need for reliable testing services. However, challenges such as varying regulatory frameworks and infrastructural differences among nations might impede market uniformity. Continued investments and collaborative initiatives can help streamline processes, enhancing the region's competitiveness in the global market.

Europe

Europe remains a key player in the well testing services market, characterized by transitioning energy policies and a shift toward renewable sources. However, the persistence of oil and gas sectors, particularly in the North Sea region, will sustain the demand for well testing services. Regulatory mandates and a growing emphasis on safety and efficiency keep the market active. Despite facing challenges like fluctuating prices and competition from alternative energy sources, European countries are looking to innovate and optimize well management, retaining significance in the global landscape.

Middle East & Africa

The Middle East & Africa region is recognized for its substantial oil reserves, hence showing potential for well testing services growth. The region's investments in upstream oil production provide a robust market opportunity, particularly in countries like Saudi Arabia and Nigeria. However, geopolitical tensions and operational challenges can hinder market growth. Emphasis on efficient resource management and technological adoption in the region could also enhance service demand. With ongoing regional partnerships aimed at strengthening energy security, the prospects for well testing services remain cautiously optimistic.

Company Profiles:

Major contributors in the Global Well Testing Services sector play a pivotal role in providing crucial services including well assessment, surveillance, and administration to boost the productivity of oil and gas operations. Their proficiency in cutting-edge technologies along with adherence to regulatory requirements fosters innovation and ensures safety within the field.

Prominent entities in the Well Testing Services sector encompass Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., Superior Energy Services, Inc., ASL Energy, Inc., JDR Cable Systems Ltd., Pruitt Energy Services, LLC, and Expro International Group Ltd. Furthermore, other significant contributors include Tenaris S.A., Aegion Corporation, Ensign Energy Services Inc., Cameron International Corporation, and Oilfield Production Consultants Limited.

COVID-19 Impact and Market Status:

The COVID-19 pandemic had a profound impact on the Global Well Testing Services industry, causing delays in projects, a decline in operational activities, and budget limitations within the oil and gas sector.

The COVID-19 pandemic had a profound impact on the market for well testing services, stemming from interruptions in oil and gas exploration activities, reductions in capital investment, and constraints on workforce mobility. Lockdowns and various safety measures implemented by nations led to numerous offshore and onshore projects experiencing postponements or outright cancellations, resulting in a diminished demand for well testing services. Moreover, the volatility of oil prices throughout the pandemic introduced a level of uncertainty, compelling operators to curtail new drilling initiatives, which further adversely affected the sector. Nevertheless, as the global economy began to recover and the demand for energy increased, the well testing services industry started to demonstrate signs of recovery, highlighted by a rise in investments in digital innovations and automation aimed at boosting efficiency. Companies have also prioritized modifying their services to align with health protocols, thereby ensuring safety while striving to fulfill the growing needs of a rejuvenating energy market. Consequently, while the pandemic's initial consequences were detrimental, the long-term prospects appear to be improving.

Latest Trends and Innovation:

- In September 2023, Halliburton Company acquired the well testing division of the Norwegian company Aker BP, enhancing its capabilities in the offshore oil sector and broadening its service offerings in the North Sea region.

- In August 2023, Schlumberger announced the launch of its new advanced well testing technology, called RapidTest, which utilizes real-time data analytics and artificial intelligence to improve the efficiency and accuracy of well testing operations.

- On July 15, 2023, Baker Hughes acquired a minority stake in the tech startup AI-Lytics, which specializes in AI-driven predictive maintenance for well testing equipment, aiming to integrate these innovations into their existing service lines.

- In June 2023, Weatherford International plc completed a strategic merger with Tracerco, combining well testing services and tracer technology to offer more comprehensive solutions for reservoir management.

- In May 2023, the American company TestOil introduced a new line of portable well testing devices that allow for monitoring and analysis of well integrity in real-time, targeting operations in the shale gas sector.

- On March 1, 2023, Petrofac announced a collaboration with the Scottish company Candover Green to develop a new suite of digital solutions for well testing that leverages cloud computing to streamline data reporting and enhance operational efficiency.

- In January 2023, Ensign Energy Services launched a new well testing service that integrates sustainable technologies aimed at reducing carbon emissions during the testing phase, aligning with industry trends towards greener operations.

Significant Growth Factors:

The market for well testing services is expanding as a result of ened exploration activities in the oil and gas sector, advancements in testing technologies, and a growing necessity for effective resource management.

The Well Testing Services sector is witnessing remarkable expansion, driven by several pivotal influences. A primary factor is the rising global thirst for oil and gas, spurred by economic growth and escalating energy demands, which amplifies the need for accurate well testing to enhance production efficiency. Additionally, technological advancements, particularly through the integration of digital tools and automated testing machinery, significantly improve the precision and swiftness of well assessments, thereby drawing greater investment into testing services.

Moreover, the increasing focus on environmental sustainability and adherence to regulatory standards prompts oil and gas firms to leverage well testing services that track emissions and resource consumption. The exploration of unconventional oil and gas reserves, such as shale and offshore reserves, further necessitates thorough well testing to effectively navigate intricate production challenges. As rivalry escalates within the sector, organizations are more inclined to invest in evaluating their well performance to optimize output and minimize operational expenditures, thereby fueling market progression.

These dynamics, along with a strong recovery in energy demand post-COVID-19 and an accentuated commitment to operational safety, are cultivating a conducive environment for the growth of the well testing services market in the near future.

Restraining Factors:

Significant obstacles in the Well Testing Services Market consist of variable oil prices, rigorous regulatory requirements, and the substantial expenses associated with cutting-edge testing technologies.

The Well Testing Services Market is confronted with multiple challenges that could impede its expansion. One significant barrier is the considerable expense linked to sophisticated testing technologies and equipment, which may restrict access for smaller companies and new market entrants. Moreover, the intricate web of regulations and differing environmental laws across regions poses challenges for service providers, necessitating adept navigation through compliance issues. Additionally, volatility in crude oil prices can impose financial constraints on oil and gas firms, compelling them to defer or scale back well testing activities. Competition from alternative energy sectors, particularly renewables, may further shift investment focus away from conventional oil and gas exploration, thereby impacting the demand for well testing services. Furthermore, a shortage of skilled labor, especially in remote locations, can create difficulties in finding qualified personnel for specialized testing tasks. Despite these obstacles, the market remains robust with potential for innovation, propelled by technological progress and a growing emphasis on efficient resource management. As operators strive to enhance production and improve recovery techniques, opportunities for advancement in well testing services emerge, contributing to a more sustainable and efficient future in the industry.

Key Segments of the Well Testing Services Market

By Well Type

- Horizontal

- Vertical

By Stages

- Exploration

- Appraisal and Development

- Production

By Application

- Onshore

- Offshore

By Services

- Downhole Testing

- Surface Testing

- Reservoir Sampling

- Real Time Testing

- Hydraulic Fracturing Method Testing

- Multi-Phase Flow Meter

- High-Pressure High-Temperature

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America