Water Desalination Plant Equipment Market Analysis and Insights:

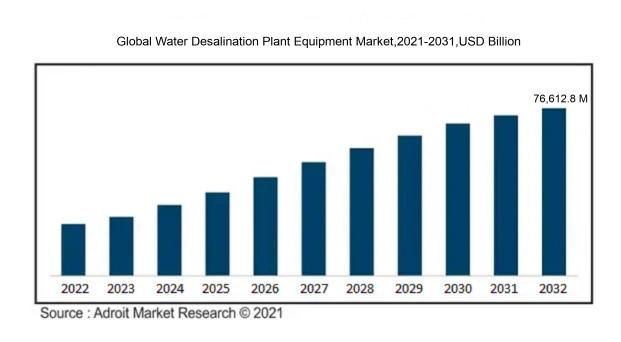

In 2023, the size of the worldwide Water Desalination Plant Equipment market was US$ 37,966.2 million. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 10.2 % from 2024 to 2032, reaching US$ 76,612.8 million.

The market for water desalination equipment is predominantly influenced by an acute shortage of water and a surging need for potable water in dry regions and densely populated urban centers. The pressures from swift population increases and industrial growth exacerbate the strain on current water supplies, motivating governmental and organizational investments in desalination solutions. Innovations in technology, including energy-saving methods and advanced membrane technologies, significantly improve the viability and cost-efficiency of these desalination initiatives. Moreover, a growing emphasis on sustainable water management and adherence to environmental regulations propels financial backing for eco-friendly technologies in this sector. The escalating effects of climate change, which lead to a reduction in accessible freshwater resources, further amplify the necessity for dependable alternative water sources. Consequently, these elements collectively create a favorable landscape for the expansion of the desalination equipment market, encouraging innovation and the diversification of product lines to cater to various regional needs.

Water Desalination Plant Equipment Market Definition

Desalination plant apparatus encompasses the advanced technology and machinery employed to eliminate salt and contaminants from seawater or brackish sources, thereby converting it into drinkable water. This encompasses various systems such as reverse osmosis membranes, distillation systems, and pretreatment filters, all crafted to optimize the water purification process.

Desalination plant machinery is essential for tackling the pressing challenges of global water shortages by transforming saline or brackish water into safe, drinkable water. As populations rise and climate change affects existing freshwater resources, these innovations are pivotal in maintaining a stable water supply. They ensure dependable water for agricultural, industrial, and residential needs, especially in dry areas. Moreover, improvements in desalination methods boost efficiency and lower expenses, rendering it a more feasible option. By broadening the availability of fresh water, desalination technology plays a critical role in fostering economic growth, enhancing public health, and promoting environmental sustainability.

Water Desalination Plant Equipment Market Segmental Analysis:

Insights On Equipment

Desalination Device

Desalination Device is anticipated to dominate the Global Water Desalination Plant Equipment Market. While the actual desalination device encompasses several technologies, the effective combination of various mechanisms enhances water quality. Continuous advancements in materials and processes have prompted innovations within this category, making devices more energy-efficient and cost-effective. As global water scarcity issues gain prominence, this equipment will remain vital, ensuring flexible and reliable operations suited to different environmental conditions. Ongoing research and development are expected to yield significant improvements in this equipment area, positively impacting the overall desalination landscape.

Reverse Osmosis

The Reverse Osmosis (RO) technology is growing in the Global Water Desalination Plant Equipment Market due to its efficiency and widespread acceptance. This technology effectively removes salts and impurities from seawater or brackish water, making it a reliable method for producing potable water. Increasing demands for fresh water in water-scarce regions and advancements in RO membrane technology, coupled with lower energy consumption compared to traditional methods, are factors contributing to its leading position. Its scalability allows it to cater to both small-scale and large-scale desalination plants, further solidifying its dominance in the market.

Pretreatment System

The Pretreatment System plays a crucial role in ensuring the longevity and efficiency of desalination processes. It involves the removal of suspended solids and organic matter to protect the main desalination units, especially reverse osmosis membranes. The increasing awareness regarding fouling and scaling in desalination systems has led to investment in advanced pretreatment technologies. Factors such as stringent regulatory standards and the need to enhance overall plant efficiency have propelled the growth of this equipment type in the industry, marking it as essential for effective water treatment processes.

Multi-stage Flash (MSF) Distillation

Multi-stage Flash (MSF) Distillation stands out for its capability to produce large volumes of distilled water, making it particularly suitable for industrial applications. This method operates by rapidly flashing heated seawater into steam at lower pressures, capturing the latent heat for subsequent evaporation stages. While energy-intensive, advancements in heat recovery systems are being made to minimize operational costs. As countries with substantial industrial water demands seek efficient systems, MSF's established technology will likely maintain a significant presence in the market, continuing to serve specific high-demand scenarios.

Multi-effect Distillation (MED)

Multi-effect Distillation (MED) is recognized for its energy efficiency relative to traditional methods. This technology operates by utilizing the vapors generated in one effect to heat the next, resulting in lower energy consumption. MED systems are particularly effective in regions where energy costs are a major consideration. As environmental concerns mount and industries aim to reduce their carbon footprint, MED’s sustainability profile becomes more appealing. This trend is expected to positively influence the growth and implementation of MED equipment in desalination projects worldwide.

Post-Processing System

Post-Processing Systems are essential for enhancing the quality of desalinated water to meet various standards. They typically incorporate filtration, disinfection, and mineralization processes to ensure the safety and palatability of the water produced. Increasing consumer awareness and regulatory pressures are driving the demand for advanced post-treatment solutions. These systems are critical in specific applications, especially in regions vulnerable to waterborne diseases. The focus on promoting public health through effective water treatment solutions ensures that post-processing remains a significant within the desalination equipment market.

Cleaning System

Cleaning Systems are necessary for maintaining operational efficiency and extending the lifespan of desalination equipment, particularly for reverse osmosis membranes. With processes subjected to fouling and scaling, cleaning regimens play a pivotal role in optimizing performance. As technological developments lead to more effective and less harmful cleaning solutions, the market for these cleaning technologies is likely to see growth. High levels of upkeep demand in desalination plants ensure that the market for cleaning systems will remain relevant and essential for sustaining overall water treatment efficacy.

Electrical Control System

Electrical Control Systems encompass automation and control technologies that manage the operation and efficiency of desalination plants. These systems play a critical role in monitoring performance, optimizing processes, and ensuring safety standards. With increasing trends towards smarter and more automated facilities, demand for advanced electrical control solutions is rising. The integration of IoT and data analytics in these systems enables real-time performance monitoring and predictive maintenance, which are crucial for improving operational efficiency. This growing reliance on advanced control technologies is anticipated to drive the market for electrical control systems within desalination operations.

Insights On Source

Brackish Water

Brackish water is expected to dominate the Global Water Desalination Plant Equipment Market as it represents a significant portion of the water desalination market, especially in areas where freshwater sources are limited, and saline intrusion is a concern. This type of water, which has a lower salinity than seawater and is frequently found in estuaries and coastal aquifers, is gaining attention due to its cost-efficient treatment relative to seawater desalination. Moreover, brackish water can often be treated at lower energy costs, making it an attractive option for regions that possess an abundance of brackish water. As technology improves and environmental regulations on freshwater use tighten, reliance on this source is projected to grow, providing an essential alternative for both agriculture and potable water supplies.

Seawater

Seawater is expected to grow in the Global Water Desalination Plant Equipment Market due to its abundant availability and the increasing demand for fresh water in coastal regions. With nearly 97% of the Earth's water being saltwater, desalination provides a viable solution to water scarcity challenges. Countries with large coastal areas and growing populations, such as those in the Middle East, are investing heavily in desalination technologies. The advancements in reverse osmosis membrane technology, which makes the process more efficient, are enhancing the feasibility of seawater desalination projects. Consequently, the focus on sustainable and scalable desalination from seawater aligns with both governmental and environmental objectives, solidifying its position as the leading source in this market.

River Water

River water is the source that generally has less attention in the desalination market but remains a critical component in certain contexts. While conventional treatment methods are predominantly employed to make river water potable, there is potential for desalination technologies to be adapted for river systems affected by saltwater intrusion or pollution. Occasional saline impacts from urban runoff or nearby saline bodies make this an area of exploration. The market for river water desalination might not currently dominate, but its role could evolve, especially in specific geographic locales where environmental conditions necessitate innovative solutions. The adaptation of desalination methods for river water could present new opportunities for addressing water scarcity challenges.

Others

The "Others" category in the water desalination market often includes various alternative sources such as rainwater, groundwater, and treated wastewater. Although these sources currently play a smaller role in desalination compared to seawater and brackish water, they represent an emerging landscape with significant potential. New technologies and increased awareness of water recycling and conservation methods are driving interest in these unconventional sources. Additionally, many regions are focusing on sustainable practices, making water reclamation and the use of alternative sources more appealing. As communities strive to enhance their water resilience, the "Others" category could see substantial growth, creating various opportunities for innovative water treatment solutions.

Insights On Production Capacity

Above 1,500 m3/hr

The category expected to dominate the Global Water Desalination Plant Equipment Market is "Above 1,500 m3/hr." This is increasingly favored due to its efficiency in meeting large-scale water demands, particularly in regions facing severe water scarcity. As populations grow and industrial activities increase, the need for higher production capacities will drive significant investment in large desalination plants. Additionally, technological advancements are enabling the construction of plants with greater throughput capabilities, making this category not only economically viable but also a preferred option for governments and corporations seeking sustainable solutions to water shortages.

Below 10 m3/hr

The "Below 10 m3/hr" category primarily caters to small-scale applications, making it suited for households or small communities. While it may not hold a dominant position within the overall market, its significance lies in providing localized water solutions in remote areas. This can be crucial for areas where large desalination plants are not feasible. The simplicity and lower cost of such systems can appeal to individuals and small enterprises looking for affordable alternatives.

11-100 m3/hr

The "11-100 m3/hr" category serves small to medium-sized industrial applications and rural areas. This range presents an attractive solution for businesses that require a continuous water supply but do not have the demand for larger systems. As awareness of water scarcity grows, many industries are considering installing these systems to ensure a consistent water supply, particularly in agriculture and fisheries. This is thus positioned for stable growth as businesses increasingly prioritize sustainable water management practices.

101-400 m3/hr

The "101-400 m3/hr" range is designed for mid-tier industrial requirements and is becoming increasingly relevant in areas where water stress is pronounced. This capacity can address the needs of various sectors, including tourism, agriculture, and municipal services. As industries adapt to more sustainable practices, the demand for desalination solutions in this capacity range is projected to rise. Furthermore, government initiatives promoting water conservation and efficiency are expected to further strengthen this category's market presence.

401-1,000 m3/hr

Within the "401-1,000 m3/hr" category, there is a strong focus on supplying larger commercial operations and municipal projects. These systems present a compelling balance of performance and affordability, appealing to urban areas and industries experiencing rapid growth. As cities expand and face water scarcity issues, the demand for these systems is likely to increase. The push for efficient resource management and investment into infrastructure development positions this favorably for future opportunities.

1,001-1,500 m3/hr

The "1,001-1,500 m3/hr" category targets high-demand sectors that require considerable water quantities, such as energy production and large-scale agriculture. It sits between medium-sized and substantial plants, showcasing versatility across different industries. This may not dominate the market but plays a critical supportive role as companies look to scale their operations with reliable water supplies. The ongoing pressures of climate change and water scarcity could see demand for this category increase in the coming years as businesses expand their reliance on desalinated water.

Insights On Application

Municipal

The municipal sector is expected to dominate the Global Water Desalination Plant Equipment Market. This is primarily due to the increasing demand for potable water in urban areas where freshwater sources are diminishing. As cities expand and populations grow, municipalities are challenged to provide sufficient clean drinking water. Governments are investing in infrastructure for desalination as a reliable solution to address water scarcity issues. Additionally, the rising concerns about water quality, climate change, and environmental sustainability drive municipalities to adopt advanced desalination technologies. This growing focus on water security, coupled with rising urbanization, positions the municipal sector at the forefront of the market.

Industrial

The industrial is also experiencing noteworthy growth within the water desalination equipment market. Industries that are heavily reliant on water, such as energy, manufacturing, and food processing, have begun to invest in desalination technology to ensure a consistent supply of water. This approach not only aids in meeting their operational needs but also addresses regulatory pressures for water conservation and sustainability practices. Industries have recognized the importance of diversifying their water sources, especially in regions where freshwater resources are limited, thereby pushing the growth of desalination solutions specifically for industrial applications.

Others

The 'Others' category encompasses various applications such as agriculture, tourism, and military. While this does not dominate the market, it plays a crucial role in specific instances where fresh water is either scarce or needs to be supplemented. In agriculture, for example, desalinated water is increasingly used to support irrigation in arid regions where freshwater supplies are minimal. The tourism sector, particularly in coastal areas, often requires reliable water sources to accommodate influxes of visitors. Although small compared to municipal needs, this demonstrates the versatility and necessity of desalination technologies across diverse applications.

Global Water Desalination Plant Equipment Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Water Desalination Plant Equipment market due to a combination of rapid urbanization, water scarcity issues, and increasing investments in infrastructure. Countries such as China, India, and Australia are highly reliant on desalination technologies to meet their growing water demand, driven by industrialization and population growth. Furthermore, government initiatives aimed at improving water quality and availability are propelling the expansion of the desalination sector in this region. The presence of market players and ongoing technological advancements also strengthen the region’s position, making Asia Pacific a leader in the global desalination equipment market.

North America

North America holds a significant portion of the Global Water Desalination Plant Equipment market, particularly with the United States leading in advanced technology adoption. The region’s aging water infrastructure and increasing focus on sustainable water resources management are driving desalination projects. Additionally, federal and state-funded initiatives are aimed at enhancing water systems, propelling demand for advanced desalination technologies. The collaboration between public and private entities further boosts developmental projects in this area.

Europe

Europe presents a stable market for Water Desalination Plant Equipment, driven by stringent environmental regulations and the need for sustainable water management. Countries such as Spain and Italy are notable for their established desalination plants, particularly in regions facing severe water shortages. The European market is increasingly integrating renewable energy sources with desalination processes, promoting sustainability efforts. Furthermore, ongoing research and innovation in treatment technologies are enhancing efficiency, thereby increasing market competitiveness.

Latin America

Latin America’s Water Desalination Plant Equipment market is primarily characterized by nascent development stages but is poised for growth due to increasing water scarcity. Countries like Chile and Brazil are exploring desalination as a viable solution to freshwater shortages caused by climate change and population growth. However, economic challenges sometimes hinder large-scale investments. Collaborative efforts between governments and international organizations aim to enhance technology adoption, which could catalyze the expansion of the desalination market in the region.

Middle East & Africa

The Middle East & Africa region has a significant demand for water desalination technologies due to extreme water scarcity exacerbated by climate factors and population increase. Countries such as Saudi Arabia and the UAE lead in desalination facilities, heavily investing in innovative and energy-efficient technologies. However, challenges include high capital costs and reliance on fossil fuels for energy, which can impact sustainability. Nevertheless, government initiatives towards diversifying water sources and renewable energy integration could drive future growth in this market.

Water Desalination Plant Equipment Market Competitive Landscape:

The foremost contributors in the international market for water desalination plant equipment are propelling advancements and operational efficiency by innovating in areas such as sophisticated filtration methods, reverse osmosis processes, and energy recovery systems. These entities work in partnership with governmental bodies and various industries to improve water security and promote sustainability through efficient desalination technologies.

Prominent entities in the market for Water Desalination Plant Equipment encompass Acciona, Suez Water Technologies & Solutions, Veolia Environnement, IDE Technologies, Aquatech International, Fisia Italimpianti, Doosan Heavy Industries & Construction, Abengoa, Mitsubishi Heavy Industries, and Toshiba. Notable additional players in this field include GE Water & Process Technologies, Xylem Inc., and Reverse Osmosis Desalination Systems (RO-DES). Furthermore, companies like Nalco Water (a division of Ecolab Inc.), KSB AG, and H2O Innovation also significantly influence this industry. These organizations are recognized for their pivotal roles in advancing and providing desalination technologies and related equipment.

Global Water Desalination Plant Equipment Market COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted the market for water desalination plant equipment worldwide, causing disruptions in supply chains and delays in project execution. At the same time, it ened awareness of water scarcity issues and underscored the importance of sustainable solutions.

The COVID-19 pandemic had a profound effect on the market for water desalination equipment, leading to both challenges and new prospects. At the outset, lockdowns and disruptions in supply chains resulted in project delays and decreased demand for equipment, as governments prioritized urgent health issues. However, the crisis highlighted the urgent need for reliable water supply systems, resulting in increased investments in desalination technologies, especially in arid regions. The growing emphasis on public health and hygiene further amplified the necessity for safe and dependable water sources, motivating both governmental and private entities to investigate advanced desalination methods. Moreover, ongoing technological advancements and a transition toward sustainable approaches fostered the emergence of energy-efficient desalination technologies. Consequently, the market is positioned for recovery and expansion, bolstered by ened infrastructure investments, innovative technologies, and a strong emphasis on securing water resources for future resilience. Ultimately, the pandemic acted as a catalyst for rethinking water management strategies, emphasizing the crucial role of desalination in fostering sustainable development.

Latest Trends and Innovation in The Global Water Desalination Plant Equipment Market:

- In June 2023, Veolia Water Technologies announced an acquisition of the French company, Aqualia, aimed at enhancing its desalination operations and expanding its market presence in Southern Europe and Latin America. This merger is expected to improve Veolia’s technological capabilities in seawater treatment and sustainability initiatives.

- In July 2023, Acciona announced the completion of the desalination plant in Al Khobar, Saudi Arabia, with a capacity of 210,000 cubic meters per day. This advanced facility incorporates innovative reverse osmosis technology, significantly improving energy efficiency compared to traditional desalination plants.

- In August 2023, IDE Technologies and the Israeli government signed a partnership agreement to develop a new desalination plant in Ashdod, which will utilize cutting-edge desalination technology to provide an additional 100 million cubic meters of potable water per year, targeting sustainability and environmental impact.

- In September 2023, Suez completed the installation of a state-of-the-art reverse osmosis desalination unit in its existing facility in Australia. This unit is integrated with energy recovery systems designed to reduce operational costs by up to 30%, highlighting Suez's commitment to innovation in the water sector.

- In October 2023, H2O Innovation announced its strategic acquisition of the operating assets of the Canadian company, Aqua-4S, focusing on enriching its portfolio of water treatment technologies, including advanced desalination solutions that meet the growing demand in North America.

- In November 2023, Xylem unveiled its new desalination module, designed for ease of retrofitting older desalination plants, aiming to improve the energy efficiency of existing setups by integrating IoT technology for real-time data analytics and monitoring.

- In December 2023, Oasys Water announced a significant investment round of $20 million from investors including Bill Gates's Breakthrough Energy Ventures. The funding will accelerate the development of their low-energy desalination technology, targeting commercial deployment by 2025.

Water Desalination Plant Equipment Market Growth Factors:

The primary drivers fueling the expansion of the Water Desalination Plant Equipment Market encompass the escalating shortage of freshwater resources, innovations in technology, and ened financial commitments towards sustainable water management strategies.

The market for water desalination plant equipment is witnessing notable expansion due to various pivotal elements. Primarily, the escalating global water shortage, exacerbated by rapid urbanization and population increases, calls for innovative water management strategies. This situation motivates both governmental bodies and private enterprises to channel substantial investments into desalination technologies. Moreover, the ongoing enhancements in filtration and membrane technologies are boosting the efficiency and cost-reduction of desalination processes, making them increasingly attractive for widespread usage.

Environmental issues related to the depletion of freshwater resources and the imperative for sustainable water management practices are further accelerating the integration of desalination solutions. The growing need for drinking water in arid and semi-arid areas, coupled with climate change's impact on freshwater availability, is another significant factor propelling market growth. Additionally, collaborative efforts between equipment manufacturers and academic institutions are driving innovation, thus expanding the range of applications for desalination technologies.

Government initiatives and funding aimed at improving water infrastructure play a crucial role in this market's development. The trend towards decentralized water systems, particularly in isolated or underserved regions, presents new avenues for the implementation of desalination equipment. Collectively, these dynamics shape the trajectory of the water desalination plant equipment market, highlighting a pressing necessity for sustainable water solutions to tackle global challenges.

Water Desalination Plant Equipment Market Restaining Factors:

The primary obstacles hindering the water desalination equipment market encompass substantial initial capital requirements, difficulties related to energy consumption, and apprehensions regarding environmental repercussions.

The market for water desalination plant equipment encounters various challenges that could hinder its expansion. One of the primary obstacles is the high capital and operational expenditures associated with establishing desalination facilities; these significant financial commitments can discourage investment, especially in developing nations. Moreover, energy efficiency is a major concern, as traditional desalination methods require considerable electricity, resulting in potential sustainability dilemmas and elevated operating costs. The environmental repercussions, such as the release of brine and chemicals into ocean habitats, also provoke regulatory scrutiny and public opposition. Technological hurdles, including the necessity for advancements in membrane technologies and energy-saving procedures, can further restrict market growth. Additionally, the availability of freshwater resources and competing water management strategies might diminish the demand for desalination systems. Nevertheless, the ongoing progress in desalination technologies, such as solar-powered solutions and enhanced membranes, presents new avenues for expansion. As governments and industries increasingly prioritize sustainable water management to combat water scarcity, the market is poised for transformation, fostering more efficient and innovative desalination methods. Collectively, these trends signify a favorable outlook for the desalination equipment industry.

Segments of the Water Desalination Plant Equipment Market

By Equipment:

• Pretreatment System

• Desalination Device

- Reverse Osmosis

- Multi-stage Flash (MSF) Distillation

- Multi-effect Distillation (MED)

• Post-Processing System

• Cleaning System

• Electrical Control System

By Source:

• Seawater

• Brackish water

• River water

• Others

By Production Capacity:

• Below 10 m³/hr

• 11-100 m³/hr

• 101-400 m³/hr

• 401-1,000 m³/hr

• 1,001-1,500 m³/hr

• Above 1,500 m³/hr

By Application:

• Municipal

• Industrial

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America