The value of the Virtualized RAN market is projected to grow to US$ 6.4 Bn with an estimated CAGR of 19% by 2030

.jpg)

The factors such as the advent of 4G and 5G accessibility, along with a rapid Operational Expenditure (OPEX) and Capital Expenditure (CAPEX) reduction offered by V-RAN, are responsible for the industry growth. The virtualized technology is gaining importance, owing to increasing technological development in optical and public safety wireless communication system. Additionally, the data center networking technology facilitates low-cost, latent free, and extremely scalable networking modules in the BBU pool.

Software architectures are probing in almost all industries, be it government, telecommunication, or defense sectors. Though, important challenges such as timing and processing requirements are very vital for the adoption of vRAN. Processing and timing requirements are the determining factors for RAN coverage and capacity. Thus, the advantages of virtualized RAN such as the implementation of the distinct uniform hardware platform through the core network, possibly offsets the drawbacks of vRAN. Singular hardware platforms streamline the management of the complete network whilst reducing maintenance and operational analytics costs.

Virtualized RAN Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | US$ 6.4 Bn |

| Growth Rate | CAGR of 19 % during 2020-2030 |

| Segment Covered | Component, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Cisco Systems, Inc., Fujitsu Limited, Huawei Technologies co. Ltd, NEC Corporation, Samsung Electronics Co., Ltd., Verizon Communications, Ericsson Inc. |

Key Segments of the Global Virtualized RAN Market

Communication Infrastructure Overview

- Small Cell

- Macro Cell

Connectivity Overview,

- 2G

- 3G

- 4G/LTE

- 5G

Component Overview

- Central Unit

- Distributed Unit

- Radio Unit

- Others

End-User Overview

- Commercial

- Government & Defense

- Telecommunication

- Others

Regional Overview

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global virtualized RAN market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global virtualized RAN market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the virtualized RAN industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on connectivity, communication infrastructure, component, and end-user. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global virtualized RAN market. The report will benefit:

- Every stakeholder involved in the virtualized RAN market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the global virtualized RAN market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global virtualized RAN market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

The demand for virtualized RAN market globally to witness considerable growth in the coming five years. The vRAN industry is currently at a nascent phase with most investments engrossed in virtualized small cells for pilot engagements and targeted greenfield deployments for macrocell coverage. RAN Virtualization leverages NFV/SDN to virtualize a share of the RAN against COTS (Commercial Off The Shelf) or standard IT hardware in the cloud or a central location, and has the prospective to offer advantages that include less energy consumption and smaller footprint resulting from dynamic traffic steering and load-balancing.

V-RAN is gaining increasing acceptance among mobile network operators (MNOs) and those vendors who can construct on C-RAN architectures and advance to virtualized RAN will benefit. Segments of the industry which have been adopting C-RAN architectures for some time are now among the foremost to virtualize the RAN. With an increasing demand for mobile data accompanied by augmented video streaming services, the adoption of 5G Services in the developing nations is fueling the adoption of virtualized RAN to enable high-speed data connectivity.

Communication Infrastructure Segment

The global virtualized RAN market by communication infrastructure contains both small cells, macro cell segments. The small cell segment has a considerable revenue share within the global virtualized RAN market in 2019. Small cells have the advantage of lower latency and higher speeds than macro cells and are more capable of facilitating future 5G networks. Small cells function better through controlled distances, such as the train line or neighborhoods. As they are less intrusive, small cells can be easily implemented in more populated areas and have the potential for smart cities, 5G, high-speed transport connectivity, IoT, and more owing to their low latency.

Connectivity Segment

Based on the connectivity segment, the market is bifurcated into two sub-segments that are 2G, 3G, 4G/LTE, and 5G. In 2019, the 5G segment to grow at a significant rate throughout the forecast period. The factors including lower latencies, faster networking data rates, and higher bandwidth are major requirements across industry verticals to develop business operations. 5G networking is likely to facilitate these requirements. The investment in the 5G network infrastructure is anticipated to have a positive impact on the V-RAN market by increasing product innovation and R&D activities.

Component Segment

Based on the component segment, the market is bifurcated into the central unit, distributed unit, radio unit, and others. In 2019, the central unit segment holds significant market revenue and it is anticipated to dominate the market throughout the forecast period. However, the radio unit segment is anticipated to grow at a substantial growth rate over the forecast period.

End-User Segment

Based on the end-user, the industry is classified into government & defense, telecommunication, commercial, and others. The market for the telecommunications sector is anticipated to possess the largest market share in 2019 since the telecom companies today are predominantly developing to match their user needs. Many communications service providers are selecting to extend the advantages of network virtualization within the RAN for enhanced agility as they roll out new 5G services.

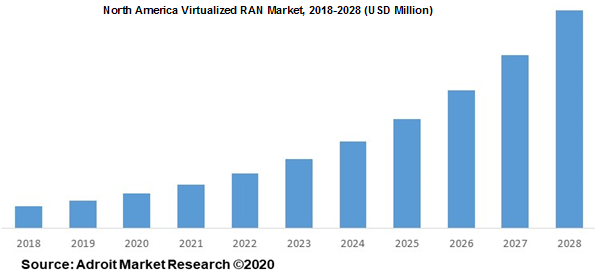

The global virtualized RAN market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in virtualized RAN applications, owing to an outsized presence of organizations with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the virtualized RAN market in North America. However, the Asia Pacific region is anticipated to grow at a staggering CAGR over the forecast period.

The major players of the global virtualized RAN market are Cisco Systems, Inc., Ericsson Inc., Fujitsu Limited, Huawei Technologies co. Ltd, Juniper Networks Inc. Microchip Technology Inc., NEC Corporation, Qualcomm Technologies, Inc., Red Hat, Inc, Nokia Corporation, Verizon Communications, Samsung Electronics Co., Ltd., ZTE Corporation, and more. The virtualized RAN market is fragmented with the existence of well-known global and domestic players across the globe.