Outlook for the Global Virtual Private Cloud Market. In 2023, the market for virtual private clouds reached a size of roughly USD 45.02 billion. The market is anticipated to expand at a compound annual growth rate (CAGR) of more than 22.7% during the 2024–2032 forecast period, reaching USD 153.06 billion by that time.

.jpg)

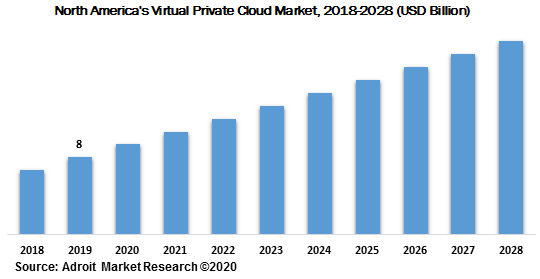

The market size for Virtual Private Cloud Market is anticipated to reach USD 107.29 Billion by 2028. Virtual Private Cloud streamlines the management by increasing the need for security, IT modernization, agility, automating the manual process and rising cost savings has led to the growth of the market. On the contrary, a lack of experts is restraining the growth of the market.

The growing requirement for enterprises to have a secure environment in cloud mobility has given rise to the increasing adoption of virtual private cloud services. Also, for an increase in revenue opportunity, SME’s are adopting a large number of private clouds for the security analytics of the organization. Many industries have started adopting the increasing need for agility and automation practices. On the other hand, poor infrastructure of the internet in some of the countries may act as a challenge for the growth of the growth. With the increasing Internet of Things security, it will create opportunities for the market of virtual private clouds market.

Virtual Private Cloud Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 153.06 billion |

| Growth Rate | CAGR of 22.7 % during 2024-2032 |

| Segment Covered | Component,Organization Size,Vertical,Regions. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Google, Microsoft, Alibaba, Huawei Technologies, Rackspace, Century Link, AWS, and many more |

Key Segments of the Virtual Private Cloud Market

Component Overview

- Software

- Services

- Implementation

- Training & Support

- Consulting & Advisory

Organization Size Overview

- Small & Medium Enterprise

- Large Enterprise

Vertical Overview

- BFSI

- IT & Telcom

- Government and Defense

- Healthcare

- Media and Entertainment

- Retail

- Manufacturing

- Others

Regional Overview

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global Virtual Private Cloud Market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global Virtual Private Cloud Market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on organization type, component, deployment, and Vertical. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global Virtual Private Cloud Market. The report will benefit:

- Every stakeholder is involved in the Virtual Private Cloud Market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the global Virtual Private Cloud Market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global Virtual Private Cloud Market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

The demand for the Virtual Private Cloud market globally to witness considerable growth in the coming five years. Wide area networking enables the organizations to outspread their computer networks over great distances, to connect remote branch workplaces to data centers and among each other, and provide the services and Verticals needed to perform business operations. The growing need for reducing IT expenses along with the dynamic business environments and growth in the implementation of cloud services in organizations are the key factors fueling the Virtual Private Cloud market growth. This, in turn, shall surge the demand for Virtual Private Cloud to prioritize the increasing focus on customer experience. However, mandatory regulations and issues with legacy systems are likely to hinder the industry growth in the coming years.

Component Segment

The Virtual Private Cloud Market market contains both software and services. It helps in building a secure and isolated environment which is the best alternative for an organization to secure its on-premises to the virtual cloud. The services segment further subdivided into Implementation, Training & Support, Consulting & Advisory

Organization Size Segment

Based on the organization size segment, the market is divided into two sub-segments that are small & medium, and large enterprise. In 2019, the SME’s gathered the largest market revenue and it is anticipated to govern the Virtual Private Cloud market throughout the forecast period. Virtual Private Cloud solutions are essential for large organizations since they have to maintain huge volumes of data, as well as a large workforce. The Virtual Private Cloud technology advances troubleshooting for networks of large organizations by having data about forwarding tables through the network. However, the small & medium segment is projected to grow at a significant growth rate over the forecast period.

Vertical Segment

Based on the Vertical, the market is segmented into BFSI, Government & Defense, and others. The BFSI dominated the Virtual Private Cloud industry in 2019 owing to the increasing demand for customers' concerns in the vertical. Moreover, cloud computing services help BFSI vendors to focus the customer's specific model by creating a multi-channel relationship with customers at every step of service provided by them. Also the vertical is adapting digitalization at a rapid scale to meet the customer requirements. The BFSI vertical deals with high volumes of data, cybersecurity, and recovery, virtual private cloud are the best solution provider of private cloud on a public cloud.

The Virtual Private Cloud Market market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the virtual private cloud market, increasing investment in cloud services has led to the growth of the market. The major contributors are US and Canada for Virtual Private Cloud Market.

The major players of the global Virtual Private Cloud Market are Google, Microsoft, Alibaba, Huawei Technologies, Rackspace, Century Link, AWS, and many more. The Virtual Private Cloud Market is fragmented with the existence of well-known global and domestic players across the globe.