Viral Vectors and Plasmid DNA Manufacturing Market Analysis and Insights:

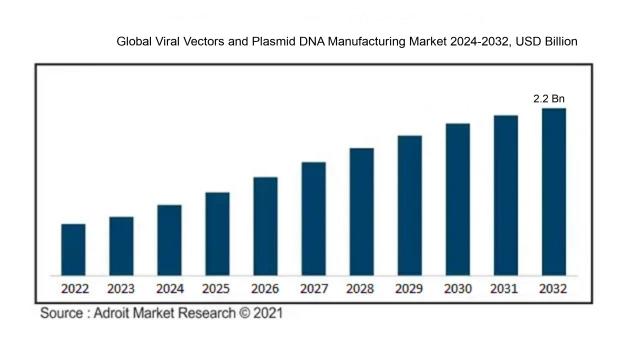

The market size for viral vectors and plasmid DNA manufacturing was estimated at USD 0.42 billion in 2023 and is expected to increase at a compound annual growth rate (CAGR) of 14.20 from 2024 to 2032, from USD 0.40 billion in 2024 to USD 2.2 billion by 2032.

The primary drivers of the market expansion for viral vectors and plasmid DNA manufacture are the rising incidence of genetic defects, as well as the rising need for gene therapy and vaccine development. Progress in biotechnology and biopharmaceuticals, particularly with innovations such as CRISPR and personalized medicine, is further driving market growth. The ongoing COVID-19 pandemic has intensified the application of viral vectors in vaccine research, underscoring their vital role in addressing infectious diseases. Moreover, the surge in research and development investments from both public and private entities is enhancing production capabilities and operational efficiency. The approval of cutting-edge therapies by regulatory bodies and the growing integration of cell and gene therapies in clinical applications are also essential elements contributing to market dynamics. In addition, partnerships between pharmaceutical companies and academic entities are promoting innovation and technological progress in the synthesis of viral vectors and plasmid DNA, reinforcing their significance in the global healthcare ecosystem.

Viral Vectors and Plasmid DNA Manufacturing Market Definition

Viral vectors are engineered viruses designed to transport therapeutic genes into cells, playing a crucial role in gene therapy strategies. The process of plasmid DNA production entails the creation of circular DNA structures that serve multiple functions, such as in gene therapy, vaccine development, and the synthesis of recombinant proteins.

The development of vaccines, gene therapy, and molecular biology studies all depend on the creation of viral vectors and plasmid DNA. These methodologies allow for the introduction of genetic material into specific cells, aiding in the treatment of genetic conditions, cancers, and infectious diseases. Their significance has increased notably with the advent of mRNA vaccines, in which plasmid DNA acts as a template for creating therapeutic proteins. Additionally, consistent and dependable manufacturing protocols are key to ensuring safety and effectiveness while complying with regulatory requirements necessary for clinical use. Ongoing advancements in this sector are crucial for improving therapeutic strategies and broadening the capability to address a wide range of diseases successfully.

Viral Vectors and Plasmid DNA Manufacturing Market Segmental Analysis:

Insights On Vector Type

Viral Vector

The dominating category in the Global Viral Vectors and Plasmid DNA Manufacturing Market is expected to be the Viral Vector. This can largely be attributed to the rising applications of viral vectors in gene therapy, vaccine development, and advanced therapeutic techniques. The industry has seen a rapid increase in investments focusing on the innovation and efficiency of viral vector technologies due to their effectiveness in delivering genetic material into target cells. Furthermore, the increasing incidence of genetic disorders and the need for personalized medicine are expected to propel the demand for viral vectors even more, thereby solidifying their leading position in the manufacturing market.

Plasmid DNA

The Plasmid DNA category is characterized by its crucial role in biotechnology and pharmaceutical applications, particularly in the production of vaccines and gene therapies. Plasmid DNA has gained popularity because of its safety profile and ease of modification, while not being as popular as viral vectors. Its significance in the market is further supported by its capacity to effectively manufacture vast amounts of plasmid DNA. Additionally, ongoing research and development focusing on plasmid technologies for therapeutic purposes can also drive demand, making it a noteworthy in the overall manufacturing landscape.

Non-viral Vector

Non-viral Vector technologies are being increasingly recognized for their potential benefits, such as lower immunogenicity and safety concerns compared to viral counterparts. However, their market share remains eclipsed by viral vectors and plasmid DNA. The research community is actively exploring non-viral options for gene delivery due to their ability to provide stable genetic integration. While their application is growing in certain areas, such as DNA vaccines and gene editing tools, they still face challenges in efficiency and uptake. This prevents them from becoming a dominant group in the market for plasmid DNA and viral vectors as a whole.

Insights On Disease Type

Cancer

The global market for viral vectors and plasmid DNA manufacturing is anticipated to be dominated by those who focus on cancer. The main reason for this is the rising incidence of cancer globally, which has increased demand for gene treatments and other cutting-edge therapeutic approaches. Cancer therapies utilizing viral vectors are gaining traction, as they offer targeted approaches to treatment and the potential for long-lasting effects. Research advancements and significant investments in oncology, particularly in gene therapy and personalized medicine, further underpin the growth of this sector. Additionally, the rising number of clinical trials and collaborations among biotechnology companies specifically aim to tackle various forms of cancer, making it the leading category in this market.

Genetic Disorder

The market for viral vectors and plasmid DNA manufacturing related to genetic disorders is also witnessing notable growth. This surge can be attributed to the increasing identification and understanding of various genetic diseases, combined with a rise in gene therapy applications aimed at correcting genetic defects. Regulatory approvals for innovative gene therapies targeting disorders such as cystic fibrosis and hemophilia are encouraging research and investment in this space. Moreover, advancements in genome-editing technologies further enhance the feasibility and appeal of developing therapies for genetic disorders, allowing for potentially curative approaches that can change patient outcomes.

Infectious Disease

The associated with infectious diseases is steadily progressing within the Global Viral Vectors and Plasmid DNA Manufacturing Market. The growing concern regarding infectious outbreaks, especially highlighted by recent global health crises, has driven investments in vaccine development and antiviral systems utilizing viral vectors and plasmids. Research efforts aimed at creating effective vaccines against diseases such as HIV, Hepatitis C, and emerging pathogens are increasing. This intensified focus not only addresses immediate health threats but also paves the way for future preventative treatments, establishing a solid foundation for the continued development in this area, albeit with comparatively less dominance compared to cancer treatment scenarios.

Insights On Applications

Gene Therapy

Gene therapy is anticipated to lead the Global Viral Vectors and Plasmid DNA Manufacturing Market due to the rapidly increasing adoption of innovative treatments that target genetic disorders. The advancement in customized therapies utilizing viral vectors allows for precise delivery and modification of genes, making it a focal point for pharmaceutical companies and research institutions. Additionally, the successful approval of several commercial gene therapies has generated increased interest and funding in this area, driving up demand for manufacturing capabilities. As many genetic diseases are currently untreatable, the need for effective therapies is urgent, making gene therapy a dominant player in this market.

Antisense & RNAi Therapy

Antisense and RNAi therapy is a promising area that focuses on the modulation of gene expression through targeted RNA sequences. It holds potential for treating various diseases, including cancers and genetic disorders, by silencing specific genes. The ongoing research and clinical trials to expand the applicability of these therapies have drawn significant attention. However, compared to gene therapy, antisense and RNAi therapies are still developing, which puts them in a supportive position rather than a dominant one in the current market landscape.

Cell Therapy

Living cells are used in cell therapy to treat a variety of illnesses, such as cancer and degenerative disorders. This strategy has gained popularity because of its potential uses in personalized medicine and regenerative medicine. However, while the demand for cell therapies is growing, the complexity of manufacturing and regulatory challenges can impede rapid scale-up and commercialization. This makes it an important area, but currently, it lacks the market dominance seen in gene therapy, which is further along in terms of clinical success and product availability.

Vaccinology

Vaccinology refers to the study and development of vaccines to prevent infectious diseases, and it has gained immense importance in light of recent global health challenges. The manufacturing process for viral vectors and plasmid DNA is critical in the production of vector-based vaccines, particularly against emerging viruses. While this is experiencing growth, particularly due to the COVID-19 pandemic, it still competes with gene therapy's established applications for more targeted genetic diseases, highlighting its pivotal but not leading role in the Viral Vectors and Plasmid DNA Manufacturing Market.

Research

The research application involves the usage of viral vectors and plasmid DNA in academic and clinical studies to advance understanding and innovation in the field of genetics and molecular biology. Although it plays a vital role in the development of new therapies and drug discovery, its focus is primarily on exploration rather than commercialization. Research is generally considered a more foundational aspect of the applications landscape and does not yet match the commercial potential and market influence exerted by gene therapy and its therapeutic applications.

Insights On Workflow

Downstream Processing

Downstream Processing is expected to dominate the Global Viral Vectors and Plasmid DNA Manufacturing Market primarily due to its critical role in purifying and formulating the viral vectors and plasmid DNA essential for therapeutic applications. With the increasing focus on gene therapies and vaccines, the demand for effective downstream processes that ensure high purity and yield is becoming more pronounced. The complexity of these processes, which include filtration, chromatography, and concentration techniques, drives investments and technological advancements in downstream processing. As the industry seeks to optimize product quality and regulatory compliance, Downstream Processing will likely see ened activity, making it the leading aspect of workflow in this market.

Upstream Processing

Upstream Processing refers to the initial stage of manufacturing where cell culture and fermentation processes are employed to produce the viral vectors and plasmid DNA. Although vital, this phase tends to be less emphasized than downstream due to its lower complexity and the abundance of established technologies. The drive toward automation and process optimization continues to foster growth in this area, but it is the purification and final product development stages, characteristic of downstream processing, that draw more focus and investment. As such, while important, Upstream Processing is likely to remain behind its counterpart in market dominance.

Downstream Processing

Downstream Processing involves the purification and formulation of viral vectors and plasmid DNA, making it essential for ensuring product efficacy and safety. This stage includes several sophisticated methods, such as chromatography and filtration, aimed at removing impurities and concentrating the desired products. As the market sees a rise in advanced therapies that require the highest levels of quality assurance, investments in Downstream Processing technologies will continue to increase significantly. Consequently, this area is pivotal for meeting stringent regulatory requirements and customer demand, solidifying its crucial role within the viral vectors and plasmid DNA manufacturing landscape.

Insights On End User

Pharmaceutical and Biopharmaceutical Companies

The Pharmaceutical and Biopharmaceutical Companies category is expected to dominate the Global Viral Vectors and Plasmid DNA Manufacturing Market. This predominance can be attributed to the increasing focus on gene therapies and personalized medicines that these companies are actively developing. The surge in research and development investments, coupled with a growing number of clinical trials, is driving demand for high-quality viral vectors and plasmid DNA. Additionally, innovations in biomanufacturing processes and the rising incidence of chronic diseases are further incentivizing these companies to utilize advanced vectors and plasmids for effective treatment solutions in the therapeutic landscape.

Research Institutes

Research Institutes represent a critical of the Global Viral Vectors and Plasmid DNA Manufacturing Market, albeit a smaller one compared to pharmaceutical companies. These institutions play a pivotal role in foundational research and development activities, often collaborating with pharmaceutical companies to advance scientific knowledge and develop novel therapies. Their demand for viral vectors and plasmid DNA is primarily tied to academic studies and preclinical research, where innovation in gene delivery systems is pursued. However, the limited budget and longer timelines associated with research projects can often hinder their impact on overall market growth.

Global Viral Vectors and Plasmid DNA Manufacturing Market Regional Insights:

North America

North America is anticipated to dominate the Global Viral Vectors and Plasmid DNA Manufacturing market due to its robust biotechnology infrastructure, significant funding for research and development, and the presence of leading companies in the healthcare and pharmaceutical sectors. A strong focus on gene therapies and personalized medicine fuels demand, particularly in the United States. Furthermore, collaborations between academic institutions and private industry enhance innovation and speed up product development. High investment in advanced manufacturing processes and regulatory support for novel treatments also position North America as the frontrunner in this market, making it a critical hub for advancements in viral vectors and plasmid DNA production.

Latin America

Latin America is emerging as a potential growth area for the Global Viral Vectors and Plasmid DNA Manufacturing market, driven by increasing investments in healthcare and biotechnology. Governments in countries like Brazil and Argentina are recognizing the importance of biotechnology in addressing healthcare challenges and are boosting funding for research initiatives. The market is still developing, but growing interest from global companies and collaboration with local institutions could gradually enhance its landscape.

Asia Pacific

The Asia Pacific region shows promise in the Global Viral Vectors and Plasmid DNA Manufacturing market, primarily due to rising investments in healthcare infrastructure and research. Nations like China and India are focusing on expanding their biomanufacturing capabilities, attracting investments for advancing gene therapy solutions. The increasing prevalence of chronic diseases and genetic disorders, coupled with a vast patient population, creates a favorable atmosphere for growth in this sector, although it may still lag behind North America.

Europe

Europe is a significant player in the Global Viral Vectors and Plasmid DNA Manufacturing market, powered by established regulatory frameworks and a strong focus on research and innovation. Countries such as Germany and the UK are at the forefront of biotechnology, promoting collaboration between academia and industry. However, the market's growth is relatively tempered compared to North America, owing to regulatory complexities and varying degrees of funding support across different nations.

Middle East & Africa

The Middle East & Africa region represents a nascent sector in the Global Viral Vectors and Plasmid DNA Manufacturing market. While there is notable growth potential, particularly in areas such as South Africa and the Gulf Cooperation Council (GCC) countries, challenges such as limited funding, infrastructure, and regulatory hurdles hinder rapid development. However, ongoing efforts to improve healthcare systems and promote biotechnology could gradually shift the region's position in this market, fostering future opportunities.

Viral Vectors and Plasmid DNA Manufacturing Competitive Landscape:

Prominent entities within the global manufacturing sector of viral vectors and plasmid DNA are concentrating on pioneering production methodologies and forming strategic alliances to improve the efficiency and scalability of their manufacturing processes. Their partnerships with research organizations and biotech firms facilitate progress in the realms of gene therapy and vaccine innovation.

Prominent entities within the Viral Vectors and Plasmid DNA Manufacturing sector comprise Lonza Group AG, Thermo Fisher Scientific Inc., Merck KGaA, Fujifilm Diosynth Biotechnologies, Charles River Laboratories International, Inc., Takara Bio Inc., GenScript Biotech Corporation, MilliporeSigma, WuXi AppTec, and BioVectra. Furthermore, other significant players in this arena include Sangamo Therapeutics, Inc., Oxford Biomedica, Virovek, Inc., Avid Bioservices, Inc., and SIRION Biotech GmbH. Moreover, Uniqure N.V., KBI Biopharma, and Aldevron also play a vital role in contributing to this industry.

Global Viral Vectors and Plasmid DNA Manufacturing COVID-19 Impact and Market Status:

The COVID-19 pandemic greatly ened the need for the production of viral vectors and plasmid DNA, fueled by a surge in funding for gene therapy initiatives and the advancement of vaccine research.

The COVID-19 health crisis has profoundly impacted the market for viral vectors and plasmid DNA production, driving a surge in the need for innovative therapies and vaccines. The urgent requirement for swift vaccine deployment has prompted organizations to intensify their efforts in leveraging viral vector and plasmid DNA technologies, particularly for mRNA vaccine formulation, which depends on plasmid synthesis. This rising demand has catalyzed greater investments in manufacturing infrastructures and technological advancements, encouraging the creation of new production facilities and collaborative efforts. Furthermore, the pandemic has highlighted the critical nature of supply chain robustness, leading manufacturers to expand and diversify their sourcing and production methodologies. Despite ongoing challenges such as regulatory complexities and production constraints, the overall industry landscape has evolved, setting the stage for continued growth as biopharmaceutical companies investigate gene therapies and vaccine solutions for a variety of health conditions beyond COVID-19.

Latest Trends and Innovation in The Global Viral Vectors and Plasmid DNA Manufacturing Market:

- In October 2023, Lonza announced a collaboration with the University of Helsinki to advance the development of viral vectors for gene therapy applications, aiming to enhance its manufacturing capabilities and capacity for producing viral vectors.

- In September 2023, WuXi AppTec expanded its plasmid DNA manufacturing capabilities by opening a new facility in Massachusetts, allowing for increased production capacity to support the growing demand in the cell and gene therapy sectors.

- In August 2023, Catalent completed the acquisition of Paragon Bioservices, enhancing its capability to produce viral vectors at scale and strengthening its position in the gene therapy market.

- In July 2023, Charles River Laboratories announced an expansion of its viral vector manufacturing capacity in North Carolina, focusing on improving turn-around times and increasing overall production efficiency.

- In June 2023, Pfizer entered into a partnership with BioNTech to co-develop a new mRNA platform that utilizes advanced plasmid DNA technologies, signaling a strategic move towards enhancing their collective capabilities in vaccine and therapy development.

- In May 2023, Iovance Biotherapeutics reported a successful completion of their IND application for a new cell therapy that uses plasmid DNA, marking a significant step forward in their manufacturing process for advanced therapies.

- In April 2023, Avidity Biosciences acquired an innovative gene delivery technology company, allowing for better precision and efficiency in viral vector design, furthering their platform in RNA-based therapies.

- In March 2023, Rhein Biotech announced the successful scaling of their proprietary technology for plasmid DNA production, resulting in cost reductions and enhanced yield, which can benefit various biotech applications moving forward.

- In February 2023, SINGULUS TECHNOLOGIES showcased advancements in its C pipeline for producing nucleic acid therapies, focusing on efficiency and automation improvements in viral vector production practices during the BIO International Convention.

- In January 2023, Amgen announced a strategic investment in the development of a viral vector platform aimed at improving production processes and enhancing development timelines for their gene therapy projects.

Viral Vectors and Plasmid DNA Manufacturing Market Growth Factors:

The expansion of the market for Viral Vectors and Plasmid DNA manufacturing is primarily fueled by the escalating need for gene therapies, innovations in biotechnological practices, and a surge in financial support for research and development in the field of genetic medicine.

The expansion of the Viral Vectors and Plasmid DNA Manufacturing Market is influenced by a multitude of key drivers. Primarily, the increasing incidence of genetic disorders and cancers has ened the demand for gene therapies, which in turn necessitates the effective development of viral vectors and plasmid DNA-based interventions. Moreover, significant progress in biotechnology, paired with rising investments in research and development, encourages innovations that improve the safety and efficiency of production techniques.

The ened engagement of biopharmaceutical firms in adopting gene therapies for a range of health issues further fuels market growth. Additionally, collaborations and strategic partnerships amongst research institutions, academic organizations, and pharmaceutical companies promote the exchange of knowledge and resource sharing, thereby expediting development timelines for new products.

The regulatory environment is also evolving, offering clearer approval pathways that incentivize new entrants into the market. Finally, the increasing momentum towards personalized medicine, focusing on individualized treatment approaches, enhances the demand for bespoke therapeutic solutions, further propelling the growth of viral vectors and plasmid DNA manufacturing. In summary, these interconnected factors suggest a promising future for the market as it seeks to address emerging health care challenges through innovative therapeutic strategies.

Viral Vectors and Plasmid DNA Manufacturing Market Restaining Factors:

Significant obstacles in the manufacturing market for viral vectors and plasmid DNA involve elevated production expenses, intricate regulatory requirements, and difficulties related to scalability.

The market for viral vectors and plasmid DNA manufacturing is confronted with numerous challenges that could impede its growth. Key obstacles include elevated production expenses, rigorous regulatory standards, and the complexities associated with scaling manufacturing operations. The production of viral vectors is particularly intricate, requiring sophisticated technologies and highly skilled professionals, which often leads to considerable capital investments and ongoing operational costs. Moreover, adherence to strict regulatory guidelines can protract development timelines and present hurdles for new market entrants. The threat of contamination during the manufacturing process is also a critical concern, as it may result in product recalls and financial losses. Additionally, ongoing intellectual property disputes and competition from alternative gene delivery systems, such as liposomes and nanoparticles, may further restrict market growth. Nevertheless, continuous advancements in manufacturing technologies combined with increased investment in research and development are creating pathways for enhanced efficiency and cost reduction over time. As research continues to evolve and regulatory environments shift, the potential for innovation and expansion in the viral vectors and plasmid DNA manufacturing sector remains strong, ultimately yielding benefits for patients and healthcare systems on a global scale.

Key Segments of the Viral Vectors and Plasmid DNA Manufacturing Market

By Vector Type

• Plasmid DNA

• Viral Vector

• Non-viral Vector

By Disease Type

• Cancer

• Genetic Disorder

• Infectious Disease

By Applications

• Antisense & RNAi Therapy

• Gene Therapy

• Cell Therapy

• Vaccinology

• Research

By Workflow

• Upstream Processing

• Downstream Processing

By End User

• Pharmaceutical and Biopharmaceutical Companies

• Research Institutes

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America