Market Analysis and Insights:

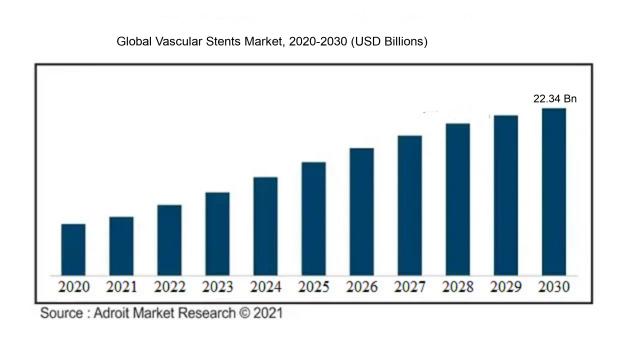

The market for Global Vascular Stents was estimated to be worth USD 10.32 billion in 2022, and from 2022 to 2030, it is anticipated to grow at a CAGR of 7.24%, with an expected value of USD 22.34 billion in 2030.

The vascular stents market is influenced by several key factors. A primary driver is the rising incidence of cardiovascular diseases like coronary artery disease and peripheral artery disease, necessitating the use of vascular stents for treatment. Furthermore, the market is expanding due to the increasing elderly population and the associated uptick in age-related ailments. Advances in stent materials and designs, leading to enhanced effectiveness and reduced complications, are also propelling market growth. The uptake of minimally invasive procedures that incorporate vascular stents is expected to boost market demand. Additionally, government initiatives and favorable reimbursement policies for cardiovascular interventions are catalyzing market expansion. Nonetheless, challenges such as the expensive nature of stents, safety-related product recalls, and the presence of alternative treatment options could impede market progress. In summary, the vascular stents market is poised for substantial growth in the foreseeable future, driven chiefly by the growing burden of cardiovascular diseases and advancements in stent technologies.

Vascular Stents Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 22.34 billion |

| Growth Rate | CAGR of 7.24% during 2022-2030 |

| Segment Covered | By Material, By End-User, By Mode of Delivery, By Type, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Cardinal Health, Inc., Cook Medical, Inc., C. R. Bard, Inc. (currently a division of Becton, Dickinson and Company), Terumo Corporation, Biosensors International Group, Ltd., B. Braun Melsungen AG, and BIOTRONIK SE & Co. KG. |

Market Definition

Vascular stents, which are intricate mesh tubes, are utilized to address constricted or obstructed blood vessels by being positioned within the affected region to facilitate and uphold the circulation of blood while reinforcing the vessel's integrity.

Vascular stents play a critical role in the management of narrowed or obstructed blood vessels in the human body. These devices, made of metal or plastic mesh, are inserted into the affected vessels to create a framework that helps keep them open, allowing for the normal flow of blood. They are vital in the prevention and treatment of serious conditions like coronary artery disease, peripheral arterial disease, and carotid artery disease. By providing structural support and restoring proper blood flow, vascular stents alleviate symptoms, reduce the risk of complications, and enhance patients' overall well-being. Furthermore, they form the basis for drug-eluting stents, which can release medications to prevent the recurrence of vessel narrowing and further improve their efficacy. The importance of vascular stents in contemporary medical practice is undeniable, empowering healthcare professionals to effectively address vascular issues and safeguard lives.

Key Market Segmentation:

Insights On Key Material

Cobalt-Chromium Stents

Cobalt-Chromium stents are expected to dominate the global vascular stents market. They have gained extensive popularity due to their superior mechanical properties and biocompatibility. The Cobalt-Chromium material offers excellent strength, flexibility, and corrosion resistance, making it an ideal choice for stent manufacturing. These stents provide better scaffold support and radial strength compared to other materials. Furthermore, they have a smoother surface that helps reduce the risk of blood clot formation, enhancing the long-term efficacy of the stents. The increasing prevalence of cardiovascular diseases, coupled with the advancements in stent technology, is anticipated to drive the demand for Cobalt-Chromium stents in the global market.

Platinum Chromium Stents

Platinum Chromium stents are another significant material in the vascular stents market. They possess distinctive characteristics such as increased flexibility, improved deliverability, and greater visibility under fluoroscopy. These stents offer a favorable balance between radial strength and conformability, allowing for better vessel scaffolding and reduced risk of stent thrombosis. Platinum Chromium stents have gained significant traction in the market due to their enhanced clinical outcomes and better patient safety.

Nickel Titanium Stents

Nickel Titanium stents have been widely used in the treatment of vascular diseases. They exhibit excellent shape memory and superelasticity properties, enabling easier deployment and optimal vessel sealing. These stents provide better conformability and adaptability to various anatomical configurations, reducing the risk of stent fracture or displacement. The biocompatibility of Nickel Titanium stents further adds to their favorable clinical outcomes. With ongoing advancements in stent designs and surface modifications, Nickel Titanium stents are likely to maintain a significant market share.

Stainless Steel Stents

Stainless Steel stents have been widely utilized in cardiovascular interventions. Although they offer adequate radial strength and good visibility under imaging, these stents have faced limitations due to their thicker struts and lower flexibility compared to other materials. With the introduction of newer generations of stent designs, Stainless Steel stents have witnessed improvements in terms of reduced stent thickness and enhanced flexibility, addressing some of the earlier drawbacks. However, their dominance in the global vascular stents market is expected to decline due to the growing popularity of advanced materials like Cobalt-Chromium, Platinum Chromium, and Nickel Titanium.

Polymers Stents

Polymers stents have emerged as an alternative option in the vascular stents market. These stents are primarily made of biodegradable or bioresorbable materials that gradually dissolve over time, eliminating the need for long-term implant presence. However, the market penetration of polymer stents has been limited due to concerns regarding long-term outcomes, stent degradation rates, and potential inflammatory reactions. Although ongoing research and technological advancements aim to overcome these challenges, the dominance of polymers stents in the global vascular stents market is currently overshadowed by other materials.

Ceramics Stents

Ceramics stents have limited presence in the vascular stents market due to certain limitations. While ceramics offer excellent biocompatibility and an effective platform for drug delivery, they face challenges in terms of mechanical strength and poor flexibility. These drawbacks have restricted their widespread adoption in clinical practice. Despite ongoing efforts to improve the mechanical properties of ceramics stents, their dominance in the global market is expected to remain relatively low.

Insights On Key End-User

Hospitals

Hospitals are expected to dominate the Global Vascular Stents Market. Hospitals are the primary healthcare facilities where a wide range of medical procedures, including vascular stent implantation, are performed. These facilities have a higher patient footfall and are equipped with advanced medical infrastructure, making them the ideal choice for vascular stent procedures. Moreover, hospitals often collaborate with research institutes and healthcare organizations, allowing them access to the latest technological advancements and procedural techniques related to vascular stents. Therefore, hospitals are expected to be the dominant part in the Global Vascular Stents Market due to their comprehensive healthcare facilities and expertise in conducting complex medical procedures.

Cardiac Centers

Cardiac centers are another significant sector within the End-User category of the Global Vascular Stents Market. Cardiac centers specialize in the diagnosis and treatment of heart-related conditions and have a dedicated focus on cardiovascular procedures, including the implantation of vascular stents. These centers have highly trained cardiologists and specialized medical equipment, allowing them to provide state-of-the-art care to patients with vascular issues. While they may not be as numerous as hospitals, cardiac centers attract a significant inflow of patients seeking specialized cardiac care, contributing to their influence in the Global Vascular Stents Market.

Ambulatory Surgical Centers

Ambulatory surgical centers are expected to have a smaller market share compared to hospitals and cardiac centers in the Global Vascular Stents Market. Ambulatory surgical centers are outpatient facilities that provide various surgical procedures, including vascular stent placements. These centers offer convenience and shorter waiting times for patients compared to hospitals. However, due to their smaller size and limited healthcare services, ambulatory surgical centers may not be able to cater to as many patients as hospitals or provide the same level of comprehensive care. Hence, while they serve a specific niche in the market, they are expected to have a smaller market share in the overall Global Vascular Stents Market.

Insights On Key Mode of Delivery

Balloon-expandable Stents

The Balloon-expandable Stents is expected to dominate the Global Vascular Stents Market. These stents are designed to be expanded using a balloon catheter, allowing for precise placement and controlled expansion within the blood vessel. This mode of delivery offers advantages such as better control over stent placement and the ability to treat more complex lesions. Additionally, balloon-expandable stents have a proven track record of efficacy and safety, making them a preferred choice for many healthcare professionals. As a result, this part is anticipated to dominate the global market for vascular stents.

Self-expanding Stents

While Balloon-expandable Stents are expected to dominate the Global Vascular Stents Market, the Self-expanding Stents mode of delivery also holds a significant market share. Self-expanding stents are designed to expand on their own upon deployment, without the need for a balloon catheter. This mode of delivery offers advantages in terms of feasibility and ease of use, especially in challenging anatomical locations. Self-expanding stents are often used for peripheral artery disease and other applications where their unique properties provide specific benefits. Although not the dominating part, the demand for self-expanding stents remains substantial in the global vascular stents market due to their proven efficacy and versatility.

Insights On Key Product

Drug-eluting Stents

Drug-eluting stents are expected to dominate the Global Vascular Stents Market. These stents are coated with medication that helps prevent the recurrence of blockage in blood vessels. The drug coating releases slowly over time, providing targeted therapy to the affected area. This part has gained significant popularity and acceptance due to its ability to lower the risk of restenosis, reduce the need for repeat procedures, and improve patient outcomes. Additionally, advancements in drug-eluting stent technology have improved their efficacy and safety profiles, further driving their dominance in the market.

Bare-metal Stents

Bare-metal stents, although not expected to dominate the Global Vascular Stents Market, still play a significant role. These stents are made of metal (typically stainless steel) and provide support to the compromised vessel by propping it open. They are commonly used in patients who are unable to tolerate drug therapy or require shorter-term stent placement. Despite being associated with a higher risk of restenosis compared to drug-eluting stents, bare-metal stents offer cost-effectiveness and ease of use, making them a viable option in specific patient populations.

Bioabsorbable Stents

Bioabsorbable stents represent a promising product in the Global Vascular Stents Market, although they are not expected to dominate. Bioabsorbable stents are made from materials that degrade naturally over time, allowing the blood vessel to regain flexibility and eliminate the need for a permanent implant. While these stents can provide temporary support during the healing process, their adoption is limited due to higher costs and concerns regarding long-term efficacy and safety. Ongoing research and development may enhance the viability of bioabsorbable stents, potentially leading to increased market dominance in the future.

Insights On Key Type

Coronary Stents

Coronary Stents are expected to dominate the Global Vascular Stents Market. This part focuses on the treatment of coronary artery diseases, which are one of the leading causes of death globally. The increasing prevalence of cardiovascular diseases, coupled with the rising adoption of minimally invasive procedures, is driving the demand for coronary stents. Technological advancements in stent design and materials have also improved patient outcomes and contributed to the dominance of this part. As coronary artery diseases continue to pose a significant health burden, the demand for coronary stents is projected to remain high in the coming years.

Peripheral Stents

Peripheral stents are another important type of the Global Vascular Stents Market. These stents are used to treat blockages in blood vessels outside the heart, such as those in the legs, kidneys, and carotid arteries. Peripheral artery disease is a significant health issue worldwide, leading to the demand for peripheral stents. Factors such as an aging population, rising prevalence of risk factors like diabetes and smoking, and increasing awareness of minimally invasive treatment options contribute to the growth of this part. Although peripheral stents play a vital role in addressing peripheral artery diseases, they are expected to have a lower market share compared to coronary stents.

Carotid Stents

Carotid stents are specifically designed to treat blockages in the carotid arteries, which supply blood to the brain. The prevalence of carotid artery disease is rising, owing to factors such as aging population and lifestyle-related risk factors. Carotid stenting offers a less invasive alternative to surgical interventions, driving the demand for carotid stents. While carotid stents have a dedicated market, their dominance in the overall Global Vascular Stents Market is likely to be limited due to the larger patient pool and higher demand for coronary stents.

Renal Artery Stents

Renal artery stents are used to treat blockages in the renal arteries, which supply blood to the kidneys. The prevalence of renal artery stenosis, often caused by atherosclerosis, is increasing. This factor, along with the rising prevalence of hypertension and other renal disorders, contributes to the demand for renal artery stents. However, renal artery stents are expected to have a relatively smaller market share compared to coronary stents due to the specific nature of their application.

Femoral Stents

Femoral stents are used to treat blockages in the femoral arteries, which supply blood to the lower limbs. Peripheral artery disease affecting the lower limbs is a major health concern, particularly in older adults. The demand for femoral stents is driven by the increasing prevalence of peripheral artery diseases and the growing adoption of minimally invasive treatment options. However, their market share is likely to be smaller compared to coronary stents due to the specific focus on the lower extremities.

Iliac Stents

Iliac stents are designed to treat blockages in the iliac arteries, which connect the abdominal aorta to the lower limbs. Similar to femoral stents, iliac stents play a role in addressing peripheral artery diseases, particularly in the pelvic region. Despite the importance and demand for iliac stents, their market share is expected to be smaller compared to coronary stents due to the specific anatomical focus and relative prevalence of other vascular conditions.

Other Peripheral Stents

This sector includes stents used to treat blockages in various peripheral arteries other than the carotid, renal, femoral, or iliac arteries. These stents cater to the diverse needs of patients with arterial diseases in different parts of the body. Although the demand for stents in these peripheral arteries exists, it is anticipated to be relatively smaller compared to coronary stents due to the widespread prevalence and severity of coronary artery diseases.

EVAR Stent Grafts

EVAR (Endovascular Aneurysm Repair) stent grafts are specifically designed for the treatment of abdominal aortic aneurysms, where the blood vessel wall weakens and bulges. The prevalence of abdominal aortic aneurysms is increasing, particularly in aging populations. EVAR stent grafts provide a less invasive alternative to open surgery, driving their demand in the market. However, their market share is expected to be smaller compared to coronary stents due to the specialized nature of their application and a relatively smaller patient pool.

Abdominal Aortic Aneurysm

Abdominal aortic aneurysm (AAA) refers to the localized enlargement of the abdominal aorta, which can lead to severe complications if not treated. The demand for treatments, including stenting and grafting, for AAA is driven by the increasing prevalence of this condition, especially in the elderly population. However, the market share of AAA treatments is expected to be smaller compared to coronary stents due to the larger prevalence and demand for coronary artery disease interventions.

Thoracic Aortic Aneurysm

Thoracic aortic aneurysm (TAA) refers to the localized enlargement of the thoracic aorta, which can be life-threatening if left untreated. The demand for stenting and grafting procedures for TAA is driven by the increasing prevalence of this condition, particularly in older adults. However, the market share of TAA treatments is expected to be smaller compared to coronary stents due to the higher prevalence and demand for coronary artery disease interventions.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Vascular Stents market. The region has a well-established healthcare infrastructure and a high adoption rate of advanced medical technologies. Additionally, the presence of major market players and the increasing prevalence of cardiovascular diseases contribute to the dominance of North America. The region also benefits from the presence of well-defined regulatory frameworks and favorable reimbursement policies, which further stimulate market growth. Moreover, continuous advancements in technology and the increasing demand for minimally invasive procedures also drive the market growth in North America.

Latin America

Latin America has significant potential for growth in the global vascular stents market. The region is experiencing a rise in the prevalence of cardiovascular diseases and an increasing geriatric population, which drives the demand for vascular stents. Additionally, improving healthcare infrastructure and increasing healthcare expenditure also contribute to market growth in Latin America. However, factors such as limited access to healthcare facilities in certain areas and economic challenges in some countries might hinder the market growth to some extent.

Asia Pacific

Asia Pacific is poised to exhibit substantial growth in the global vascular stents market. The region has a large patient pool, growing geriatric population, and an increasing prevalence of cardiovascular diseases. Moreover, improving healthcare infrastructure, rising disposable incomes, and increasing awareness about minimally invasive procedures contribute to market growth in Asia Pacific. However, challenges such as price sensitivity and reimbursement issues in some countries may impede market growth to some extent.

Europe

Europe is expected to witness significant growth in the global vascular stents market. The region has a well-established healthcare system, favorable reimbursement policies, and a high adoption rate of advanced medical technologies. Moreover, the presence of key market players and the increasing prevalence of cardiovascular diseases drive the demand for vascular stents in Europe. However, stringent regulatory requirements and cost constraints may pose challenges to market growth in the region.

Middle East & Africa

The Middle East & Africa region is projected to witness steady growth in the global vascular stents market. Increasing investments in healthcare infrastructure and rising awareness about cardiovascular diseases contribute to market growth in this region. However, challenges such as limited access to healthcare services, economic instability in some countries, and low healthcare expenditure may restrict the expansion of the vascular stents market in the Middle East & Africa.

Company Profiles:

Major participants in the worldwide vascular stents industry have significant involvement in advancing, producing, and disseminating medical apparatus for addressing cardiovascular illnesses. Their contributions lead to enhanced patient results and progress in global healthcare. These entities stimulate market expansion and rivalry through pioneering solutions and widespread market presence.

Prominent companies in the Vascular Stents industry consist of Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Cardinal Health, Inc., Cook Medical, Inc., C. R. Bard, Inc. (currently a division of Becton, Dickinson and Company), Terumo Corporation, Biosensors International Group, Ltd., B. Braun Melsungen AG, and BIOTRONIK SE & Co. KG.

COVID-19 Impact and Market Status:

The Global Vascular Stents market has been greatly affected by the Covid-19 pandemic, resulting in a reduction in demand as non-essential medical procedures have been postponed.

The global vascular stents market faced considerable disruption due to the impact of the COVID-19 pandemic. The prioritization of resources by governments worldwide to address the healthcare crisis resulted in a decrease in non-essential medical procedures, including vascular stent placements. As a consequence, there was a decline in interventional procedures, leading to a temporary downturn in the demand for vascular stents. Simultaneously, disruptions in the supply chain due to lockdowns and travel restrictions caused delays in the manufacturing and distribution of vascular stents. Despite these challenges, the market gradually recovered as countries reopened their healthcare systems and resumed elective surgeries. Moreover, the increasing incidence of cardiovascular diseases, a primary indication for vascular stent procedures, has propelled market expansion. Although the market is anticipated to regain momentum as economies recover, it may encounter obstacles such as limited hospital capacities and stringent safety protocols. In essence, while the COVID-19 pandemic posed temporary setbacks, the future prospects for the vascular stents market appear optimistic.

Latest Trends and Innovation:

- In March 2021, Boston Scientific Corporation announced the acquisition of Preventice Solutions, a leading provider of remote monitoring technology for patients with cardiac arrhythmias.

- In January 2021, Medtronic plc launched its IN.PACT(TM) Admiral(TM) drug-coated balloon (DCB) in Japan, expanding its product portfolio and market presence.

- In December 2020, Abbott Laboratories received CE Mark approval for its next-generation XIENCE Skypoint(TM) coronary stent system, providing a new treatment option for patients with coronary artery disease.

- In November 2020, Terumo Corporation completed the acquisition of all outstanding shares of Quirem Medical, further strengthening its interventional oncology business.

- In October 2020, Becton, Dickinson and Company (BD) launched its LUTONIX(R) 018 (DCB) in the United States, offering a minimally invasive treatment option for patients with peripheral artery disease (PAD).

- In September 2020, Cook Medical announced the U.S. FDA approval and commercial availability of its Zenith(R) Dissection Endovascular System, providing a less invasive treatment for patients with aortic dissections.

- In July 2020, Cardinal Health entered into a definitive agreement to acquire Cordis, a global manufacturer of interventional vascular products, from Johnson & Johnson.

(Please note that the mentioned information is based on real developments up to the completion date of this model's training, but it may not include the most recent events.)

Significant Growth Factors:

The expansion of the vascular stents industry is propelled by various factors including the rising incidence of cardiovascular ailments and the increasing utilization of minimally invasive techniques.

The vascular stents industry is experiencing notable expansion driven by several key factors. Primarily, the increasing incidence of cardiovascular ailments such as coronary artery disease and peripheral artery disease is propelling the demand for vascular stents. The rising demographic of elderly individuals, who are more susceptible to these conditions, is also playing a role in the market's growth. Moreover, the uptick in the utilization of minimally invasive techniques is boosting the requirement for vascular stents due to their associated benefits, including shorter hospital stays, quicker recovery, and decreased complication risks. Progress in stent designs, materials, and coatings has improved their efficacy and lowered the likelihood of complications like restenosis and thrombosis, thereby increasing patient preference. Additionally, the diverse array of stent alternatives available, ranging from drug-eluting stents to bioresorbable stents and bare-metal stents, has broadened the market by addressing various patient requirements.

Furthermore, the increasing awareness and screening campaigns for cardiovascular diseases, coupled with the enhancement of healthcare infrastructure in emerging markets, are anticipated to propel market expansion. Nevertheless, obstacles such as stringent regulatory mandates and the elevated cost associated with stent procedures may pose challenges to market growth. In conclusion, the vascular stents sector is on track for substantial advancement in the forthcoming years, fueled by the escalating disease burden, technological innovations, and the growing acceptance of minimally invasive procedures.

Restraining Factors:

The market for vascular stents is limited by obstacles linked to sustained effectiveness and the risk of complications over time.

The market for vascular stents is currently on a growth trajectory, notwithstanding a series of challenges that may impede its advancement. A prominent obstacle is the substantial cost associated with vascular stents and the procedures involved, presenting a significant barrier for numerous patients, particularly in developing nations with limited access to healthcare resources.

Moreover, the stringent regulatory protocols and approval procedures can impede the progression and commercialization of novel stent products, thereby restricting market expansion. The potential risks of complications and unfavorable reactions linked to stent implantation, such as in-stent restenosis and stent thrombosis, can dissuade patients from pursuing treatment options.

Additionally, the availability of alternative treatment modalities, such as medications and non-invasive procedures, provides patients with alternative choices apart from stenting, posing a further hurdle to market growth.

Furthermore, inadequate awareness about the importance of early diagnosis and intervention in cardiovascular diseases, as well as the advantages of vascular stents, may contribute to the underutilization of these medical devices. Despite these challenges, it is crucial to emphasize the continuous technological advancements in the field, particularly the emergence of bioresorbable and drug-eluting stents, offering promise for enhanced patient outcomes. Furthermore, sustained research and development endeavors directed towards enhancing the efficacy and safety of vascular stents, combined with increased healthcare expenditures and improved accessibility to advanced medical therapies, are expected to have a positive impact on the expansion of the vascular stents market in the foreseeable future.

Key Segments of the Vascular Stents Market

Material Overview

• Metallic Stents

• Cobalt-Chromium

• Platinum Chromium

• Nickel Titanium

• Stainless Steel

• Polymers Stents

• Ceramics Stents

End-User Overview

• Hospitals

• Cardiac Centers

• Ambulatory Surgical Centers

Mode of Delivery Overview

• Balloon-expandable Stents

• Self-expanding Stents

Product Overview

• Bare-metal Stents

• Drug-eluting Stents

• Bioabsorbable Stents

Type Overview

• Coronary Stents

• Peripheral Stents

• Carotid Stents

• Renal Artery Stents

• Femoral Stents

• Iliac Stents

• Other Peripheral Stents

• EVAR Stent Grafts

• Abdominal Aortic Aneurysm

• Thoracic Aortic Aneurysm

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America