Market Analysis and Insights:

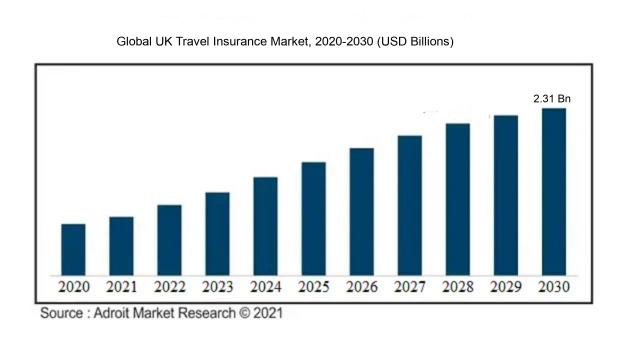

The market for UK Travel Insurance was estimated to be worth USD 1.23 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 6.29%, with an expected value of USD 2.31 billion in 2030.

The UK travel insurance market experiences the influence of various key factors. Initially, the growing consciousness and significance of travel insurance among consumers serve as a pivotal force. Individuals are increasingly recognizing the potential risks involved in traveling, encompassing scenarios like medical emergencies, trip disruptions, and lost luggage.

Consequently, there is a ened interest in securing travel insurance coverage for safeguarding against such uncertainties. Furthermore, the escalating volume of international travelers plays a significant role in driving market expansion. With more people venturing into foreign destinations, the demand for travel insurance experiences a corresponding uptick. Additionally, regulatory changes and travel prerequisites, including compulsory insurance for specific visa applications, also contribute to propelling the market forward.

Moreover, the continuous advancements in technology and the convenience offered by online booking platforms have simplified the process of accessing and comparing travel insurance products for consumers. This convenience factor not only enhances market accessibility but also fuels market growth rates. Lastly, the surge in popularity of adventure tourism and the increasing preference for comprehensive coverage tailored to specialized activities like extreme sports or wildlife excursions further stimulate market growth trajectories. In essence, these combined factors collectively propel the UK travel insurance market, aligning with the evolving needs of travelers seeking assurance and security during their journeys.

UK Travel Insurance Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 2.31 billion |

| Growth Rate | CAGR of 6.29% during 2024-2030 |

| Segment Covered | By Type, By End-user, By Distribution Channel, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Aviva, AXA, Allianz, Direct Line, LV=, Churchill, Saga, Staysure, Post Office, and InsureandGo. |

Market Definition

UK Travel Insurance is an insurance product specifically created to offer financial security and support for individuals while traveling domestically in the United Kingdom or internationally. This type of insurance usually includes coverage for costs associated with healthcare emergencies, trip disruptions, and the loss or theft of personal belongings.

Travel insurance is highly important for a variety of reasons. Firstly, it serves as a safeguard against unforeseen costs that may occur during a journey, such as medical emergencies or trip cancellations. This ensures that travelers are protected from significant financial strains and can enjoy their trip with peace of mind. In addition, travel insurance offers coverage for lost or stolen items, including important documents like passports, which is particularly significant considering the prevalent incidents of theft in travel destinations around the world. Moreover, it may encompass services such as emergency medical evacuation or repatriation, which could be crucial in serious emergencies. Lastly, the possession of travel insurance is frequently a mandatory component of some visa applications, making it a vital necessity for international travel. To sum up, travel insurance is crucial for shielding travelers from potential risks and uncertainties, providing them with assurance and assistance when required.

Key Market Segmentation:

Insights On Key Type

Annual Multi-Trip

The Annual Multi-Trip insurance is expected to dominate the Global UK Travel Insurance market. This is primarily due to its flexibility and cost-effectiveness for frequent travelers. Annual Multi-Trip insurance provides coverage for an unlimited number of trips within a specific timeframe, usually a year. It caters to the needs of individuals who travel frequently for business or pleasure and offers convenience by eliminating the need to purchase insurance every time a trip is taken. With increased globalization and ease of travel, the demand for Annual Multi-Trip insurance is expected to grow significantly.

Single-Trip

Although not expected to dominate the Global UK Travel Insurance market like the Annual Multi-Trip insurance, the Single-Trip insurance still holds importance. Single-Trip insurance provides coverage for a specific trip and is suitable for individuals who travel infrequently or have specific travel needs. This caters to customers who only require insurance for a one-time trip, such as a vacation or business trip. While it may not have the same level of market dominance as Annual Multi-Trip insurance, the Single-Trip remains a valuable option for those with specific travel requirements.

Insights On Key End-user

Family Travelers

Family Travelers are expected to dominate the Global UK Travel Insurance Market. The demand for travel insurance among families is driven by the need to ensure the safety and well-being of all family members during their trips. Families often embark on vacations that involve multiple destinations, longer durations, and various activities, making them more prone to unforeseen events such as medical emergencies, trip cancellations, or lost baggage. As a result, insurance coverage becomes crucial for families to mitigate financial risks and provide peace of mind while traveling. The Family Travelers part is expected to command a significant share of the market due to the high number of families engaging in international or domestic travel.

Senior Citizens

Senior Citizens, while not dominating the market, hold an important position within the Global UK Travel Insurance Market. With increasing life expectancy and improved healthcare, seniors are more likely to embark on travel adventures during their retirement years. However, due to their age, they may face more health-related risks compared to other age groups. Hence, travel insurance becomes a critical consideration for senior citizens to cover medical expenses, trip cancellations, or other unexpected events. The Senior Citizens part is expected to hold a considerable share of the market due to the growing number of individuals aged 65 and above engaging in travel activities.

Education Travelers

Education Travelers, although not expected to dominate the Global UK Travel Insurance Market, represent a significant sector within the market. This part primarily includes students, scholars, and individuals traveling abroad for educational purposes such as language courses, exchange programs, or academic conferences. While the primary focus of education travelers may not solely be insurance, it remains a vital aspect of their travel plans. Insurance coverage provides financial protection in case of medical emergencies, trip interruptions, or even accidents during adventure activities. The Education Travelers part is expected to contribute a substantial share to the market due to the continuous growth in international education exchanges and student mobility.

Others

The Other end-users comprises a diverse range of end-users who may not fit into the categories of Senior Citizens, Education Travelers, or Family Travelers. This part could include individuals traveling for business purposes, solo travelers, adventure enthusiasts, or any other demographic not specifically categorized. Although this part may have varying insurance requirements and preferences, it is not expected to dominate the Global UK Travel Insurance Market. However, their participation in the market holds significance, contributing to the overall growth and competitiveness of the industry.

Insights On Key Distribution Channel

Insurance Intermediaries

Insurance intermediaries are expected to dominate the Global UK Travel Insurance Market. This includes agents and brokers who play a crucial role in connecting customers with insurance products. Insurance intermediaries act as advisors and facilitators, providing personalized recommendations and helping customers navigate through various travel insurance options. Their expertise and direct interaction with customers give them a competitive edge in understanding their specific needs and tailoring insurance policies accordingly. Moreover, insurance intermediaries often have established relationships with multiple insurance providers, giving them access to a wide range of products and the ability to offer more comprehensive coverage options. With their customer-centric approach and industry expertise, insurance intermediaries are well-positioned to dominate the Global UK Travel Insurance Market.

Insurance Companies

Insurance companies hold a significant share in the Global UK Travel Insurance Market. These companies directly underwrite travel insurance policies and provide coverage to customers. Insurance companies have a strong presence and reputation in the market, built over years of experience and brand trust. They often have the financial resources to support large-scale marketing campaigns and offer competitive pricing. Additionally, insurance companies have expertise in risk assessment and claims management, allowing them to efficiently handle travel insurance-related issues. While insurance intermediaries may dominate the market due to their personalized approach, insurance companies still play a crucial role in offering direct-to-customer solutions and have the advantage of brand recognition and financial stability.

Banks

Banks have a notable presence in the Global UK Travel Insurance Market. They leverage their existing customer base and branch networks to offer travel insurance as an additional service. Banks often provide bundled packages or discounts to customers who purchase insurance alongside other financial products. While they may not have the specialized expertise or personalized approach of insurance intermediaries, banks offer convenience and accessibility through their widespread branches and online platforms. The trust customers have in their financial institution can also contribute to their market dominance. However, due to the nature of their offerings, banks may have limited customization options compared to insurance intermediaries, which could limit their dominance in the market.

Insurance Brokers

Insurance brokers have a smaller share in the Global UK Travel Insurance Market compared to insurance intermediaries and insurance companies. Unlike insurance intermediaries who represent multiple insurance providers, insurance brokers typically work on behalf of the customer and have relationships with specific insurers. They assist customers in finding the best travel insurance coverage by evaluating different options and negotiating terms on their behalf. While brokers offer personalized advice and advocacy for customers, their market dominance may be limited by the fact that they have more niche or specialized clientele. However, for specific customer s seeking tailored travel insurance solutions, insurance brokers can have a significant impact.

Others

The Others category within the Distribution Channel encompasses various stakeholders that do not fit into the other parts mentioned above, such as aggregators, affinity groups, or digital platforms. While their presence in the Global UK Travel Insurance Market cannot be ignored, their dominance is less certain. Aggregators, for example, gather information from multiple insurers and provide customers with comparative pricing and coverage options. Affinity groups may offer travel insurance as part of a membership or loyalty program. Digital platforms also play a role in facilitating travel insurance purchases online. However, the dominance of these parts will depend on factors such as their ability to differentiate themselves, their reach, and the value-added services they provide to customers.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global UK Travel Insurance market. This region has a well-established tourism industry and a strong demand for travel insurance. Moreover, UK residents frequently travel within Europe due to its close proximity and convenient transportation options. The well-developed infrastructure, coupled with a high standard of living and disposable income in many European countries, further drives the demand for travel insurance among European travelers. Additionally, the European market is characterized by a competitive landscape with a wide range of insurance providers offering comprehensive travel insurance plans, catered to the diverse needs and preferences of travelers. Hence, Europe is likely to dominate the Global UK Travel Insurance market.

North America

In North America, the Global UK Travel Insurance market is expected to witness significant growth. The region is home to a large number of UK expatriates and citizens who travel to the UK for various purposes, including tourism, business, and visiting friends and family. These individuals often require travel insurance to protect themselves against unforeseen circumstances and health-related emergencies during their trips. The robust international travel industry and well-established insurance infrastructure in countries like the United States and Canada provide ample opportunities for travel insurance providers. As a result, North America is projected to be a key market for UK travel insurance.

Latin America

Latin America is anticipated to be a promising market for the Global UK Travel Insurance industry. The region has witnessed a steady rise in outbound tourism, with an increasing number of travelers visiting the UK for leisure, business, or educational purposes. As travelers become more aware of the importance of travel insurance, the demand for comprehensive coverage also grows. The rising middle class, improving economic conditions, and expanding air travel network contribute to the overall growth of the travel insurance market in Latin America.

Asia Pacific

Asia Pacific is expected to be a key growth market for the Global UK Travel Insurance industry. The region is home to a rapidly expanding middle class with rising disposable incomes, which has led to a surge in outbound tourism. Many Asian travelers choose the UK as a preferred destination for tourism, higher education, and business. As the popularity of UK travel increases, so does the demand for travel insurance to protect against unforeseen events such as trip cancellations, medical emergencies, and lost baggage. The presence of a large population in countries like China and India provides a significant customer base for travel insurance providers.

Middle East & Africa

The Middle East & Africa region also holds potential for growth in the Global UK Travel Insurance market. The region has witnessed an increase in outbound tourism, with travelers visiting the UK for various purposes such as leisure, educational pursuits, and medical treatment. The Middle East, in particular, has a substantial expatriate population, with many UK citizens living and working in countries like the United Arab Emirates and Saudi Arabia, who often return to the UK for vacations and visits. The growing awareness of the benefits of travel insurance, combined with the rising disposable income and changing lifestyle patterns, drives the demand for travel insurance in the Middle East & Africa region.

Company Profiles:

The prominent entities in the international United Kingdom Travel Insurance sector play a vital role in furnishing insurance solutions to individuals traveling abroad, safeguarding them financially in the event of unexpected circumstances or mishaps while on their journeys. These entities present a variety of insurance options and support services tailored to cater to the varied requirements of travelers, thereby promoting the resilience and development of the travel insurance sphere.

In the competitive UK travel insurance market, there are several dominant players who lead the industry. Among them are Aviva, AXA, Allianz, Direct Line, LV=, Churchill, Saga, Staysure, Post Office, and InsureandGo. Aviva stands out as a top provider of comprehensive and tailored travel insurance policies. AXA is recognized for its abundant coverage options and high-quality customer service. Allianz, being a globally renowned insurance company, offers a diverse range of travel insurance products. Direct Line is a favored choice for travelers seeking dependable and cost-effective coverage.

Meanwhile, LV=, Churchill, and Saga also have significant market presence, delivering competitive offerings suitable for all types of travelers. Additionally, Staysure, Post Office, and InsureandGo are prominent players in the UK travel insurance sector, catering to the diverse insurance needs of travelers across different budget ranges and requirements.

COVID-19 Impact and Market Status:

The Global UK Travel Insurance market has been greatly influenced by the Covid-19 pandemic, resulting in a decrease in demand and a transition towards insurance policies that include coverage for cancellations and medical costs associated with the virus.

The travel insurance sector in the UK has been significantly impacted by the COVID-19 pandemic. Factors such as travel restrictions, lockdown measures, and the ened risks associated with international travel have led to a notable decrease in the demand for travel insurance policies. The guidance against non-essential travel for UK citizens has resulted in a sharp reduction in the number of individuals purchasing such policies. Furthermore, many insurance companies have adjusted their terms to exclude coverage for COVID-19-related claims, causing uncertainty among travelers and making them hesitant to acquire insurance protection. Consequently, there has been a decline in the issuance of new policies and an increase in cancellations and refunds as travelers navigate the changing landscape. Insurers have encountered financial challenges as a result of the upsurge in claims and the necessity to provide refunds for disrupted travel plans. Some insurance providers have even opted to discontinue offering coverage for issues related to pandemics. This shift has led to a notable downturn in the market, prompting insurers to reevaluate and revise their policies in response to the ongoing uncertainties and complexities brought about by the COVID-19 crisis.

Latest Trends and Innovation:

- In May 2021, Saga, a UK-based insurance provider, announced a partnership with AXA to offer Saga-branded travel insurance products to their customers.

- In April 2021, AllClear, a specialist medical travel insurance provider, acquired Voyager Insurance Services, a UK-based travel insurance intermediary.

- In March 2021, Cedar Tree, a UK-based travel insurance provider, introduced a new product called 'Safe Journey', providing cover for travel within the UK.

- In February 2021, Staysure, a travel insurance company, acquired InsureandGo, a UK-based travel insurance provider, expanding their market presence.

- In December 2020, Zurich Insurance, a global insurance company, launched 'Cover-More', a new travel insurance product designed for the UK market.

- In November 2020, Aviva, an insurance company, partnered with the Post Office, a UK-based retail company, to provide travel insurance to Post Office customers.

- In October 2020, Columbus Direct, a travel insurance specialist, introduced a new product called 'COVID-19 cancellation cover', providing protection to customers in case of trip cancellations due to COVID-19.

- In September 2020, Direct Line, a UK-based insurance company, launched a new 'Flexi-Cover' option for travel insurance, allowing customers to choose coverage specifically tailored to their needs.

- In August 2020, Insurefor, a travel insurance provider, introduced a new 'COVID-19 overseas medical expenses' cover to protect customers against medical costs related to COVID-19 while abroad.

- In July 2020, Post Office, a retail company, acquired InsureandGo, a UK-based travel insurance provider, to strengthen its position in the travel insurance market.

Significant Growth Factors:

Driving forces behind the expansion of the UK Travel Insurance Market comprise the surge in global travel, ened recognition of the significance of travel insurance, and the introduction of inventive insurance solutions tailored to meet varying customer demands.

The UK travel insurance industry has undergone substantial expansion in recent years, driven by a multitude of factors. Primarily, the escalating number of British citizens traveling abroad has been a pivotal factor in boosting the demand for travel insurance. With more individuals venturing on international journeys for various purposes like business or recreation, the recognition of the necessity for all-encompassing coverage to safeguard against unforeseen circumstances such as medical emergencies, trip cancellations, or baggage loss has grown significantly. Additionally, the mounting understanding of the potential hazards linked to travel, including political unrest, natural calamities, and health crises, has further fueled the requirement for travel insurance. Furthermore, the advent of online platforms and digital innovations has transformed the accessibility and ease of procuring travel insurance policies.

Consumers now have the ability to effortlessly compare different plans, prices, and coverage options, thereby streamlining the process and making it more transparent and efficient. Moreover, the dynamic landscape of travel-related regulations, particularly following Brexit and the persistent COVID-19 pandemic, has underscored the importance for individuals to possess adequate insurance coverage while traveling. This development has driven the expansion of the UK travel insurance sector as travelers seek tailored policies that align with the evolving requirements and potential hazards associated with their trips. Overall, these various factors have collectively played a crucial role in the substantial growth of the UK travel insurance market. This growth has not only presented new opportunities for insurers and enriched their product portfolios but also provided British travelers with a sense of security and tranquility during their journeys.

Restraining Factors:

The UK travel insurance market is impeded by substantial barriers such as the elevated expenses associated with insurance policies and a notable lack of consumer awareness.

The UK travel insurance sector has exhibited consistent growth over time, yet faces impediments that impede its expansion. Chief among these is the escalating expense of premiums, which many consumers deem prohibitive, particularly for extended or high-risk journeys. This pricing sensitivity constrains market potential and deters some from procuring travel insurance altogether. Furthermore, the prevalence of exclusions and restrictions within policies adds another barrier. Policyholders often grapple with deciphering intricate terms and conditions, leading to conflicts when filing claims, eroding trust and dissuading potential clients. Additionally, limited consumer awareness regarding the necessity of travel insurance significantly hampers market advancement. Many travelers are oblivious to the risks they face without adequate protection, resulting in subdued demand for insurance. Lastly, the uncertainties stemming from Brexit have cast a shadow over the market. Regulatory alterations and international agreements may influence insurance provision and costs, causing prospective buyers to hesitate.

Nevertheless, notwithstanding these challenges, the UK travel insurance sector can expand by tackling consumer concerns and enhancing transparency. Initiatives to enlighten the public about the significance of travel insurance, clarify policy terms, and offer more competitive pricing alternatives can surmount these obstacles and foster a more robust and flourishing market in the future.

Key Segments of the UK Travel Insurance Market

Type Overview

• Single-Trip

• Annual Multi-Trip

End-User Overview

• Senior Citizens

• Education Travelers

• Family Travelers

• Others

Distribution Channel Overview

• Insurance Intermediaries

• Insurance Companies

• Banks

• Insurance Brokers

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America