Market Analysis and Insights:

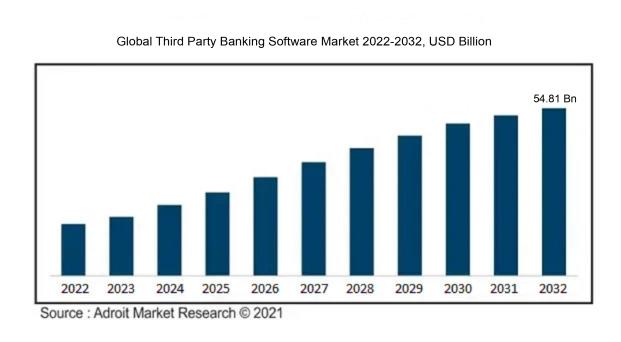

The market for Global Third Party Banking Software was estimated to be worth USD 28.91 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 7.21%, with an expected value of USD 54.81 billion in 2032.

The market for third-party banking software is experiencing significant growth due to various key factors. The increasing need for efficient and cost-effective banking solutions is driving the adoption of third-party software within the industry. These solutions play a crucial role in helping banks streamline their operations, improve customer experience, and reduce operational expenses. Moreover, the emerging requirement for digital transformation in the banking sector is fueling the market growth further. Banks are increasingly looking towards third-party software providers to assist in their digital transformation initiatives as they adapt to evolving customer expectations and technological advancements.

Furthermore, the ened concerns around cybersecurity threats have compelled banks to enhance their security measures and invest in advanced software solutions. This has resulted in a surge in demand for third-party banking software that integrates robust security features. Additionally, the expanding global footprint of banks and the rising trend of international banking have created new opportunities for third-party software providers to address the specific requirements of these financial institutions.

Third Party Banking Software Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 54.81 billion |

| Growth Rate | CAGR of 7.21% during 2024-2032 |

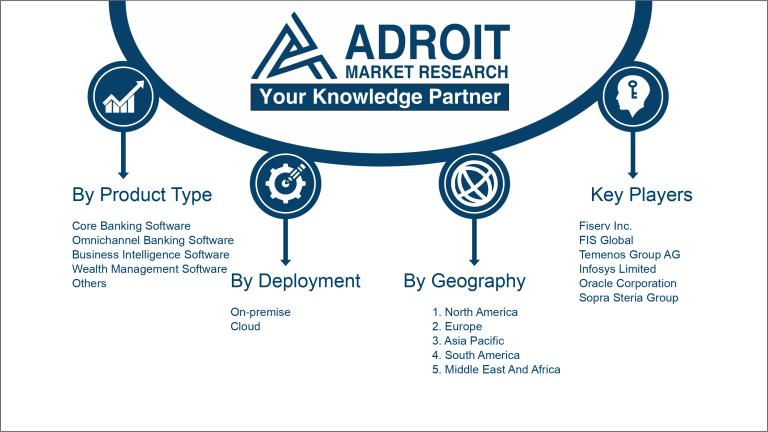

| Segment Covered | By Product Type,By Deployment , By End-use, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Fiserv Inc., FIS Global, Temenos Group AG, Infosys Limited, Oracle Corporation, Sopra Steria Group, Tata Consultancy Services Limited, EdgeVerve Systems Limited, Capgemini SE, and IBM Corporation. |

Market Definition

External banking software, also known as third-party banking software, encompasses software products created by independent vendors or entities. These solutions deliver a range of capabilities to financial institutions, including core banking systems, customer relationship management, and fraud detection, with the aim of boosting operational effectiveness and delivering enhanced banking services. By incorporating these off-the-shelf software solutions into their current systems, banks can optimize processes and elevate their operational efficacy.

Third-party banking software plays a crucial role due to various reasons. Firstly, it empowers banks to provide customers with advanced and tailored services like online banking, mobile banking, and financial planning tools, which might not be accessible through their primary banking systems.

Secondly, it facilitates integration with other financial institutions and payment systems, thereby streamlining transactions and improving the overall customer experience. Furthermore, third-party banking software offers sophisticated security measures, safeguarding against fraudulent activities and upholding the confidentiality of customer information. Ultimately, it enables banks to remain competitive in the ever-changing digital landscape, ensuring they can adapt to the changing needs and preferences of their clientele.

Key Market Segmentation:

Insights On Key Product Type

Core Banking Software

Core Banking Software is expected to dominate the Global Third Party Banking Software market. This part is crucial for banks as it provides the foundation for their operations and enables centralized processing of banking transactions. Core banking software handles various tasks such as account management, loan processing, customer relationship management, and risk management. With the growing adoption of digital banking and the need for efficient and secure banking operations, the demand for core banking software is on the rise. It offers features like real-time banking, scalability, and integration capabilities, making it indispensable for banks to enhance their operational efficiency and customer experience.

Omnichannel Banking Software

Omnichannel Banking Software is another significant part in the Global Third Party Banking Software market. With the increasing popularity of digital channels, banks are focused on providing a seamless banking experience across multiple channels, including online banking, mobile banking, and branch banking. Omnichannel banking software enables banks to offer consistent and personalized services to customers irrespective of the channel used. It allows customers to access their accounts, perform transactions, and access banking services on various devices. The demand for omnichannel banking software is driven by the need to strengthen customer engagement, improve cross-selling opportunities, and enhance customer satisfaction.

Business Intelligence Software

Business Intelligence Software is an essential part in the Global Third Party Banking Software market. Banks generate vast amounts of data, and leveraging this data for decision-making and insights is crucial in today's competitive landscape. Business Intelligence software enables banks to extract, transform, and analyze data for meaningful insights and reporting. It helps banks monitor key performance indicators, detect fraud, identify market trends, and make data-driven business decisions. The adoption of business intelligence software is driven by the increasing focus on data-driven strategies and the need for better risk management and compliance in the banking sector.

Wealth Management Software

Wealth Management Software is a significant part in the Global Third Party Banking Software market. With the rising number of high-net-worth individuals and the growing complexity of wealth management, banks are investing in specialized software to cater to this . Wealth management software offers features such as portfolio management, financial planning, risk analysis, and client relationship management. It allows banks to offer personalized wealth management services, track investment performance, and provide comprehensive reporting to clients. The demand for wealth management software is driven by the need to enhance operational efficiency, improve client satisfaction, and deliver superior investment advisory services.

Others

The Others part includes various specialized banking software solutions that are not specifically categorized under the core banking, omnichannel banking, business intelligence, or wealth management software. This part comprises niche solutions catering to specific banking functions such as payment processing, credit management, compliance management, and trade finance. While these solutions may be vital for specific banks or markets, their overall market dominance is relatively lower compared to the previously mentioned parts.

Insights On Key Deployment

Cloud Deployment

Cloud deployment is set to dominate the Global Third Party Banking Software market. Cloud deployment offers numerous advantages like scalability, flexibility, and cost-effectiveness, which are driving its adoption in the banking sector. It allows banks to access software applications remotely, enabling seamless collaboration, data sharing, and real-time updates. Moreover, cloud deployment eliminates the need for significant upfront investments in hardware and software, making it an attractive choice for banks of all sizes. The increasing demand for advanced banking software solutions coupled with the growing adoption of cloud technology is expected to propel the dominance of the cloud deployment in the global market.

On-Premise Deployment

Although cloud deployment is anticipated to dominate the market, on-premise deployment still holds significance in the Global Third Party Banking Software market. Some banks prefer on-premise deployment due to existing infrastructure investments, data security concerns, and regulatory compliance requirements. On-premise deployment provides banks with complete control over their software and data, which is preferred by organizations with stringent data privacy regulations or unique requirements that cannot be met by cloud solutions.

Insights On Key Application

Business Intelligence

Business Intelligence is expected to dominate the Global Third Party Banking Software market. This is because businesses in the banking sector are increasingly relying on data-driven insights to make informed decisions. Business Intelligence software enables banks to gather, analyze, and visualize large volumes of data from various sources, allowing them to identify patterns, trends, and market opportunities. With the growing demand for data analytics solutions within the banking industry, Business Intelligence is likely to be the dominating part.

Risk Management

Risk management is another crucial part of the Global Third Party Banking Software market. Banks need robust risk management systems to assess, quantify, and mitigate potential risks associated with their operations. These risks include credit risk, market risk, liquidity risk, and operational risk. Third-party banking software solutions catering to risk management provide banks with advanced tools to monitor, analyze, and manage risks effectively, ensuring compliance with regulatory requirements.

Information Security

Given the sensitive nature of banking operations, information security is of utmost importance. This part offers software solutions that protect banks' systems, networks, and data from unauthorized access, fraud, and cyber threats. With the increasing frequency and sophistication of cyber attacks, banks are investing heavily in robust information security solutions to safeguard their customers' data and maintain public trust.

Insights On Key End-use

Commercial Banks

The commercial banks part is expected to dominate the global third party banking software market. This can be attributed to the increasing adoption of digital banking solutions by commercial banks to enhance their operational efficiency, improve customer experience, and streamline their banking processes. Third party banking software provides commercial banks with advanced features such as risk management, customer relationship management, and transaction processing, which are crucial for their day-to-day operations. As commercial banks strive to remain competitive in the evolving banking landscape, the demand for third party banking software is likely to continue growing, thus making it the dominating part in the market.

Retail Banks:

Retail banks also hold significant potential in the global third party banking software market. Retail banks cater to individual customers and need to offer a seamless and user-friendly banking experience. Third party banking software plays a vital role in enabling retail banks to provide a wide range of services such as online banking, mobile banking, and digital wallets. These solutions help retail banks to attract and retain customers by offering convenience, personalization, and enhanced accessibility. Although the retail banks part is expected to show considerable growth, it is likely to be overshadowed by the dominating commercial banks part due to the greater number of commercial banks and their larger market share.

Insights on Regional Analysis:

North America:

North America is expected to dominate the global Third Party Banking Software market in terms of revenue. The region has a well-established financial sector and a strong focus on technological advancements. The high adoption rate of digital banking solutions, increasing investments in innovation, and the presence of key market players contribute to the dominance of this region. Additionally, stringent regulatory frameworks and the need for enhanced security measures in financial transactions drive the demand for third party banking software in North America.

Latin America:

Latin America has witnessed significant growth in the adoption of third-party banking software in recent years. The region is characterized by the increasing penetration of smartphones and internet connectivity, enabling a larger population to access financial services remotely. The growing focus on digitalization, government initiatives to promote financial inclusion, and the emergence of fintech startups have contributed to the rising demand for third-party banking software solutions in Latin America. While still emerging, the region shows promising potential for further growth.

Asia Pacific:

Asia Pacific is experiencing a rapid rise in the adoption of third party banking software. The region has a large population, increasing smartphone penetration, and a rapidly expanding digital infrastructure. The flourishing fintech sector, favorable regulatory frameworks, and government initiatives to promote digital banking services drive the demand for third-party software solutions in Asia Pacific. Moreover, the region's diverse banking landscape, including both developed and emerging economies, presents opportunities for software providers to cater to the specific needs of different markets.

Europe:

Europe represents a significant market for third party banking software, driven by the region's well-established financial industry and emphasis on innovation. The increasing focus on open banking and PSD2 regulations has propelled the demand for third-party software solutions in Europe. Moreover, the region's highly competitive banking sector, customer-centric approach, and shifting consumer preferences towards digital banking solutions contribute to the growth of the market. Europe showcases a diverse mix of mature markets and emerging economies, creating opportunities for software providers to cater to a wide range of banking institutions.

Middle East & Africa:

The Middle East & Africa region is witnessing steady growth in the adoption of third party banking software. The region's financial sector is undergoing digital transformation, driven by government initiatives to promote financial inclusion and innovation in banking services. The increasing smartphone penetration, expanding digital infrastructure, and a growing population of tech-savvy users contribute to the demand for third-party banking software solutions in this region. Although still nascent compared to other regions, Middle East & Africa presents untapped potential for software providers looking to enter emerging markets and meet the evolving needs of the banking industry.

Company Profiles:

Prominent entities in the worldwide market for Third Party Banking Software are FIS, Fiserv, Infosys, and Temenos. These organizations deliver cutting-edge banking software solutions and services to financial institutions, empowering them to elevate operational efficacy, enhance customer satisfaction, and expedite digital evolution.

Prominent entities in the Third Party Banking Software Market comprise of Fiserv Inc., FIS Global, Temenos Group AG, Infosys Limited, Oracle Corporation, Sopra Steria Group, Tata Consultancy Services Limited, EdgeVerve Systems Limited, Capgemini SE, and IBM Corporation. These industry leaders are instrumental in delivering advanced software solutions and services to the banking sector, facilitating operational efficiency enhancements, customer experience improvements, and alignment with the constantly evolving technological realm. Through their deep knowledge and cutting-edge products, these major stakeholders drive progress and innovation within the Third Party Banking Software Market, meeting the diverse demands and specifications of banks and financial institutions across the globe.

COVID-19 Impact and Market Status:

The worldwide market for third-party banking software has been greatly influenced by the Covid-19 crisis, causing disruptions in the roll-out and utilization of such software. However, this situation has also opened up possibilities for digitalization and the provision of remote banking services.

The global outbreak of COVID-19 has brought about significant changes in the third-party banking software sector. The strict lockdown measures and social distancing protocols imposed worldwide have fueled the demand for digital banking solutions. Consequently, there has been a notable uptick in the adoption of third-party banking software by financial institutions seeking to offer seamless online services to their clientele. Furthermore, the pandemic has hastened the transition towards digital banking as customers increasingly favor contactless transactions and remote banking capabilities.

As a response to these evolving trends, banks and financial organizations have ramped up their investments in third-party banking software to enrich their digital service offerings and ensure a frictionless user experience.

Nevertheless, the pandemic has not been without its challenges. The economic downturn has led to reductions in IT budgets, resulting in a deceleration in the deployment of new software solutions. Additionally, the ened risk of cyber threats and data breaches has become a significant concern, prompting banking institutions to prioritize robust security protocols.

Latest Trends and Innovation:

• December 2019: Temenos, a banking software company, entered into a partnership with Microsoft to expand their cloud-based services for financial institutions.

• November 2019: Fiserv completed the acquisition of First Data, a payment technology company, to enhance their capabilities in the third-party banking software market.

• October 2019: FIS acquired Worldpay, a global payments technology provider, to strengthen their position in the third-party banking software market.

• September 2019: Oracle announced the launch of Oracle Banking APIs, a comprehensive set of open APIs to enable banks to rapidly develop new digital experiences.

• July 2019: ACI Worldwide acquired Speedpay, a provider of electronic bill payment solutions, to offer enhanced payment services through their third-party banking software solutions.

• June 2019: SAP partnered with Citibank to create a co-innovation initiative called Global Financing Services, aiming to provide financial solutions to SAP customers.

• May 2019: IBM announced the launch of IBM Blockchain World Wire, a blockchain-based cross-border payments solution, enabling banks to provide faster and more efficient services.

• April 2019: D+H merged with Misys to form Finastra, one of the world's largest financial technology companies, offering a wide range of third-party banking software solutions.

• March 2019: Infosys partnered with Temenos to develop joint solutions for the banking industry, combining Temenos' core banking platforms with Infosys' digital capabilities.

• January 2019: Avaloq acquired 10% stake in the Swiss fintech firm, Metaco, to incorporate blockchain technology in their third-party banking software solutions.

Significant Growth Factors:

Growth drivers for the Third Party Banking Software Market comprise the expanding digitization within the banking industry, escalating need for cutting-edge financial technologies, and the increasing uptake of cloud-based solutions.

The market for third-party banking software is poised for substantial growth in the upcoming years for several compelling reasons. Primarily, the surge in the adoption of digital banking solutions is propelling the demand for third-party software, as financial institutions aim to augment their technological prowess and enrich customer interactions. These solutions encompass a diverse set of advantages, including real-time transaction monitoring, secure payment processing, and tailored financial guidance, all of which are increasingly imperative in today's digitally driven banking environment. Furthermore, the escalating necessity for regulatory conformity and risk mitigation is spurring the uptake of third-party software solutions that boast sophisticated security measures, fraud detection capabilities, and risk evaluation tools. Additionally, the advent of open banking schemes is bolstering market expansion by fostering partnerships between banks and third-party service providers, thereby fostering enhanced innovation and market access. Moreover, the introduction of artificial intelligence, machine learning, and big data analytics is transforming banking operations, with third-party software vendors at the forefront of harnessing these technologies to deliver advanced data insights, personalized advice, and automated processes, pivotal for banks to maintain their competitive edge. In essence, the amalgamation of digital transformation, regulatory prerequisites, open banking initiatives, and technological innovations is steering the upward trajectory of the third-party banking software market, rendering it a profitable arena for software providers aiming to cater to the evolving demands of financial establishments.

Restraining Factors:

Limiting elements in the Third-Party Banking Software Market encompass worries regarding security, hurdles related to interoperability, and complications with regulatory adherence.

The market for third-party banking software has displayed consistent growth over time. However, its expansion potential has been hindered by several obstacles. A prominent challenge is the substantial costs associated with implementing and maintaining third-party software within existing banking systems. The need for substantial investments to seamlessly integrate these solutions can dissuade banks from their adoption.

Moreover, concerns regarding data security and privacy act as another deterrent. Given the escalating cyber threats and stringent regulatory frameworks, banks are wary of utilizing third-party software that may jeopardize sensitive customer data. Additionally, the intricate process of integrating third-party applications with current banking infrastructure presents a significant hurdle. This complexity often leads to extended integration periods, deployment delays, and operational disruptions.

Furthermore, resistance to change within traditional banking establishments can impede the uptake of third-party banking software. Legacy systems and a reluctance to embrace technological advancements make it challenging for banks to incorporate new solutions. Despite these challenges, it is crucial to recognize the substantial potential that exists within the third-party banking software market.

As technology progresses and regulatory environments become more receptive, banks are poised to discover innovative ways to surmount these impediments. Through thorough research, strategic planning, and proactive risk management, banks can effectively utilize third-party software to boost operational efficiency, enhance customer experiences, and maintain competitiveness within the ever-evolving banking sector.

Key Segments of the Third Party Banking Software Market

Product Type Overview

• Core Banking Software

• Omnichannel Banking Software

• Business Intelligence Software

• Wealth Management Software

• Others

Deployment Overview

• On-premise

• Cloud

Application Overview

• Risk Management

• Information Security

• Business Intelligence

End-Use Overview

• Commercial Banks

• Retail Banks

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America