Telematics Control Unit Market Analysis and Insights:

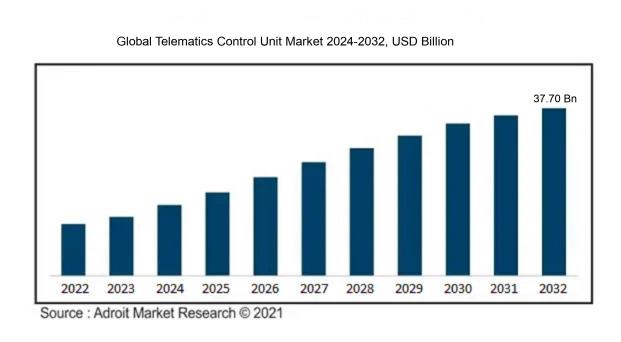

The market size for telematics control units worldwide was estimated at USD 12.40 billion in 2023. At a compound annual growth rate (CAGR) of 13.5%, the market is expected to increase from USD 13.90 billion in 2024 to USD 37.70 billion by 2032.

The market for Telematics Control Units (TCUs) is significantly influenced by the surging need for connected automobiles, improvements in automotive safety features, and the accelerating shift towards vehicle electrification. The rise in the use of advanced driver-assistance systems (ADAS) and the focus on adhering to regulatory requirements for vehicle tracking and reporting enhance the growth trajectory of this market. Moreover, the increasing incorporation of Internet of Things (IoT) technologies fosters real-time data communication, bolstering fleet management and operational efficiency. Consumer eagerness for cutting-edge infotainment systems and superior connectivity options further drives the adoption of TCUs, as automotive manufacturers aim to offer greater value through onboard technologies. In addition, the growing focus on autonomous vehicles underscores the necessity for sophisticated telematics solutions, positioning TCUs as essential elements in the automotive industry’s transformation. Altogether, these dynamics suggest a promising outlook for the TCU market's continued development in the coming years.

Telematics Control Unit Market Definition

A Telematics Control Unit (TCU) is a sophisticated electronic system that facilitates data exchange between a vehicle and external networks, supporting functionalities such as GPS navigation, vehicle diagnostics, and communication services. This unit combines various technologies to oversee and improve vehicle performance and safety.

The Telematics Control Unit (TCU) is essential to contemporary automobiles, combining a variety of communication technologies to boost vehicle effectiveness, safety, and user engagement. It allows for instantaneous data exchange between the automobile and outside networks, supplying vital insights for fleet oversight, navigation, and emergency support. The TCU enables functionalities such as GPS monitoring, vehicle health assessments, and entertainment services, promoting a seamless link between drivers and their vehicles. Additionally, by allowing over-the-air software updates, it guarantees that vehicles stay current with cutting-edge features and security protocols, thereby enhancing operational productivity and driver safety.

Telematics Control Unit Market Segmentation:

Insights On Key Type

5G

The 5G technology is expected to dominate the Global Telematics Control Unit Market due to its significantly enhanced data speed, lower latency, and higher capacity for connected devices. As automakers and service providers aim to implement smarter, more connected vehicles, the need for advanced telematics solutions becomes prevalent. 5G’s capability to support real-time data transmission and improved vehicle-to-everything (V2X) communication is driving its adoption. Furthermore, the increasing demand for enhanced safety features, autonomous driving capabilities, and seamless connectivity in mobility solutions positions 5G as the optimal choice for future telematics systems.

4G

The 4G technology continues to maintain a notable presence in the telematics control unit market, primarily attributed to its widespread adoption and infrastructure. Many existing vehicles are already equipped with 4G technologies, enabling efficient data transmission and connectivity. Although it may be overshadowed by the rise of 5G, the extensive availability of 4G networks ensures that it remains a reliable option for telematics applications, particularly in regions where 5G is still being deployed. The established nature of 4G networks provides stability and access to a vast user base for telematics service providers.

3G

The 3G technology, while being phased out in favor of more advanced solutions, still plays a role in the telematics control unit market, especially in older vehicle models. Some markets, particularly in developing regions, continue to rely on 3G connectivity for their telematics needs. However, it suffers from limitations in speed and data transmission compared to its successors. Consequently, while it still has some utility, it is progressively being replaced by 4G and 5G technologies to meet the evolving demands of connectivity within automotive telematics.

2G/2.5G

The 2G and 2.5G technologies have become increasingly obsolete in the telematics control unit market due to their inadequacy in handling modern data-rich applications. These technologies are primarily utilized in very low-bandwidth applications, such as basic tracking systems. Their limitations in terms of speed, capacity, and reliability restrict their attractiveness in the face of rapidly advancing telematics solutions. Thus, as the automotive industry pushes towards greater connectivity and advanced functionalities, 2G and 2.5G are gradually being phased out in favor of more capable technologies like 4G and 5G.

Insights On Key Application

Electric Vehicle

The Electric Vehicle is expected to dominate the Global Telematics Control Unit Market. This is largely driven by the rapid adoption of electric mobility solutions, propelled by environmental concerns and government incentives aimed at reducing carbon emissions. The increasing focus on providing efficient logistics and real-time fleet management is also contributing to the demand for advanced telematics systems in electric vehicles. Moreover, information technology advances and the interconnectedness of electric vehicles with smart infrastructure further enhance the utility of telematics control units. As electric vehicle production increases, the need for sophisticated monitoring and data analytics will elevate the presence of telematics solutions in this sector, leading to its expected dominance in the market.

Passenger Vehicle

The Passenger Vehicle category remains a significant within the Global Telematics Control Unit Market. This sector is characterized by a growing trend toward enhanced connectivity and infotainment features, which play a crucial role in consumer purchasing decisions. Technologies such as GPS and real-time traffic updates have become essential for modern passenger cars, driving the development of telematics. Additionally, automakers are increasingly integrating advanced driver assistance systems (ADAS) into personal vehicles, ening the demand for telematics solutions capable of supporting these technologies. Overall, while it remains vital, the ’s growth rate may be overshadowed by the rising prominence of electric vehicles.

Commercial Vehicle

The Commercial Vehicle part of the Global Telematics Control Unit Market is also noteworthy due to its focus on operational efficiency and safety in logistics and transportation. The use of telematics in commercial vehicles allows fleet operators to monitor vehicle performance, optimize routes, and ensure compliance with regulatory requirements, thereby significantly reducing operational costs. Fleet management solutions work in real-time to enhance productivity and driver accountability, making telematics solutions indispensable for businesses operating in this sector. However, with the accelerating trend towards electrification, its growth may face stiff competition from the emerging electric vehicle that targets both individual consumer preferences and significant operational efficiencies.

Insights On Key Component

Hardware

Based on current analysis and market trends, hardware is expected to dominate the Global Telematics Control Unit Market. The increasing integration of advanced technologies such as GPS, cellular connectivity, and sensors in automotive applications is driving the demand for robust hardware components. Hardware is essential for the functionality of telematics systems, providing the infrastructure required for data collection, transmission, and storage. Moreover, as vehicle manufacturers continue to adopt more connected vehicle solutions, the reliance on high-quality, reliable hardware solutions will only intensify, thereby solidifying its position as the leading component in the market.

Software

Software is a critical component in the telematics control unit market, playing a vital role in data processing, vehicle diagnostics, and enabling features like real-time tracking and fleet management. The increasing emphasis on data analytics and predictive maintenance solutions has led to the growth of this sector. As end-users seek comprehensive insights from their vehicle operations, they increasingly depend on sophisticated software systems to interpret data collected from hardware devices. This ongoing demand for innovative software applications is expected to boost its growth over the coming years, although it may not surpass the hardware.

Services

The services within the telematics control unit market encompasses installation, maintenance, and support services required for effective implementation and operation of telematics systems. With the evolving automotive landscape and the integration of connected vehicle technologies, the demand for specialized services has grown significantly. As businesses and consumers continuously seek to maximize the performance and reliability of their telematics solutions, service providers who can deliver exceptional customer support and expertise in installation will be crucial. However, this demand, while important, will still trail behind the hardware growth in the overall market.

Insights On Key Sales Channel

OEM

The Original Equipment Manufacturer (OEM) channel is expected to dominate the Global Telematics Control Unit Market. This trend is largely driven by the increasing integration of telematics systems in new vehicles as manufacturers seek to enhance features such as navigation, safety, and remote vehicle diagnostics. The rise in smart vehicle technologies, including connected cars and advanced driver-assistance systems (ADAS), has significantly pushed OEMs to adopt telematics solutions right from the manufacturing stage. Furthermore, regulatory requirements concerning vehicle safety and emissions are compelling manufacturers to equip their vehicles with advanced telematics systems, solidifying the OEMs' leading position in the marketplace.

Aftermarket

The aftermarket channel is anticipated to experience steady growth in the Global Telematics Control Unit Market. As vehicle owners look to enhance their existing vehicles with modern telematics technologies, the demand for aftermarket solutions has surged. This growth is fueled by the increasing awareness of the advantages of telematics systems, such as real-time fleet management, driver behavior analysis, and theft recovery services. The availability of numerous third-party providers offering competitive, innovative solutions is also driving the aftermarket. However, it faces challenges in competing with OEMs that can bundle telematics directly into new vehicles.

Insights On Key Connectivity

Integrated

The Integrated connectivity variant is anticipated to dominate the Global Telematics Control Unit Market primarily due to its advanced functionalities and increased efficiency. It merges both hardware and software components into one cohesive unit, allowing for seamless data processing and communication. This form of connectivity has gained traction among automotive manufacturers seeking to incorporate advanced driver assistance systems (ADAS) and infotainment solutions. Furthermore, the rise in demand for connected vehicles is driving automakers to opt for Integrated solutions, as they offer enhanced user experiences and real-time data analytics. The ability to provide consistent updates and maintenance via integrated systems significantly enhances market attractiveness and positions this category value-adding crucial differentiators for consumers.

Embedded

Embedded connectivity serves as a strong contender in the Global Telematics Control Unit Market. This approach involves devices that are hardwired into the vehicle's systems, delivering a robust and reliable form of communication. The enhanced security features of Embedded devices also appeal to consumers, ensuring data privacy and protection against cyber threats. As the automotive industry increasingly focuses on security measures, the demand for Embedded solutions is expected to grow. Additionally, the ability to operate independently from external devices can enhance dependability, making it a favorable option among vehicle manufacturers.

Tethered

Tethered connectivity is another option in the Global Telematics Control Unit Market, although it is seen as less dominant compared to the Integrated and Embedded approaches. This connectivity relies heavily on external devices, such as smartphones, for data processing and communication. While this option is often more cost-effective and user-friendly, it poses challenges related to connectivity reliability and dependency on the user’s device. However, with the increasing prevalence of smartphones, Tethered solutions may still appeal to specific markets that prioritize budget-friendly options, particularly in lower-end vehicles or in regions with a high smartphone adoption rate.

Insights on Regional Analysis for Telematics Control Unit Market:

Asia Pacific

Asia Pacific is projected to dominate the Global Telematics Control Unit market due to its rapid technological advancements, increasing vehicle production, and rising demand for smart transportation solutions. The region benefits from a substantial number of automobile manufacturers, particularly in countries like China, Japan, and South Korea, which are investing heavily in connected vehicle technologies. Furthermore, the growing concerns for safety and efficiency in transportation systems drive the acceptance of telematics solutions, further solidifying the region's leadership in the market. Strong governmental support for developing infrastructure and the integration of IoT in automotive applications bolsters the demand for telematics control units in these markets.

North America

North America holds a significant position in the Global Telematics Control Unit market, largely driven by a mature automotive industry and a well-established ecosystem of telematics service providers. The region's strong focus on safety regulations and increased consumer awareness of connected car technologies further enhances market growth. Additionally, innovations in autonomous driving and the integration of telematics into fleet management solutions create substantial opportunities for telematics control units. As both OEMs and aftermarket suppliers implement advanced telematics features, North America is poised for continued growth in this space.

Europe

Europe is a key player in the Global Telematics Control Unit market, supported by stringent regulations regarding vehicle safety and emissions. The region is home to numerous leading automotive manufacturers, which are embracing telematics as a standard feature in vehicles to enhance driving experiences and raise operational efficiency. The push towards green mobility and reduced carbon footprints has driven demand for telematics systems that can monitor vehicle performance and driving behavior. Europe’s commitment to innovation in connected and autonomous vehicles positions it favorably, but it faces stiff competition from the Asia Pacific region.

Latin America

Latin America is gradually emerging in the Global Telematics Control Unit market, albeit at a slower pace compared to other regions. The adoption of telematics technology is gaining traction primarily due to increasing urbanization and the need for improved transportation infrastructure. However, challenges such as economic volatility and less developed automotive markets hinder swift growth. Efforts to modernize fleets for logistics and transportation services present growth opportunities, and as awareness grows regarding the benefits of telematics, the region is expected to see more investment and progress in this area over the coming years.

Middle East & Africa

The Middle East & Africa market shows potential for growth within the Global Telematics Control Unit domain, driven by increasing demand for fleet management and logistics optimization. However, the growth is constrained by varying levels of infrastructure development and market maturity across different countries. Countries with established automotive markets, such as South Africa, are beginning to recognize the value of telematics for enhancing operational efficiency and safety. Furthermore, as governments aim to improve transportation networks and embrace smart city initiatives, the market for telematics control units is anticipated to flourish, albeit gradually compared to more dominant regions.

Telematics Control Unit Market Company Profiles:

Major contributors in the worldwide Telematics Control Unit sector, including auto manufacturers and tech solution providers, are creating cutting-edge solutions aimed at improving vehicle connectivity and data oversight. These entities facilitate market expansion through the incorporation of sophisticated features that enhance fleet management, bolster safety measures, and offer real-time monitoring functionalities.

Major entities in the Telematics Control Unit sector encompass Agero, Inc., Harman International, Bosch, Continental AG, Denso Corporation, ETSI, Verizon Connect, TomTom Telematics, Geotab Inc., Qualcomm Technologies, Inc., LG Electronics, Vodafone Group Plc, BMW Group, Ford Motor Company, Toyota Motor Corporation, and ZF Friedrichshafen AG.

COVID-19 Impact and Market Status for Telematics Control Unit Market:

The Covid-19 pandemic has significantly expedited the global integration of telematics control units, fueled by an increasing need for remote oversight and connectivity solutions across diverse sectors.

The COVID-19 pandemic had a profound effect on the Telematics Control Unit (TCU) sector, presenting both obstacles and avenues for development. During the early stages of the pandemic, automotive manufacturing faced declines, and the market for new vehicles slowed down, which adversely impacted the demand for telematics solutions. However, as the need for remote monitoring and connected systems became more crucial for fleet management and supply chain effectiveness, the TCU market began to see a revival. The growing focus on safety, paired with shifts in consumer preferences towards contactless services, drove the uptake of telematics technology across multiple industries, such as logistics and transportation. Furthermore, the pandemic expedited the digital transformation of enterprises, leading to increased investments in sophisticated telematics solutions to improve operational performance and data analytics. Ultimately, although the pandemic introduced notable challenges, it also sparked innovation and adaptability within the Telematics Control Unit market, paving the way for sustained growth in the future.

Telematics Control Unit Market Latest Trends and Innovation:

- In September 2023, Geotab announced the acquisition of the telematics software provider, GPS Insight, aiming to expand its fleet management offerings and enhance its data analytics capabilities in the logistics sector.

- In June 2023, Verizon Connect introduced a new feature for its telematics platform that leverages artificial intelligence to improve driver safety and reduce fleet operational costs.

- In April 2023, Fleet Complete launched its next-generation Telematics Control Unit, which incorporates advanced sensor technology designed to provide real-time tracking and remote diagnostics for commercial vehicles.

- In January 2023, Bosch and Continental formed a partnership to co-develop an integrated telematics solution focused on enhancing connectivity for electric and autonomous vehicles.

- In November 2022, Qualcomm Technologies and HERE Technologies collaborated to create a new telematics platform designed to facilitate improved navigation and vehicle-to-vehicle communication for smart cities.

- In October 2022, Trimble acquired the telematics startup, Kuebix, to enhance its cloud-based fleet management solutions with advanced telematics capabilities for supply chain efficiency.

- In August 2022, Octo Telematics announced a strategic partnership with Generali, integrating advanced analytics and AI-driven telematics solutions to support pay-as-you-drive insurance models in Europe.

- In May 2022, TomTom launched a new telematics control unit specifically designed for electric vehicles, aimed at providing precise energy management and driving behavior insights.

- In March 2022, Zubie and Toyota North America collaborated on a pilot program to integrate telematics data with the Toyota Connected platform, enhancing customer experiences with real-time vehicle monitoring.

Telematics Control Unit Market Significant Growth Factors:

The expansion of the Telematics Control Unit sector is fueled by an increasing appetite for connected automobiles, improved safety functionalities, and progressions in automotive technology.

The Telematics Control Unit (TCU) sector is witnessing substantial expansion, influenced by a variety of critical elements. A primary factor is the escalating demand for connected vehicles, which incorporate sophisticated telematics technologies aimed at improving driver safety, navigation, and communication capabilities. Additionally, regulatory requirements for vehicle tracking and diagnostics, especially within commercial vehicle fleets, are driving manufacturers to implement TCUs in order to achieve compliance and enhance operational efficacy.

The increasing emphasis on real-time data analytics and artificial intelligence (AI) for predictive maintenance is another catalyst for market growth, as businesses seek to minimize operational expenditures and boost productivity. Moreover, the rising electric vehicle (EV) market is spurring innovation in telematics solutions that address specialized needs, such as battery management and charging systems.

Consumer desires are also shifting towards more tailored and integrated in-vehicle experiences, leading to the development of advanced infotainment systems that leverage TCUs for improved connectivity and content distribution. The advent of 5G technology further enhances the landscape, offering superior data transmission capabilities that broaden the scope of telematics applications. Lastly, an increasing commitment to sustainability and eco-friendly transportation is driving the integration of telematics to optimize routes and decrease emissions, thereby further propelling the growth of the TCU market.

Telematics Control Unit Market Restraining Factors:

The primary challenges facing the Telematics Control Unit market encompass elevated implementation expenses and apprehensions regarding data security and privacy.

The market for Telematics Control Units (TCUs) encounters various challenges that could impede its development. A primary obstacle is the substantial expense associated with implementing telematics systems, which can be particularly burdensome for small and medium-sized enterprises operating under tight budget constraints. Moreover, the absence of standardized protocols and regulations within the industry may result in discrepancies in data interoperability and integration, ultimately leading to inefficiencies in operations.

Data privacy and security issues also pose significant concerns; as connectivity increases, so too does the vulnerability to cyber threats, which can make businesses reluctant to embrace these technologies. Additionally, the intricate nature of TCU systems might dissuade potential users who favor traditional vehicle management approaches that appear simpler. Geographic limitations, particularly in developing areas with inadequate infrastructure, can further hinder the uptake of telematics solutions, restricting market growth.

Nevertheless, as understanding of the advantages of telematics expands and technological advancements progress, these challenges may be progressively addressed. Fostering research initiatives aimed at improving data security and creating more affordable solutions could enhance the acceptance and integration of telematics technology, ultimately paving the way for a more interconnected and efficient automotive sector.

Key Segments of the Telematics Control Unit Market

By Type:

- 2G/2.5G

- 3G

- 4G

- 5G

By Application:

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

By Component:

- Hardware

- Software

- Services

By Sales Channel:

- OEM

- Aftermarket

By Connectivity:

- Embedded

- Integrated

- Tethered

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America