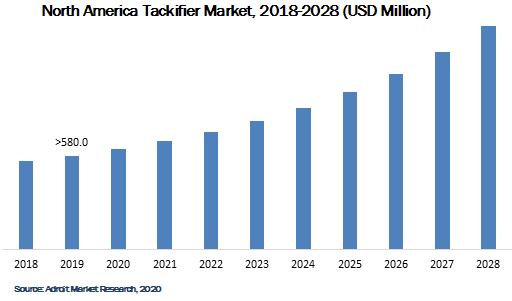

It’s being expected that by 2028, the Tackifier market cap will hit USD 5.73 Billion at a CAGR growth of about 4.81%.

.jpg

)

The global tackifier market is expected to reach a revenue of USD 3.50 billion by the end of 2028.The main feedstock for the production of tackifiers are oil resins, rosin resins and terpene resins. Oil resins, by far the most common feedstock used, are the primary resins C9 aromatic resins and C5 aromatic aliphatic resins. The oldest resin that can be collected from coniferous and pine trees used in an adhesive system is rosin resin. Terpene resins are sustainable resins, both from citrus extract fruits and wood sources taken from terpene food.

Tackifiers are a chemical composite used for adhesive production which represents the largest part of the melting process and requires sensitive adhesives. They are used in a wide range of applications, for example: adhesives assembled, books binder, tapes and labels, smart clothing, several building adhesives, and adhesives used mostly for footwear and rubber products. tacker is made of natural materials or synthetically formed.

In addition to this, the packaging industry, where tackifiers are used for paperback binding, hard binding, binding, editing and binding in the library, will be expected to be the main user of PSA and HMA tackifier items.

Tackifier Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 5.73 Billion |

| Growth Rate | CAGR of 4.81% during 2018-2028 |

| Segment Covered | Type, Applications, Form, End-Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Henkel AG & Company, KGaA, H B Fuller Company, Ashland, and Evonik Industries AG |

Key Segment Of The Tackifier Market

By Type, (USD Million)

• Natural

• Synthetic

By Form, (USD Million)

• Solid

• Liquid

By Application,(USD Million)

• Pressure Sensitive Adhesives (Ps As)

• Hot Melt Adhesives

By End-Use, (USD Million)

• Packaging

• Building & Construction

• Rubber

• Paints & Coatings

• Pulp & Paper

Regional Overview, (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The global tackifier market is likely to expand a CAGR by nearly 5.0% during the forecast period. One of the major factors driving the market is the growing urban infrastructure in developing countries. However, the emerging tackifier free adhesives market is hindering the growth of the market studied. Shifting focus towards bio-based tackifiers is expected to provide a major growth opportunity for the market studied.

The pressure-susceptible adhesive is projected to control the global tackifier market and is also estimated to be the highest growing market. Pressure susceptible adhesives are utilized mainly in the marks, tapes, and graphics businesses. Based on the application in which they are operated, tapes can be contemporary, medical, or subjective. Marks or labels are usually utilized as a part of general-purpose products, therapeutic, wares, food packaging, and beauty care products are among others. Nameplates, decals, emblems, and logos, window safety films, and signage among others are the important employments of graphics.

Type Segment

The tackifier market based on type has been divided as natural tackifiers and synthetic tackifiers. Due to their ease of use in terms of quality and volume, hydrocarbon feedstock was the largest share of the market, while the natural form is projected to grow at the highest rate. The demand for tackifiers has been divided into three main areas depending on the frame: basic and solid, liquid resin dispersion. In the previous year, the solid share played the main part of the business. Pellets and chips that can be transformed into blocks, lumps, or fuses depending largely on circumstances are typically given in solid shape.

End-user Segment

Building & construction is currently the largest share of the global market for tackifiers in the end-user industries. For various purposes in construction, heating, ventilation, air conditioning, cement, fasteners, fabricated housings, resilience floors, and so forth, pressurizing and water-borne adhesives are of great demand.

A significant proportion of these adhesives are used by tackers to improve surface tacks, scrub, and bonding. The growing worldwide construction industry offers the market-tested growth prospects that are probably leading to increasing demand for adhesive tackifiers

Hence, owing to the above-mentioned factors, the building & construction industry is expected to dominate the market studied during the forecast period.

The economic condition of consumers has been enhanced by the continuous improvement of Asia Pacific economic conditions and the demand for electronic equipment, buildings, cars, and textiles has, in turn, risen. China is also a leading adhesive manufacturer and exporter in numerous countries and is a major player in the Asia Pacific market for adhesives.

The major adhesive manufacturing companies, such as Henkel AG & Company, KGaA, H B Fuller Company, Ashland, and Evonik Industries AG, have their manufacturing plants in this region. The players are planning strategic innovations to increase the production and sales of adhesive and sealants market

The increase in the production of adhesives and their outputs is expected to drive the consumption of tackifiers. Thus, the Asia-Pacific region is expected to dominate the tackifier market during the forecast period.