Sustainable Aviation Fuel Market Analysis and Insights:

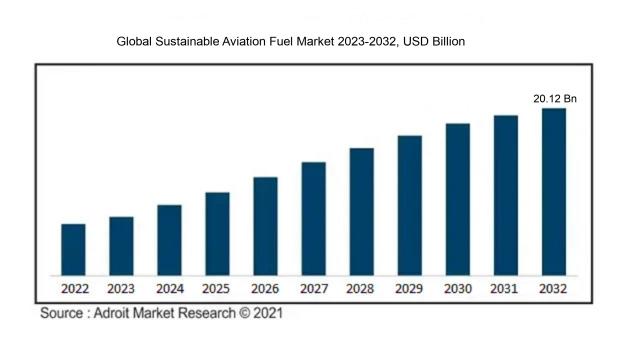

The market size for sustainable aviation fuel was estimated at USD 0.8 billion in 2022. With a compound annual growth rate (CAGR) of 53.85% from 2023 to 2032, the Sustainable Aviation Fuel Market is expected to increase from USD 0.10 billion in 2023 to USD 20.12 billion by 2032.

The market for Sustainable Aviation Fuel (SAF) is significantly influenced by growing regulatory demands focused on minimizing carbon emissions in the aviation industry. Various governments are adopting policies and offering incentives to encourage the implementation of renewable fuels, in line with international climate agreements such as the Paris Agreement. Additionally, increasing consumer consciousness regarding eco-friendly travel options is driving airlines to integrate SAF into their sustainability strategies. Innovations in fuel production technology are also pivotal, as they improve the efficiency and financial viability of SAF in comparison to conventional fuels. In addition, partnerships and investments among key players—including airlines, fuel manufacturers, and research organizations—are fostering innovation and expanding production capacity. Finally, the instability of fossil fuel prices and crude oil market fluctuations are motivating the aviation sector to broaden its fuel sourcing, further enhancing the growth prospects of the SAF market.

Sustainable Aviation Fuel Market Definition

Sustainable Aviation Fuel (SAF) encompasses jet fuels produced from renewable sources, which have the potential to substantially decrease greenhouse gas emissions when compared to conventional fossil fuels. These alternatives can be derived from a diverse range of raw materials, such as vegetable oils, agricultural byproducts, and recycled waste, thereby fostering ecological sustainability within the aviation industry.

Sustainable Aviation Fuel (SAF) plays a pivotal role in minimizing the environmental impact of the aviation sector and addressing climate change challenges. With the surge in global air traffic, the reliance on conventional fossil fuels has led to substantial greenhouse gas emissions. SAF, derived from renewable sources like biomass and waste products, presents a more sustainable option that can potentially decrease lifecycle carbon emissions by as much as 80% when compared to traditional jet fuel. Moreover, SAF is designed to be fully compatible with current aircraft engines and infrastructure, thus enabling airlines to transition smoothly. By advocating for the adoption of SAF, the aviation industry can boost its sustainability efforts, foster technological advancements, and meet its pledge to achieve net-zero emissions.

Sustainable Aviation Fuel Market Segmental Analysis:

Insights On Fuel Type

Biofuel

Biofuel is expected to dominate the Global Sustainable Aviation Fuel Market due to its well-established production processes and compatibility with existing aviation infrastructure. It includes feedstocks such as vegetable oils and waste oils that can be processed using conventional refining methods. The global demand for sustainable solutions amidst climate change concerns has amplified interest in biofuel as it can significantly reduce lifecycle greenhouse gas emissions compared to fossil fuels. Furthermore, government policies and incentives aimed at reducing carbon footprints are driving investments in biofuel technologies, making it a clear leader in sustainable aviation fuel options.

Power-to-Liquid

Power-to-Liquid technology, which involves converting renewable electricity into liquid fuels, has garnered notable attention in recent years. This method allows for the utilization of excess renewable energy, such as wind or solar, to produce synthetic fuels. However, due to its relatively high production costs and the need for ongoing technological advancements to improve efficiency, it has not reached commercial maturity compared to biofuels. Nevertheless, as technology evolves and green electricity becomes more abundant and affordable, Power-to-Liquid could play a significant role in the future of sustainable aviation fuels, especially in regions with ample renewable resources.

Gas-to-Liquid

Gas-to-Liquid technology, which converts natural gas into liquid fuels, is another alternative being explored within the sustainable aviation fuel market. While this method can create cleaner-burning fuels, its reliance on natural gas raises questions about sustainability and environmental impact. The industry has focused on improving the efficiency and reducing the carbon footprint of the Gas-to-Liquid process. However, it still faces challenges in competing against more readily available and sustainable options like biofuels. The future of this technology might hinge on advancements in carbon capture technology, which can mitigate some environmental concerns and enhance its appeal in the aviation sector.

Insights On Technology

HEFA-SPK

HEFA-SPK (Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene) is expected to dominate the Global Sustainable Aviation Fuel market due to its strong technological maturity and established supply chain. This technology has gained significant traction in recent years thanks to its compatibility with existing jet fuel infrastructure and engines, leading to lower transitional costs for airlines. The widespread adoption of HEFA-SPK across major airlines and its ability to be blended easily with conventional jet fuels are driving its popularity. Additionally, the ability to produce HEFA-SPK from a variety of feedstocks, including waste oils and fats, enhances its sustainability credentials, making it the preferred choice for green aviation initiatives.

FT-SPK

FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene) is recognized for its potential in the sustainable aviation fuel market, but it faces challenges primarily in terms of capital investment and technology development. While FT-SPK can produce high-quality fuel from coal or biomass, the conversion processes can be complex and costly, leading to limited adoption compared to more mature technologies. Furthermore, environmental concerns related to sourcing feedstock, particularly from fossil fuel sources, may hinder its acceptance in a market that increasingly prioritizes sustainability. Although FT-SPK can potentially contribute to the aviation fuel mix, its growth is likely to be overshadowed by more established alternatives.

HFS-SIP

HFS-SIP (Hydroprocessed Fermented Sugars to Synthetic Iso-paraffins) is a promising technology for producing drop-in fuels, yet it remains in the early stages of commercialization. The technology utilizes sugar feedstocks, which positions it well within the renewable energy landscape. However, its limited scalability and relatively high production costs compared to other alternatives hinder its immediate market presence. Although HFS-SIP has unique advantages, including the ability to convert waste sugar into fuel, its adoption has been slow, making it less competitive in a rapidly evolving market focused on other more developed technologies.

ATJ-SPK

ATJ-SPK (Alcohol-to-Jet Synthetic Paraffinic Kerosene) shows potential as an innovative technology for sustainable aviation fuel. It effectively converts alcohols into aviation-grade fuels, thereby providing an alternative feedstock approach. However, ATJ-SPK is still in the developmental phase, which poses challenges regarding scalability and economic feasibility. The production process has not yet reached commercial maturity, and while it provides a novel route to bio-jet fuel, the high initial investments and lower yields compared to more established technologies like HEFA-SPK hinder its widespread adoption in the aviation industry.

Insights On Aircraft Type

Fixed Wings

The Fixed Wings category is anticipated to dominate the Global Sustainable Aviation Fuel Market due to its significant contribution to the total aviation emissions. Aircraft in this, such as commercial airliners and cargo planes, represent a larger share of global flight operations compared to rotorcraft. As airlines and manufacturers increasingly prioritize sustainability, the demand for sustainable aviation fuels (SAFs) for fixed-wing aircraft is rising. Additionally, several initiatives and partnerships are underway within major airline companies to transition their fleets to more sustainable alternatives, bolstering the 's growth potential. The large operational scale, ongoing technological advancements, and regulatory pressures further enhance its leadership in the market.

Rotorcraft

The Rotorcraft category, which includes helicopters and other vertical takeoff aircraft, holds a smaller share of the overall aviation market compared to fixed wings. However, rotorcraft are increasingly being integrated into urban air mobility solutions and emergency services, where rapid transport is crucial. The demand for more efficient and eco-friendly alternatives in these applications is gradually rising. Though the adoption of sustainable aviation fuels is not as vigorous in this, specific sectors, such as medical transportation, are paving the way for innovations in SAF usage, showing a potential for growth in the rotorcraft realm in the coming years.

Others

The Others category encompasses various aircraft types that do not fall into the fixed wings or rotorcraft classifications. This can include drones and smaller, specialized aircraft used for agriculture, surveillance, or research purposes. The market for sustainable aviation fuel in this remains relatively niche, driven primarily by advancements in environmental technology and regulatory compliance. As innovation increases in these alternative aircraft applications, the interest in sustainable fuel solutions is likely to grow, albeit at a slower pace compared to the dominant fixed wings category. The diversity in aircraft use cases results in varied adoption rates of SAFs across this group.

Insights On Biofuel Blending Capacity

Above 50%

The with biofuel blending capacity above 50% is expected to dominate the Global Sustainable Aviation Fuel Market. This is primarily due to an increasing global focus on reducing greenhouse gas emissions and meeting stringent regulatory commitments. As airlines and governments push for more sustainable initiatives, higher blending capacities are being prioritized to achieve significant reductions in carbon footprints. Additionally, advancements in technology and the commercial viability of high-blend biofuels are driving airlines to incorporate these fuels into their fleets. This not only aligns with environmental goals but also enhances fuel efficiency and performance, making this the leader in sustainable aviation fuel adoption.

30% to 50%

The with biofuel blending capacity between 30% to 50% presents a noteworthy opportunity for growth in the market. While it may not lead the market, it plays a critical role in the transition toward more sustainable aviation practices. Airlines adopting fuels within this range can benefit from an immediate reduction in emissions while minimizing operational disruptions. This blending capacity is often seen as a stepping stone for carriers that are gradually moving towards higher biofuel inclusion, thereby making it a significant contributor to the overall sustainable aviation fuel landscape.

Below 30%

The of biofuel blending capacity below 30% is currently less dominant in the Global Sustainable Aviation Fuel Market. While it allows for some level of integration of sustainable practices, it typically does not provide substantial reductions in emissions or align with the aggressive targets set by major airlines and governmental regulations. Moreover, the gradual evolution towards higher efficiencies means that this lower blending capacity is often viewed as a transitional phase rather than a long-term solution. While still relevant, it tends to be overshadowed by more impactful capacities, limiting its influence on the market's future trajectory.

Insights On Platform

Commercial

The Commercial is expected to dominate the Global Sustainable Aviation Fuel Market due to the increasing regulatory pressures and the growing awareness of carbon emissions in the aviation industry. Airlines are under significant scrutiny from governments and regulatory bodies to reduce their environmental impact, leading them to seek sustainable alternatives. The commercial aviation sector also accounts for a substantial percentage of total fuel consumption, making it a primary target for adopting sustainable aviation fuels. Major global airlines have already begun investing in innovative technologies and collaborations to integrate these fuels into their operations. This sector's significant commitment to sustainability initiatives positions it as the leading sector in the sustainable aviation fuel market.

Regional Transport Aircraft

The Regional Transport Aircraft category is characterized by smaller aircraft, primarily used for shorter routes and connecting regional airports. While it does represent a vital portion of the aviation system, its fuel requirements are comparatively lower than those of commercial aviation. However, the rising emphasis on sustainable practices at the regional level has spurred interest in alternative fuels. This presents opportunities for innovation, albeit on a limited scale, and remains focused on capturing a niche market that aligns with local environmental goals.

Military Aviation

The Military Aviation industry has increasingly begun to explore the use of sustainable aviation fuels, driven by both environmental and strategic considerations. Defense agencies globally are adopting sustainable practices as part of their operational strategies. Despite being a smaller market compared to commercial aviation, military operations often consume fuels at significant rates, and reducing carbon footprints is becoming a priority. The commitment to sustainability in military operations, alongside regulatory pressures, implies that this sector will gradually increase its adoption of sustainable fuels over time.

Business & General Aviation

Business and General Aviation plays a crucial role in accessibility and efficiency, especially for corporate travel and aerial services. This sector is less regulated than commercial airlines but is increasingly being influenced by sustainability considerations. Operators seeking to improve their public image and meet corporate social responsibility goals are looking into sustainable aviation fuels. There is potential for growth in this area, as demand for more environmentally friendly options gains traction, but it currently remains a smaller market compared to commercial aviation.

Unmanned Aerial Vehicles

The Unmanned Aerial Vehicles (UAV) has gained momentum due to its versatile applications in various industries, including logistics, surveillance, and agriculture. This is at the forefront of technological innovation, with many companies exploring electric and hybrid-power systems. Although UAVs actually use less fuel compared to manned aircraft, the implementation of sustainable fuels offers an avenue for improving their ecological footprint. As regulations evolve and public interest in ecological sustainability grows, UAVs might integrate alternative fuels, but the scale of impact remains limited compared to larger.

Global Sustainable Aviation Fuel Market Regional Insights:

North America

North America is expected to dominate the Global Sustainable Aviation Fuel (SAF) market due to several critical factors. The region has been at the forefront of technological advancements and regulatory frameworks that support the development and adoption of sustainable fuels. Significant investments from key stakeholders, such as major airlines and fuel producers, are actively driving research and infrastructure improvements. Additionally, the presence of leading regulatory bodies, such as the Federal Aviation Administration (FAA) and Environmental Protection Agency (EPA), is facilitating the implementation of policies that promote sustainability in aviation. The existing infrastructure for biofuels and strong partnerships among various industries further enhance North America's position as the dominant player in the SAF market.

Latin America

Latin America is gradually emerging in the Sustainable Aviation Fuel market, primarily driven by its abundant resources for biofuel production, such as sugarcane and other feedstocks. Countries like Brazil are at the forefront, implementing policies to support renewable fuel development. However, the region still faces challenges, including the need for better infrastructure and investment in research and development. Collaborative efforts with international organizations could further bolster Latin America's capabilities in the SAF sector, promoting sustainable growth.

Asia Pacific

The Asia Pacific region shows significant potential in the Sustainable Aviation Fuel market, primarily through rapid industrialization and increasing air travel demand. Countries such as Japan and Australia are making strides in developing SAF technologies and establishing regulatory frameworks. Nevertheless, the region is hindered by varying levels of government support and differing approaches to sustainability among its member countries. Continual investments in research, infrastructure development, and collaboration with international stakeholders are crucial to unlock the full potential of the SAF market within this region.

Europe

Europe is recognized as a key player in the Sustainable Aviation Fuel market, with aggressive policies aimed at reducing greenhouse gas emissions. The European Union's commitment to reaching climate neutrality by 2050 has spurred significant research and funding in alternative fuels. However, challenges such as high production costs and regulatory complexities pose obstacles to large-scale adoption. The awareness among consumers and industries, coupled with an increasing number of SAF initiatives, signals a growing market; however, it may not achieve dominance compared to North America.

Middle East & Africa

The Middle East & Africa region is still in the early stages of developing its Sustainable Aviation Fuel market. Although certain countries like the United Arab Emirates are exploring renewable fuel alternatives, overall market maturity remains low. Challenges include limited investment in infrastructure and resources, along with a lesser focus on sustainability compared to other regions. However, there is potential for growth as governments recognize the importance of sustainability in aviation and pursue partnerships with global industry leaders.

Sustainable Aviation Fuel Competitive Landscape:

Leading participants within the Global Sustainable Aviation Fuel sector, encompassing fuel manufacturers, airlines, and regulatory agencies, engage in collaborative efforts to innovate and expand sustainable fuel technologies, all while adhering to environmental regulations. Their contributions encompass enhancing production methodologies, forming strategic alliances, and championing industry-wide initiatives aimed at advancing sustainability within the aviation field.

Prominent organizations in the Sustainable Aviation Fuel sector comprise Boeing, Airbus, Neste, World Energy, Gevo, Velocys, LanzaTech, TotalEnergies, Shell, BP, Honeywell UOP, ExxonMobil, Pratt & Whitney, as well as major airlines such as Southwest Airlines, American Airlines, and Delta Air Lines. These entities play a crucial role in advancing, manufacturing, and advocating for sustainable aviation fuels, aiming to decrease carbon emissions and enhance environmental sustainability within the aviation field.

Global Sustainable Aviation Fuel COVID-19 Impact and Market Status:

The Covid-19 pandemic catalyzed a rapid growth in both investment and innovation within the Global Sustainable Aviation Fuel sector. In light of ened environmental awareness and a transition to more sustainable aviation practices following the crisis, airlines aimed to bolster their resilience and commitment to sustainability.

The COVID-19 pandemic had a profound effect on the Sustainable Aviation Fuel (SAF) sector, mainly by disrupting global supply chains and reducing demand for air travel. Airlines encountered unparalleled financial difficulties, leading to a slowdown in investments in SAF initiatives as cash flow diminished and uncertainty about future travel patterns grew. However, the crisis also stimulated a renewed focus on sustainability, prompting collaborations between governments and industry stakeholders who committed to adopting cleaner fuel alternatives as a component of their recovery plans. Efforts to achieve net-zero emissions by 2050 gained traction, resulting in increased interest in SAF technologies. Moreover, airlines began to integrate SAF into their operations, although this was limited by production capacity challenges. Despite facing immediate obstacles, the long-term prospects for the SAF market remain positive, with expectations of a resurgence in air travel and an increasing commitment to environmental stewardship, paving the way for enhanced growth and integration of sustainable aviation fuels in the period following the pandemic.

Latest Trends and Innovation in The Global Sustainable Aviation Fuel Market:

- In June 2023, United Airlines announced a partnership with the biofuels producer Fulcrum BioEnergy to purchase 200 million gallons of Sustainable Aviation Fuel (SAF) over a period of 20 years, marking a significant step in the airline's commitment to reduce its carbon emissions.

- In August 2023, Boeing completed a successful test flight using a blend of 100% SAF, demonstrating the viability of sustainable fuels for future aircraft operations and supporting the aerospace industry’s decarbonization goals.

- In September 2023, Delta Air Lines revealed plans to invest $1 billion in sustainable fuel production over the next five years, targeting a total of 10% sustainable fuel usage by 2030, which is part of their broader sustainability strategy.

- In October 2023, Shell announced that it would build a new SAF production facility in the U.S. with a projected output of up to 800,000 tons of SAF per year, illustrating the company’s expanding role in the renewable energy market.

- In July 2023, Neste Corporation acquired a stake in a U.S.-based biofuel company, aiming to increase its SAF production capabilities and strengthen its position in the North American renewable fuel market.

- In May 2023, the International Air Transport Association (IATA) reported that airlines worldwide signed agreements to purchase over 30 million gallons of SAF from various producers, highlighting the growing demand for sustainable fuel solutions across the aviation industry.

- In February 2023, Airbus announced its collaboration with multiple stakeholders, including airlines and fuel suppliers, to accelerate the commercialization of SAF, with a goal to have SAF-powered flights running in more regions by 2025.

Sustainable Aviation Fuel Market Growth Factors:

The Sustainable Aviation Fuel Market is influenced by several key growth drivers, such as the tightening environmental regulations, technological advancements in fuel production, and a growing consumer preference for more eco-friendly travel alternatives.

The Sustainable Aviation Fuel (SAF) sector is experiencing notable expansion, driven by a variety of crucial elements. Stricter governmental regulations aimed at curtailing greenhouse gas emissions are pushing airlines to explore alternative fuel options. Cooperative efforts between airlines and fuel manufacturers to enhance and increase SAF production are further propelling the market's development. Additionally, a growing public consciousness regarding climate change and sustainability is motivating corporations to implement environmentally friendly practices, thereby elevating the demand for SAF as a practical alternative. Advances in technology related to fuel production, including the optimization of feedstocks and innovative techniques for converting waste into fuel, are improving the economic feasibility of SAF. Rising prices of fossil fuels are also leading the aviation sector to consider more secure and sustainable alternatives. Moreover, investments in SAF infrastructure—spanning production facilities to distribution systems—are escalating, which supports enhanced supply and accessibility. Lastly, international pledges aimed at achieving net-zero emissions by mid-century are driving stakeholders within the aviation industry to invest in and shift towards sustainable fuel solutions. Together, these dynamics highlight a strong growth potential for the Sustainable Aviation Fuel market, which aligns with broader environmental initiatives and transformation within the industry.

Sustainable Aviation Fuel Market Restaining Factors:

The Sustainable Aviation Fuel market faces several significant barriers, including elevated production expenses, insufficient supply chain frameworks, and various regulatory hurdles.

The market for Sustainable Aviation Fuel (SAF) is hindered by several factors that restrict its expansion and widespread implementation. A primary obstacle is the elevated production costs, which render SAF less economically viable compared to traditional jet fuels, thereby posing a challenge for airlines that operate on narrow profit margins. Additionally, the infrastructure for supply chains is not sufficiently developed; SAF production is currently limited to a small number of facilities, and the requisite distribution networks for enhanced availability are still in their infancy.

Regulatory complexities and diverse sustainability criteria across different regions also make it challenging for new SAF producers to enter the market. Moreover, the persistent reliance on fossil fuels and the absence of robust regulatory frameworks concerning emissions in certain areas contribute to sluggish adoption rates. Technological obstacles also exist, particularly in scaling up production and fine-tuning the conversion methods for alternative feedstocks, further affecting the growth of the sector.

Nevertheless, continuous investments in research and development, increasing governmental backing, and a rising awareness of climate issues are stimulating advancements in the industry, fostering hope for a shift towards more sustainable aviation options. Overall, these dynamics are likely to cultivate a more conducive environment for the growth of the sustainable aviation fuel market in the future.

Key Segments of the Sustainable Aviation Fuel Market

By Fuel Type

• Biofuel

• Power-to-Liquid

• Gas-to-Liquid

By Technology

• HEFA-SPK

• FT-SPK

• HFS-SIP

• ATJ-SPK

By Aircraft Type

• Fixed Wings

• Rotorcraft

• Others

By Biofuel Blending Capacity

• Above 50%

• 30% to 50%

• Below 30%

By Platform

• Commercial

• Regional Transport Aircraft

• Military Aviation

• Business & General Aviation

• Unmanned Aerial Vehicles

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America