Surgical Table Market Analysis and Insights:

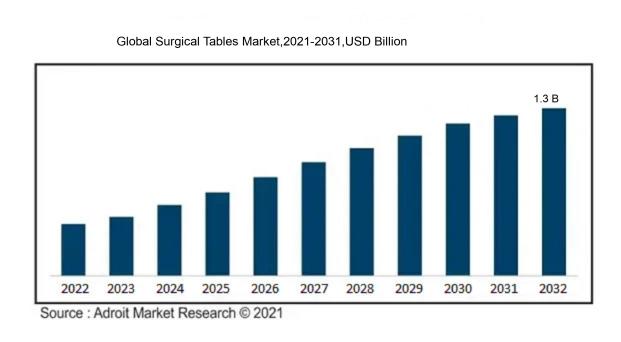

In 2023, the size of the worldwide Surgical Table market was US$ 0.8 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4.01 % from 2024 to 2032, reaching US$ 1.3 billion.

The Surgical Table Market is primarily fueled by a global increase in surgical interventions, influenced by the aging demographic, a rise in chronic illness cases, and advancements in surgical methodologies. The introduction of innovative technologies, such as automated and multifunctional surgical Table, significantly improves operational efficiency and enhances patient safety, leading to a surge in demand. Moreover, the growing focus on minimally invasive procedures requires specialized Table that provide better positioning and accessibility for surgical teams. The expansion of healthcare facilities, particularly in developing nations, coupled with an increase in healthcare spending, plays a crucial role in driving market growth. Additionally, ened awareness among medical professionals regarding the advantages of sophisticated surgical equipment amplifies the demand for contemporary surgical solutions. Furthermore, regulatory frameworks advocating for enhanced surgical environments serve as a driving force for the market, encouraging investment in state-of-the-art surgical table options.

Surgical Table Market Definition

Surgical Table are advanced medical apparatus tailored to provide support for patients throughout surgical interventions. They facilitate ideal positioning and accessibility for surgeons. These Table are adjustable and include a range of features aimed at improving patient comfort and enhancing the effectiveness of the surgical process.

Surgical Table play an essential role in the medical field, significantly improving the effectiveness and safety of surgical interventions. These devices offer healthcare providers the stability and adaptability required to position patients correctly during operations, which is critical for clear access to the surgical area. With their adjustable capabilities, these Table can be tailored to meet the diverse demands of various surgical types and patient specifications, including those of bariatric and pediatric individuals. Well-constructed surgical Table not only promote better ergonomic practices for surgeons, alleviating fatigue and increasing accuracy, but also incorporate safety mechanisms that safeguard patients during procedures, solidifying their necessity in contemporary surgical settings.

Surgical Table Market Segmental Analysis:

Insights On Product

General Surgery Table

General surgery Table are expected to dominate the Global Surgical Table Market primarily due to their versatility and widespread application across various surgical specialties. These Table can be adapted for a range of procedures, from emergency surgeries to elective operations, making them essential in surgical settings. Their design facilitates positioning and access to patients, optimized for complex surgeries, which boosts their demand. Moreover, advancements in technology have led to the development of more advanced models that offer enhanced features, including better weight capacity, adjustment, and integration with imaging devices, ensuring their continued relevance in modern surgical environments.

Orthopedic Table

Orthopedic Table play a significant role in specialized surgeries related to bones and joints. Their design allows for precise positioning and stability, which is crucial during orthopedic procedures. While they are essential in trauma centers and orthopedic clinics, their market is somewhat limited compared to general surgery Table. The growing prevalence of orthopedic surgeries due to an aging population and increased sports injuries, however, has led to a steady increase in the demand for these Table. Nevertheless, they cater primarily to a niche market, which prevents them from surpassing the dominance of general surgery Table.

Imaging Table

Imaging Table are tailored for diagnostic and imaging procedures, such as MRI and CT scans, providing a distinct yet essential function within hospitals. Although their application is crucial, they cater to a more specific area of healthcare compared to general surgery Table, limiting their overall market share. The rise in imaging technologies and the incorporation of imaging Table into surgical suites have led to increased demand. However, their reliance on existing surgical workflows and the need for compatibility with other surgical devices means they do not possess the broad applicability seen with general surgery Table.

Insights On Type

Powered

The powered surgical Table are expected to dominate the global market due to the increasing demand for advanced medical technologies and enhanced procedural efficiency in healthcare settings. As surgical procedures grow in complexity, powered Table offer significant advantages such as adjustable and tilt features that improve accessibility and ergonomics for surgical teams. These Table are specifically designed to accommodate a variety of positions and specialized requirements, facilitating better patient outcomes and safety. Furthermore, the trend toward minimally invasive surgeries continues to drive adoption, making powered models a preferred choice among hospitals and surgical centers.

Non-Powered

Non-powered surgical Table, while experiencing lower market share in comparison to their powered counterparts, still hold a niche within the global market. Their appeal lies in lower initial costs and minimal maintenance requirements. Many healthcare facilities, particularly in developing regions, may choose non-powered options due to budget constraints or limited access to electricity. These Table are straightforward and reliable, serving essential functions without the complexities of powered models. Additionally, some surgical settings prioritize manual adjustments for greater control over positioning, particularly in simpler procedures.

Insights On End User

Hospitals and ASC’s

The that is expected to dominate the Global Surgical Table Market is hospitals and Ambulatory Surgery Centers (ASC’s). This is largely due to the increasing number of surgical procedures conducted in hospitals and ASCs, driven by an aging population, a rise in chronic health issues, and advancements in surgical technologies. Hospitals require versatile and advanced surgical Table to accommodate varying medical procedures, which further fuels their demand. Additionally, with many ASCs focusing on outpatient surgeries, the need for specialized surgical Table that enhance efficiency and patient comfort is on the rise. This combined growth ensures that this category remains at the forefront of the market.

Specialty Clinics

Specialty clinics are anticipated to see steady growth in the surgical Table market, as these facilities often focus on specific types of procedures, such as orthopedic, cosmetic, or neurological surgeries. The evolving healthcare landscape emphasizes the importance of specialized care, and as patients increasingly prefer focused treatment centers, specialty clinics are upgrading their surgical capabilities. The demand for advanced and precise surgical Table tailored to specific procedures contributes significantly to this 's expansion. Furthermore, continued innovations in surgical technology are pushing specialty clinics to invest in modern surgical Table that enhance the precision and outcomes of specialized operations.

Trauma Centers

Trauma centers also represent a vital part of the surgical Table market, although they are generally smaller in scale compared to hospitals and ASCs. Due to the emergency nature of their operations, these centers require Table that are both robust and quickly adaptable to various trauma situations. The increasing incidence of accidents and emergencies, exacerbated by urbanization and high-density living, continues to drive the necessity for advanced trauma care. While this might not lead the market, its demand for specialized surgical Table that can accommodate rapid interventions and diverse patient requirements plays a crucial role in shaping the overall market landscape.

Global Surgical Table Market Regional Insights:

North America

North America is expected to dominate the Global Surgical Table market due to several compelling factors. The region hosts advanced healthcare infrastructures, a high prevalence of chronic diseases, and a robust adoption of innovative medical technologies. Significant investments in research and development, along with increasing surgical procedures driven by an aging population, are essential dynamics propelling growth in this. Furthermore, the presence of leading manufacturers and high healthcare expenditure reinforce North America's position as a pivotal player in the surgical Table market, with a continuous push for enhanced surgical solutions that facilitate better patient outcomes.

Latin America

Latin America is witnessing gradual growth in the surgical Table market due to a shifting focus on improving healthcare systems. With ongoing economic development and increasing healthcare investments, regions like Brazil and Mexico are enhancing their surgical capabilities. However, infrastructural challenges and disparities in healthcare access limit the pace of overall market growth compared to more developed regions. The rising demand for minimally invasive procedures will likely drive the surgical Table market in the region.

Asia Pacific

The Asia Pacific region is emerging as a crucial player in the surgical Table market, primarily driven by its burgeoning healthcare sector and increasing patient population. Countries such as China and India are investing heavily in healthcare infrastructure, which is expected to propel the demand for surgical equipment. Moreover, rising awareness regarding advanced medical technologies and a growing number of surgical procedures are favorable trends that can stimulate market expansion, though regulatory challenges and price sensitivity remain considerations for manufacturers.

Europe

Europe is experiencing stable growth in the surgical Table market, significantly influenced by technological advancements and a strong emphasis on improving surgical practices. The region benefits from well-established healthcare systems and an aging population, which increases the demand for surgical interventions. However, market growth is somewhat tempered by stringent regulatory frameworks and budget constraints within public health systems across many European countries. Nonetheless, the increasing adoption of electronic and specialized surgical Table is anticipated to bolster this market.

Middle East & Africa

The Middle East & Africa region holds potential in the surgical Table market, supported by the rapid enhancement of healthcare infrastructure and the rising economic development across several countries. Investment initiatives and the growing prevalence of lifestyle diseases are encouraging the adoption of advanced surgical technologies. Despite these positive developments, challenges such as supply chain issues, limited accessibility to advanced healthcare technology, and economic disparities may pose hurdles for broader market penetration in the region. Nonetheless, increasing healthcare expenditure could support gradual growth moving forward.

Surgical Table Market Competitive Landscape:

The global surgical Table market is propelled by stakeholders including manufacturers and suppliers who are committed to fostering innovation and enhancing quality. By collaborating with hospitals and surgical facilities, these entities improve operational efficiency and patient care through the integration of advanced technology and ergonomic designs.

Prominent participants in the surgical Table industry consist of Hill-Rom Holdings, Inc., Stryker Corporation, Getinge AB, Maquet GmbH & Co. KG, Medtronic plc, Alvo Medical Sp. z o.o., Mizuho OSI, Inc., Skytron LLC, Steris plc, and Trumpf Medical. Additionally, significant contributors in this field include Conmed Corporation, KLS Martin Group, Bilcare Limited, and AorTech International Plc.

Global Surgical Table Market COVID-19 Impact and Market Status:

The Covid-19 pandemic caused major disruptions in the worldwide market for surgical Table, resulting in postponed surgeries and a noticeable drop in the demand for surgical instruments during the of infection waves.

The COVID-19 pandemic had a profound impact on the market for surgical Table, resulting in a notable drop in demand as elective surgeries were postponed or canceled to redirect healthcare resources to COVID-19 patients. Hospitals encountered several obstacles, including diminished surgical capabilities, supply chain interruptions, and a reorientation towards critical care services. Nevertheless, as the healthcare sector adjusted and began to resume elective surgeries, the market witnessed a resurgence, fueled by the necessity for advanced surgical tools and improved measures for infection control. Additionally, the growing preference for minimally invasive surgical techniques and innovations in surgical table technology—such as motorized adjustments and compatibility with imaging systems— ened the interest in modernizing existing facilities. In the aftermath of the pandemic, the market is expected to expand, with healthcare organizations investing in cutting-edge surgical solutions to enhance operational efficacy and patient outcomes, while also readying themselves for any future healthcare emergencies.

Latest Trends and Innovation in The Global Surgical Table Market:

- In January 2023, Steris plc announced the acquisition of Surgical, expanding their portfolio of surgical solutions and enhancing their film technology and surgical table offerings aimed at improving surgical workflows.

- In March 2023, Maquet Medical Systems, part of the Getinge Group, launched the new Versatile Operating Table featuring advanced mobility and an improved ergonomic design that enhances surgical access and patient positioning.

- In July 2023, Hillrom, which was acquired by Baxter International, introduced the Elevation Surgical Table series designed to enhance surgical precision and patient safety with integrated technology adaptable to various surgical procedures.

- In August 2023, Stryker Corporation unveiled its new Vision™ Surgical Table featuring integrated imaging capabilities that allow surgeons to perform complex procedures with real-time visibility while optimizing the surgical environment.

- In September 2023, GE Healthcare partnered with Medtronic to develop advanced surgical Table equipped with robotics and AI capability, aiming to reduce surgery times and increase efficiency in operating rooms.

- In October 2023, Trumpf Medical promoted its new TruSystem 7500 surgical table, which offers enhanced flexibility and an intuitive control system tailored for minimally invasive surgeries, showcasing its latest innovations in surgical technology.

Surgical Table Market Growth Factors:

The Surgical Table Market is poised for significant expansion, driven by factors such as advancements in technology, a rise in the number of surgical interventions, and an increasing preference for minimally invasive surgical techniques.

The market for surgical Table is witnessing notable expansion, driven by several pivotal elements. A primary influence is the rising incidence of chronic illnesses, which leads to an increase in surgical interventions, thereby escalating the demand for sophisticated surgical Table featuring state-of-the-art technology. Innovations such as robotic integration, electric manipulation, and compatibility with imaging systems significantly improve the precision and effectiveness of surgical procedures, thereby further stimulating market growth.

Moreover, the growing elderly demographic is resulting in a higher frequency of surgical procedures, which enhances the demand for specialized Table tailored to diverse medical fields. The trend towards minimally invasive surgery, which often necessitates specific table designs, also adds to this demand. Additionally, the enhancement of healthcare infrastructure, particularly in developing nations, is driving up investments in medical apparatus, including surgical Table.

Public sector initiatives focused on improving healthcare standards and accessibility are instrumental in supporting market growth as well. Lastly, the collaboration between manufacturers and healthcare institutions promotes the creation of customized solutions that address specific surgical needs, thus elevating the overall standard of surgical care. Together, these dynamics not only improve the functionality and versatility of surgical Table but also ensure they adapt to the changing landscape of contemporary medical practices.

Surgical Table Market Restaining Factors:

The surgical Table market faces significant obstacles, including elevated expenses, rigorous regulatory standards, and the demand for innovative technological developments to align with advancing surgical methodologies.

The Surgical Table Market encounters several obstacles that could impede its growth potential. One prominent challenge is the elevated costs linked to advanced surgical table technologies, which may discourage uptake, especially in developing nations with financial limitations. Additionally, the ongoing advancements in surgical methodologies necessitate regular modifications and replacements of surgical Table, resulting in ened capital investments for healthcare institutions. Stringent regulatory standards for surgical equipment can also prolong approval timelines, hindering the market introduction of new products. The increasing popularity of alternative surgical approaches, such as minimally invasive techniques, may further diminish the demand for conventional surgical Table. Furthermore, a global scarcity of proficient healthcare workers capable of managing complex surgical apparatus presents a challenge to fully leveraging the advantages of these Table. Nevertheless, the market is expected to expand due to the rising incidence of chronic illnesses, ongoing technological innovations in surgical tools, and a growing volume of surgical interventions globally, which encourage innovation and funding in cutting-edge surgical solutions. As the healthcare landscape evolves, addressing these challenges could enhance product offerings and strengthen the surgical Table market, ultimately improving outcomes for both patients and healthcare providers.

Segments of the Surgical Table Market

By Product

• General surgery Table

• Orthopedic Table

• Imaging Table

By Type

• Powered

• Non-powered

By End User

• Hospitals and ASC’s

• Specialty clinics and trauma centers

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America