Market Analysis and Insights:

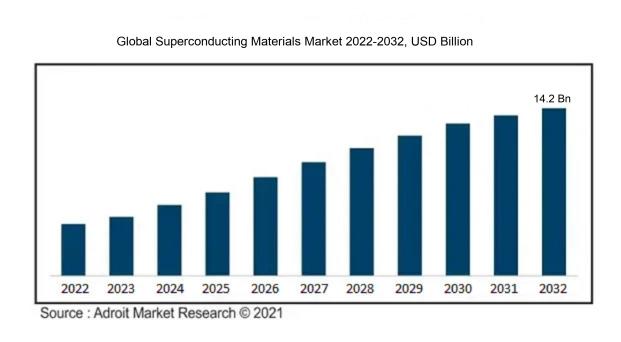

The market for Superconducting Materials was estimated to be worth USD 5.9 billion in 2022, and from 2023 to 2033, it is anticipated to grow at a CAGR of 10.30%, with an expected value of USD 14.2 billion in 2032.

The Superconducting Materials Market is experiencing growth due to various significant contributing factors. Firstly, the escalation in demand for energy-efficient technologies and sustainable energy resources is propelling market expansion. Superconducting materials, characterized by reduced electrical resistance, facilitate effective electricity transmission and storage, aligning with the worldwide emphasis on clean and renewable energy solutions.

Additionally, increased investments in research and development endeavors within the superconducting materials sector are bolstering market growth. These investments prioritize the enhancement of superconducting material properties and performance to broaden their applicability across diverse industries. Moreover, the rising utilization of superconducting materials in healthcare, particularly in imaging devices, is fueling market growth.

Furthermore, the capacity of superconducting materials to enhance computing speed and efficiency is amplifying their demand in the information technology domain. In essence, the growing emphasis on energy efficiency, ongoing research investments, healthcare applications, and advancements in the IT sector collectively serve as primary drivers behind the Superconducting Materials Market's expansion.

Superconducting Materials Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 14.2 billion |

| Growth Rate | CAGR of 10.30% during 2023-2032 |

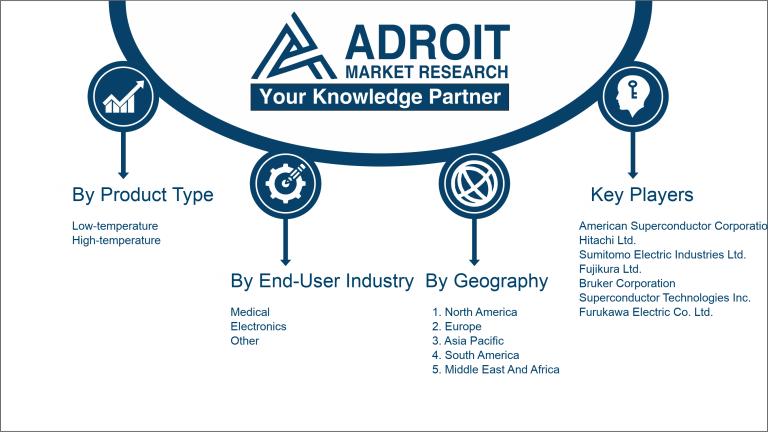

| Segment Covered | By Product Type, By End-user Industry ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | American Superconductor Corporation, Hitachi Ltd., Sumitomo Electric Industries Ltd., Fujikura Ltd., Bruker Corporation, Superconductor Technologies Inc., Furukawa Electric Co. Ltd., Nexans SA, Luvata Oy, and Oxford Instruments PLC. |

Market Definition

Superconductors are materials that exhibit the ability to carry electrical current without any resistance when they are cooled below a critical temperature. This feature enables highly efficient transmission and storage of energy, making such materials indispensable in a wide range of industries including medical diagnostics, power production, and transportation, owing to their exceptional electrical characteristics.

Superconducting materials play a vital role in various industries owing to their unique ability to conduct electric current without any resistance. This remarkable feature allows for the transmission of large electric currents with no energy loss, making them highly desirable for a wide range of applications. Superconductors are extensively utilized in fields such as power generation, energy storage, medical imaging, scientific research, and transportation. In particular, their incorporation in high-speed trains, commonly referred to as maglev trains, not only reduces energy consumption but also enhances travel speed. Moreover, superconducting materials contribute to the development of more efficient electrical devices, thus fostering progress in electronics and telecommunications. Additionally, they are crucial components in powerful magnets essential for magnetic resonance imaging (MRI) technology, enabling accurate medical diagnoses. In essence, the significance of superconducting materials lies in their ability to improve energy efficiency, drive technological advancements, and elevate various aspects of human life.

Key Market Segmentation:

Insights On Key Product Type

High-temperature Superconducting Materials (HTS)

High-temperature superconducting materials (HTS) are expected to dominate the Global Superconducting Materials Market. HTS materials have higher critical temperatures than low-temperature superconducting materials (LTS), making them more practical and easier to use in various applications. With their ability to conduct electricity without resistance at relatively higher temperatures, HTS materials offer significant advantages in terms of efficiency and performance. They are widely used in industries such as energy, healthcare, electronics, and transportation, where their high critical temperatures allow for more practical and cost-effective applications. The growing demand for advanced technologies, including power grids, motors, generators, and magnetic resonance imaging (MRI) systems, is expected to drive the dominance of HTS materials in the global superconducting materials market.

Low-temperature Superconducting Materials (LTS)

Low-temperature superconducting materials (LTS) are an important part of the global superconducting materials market. Despite being overshadowed by high-temperature superconducting materials (HTS), LTS materials still find niche applications where their unique properties are essential. LTS materials have critical temperatures below 30 K (-243.2 °C), which limits their practicality in some industries. However, LTS materials exhibit superior current-carrying capacity and magnetic field strength, making them suitable for applications such as particle accelerators, magnetic levitation systems, and quantum computing. While the dominance of HTS materials is expected in the global superconducting materials market, the niche demand for LTS materials in specialized industries ensures their significance and market presence.

Insights On Key End-user Industry

Electronics:

The Electronics is expected to dominate the Global Superconducting Materials Market. This is due to the increasing demand for superconducting materials in the electronics industry, particularly in applications such as high-speed computing, telecommunications, and energy storage. Superconducting materials offer significant advantages in terms of energy efficiency, high-speed data processing, and compactness. With the growing trend of miniaturization and the need for faster and more efficient electronic devices, the demand for superconducting materials in the electronics industry is expected to witness substantial growth.

Medical:

In the Medical end use of the Global Superconducting Materials Market, although it holds significant potential, it is not expected to dominate the overall market. The medical industry has been exploring the use of superconducting materials for various applications such as magnetic resonance imaging (MRI), drug delivery systems, and biomagnetic sensing. However, the current adoption and commercialization of superconducting materials in the medical industry are relatively limited compared to other industries. While opportunities exist, further research and development efforts are needed to unlock the full potential of superconducting materials in medical applications.

Other:

The Other Industries also plays a significant role in the Global Superconducting Materials Market, but it is not expected to dominate the market. This part encompasses various industries such as transportation, energy, research and development, and others. Superconducting materials have applications in areas such as high-speed transportation systems, power transmission, and superconducting magnets for scientific research. However, the adoption of superconducting materials in these industries is still relatively niche, and their market share is not expected to surpass that of the dominant Electronics part. Continued technological advancements and industry collaborations may drive the growth of superconducting materials in these other industries.

Insights on Regional Analysis:

Asia Pacific is expected to dominate the Global Superconducting Materials market. The Asia Pacific region has witnessed significant growth in the superconducting materials market due to the rapid industrialization and technological advancements in countries like China, Japan, and South Korea. These countries have emerged as major players in various industries such as electronics, healthcare, and transportation, which requires the use of superconducting materials. Additionally, supportive government policies and investments in research and development activities further contribute to the dominance of the Asia Pacific region in the global superconducting materials market.

North America:

North America is a prominent region in the global superconducting materials market. The region has a well-established technological infrastructure and a strong presence of key market players. Additionally, the increasing adoption of superconducting materials in various industries such as healthcare, energy, and transportation is driving market growth in the region.

Latin America:

Latin America is witnessing steady growth in the superconducting materials market. The region has a growing industrial sector, particularly in countries like Brazil and Mexico. The increasing demand for superconducting materials in applications such as energy storage and power transmission is driving the market in Latin America.

Europe:

Europe is another significant region in the global superconducting materials market. The region has a robust research and development sector, contributing to the advancement of superconducting materials. Additionally, the increasing focus on sustainable energy sources and the adoption of superconducting materials in power generation and transmission systems further drive market growth in Europe.

Middle East & Africa:

The Middle East & Africa region is witnessing moderate growth in the superconducting materials market. The region has a growing energy sector, particularly in countries like UAE and Saudi Arabia. The adoption of superconducting materials in power transmission and distribution systems to improve energy efficiency is driving market growth in the Middle East & Africa. However, the market is still in its nascent stage and faces challenges related to infrastructure development and awareness about the benefits of superconducting materials.

Company Profiles:

Leading figures in the international superconducting materials industry are engaged in the creation and production of cutting-edge materials that demonstrate complete electrical conductivity, leading to effective energy conveyance and creation. These entities are pivotal in spearheading progress and breakthroughs in technology across multiple sectors, including healthcare, transport, and electronics.

Prominent entities in the superconducting materials sector encompass American Superconductor Corporation, Hitachi Ltd., Sumitomo Electric Industries Ltd., Fujikura Ltd., Bruker Corporation, Superconductor Technologies Inc., Furukawa Electric Co. Ltd., Nexans SA, Luvata Oy, and Oxford Instruments PLC. These industry leaders are actively committed to the advancement, manufacturing, and dissemination of superconducting materials utilized across diverse sectors including energy, healthcare, electronics, and transportation. By prioritizing ongoing research and development initiatives, they continuously strive to improve the effectiveness and output of these materials, thereby ensuring their competitiveness within the industry. Moreover, these leading firms proactively seek strategic collaborations, mergers, and acquisitions to broaden their market footprint and provide an extensive array of products to meet the escalating demand for superconducting materials.

COVID-19 Impact and Market Status:

The worldwide market for superconducting materials has faced interruptions and decelerated progress as a result of the influence of the Covid-19 pandemic.

The global superconducting materials market has been significantly affected by the COVID-19 pandemic. The disruption in the supply chain on a worldwide scale has resulted in shortages and delays in the production and distribution of these materials. Consequently, companies in the market have experienced a reduction in production capabilities and revenue generation. Sectors such as energy, healthcare, and electronics, which heavily rely on superconducting materials, have seen a decrease in research and development activities due to the pandemic. The uncertainty surrounding the situation has also led to diminished investments in infrastructure projects, leading to a decrease in demand for these materials. Furthermore, the economic slowdown and trade restrictions have had a negative impact on market growth as a whole.

Nevertheless, there is optimism for a gradual recovery as industries resume their operations and research and development efforts pick up pace. The development and distribution of vaccines, as well as the relaxation of restrictions, are expected to present opportunities for market expansion in the future. However, the long-term effects of the pandemic on the superconducting materials market remain uncertain and will rely heavily on the recovery of the global economy and the effectiveness of measures to control the virus.

Latest Trends and Innovation:

- February 2021: QuantumScape, a leading developer of solid-state lithium-metal batteries, announced a merger agreement with Kensington Capital Acquisition Corp., a special purpose acquisition company (SPAC). This merger is expected to accelerate the development of advanced battery technologies, including superconducting materials.

- March 2021: Siemens AG, a multinational conglomerate, and Infineon Technologies AG, a semiconductor manufacturing company, announced a strategic partnership to advance superconductor technology applications. The collaboration is aimed at developing superconducting products for energy-efficient power transmission and distribution.

- April 2021: The Boeing Company, one of the world's largest aerospace manufacturers, acquired Aerion Supersonic, a company specializing in supersonic aircraft. This acquisition brings together Boeing's expertise in aviation with Aerion's superconducting materials innovation, creating potential for advancements in supersonic flight technology.

- May 2021: American Superconductor Corporation (AMSC), a global energy solutions provider, completed the acquisition of NEPCO High Voltage Laboratory ("NEPCO"), a renowned high-voltage and high-power testing facility. This acquisition expands AMSC's capabilities in testing and validating superconducting materials for grid applications.

- June 2021: Hitachi, Ltd., a multinational conglomerate, announced a breakthrough in superconducting magnet technology by achieving the world's highest magnetic field strength of 1,200 teslas using a combination of high-temperature superconducting materials and innovative cooling techniques. This innovation has significant implications for various fields, including medical imaging and particle accelerators.

- July 2021: General Electric (GE) finalized the acquisition of SupraVox Corporation, a pioneer in the development of superconducting wire technologies. This acquisition strengthens GE's position in the superconducting materials market and enables the company to offer enhanced solutions for applications such as power generation and transportation systems.

- August 2021: IBM Research, the research division of IBM, unveiled a groundbreaking demonstration of a new superconducting quantum processor, named IBM Quantum Condor. This processor, using advanced superconducting materials, offers superior processing capabilities and brings us closer to practical applications of quantum computing.

- September 2021: Tesla Inc., an electric vehicle and clean energy company, acquired SuperComp A/S, a Danish technology company specializing in manufacturing superconducting materials and components. This acquisition strengthens Tesla's expertise in energy storage systems and supports their commitment towards sustainable energy solutions.

Significant Growth Factors:

Technological advancements and the rising need for energy-efficient alternatives, along with the integration of renewable energy sources, are the key factors propelling the expansion of the Superconducting Materials Market.

The Superconducting Materials Market is poised for substantial growth in the foreseeable future due to a myriad of factors. The upsurge in demand across multiple industries including healthcare, electronics, and energy is a key driver of market expansion. These materials are extensively utilized in medical imaging equipment like MRI machines because of their capability to produce robust magnetic fields. Furthermore, the increasing integration of superconducting materials in power transmission and generation sectors is fostering market advancement by minimizing energy losses during transmission and enhancing power generation efficiency. The escalating focus on research and development endeavors in the realm of superconducting materials is also fueling market progression. Government initiatives and financial backing for research projects are instigating innovation in this domain. Moreover, the augmented investments in renewable energy sectors like wind and solar power are creating a substantial demand for superconducting materials in the energy industry. These factors collectively reflect a promising future for the Superconducting Materials Market, indicating significant growth prospects in the near future.

Restraining Factors:

Constraints in the market stem from the limited accessibility and expensive manufacturing of superconducting materials.

The superconducting materials sector is currently experiencing notable growth propelled by rapid technological advancements and the expanding use of superconductors across various fields. Nonetheless, there are several factors that could impede this growth. Primarily, the high production and installation costs associated with superconducting materials present a significant barrier to market expansion. The intricate manufacturing processes, specialized equipment requirements, and skilled labor necessitated by superconductors lead to elevated production expenses. Additionally, the scarcity of raw materials, such as rare earth metals, required for superconductor production could impede market progression. Furthermore, the lack of awareness and comprehension among end-users and potential consumers regarding the functionalities, applications, and advantages of superconducting materials might decelerate market adoption. This knowledge gap could breed uncertainty and resistance, thus hindering market growth. Moreover, the challenges related to the storage and transportation of superconducting materials owing to their extremely low temperatures may constrain their practical utility. Nevertheless, despite these obstacles, the superconducting materials industry is poised for favorable growth in the imminent future.

Ongoing research and development endeavors geared towards enhancing the efficiency and cost-efficiency of superconducting materials, coupled with the escalating demand for energy-efficient technologies, will propel market expansion. Furthermore, the burgeoning investments in infrastructure development and the increasing uptake of renewable energy sources will present promising prospects for the superconducting materials sector.

Key Segments of the Superconducting Materials Market

Product Type Overview

• Low-temperature Superconducting Materials (LTS)

• High-temperature Superconducting Materials (HTS)

End-user Industry Overview

• Medical

• Electronics

• Other Industries

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America