The global succinic acid market size was valued at USD 138 million in 2017. This increase is strongly driven by the increase in the number of new applications in the pharmaceutical and food industries. Strong demand from Asia Pacific is also expected to fuel the growth of the global succinic acid market owing to strong growth prospects of various end-use industries in the region.

Key players have been adopting various growth strategies such as partnership, agreement, and expansion, to enhance their current position in the global succinic acid market. For instance, in August 2015, BioAmber Inc. announced the opening of its jointly built BioAmber Sarnia plant with Mitsui & Co., Ltd. The new plant uses innovative biotechnology and produces bio-based succinic acid from glucose from agricultural suppliers in southern Ontario. The BioAmber Sarnia plant is the largest succinic acid production facility in the world and is competitive globally while increasing the sustainability of chemicals.

The market for succinic acid is expected to grow from its estimated USD 160.7 million in 2022 to USD 301.3 million in 2032, with a compound annual growth rate (CAGR) of 6.5% from 2023 to 2032.

.jpg)

Succinic acid is an intermediate chemical that demonstrates strong demand. It is a building block used for the manufacture of a wide range of specialty and commodity chemicals, such as foods, polymers, metals, pharmaceuticals, cosmetics, fibers, lubricating oils, solvents, coatings, and diesel fuel oxygenates among others. This chemical is produced by mixed-acid carbohydrate fermentation in a process that also produces other valuable chemicals such as acetic acid, formic acid, lactic acid, and alcohol. Succinic acid can be produced by conventional (crude oil-based) method and by biological route.

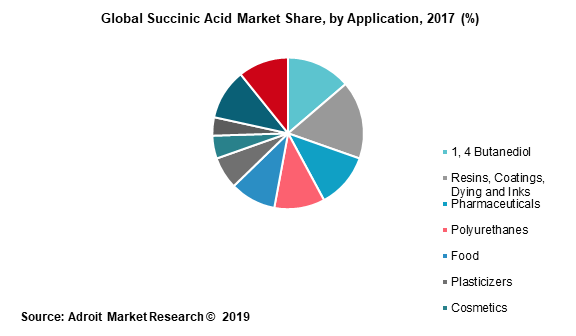

The global succinic acid market analysis shows that polyurethanes held a market share of more than 10%, both by revenue and volume, in 2017 in the and is projected to be the second fastest growing segment during the forecast period. Growing residential and commercial construction spending in emerging countries is likely to be the key driving factor behind the growth of the segment.

Polyurethanes are used in artificial leather, alkyd resins, and thermoplastics as a coating material to maintain the performance and quality of the coated materials under extreme weather conditions and UV radiation, to provide weathering resistivity, abrasion resistance, and chemicals. The cost-effective solutions with long-term durability are driving the demand for succinic acid in the polyurethane application segment. The growth of polyurethane is driven by significant demand for polyurethane foams from emerging economies like China, India, Thailand, Malaysia, and Indonesia. Additionally, factors such as increasing construction activities, electronics, automotive and aerospace sector are boosting the global polyurethane market demand across the globe.

Furthermore, food application is also expected to offer growth opportunities during the forecast period. Succinic acid is used in the food industry as a flavoring agent to regulate acidity. Succinic acid is also used to improve shelf life. Its preserving properties include the inhibition of the growth of many bacteria, mold and yeast strains. The global succinic acid market demand for food stood at 19.7 kilo tons in 2017.

Asia Pacific is projected to contribute to approximately 32% of the revenues generated in the global succinic acid market by 2025 and is projected to grow at a CAGR of 8.2% during the forecast year. The growth of food & beverage, pharmaceutical, and coating industries in China, India, and Southeast Asian countries have played an important role in augmenting the succinic acid market demand in the region. These industries are growing due to increasing per capita spending and rapid urbanization. Improving construction and infrastructure industry in emerging economies are likely to propel demand for resins, coatings, and polyurethanes, which in turn is expected to drive market growth. The region is expected to witness a high demand for succinic acid on account of the relaxed regulatory environment in countries including India and China.

The growing demand from the automotive, personal care and pharmaceutical industries coupled with environment protecting regulations offers the bio-based succinic acid market a great opportunity to continue its rapid growth. In addition, the product is an intermediate and biodegradable product and has therefore been widely accepted by industry for various purposes, including paints, food packaging, and polymer resins.

The global succinic acid market analysis covers the players having a regional and global presence. Companies including BioAmber, GC Innovation America, Reverdia, Kawasaki Kasei Chemicals, Anqing Hexing Chemical, Nippon Shokubai Co., Ltd., Mitsubishi Chemical Corporation, SHOWA DENKO K.K., and Anhui Sunsing Chemicals Co. Ltd among others have a broader presence within the global succinic acid market.

Succinic Acid Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 301.3 million |

| Growth Rate | CAGR of 6.5 % during 2023-2032 |

| Segment Covered | Type, Application, End-use Industry, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BioAmber (Canada), GC Innovation America (US), Succinity GmbH (Germany), Reverdia (Netherlands), Nippon Shokubai (Japan) |

Key segments of the global succinic acid market

Application Overview

- 1, 4 Butanediol

- Resins, Coatings, Dying and Inks

- Pharmaceuticals

- Polyurethanes

- Food

- Plasticizers

- Cosmetics

- Solvent and Lubricants

- De-Icing Solutions

- Others

Regional Overview

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- Rest of APAC

- Latin America

- Brazil

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- Rest of MEA

Key Players analysed in the report include

- BioAmber

- GC Innovation America

- Reverdia

- Kawasaki Kasei Chemicals

- Anqing Hexing Chemical

- Others