The addition of specialty feed additives such as sweeteners & flavors helps to enhance the deliciousness of the feed. This improves the taste and place of specialty food additives on the market. This enhanced flavor. Furthermore, the increasing intake of animal products as well as the advent of diseases such as bird flu, swine flu, mouth and foot infections of animals raise worries about safety and risk, and push the market for specialized feed additives.

The Specialty Feed Additives market is expected to grow at a CAGR of 5.5% to reach US$ 550 Mn in 2031.

.jpg

)

The specialty feed additive will also be favorably impacted by the encapsulation of feed acidifiers, animal husbandry advancement, harmful environmental consequences related to horticulture gases released by the crop, increasing livestock epidemics, increased egg intake, milk products, meat and agricultural goods. Increase in the demand for natural feed additives may create ample opportunities for future growth of the specialty feed additives market.

Specialty Feed Additives Market size is gaining huge importance as a nutrition content and hygiene and digestibility enhancer to augment the nutritional value of the animal feed that improves their intestinal health.

Specialty Feed Additives Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | US$ 550 Mn |

| Growth Rate | CAGR of 5.5% during 2021-2031 |

| Segment Covered | Feedstock, Form, Functionallity, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Koninklijke DSM N.V., DuPont de Nemours Inc., BASF SE, Evonik Industries, Novozymes A/S, Nutreco N.V., Novus International, Akzo Nobel Surface Chemistry AB, Kemin Industries Inc., Brookside Agra |

Key Segment Of The Specialty Feed Additives Market

Feedstock,(USD Million)

• Specialty Feed Binders

• Specialty Feed Acidifiers

• Specialty Feed Minerals

• Specialty Feed Antioxidants

• Specialty Feed Flavors & Sweeteners

• Specialty Feed Vitamins

• Other Specialty Feed Additives

Form,(USD Million)

• Dry Specialty Feed Additives

• Liquid Specialty Feed Additives

Functionality,(USD Million

• Specialty Feed Additives for Palatability Enhancement

• Specialty Feed Additives for Mycotoxin Management

• Specialty Feed Additives for Preservation of Functional Ingredients

• Specialty Feed Additives for Other Functionalities

Regional Overview,(USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The global specialty feed additives market is expected to grow at with a CAGR greater than5.43 % during the forecast period. Small-scale farmers are not aware of the advantages of the commodity, the operational and material costs and regulatory framework complexity may impede the market growth of specialty feed additives.

For farm animals, specialty feed additives, typically used as a food substitute. Their primary goal is to compensate for the absence of nutrients from their everyday diet and do not yield farm animals so that immunity and health levels are enhanced. Any of the most common feed additives in specialties are vitamins and minerals, fatty acids, and amino acids. One of the key differences between common feed additives and feed additives in specialized feeds is that they not only satisfy dietary requirements, but are often hygienic and readily absorbed.

Type Segment

The specialty feed additives markets on the basis of type has been divided as flavors & sweeteners, minerals, binders, vitamins, acidifiers, antioxidants. Acidifiers are expected to expand at a rapid pace over the projected period. The sweeteners and flavours group constituted a large part of the share of minerals in 2018. The current high rate of infliction of disease among common farm animals is the main factor attributed to the booming development of the world market for specialized feed additives.

With business income linked directly to the welfare of animals, ensuring that they do not become the victims of pathogens, dangerous bacteria or parasites becomes highly important for the persons and companies who control those animals Of these, it was found that the demand for specialty feed additives for poultry animals is the leading livestock segment on the global market. Acidifiers should secure the top spot in the specialty feed additive forms group.

Function Segment

In terms of livestock, the demand for specialized feed additives is categorized as marine, swine, ruminant and poultry products. The poultry segment is expected to rise at a prominent pace during the forecast timeframe due to the increasing market demand for eggs and other protein-rich poultry products. In the forecast timeframe the divisions of ruminants and swine will follow along. — Food safety issues and the trade in poultry between nations are factors that are likely to expand the global demand for specialized feed additives over the anticipated period of time.

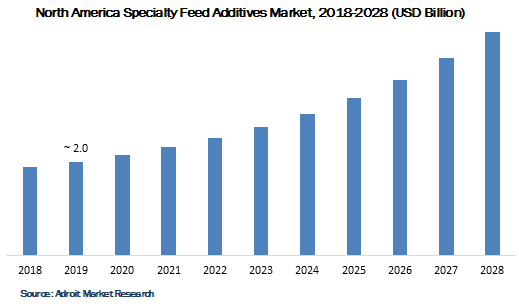

The global specialty feed additives market has been segmented, based on region, into Asia-Pacific, Europe, North America, Latin America, and the Middle East & Africa.

The Asia Pacific region is projected to be the fastest growing market for specialty feed additives followed by the North American and Europe regions. Factors such as increases in urbanization, increased disposable income and demographic growth in the respective countries drive the demand for specialty feed additives. As consumer purchasing power rises in countries such as Japan, India and China, the market for specialty feed additives is expected to rise at a higher pace.

Indian, China, and Japan's specialty feed additives markets are expected to boom in terms of demand growth in the coming years, thanks to these countries' growing buying power. Their economic growth is therefore projected to play a pivotal role in the global market for specialty feed additives for the forecast period provided by the study. The leading players in the global specialty feed additives market currently include BASF SE, Novus International, Evonik Industries, DSM, Akzo Nobel Surface Chemistry AB, Nutreco N.V., Novozymes A/S, Kemin Industries Inc., Brookside Agra, Invivo NSA, Biomin Holding GmbH, and Chr. Hansen Holdings A/S.