Software Defined Vehicles Market Analysis and Insights:

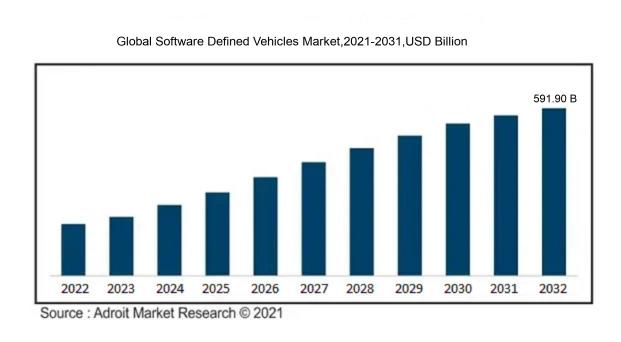

In 2023, the size of the worldwide Software Defined Vehicles market was US$ 265.7 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2032, reaching US$ 591.90 billion.

The market for Software Defined Vehicles (SDVs) is significantly influenced by various pivotal elements, notably the rising need for advanced driver-assistance systems (ADAS) and the development of autonomous vehicle technologies. Automotive manufacturers are increasingly focused on improving safety and operational efficiency, with software solutions that facilitate real-time data analysis and vehicle-to-everything (V2X) interactions. Moreover, the transition towards electric vehicles (EVs) demands the implementation of advanced software systems for effective battery management and energy efficiency optimization. The growing importance of over-the-air (OTA) updates for both vehicle upkeep and feature improvements also plays a critical role in the advancement of the SDV sector. In addition, consumer desires for tailored in-car experiences and uninterrupted connectivity with personal devices compel manufacturers to embrace software-centric frameworks. The escalating investments in research and development from established automotive companies and technology firms further stimulate innovation, fostering a competitive environment that propels the evolution of the Software Defined Vehicles market.

Software Defined Vehicles Market Definition

Software Defined Vehicles (SDVs) are automobiles that rely on software to govern essential functions, which enhances their adaptability, capabilities, and the ability to implement updates. This advanced technology facilitates immediate adjustments and enhancements to vehicle performance and features via over-the-air software updates.

Software-Defined Vehicles (SDVs) play a crucial role in transforming the automotive landscape by merging sophisticated software functionalities with conventional vehicle operations, thereby boosting performance, safety, and overall user satisfaction. These vehicles support over-the-air updates, enabling manufacturers to enhance vehicle capabilities after purchase, which lessens the necessity for physical recall processes. Additionally, SDVs allow for the introduction of cutting-edge innovations such as self-driving technologies, adaptive systems, and customized user experiences. Furthermore, they can improve energy management and vehicle health monitoring, aligning with sustainability objectives. As the industry increasingly embraces electric and connected technologies, SDVs empower manufacturers to swiftly respond to changing consumer preferences and advancements in technology.

Software Defined Vehicles Market Segmental Analysis:

Insights On Offering

Software

The Global Software Defined Vehicles Market is expected to see Software as the leading component. This is attributed to the increasing demand for advanced technologies such as autonomous driving systems, vehicle connectivity, and enhanced infotainment systems. Software solutions enable vehicle manufacturers to implement real-time updates and manage complex algorithms essential for the operation of various automated functions. The software also plays a critical role in the integration of artificial intelligence and machine learning technologies, which are becoming crucial in enhancing driver safety and improving user experience. As automakers look to innovate and differentiate their vehicles from competitors, the reliance on sophisticated software solutions will intensify, positioning this area as the dominating force in the market.

Hardware

The Hardware component of the Software Defined Vehicles Market is essential but is not expected to lead. Nevertheless, it includes vital elements such as sensors, control units, and communication devices that provide the necessary infrastructure for effective vehicle operation. As software technologies advance, the demand for advanced hardware that can support these innovations will rise. This is particularly evident in the growing reliance on high-performance computing systems and infotainment hardware that require regular updates to meet evolving software standards and consumer expectations.

Services

The Services aspect within the Software Defined Vehicles Market offers opportunities for growth but is likely to remain in a supporting role compared to Software. This includes maintenance, consultation, and integration services that are essential in ensuring the effective deployment and functionality of software and hardware components. As the market evolves, the need for professional services to assist with software updates, cybersecurity measures, and compliance with regulations will become increasingly important. However, the growth potential of this category is heavily reliant on advancements in software and hardware offerings, limiting its ability to emerge as a dominant force.

Insights On Vehicle Type

BEV

Battery Electric Vehicles (BEVs) are projected to lead the Global Software Defined Vehicles Market. This dominance is attributed to the increasing global emphasis on sustainability and the transition to electric mobility. As governments implement stricter emission regulations and consumers become more environmentally conscious, the demand for BEVs is surging. Additionally, the advancement in software technology, coupled with BEVs being inherently more compatible with software-defined features, accelerates their adoption. Automakers are investing heavily in enhancing the digital experience of vehicles, and BEVs are at the forefront of this transformation, making them the optimal choice for software integration.

ICE

Internal Combustion Engine (ICE) vehicles, although facing challenges from electrification, continue to hold a significant share of the automotive market. The vast infrastructure supporting ICE vehicles, along with the familiarity among consumers, provides a buffer against their decline. Furthermore, OEMs are increasingly incorporating software-driven solutions to enhance performance and efficiency in ICE vehicles, which keeps them relevant in the current market landscape. However, the gradual shift towards electrification poses a long-term threat to their dominance, as future investments are likely to pivot towards more sustainable options.

HEV

Hybrid Electric Vehicles (HEVs) serve as a bridge between traditional ICE vehicles and fully electric options. They appeal to consumers seeking better fuel efficiency without completely shifting to electric power. HEVs utilize advanced software systems to manage and optimize the synergy between gasoline engines and electric motors. As manufacturers continue to innovate in hybrid technologies, particularly in terms of connected features, HEVs remain an important choice for those hesitant to transition to fully electric vehicles. Their role in reducing emissions and improving fuel economy makes them relevant in the broader automotive narrative.

PHEV

Plug-In Hybrid Electric Vehicles (PHEVs) provide a compelling alternative by offering both electric and gasoline capabilities. While they are gaining popularity among eco-conscious consumers, their market share is still transitional compared to BEVs. PHEVs rely heavily on technology and software to manage the dual powertrains effectively, which enhances vehicle performance and efficiency. However, the complexity and maintenance associated with two power systems can be a deterrent for some consumers. As infrastructure for electric charging expands, PHEVs may find their niche, yet they trail behind BEVs in terms of projected long-term dominance in software-defined driving experiences.

Insights On Level Autonomy

Level 3

Level 3 autonomy is expected to dominate the Global Software Defined Vehicles Market due to its balance between human control and automated capabilities. This level allows for conditional automation, where the vehicle can handle most driving tasks without human intervention but requires a human driver to take over when requested. As vehicle manufacturers increasingly integrate advanced driver-assistance systems (ADAS), Level 3 offerings are being positioned as a feasible and desirable option for consumers looking for safety and convenience. The ongoing investment in artificial intelligence and machine learning technologies strengthens Level 3’s predominance, making it a practical choice as the industry moves toward fully autonomous solutions.

Level 0

Level 0, which represents no automation, primarily relies on human drivers for all tasks. While it will always exist in the market, particularly for older vehicles, its share is declining with consumer demand shifting towards automated features. The continuous advancements in technology lead to a decreased interest in vehicles at this level, making it less significant in the Global Software Defined Vehicles Market over time.

Level 1

Level 1 autonomy allows for some driver assistance features but still requires significant driver engagement. Functions such as adaptive cruise control and lane-keeping assist may attract consumers, but they often fall short of offering the full automation capabilities that modern drivers seek. This limitation puts Level 1 at a disadvantage compared to higher autonomy levels, leading to a modest presence in the market.

Level 2

Level 2 autonomy introduces more sophisticated driver-assistance technologies that handle steering and acceleration simultaneously. However, it still necessitates that the driver remain engaged and ready to take control at any moment. The growing prevalence of semi-automated driving systems contributes to a stable market presence for Level 2, but the preference for more advanced solutions will likely restrict its long-term growth prospects in the Global Software Defined Vehicles Market.

Level 4

Level 4 autonomy allows for full automation in certain scenarios, where the vehicle can operate independently without human intervention. While it offers attractive benefits, its reliance on specific conditions or areas limits its versatility and mass-market adoption. Consequently, while Level 4 presents technological advancement, factors like regulatory challenges and high infrastructure costs hinder its dominance in the Global Software Defined Vehicles Market compared to Level 3 capabilities.

Level 5

Level 5 autonomy represents full automation, where the vehicle requires no human involvement in any conditions. Although it has the potential to revolutionize transportation, technological limitations and the complexity of implementing a fully autonomous system currently restrict its market viability. Due to these practical constraints, Level 5 remains more of a long-term vision than an immediate contributor in the Global Software Defined Vehicles Market, leaving it overshadowed by more achievable levels like Level 3.

Insights On Application

ADAS/HAD

ADAS (Advanced Driver Assistance Systems) and HAD (Highly Automated Driving) are projected to dominate the Global Software Defined Vehicles market due to the increasing emphasis on safety and automation in the automotive industry. Consumers and manufacturers are prioritizing technological advancements that enhance safety features, reduce accidents, and improve the driving experience. With regulatory pressure and a growing demand for autonomous vehicles, investments in ADAS and HAD technologies are surging. This not only integrates software but also supports real-time data processing and machine learning, which are crucial for the evolution of autonomous driving. As a result, the market share for ADAS/HAD applications is expected to outpace others.

Powertrain and Chassis

The Powertrain and Chassis application area plays a critical role in vehicle performance and efficiency. Innovations in this category are focused on optimizing fuel consumption and emissions through software enhancements. The integration of power electronic functions allows for greater control over vehicle dynamics, leading to improved acceleration and handling abilities. Additionally, the shift towards electrification in vehicles, including hybrid and electric models, drives investments in this area. However, while significant, the growth in Powertrain and Chassis tends to be more incremental compared to the rapid advancements seen in ADAS/HAD technologies.

Body and Energy

The Body and Energy application focuses on the integration of software solutions that enhance vehicle comfort, aesthetics, and energy management. This includes climate control systems and intelligent body control electronics that optimize energy usage. Given the rise in consumer demand for in-car convenience features, investments in this area are growing. However, this does not stimulate the same level of urgency as safety and automation technologies, which are at the forefront of automaker priorities. Therefore, while Body and Energy is crucial for overall vehicle appeal, it is not expected to lead in market growth.

Infotainment

Infotainment systems have become central to enhancing the user experience within vehicles. These systems incorporate multimedia entertainment, navigation, and connectivity features, allowing for seamless interaction with smartphones and the internet. The rapid advancement in consumer electronics directly influences this sector, attracting tech-savvy consumers. Despite its importance, the market for infotainment applications is often viewed as supplementary when compared to safety-focused applications like ADAS/HAD. Consequently, while Infotainment is vital for brand differentiation, it does not dominate market share growth.

Connectivity and Security

Connectivity and Security are crucial for modern vehicles as they facilitate communication between vehicles and infrastructure, thereby enhancing user experience and safety. The integration of 5G and IoT technologies supports real-time data exchange, allowing for advanced navigation, traffic management, and vehicle updates. Security, on the other hand, focuses on protecting vehicles from cyber threats, which is becoming increasingly significant in today's networked environment. However, while the demand for connectivity is rising, it is often secondary to the critical safety applications like ADAS/HAD that are driving the highest growth in the software-defined vehicle market.

Global Software Defined Vehicles Market Regional Insights:

North America

North America is set to dominate the Global Software Defined Vehicles (SDV) market, primarily driven by the presence of automotive manufacturers, advanced technological infrastructure, and a rapidly evolving regulatory environment which supports innovative automotive solutions. The U.S. automotive industry is heavily investing in software development and autonomous driving technologies, which has substantially propelled the SDV sector forward. Strong collaborations between tech firms and automotive manufacturers, along with significant consumer demand for enhanced vehicle connectivity and autonomous capabilities, position North America as the leader in this innovative market. Additionally, government initiatives to promote electric and smart vehicles foster a favorable ecosystem for the continued growth of software-defined solutions in vehicles.

Latin America

Latin America is experiencing a gradual transformation in its automotive market, yet it currently lags behind in the software-defined vehicles arena. Despite an increasing interest in modern automotive technologies, factors such as limited infrastructure investments and varying regulatory frameworks across countries pose challenges to rapid adoption. However, there is a burgeoning desire for enhanced digital features among consumers, which can potentially drive growth in the SDV part, particularly in urban areas as they seek cost-effective and environmentally friendly vehicles.

Asia Pacific

The Asia Pacific region shows promising potential in the Global Software Defined Vehicles market, primarily due to its rapidly growing automotive sector, especially in countries like China and Japan. The increasing focus on smart mobility solutions and the burgeoning middle-class population eager for technological advancements in vehicles contribute significantly to the region's growth. In addition, local tech companies are investing heavily in research and development for various SDV technologies, indicating a competitive landscape that could enhance the region's position in the global market.

Europe

Europe holds a significant role in the software-defined vehicles market, propelled by stringent emissions regulations and a strong commitment to sustainable transportation solutions. The presence of leading automotive manufacturers that prioritize innovation, paired with governmental support for research and development in green technology, showcases the region's focus on transitioning towards electric and connected vehicles. However, competition from both North America and Asia Pacific could potentially stifle Europe’s growth rate compared to these regions.

Middle East & Africa

The Middle East & Africa remains an emerging player in the software-defined vehicles market, characterized by a focus on enhancing transportation infrastructure and connectivity. While the region has seen advancements in vehicle technology, the overall adoption of software-defined vehicles is hindered by economic and infrastructural challenges. Nevertheless, increasing investments in smart city initiatives and a growing interest in electric vehicles may contribute to the gradual expansion of the SDV market in the future, particularly in urban centers that are actively pursuing technological innovation.

Software Defined Vehicles Market Competitive Landscape:

Prominent participants in the Global Software Defined Vehicles sector are pivotal in advancing innovation through the creation of sophisticated software solutions that improve vehicle capabilities, connectivity, and overall user experience. Additionally, they play a crucial role in establishing industry standards and promoting partnerships to expedite the integration of software-centric automotive technologies.

Prominent participants in the Software Defined Vehicles sector encompass Tesla, General Motors, Ford Motor Company, BMW AG, Mercedes-Benz AG, Volkswagen AG, Honda Motor Co., Ltd., Toyota Motor Corporation, NXP Semiconductors, Qualcomm Technologies, Inc., Infineon Technologies, Continental AG, Bosch Group, ZF Friedrichshafen AG, Aptiv PLC, Luminar Technologies, Inc., Waymo LLC, and Polestar.

Global Software Defined Vehicles Market COVID-19 Impact and Market Status:

The Covid-19 pandemic acted as a catalyst for the widespread acceptance of Software Defined Vehicles (SDVs), demonstrating the imperative for improved connectivity and the capability for remote software updates within the automotive sector.

The COVID-19 pandemic had a profound impact on the market for Software Defined Vehicles (SDVs), hastening the shift toward digital solutions and remote functionalities. The imposition of lockdowns and social distancing protocols led to temporary suspensions of production and disruptions in supply chains within the automotive sector. This situation compelled manufacturers to reassess their approaches, leading to an increased emphasis on software-oriented innovations. As consumers became more conscious of health and safety considerations, there was a notable transition towards advanced driver assistance systems (ADAS) and interconnected technologies designed to enhance safety and provide a more cohesive user experience. Additionally, the crisis underscored the significance of over-the-air software updates and effective vehicle software management, demonstrating a need for improved flexibility and adaptability in vehicle architecture. Consequently, industry stakeholders are channeling more resources into research and development of SDV functionalities, projecting a ened demand for fully autonomous vehicles in the aftermath of the pandemic, thereby transforming the automotive sector into a more software-driven environment.

Latest Trends and Innovation in The Global Software Defined Vehicles Market:

- In November 2022, Mercedes-Benz announced a strategic partnership with NVIDIA to leverage AI and advanced computing for its next-generation software-defined vehicles, aiming to enhance user experience and create a centralized computing platform.

- In March 2023, General Motors expanded its collaboration with Microsoft to further integrate Azure cloud services into its software-defined vehicle architecture, focusing on improved data connectivity and in-car services.

- In June 2023, Tesla unveiled its latest software update that introduced advanced features for its vehicles, showcasing enhancements in Autopilot and full self-driving capabilities, underlining its position as a pioneer in software-defined vehicles.

- In July 2023, Stellantis announced a multi-year partnership with Foxconn to develop next-generation vehicle cockpits and other software-driven platforms, targeting greater customization and consumer engagement.

- In September 2023, Ford revealed its plans to implement a unified software platform across its entire lineup of vehicles, aiming to standardize features like over-the-air updates and enhance vehicle connectivity, emphasizing their transition towards software-defined architectures.

- In August 2023, Hyundai Motor Group invested heavily in developing its own software-defined vehicle platform, focusing on electric and autonomous vehicles, which is part of its broader strategy to push into smart mobility solutions.

- In October 2023, Volkswagen launched its new "Software as a Service" model, allowing customers to subscribe to various features and upgrades for their vehicles, heralding a shift in how vehicle software is managed and monetized.

Software Defined Vehicles Market Growth Factors:

The market for Software Defined Vehicles is largely propelled by progress in connectivity, a growing desire for improved user experiences, and an increasing focus on technologies related to autonomous driving.

The market for Software Defined Vehicles (SDV) is witnessing substantial expansion, driven by various critical factors. A primary catalyst is the rising demand for advanced driver assistance systems (ADAS) and autonomous driving innovations, which compel manufacturers to embrace software-focused strategies to enhance vehicle functionalities. Furthermore, the shift towards electrification, coupled with the necessity for cutting-edge software to optimize battery management and energy efficiency, is propelling growth in this sector.

Additionally, the increasing focus on connectivity and the Internet of Things (IoT) facilitates seamless interactions between vehicles and surrounding infrastructure, thereby improving both user experience and safety. The advancement of cloud computing and artificial intelligence is also reshaping the development of SDVs by enabling over-the-air updates and boosting vehicle performance.

Moreover, consumer desires for personalized experiences and enhanced entertainment systems drive automakers to incorporate more advanced software capabilities. Regulatory mandates aimed at promoting vehicle safety and environmental sustainability significantly contribute to the accelerated adoption of SDVs as well. In conclusion, the interplay of technological advancements, shifting consumer demands, and regulatory influences is steering the dynamic growth of the software defined vehicles market.

Software Defined Vehicles Market Restaining Factors:

The Software Defined Vehicles market faces several significant obstacles, including regulatory hurdles, issues related to data privacy, and the substantial expenses associated with technology integration.

The Software-Defined Vehicle (SDV) sector encounters various challenges that may hinder its expansion. A primary obstacle is the intricate process of merging diverse software systems, which is essential for ensuring effective interaction between the vehicle's hardware and its software components. Shifting from conventional vehicles to SDVs necessitates considerable investments in supportive infrastructure, which may discourage smaller manufacturers from entering the market. Additionally, the proliferation of connectivity raises serious cybersecurity concerns, increasing the risk of hacking and data breaches. Regulatory challenges and the absence of uniform standards for software development can further impede innovation and delay market entry. Furthermore, consumer doubts regarding the reliability and safety of these advanced technologies add another layer of complexity to their adoption. The existing skills deficit in the workforce, vital for the creation and upkeep of SDVs, may also serve as a significant barrier, given that the industry demands specialized knowledge that is still being cultivated. Nonetheless, the market presents vast opportunities, spurred by progress in artificial intelligence, machine learning, and a growing consumer appetite for improved safety and connectivity functionalities. With continuous investments and cooperative initiatives in research and development, the Software-Defined Vehicle market is set for remarkable growth, leading to a more intelligent and efficient automotive environment.

Segments of the Software Defined Vehicles Market

By Offering:

- Hardware

- Software

- Services

By Vehicle Type:

- ICE

- BEV

- HEV

- PHEV

By Level of Autonomy:

- Level 0

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Application:

- Powertrain and Chassis

- ADAS/HAD

- Body and Energy

- Infotainment

- Connectivity and Security

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America