Software Defined Storage Market Analysis and Insights:

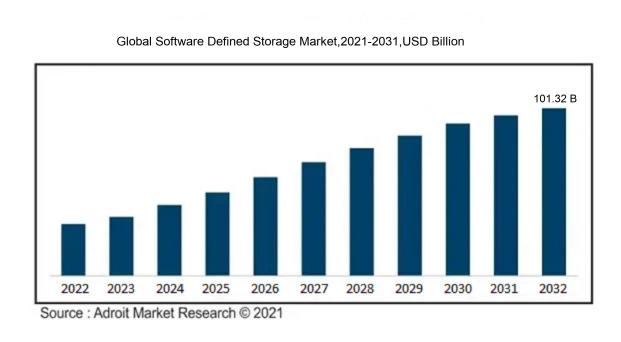

In 2023, the size of the worldwide Software Defined Storage market was US$ 14.25 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 24.38% from 2024 to 2032, reaching US$ 101.32 billion.

The Software Defined Storage (SDS) market is propelled by a variety of critical factors, chiefly the rising need for storage options that are both scalable and adaptable, allowing for the efficient handling of large volumes of data produced by contemporary enterprises. The swift expansion of cloud services and virtualization techniques has significantly accelerated the uptake of SDS, as businesses aim to streamline their storage resources and improve data accessibility. Moreover, the surge in Big Data analytics necessitates resilient storage systems that can manage a range of workloads while supporting real-time data processing capabilities. Cost-effectiveness serves as another major impetus, as SDS frequently diminishes reliance on specialized hardware, enabling companies to leverage standard commodity hardware for their storage needs. Additionally, the increasing prevalence of hybrid and multi-cloud environments urges organizations to invest in flexible storage solutions capable of seamless cross-platform integration. Lastly, improved data management functionalities, such as automated provisioning and management driven by policies, are also fueling the growing interest in Software Defined Storage solutions.

Software Defined Storage Market Definition

Software Defined Storage (SDS) is a storage framework that separates storage management software from the underlying hardware. This separation enables a more adaptable and scalable method for overseeing storage assets, utilizing software-driven controls. By employing standard hardware and allowing for the dynamic distribution of storage resources as demands fluctuate, this architecture significantly improves operational efficiency.

Software Defined Storage (SDS) plays a crucial role in improving both flexibility and scalability within data management frameworks. By separating storage from physical hardware, SDS enables organizations to allocate resources more effectively across multiple platforms, enhancing both performance and cost efficiency. This level of adaptability promotes seamless cloud service integration, which is essential for data accessibility and robust disaster recovery plans. Additionally, SDS facilitates automation processes that enhance operational efficiency and minimize the need for manual tasks. As companies depend more on data-informed decision-making, embracing SDS empowers them to quickly respond to shifting demands while optimizing storage usage, ultimately driving innovation and competitive edge in an ever-evolving technological environment.

Software Defined Storage Market Segmental Analysis:

Insights On Key By Component

Solution

The component expected to dominate the Global Software Defined Storage Market is the "Solution". This is primarily due to the increasing demand for scalable and flexible storage solutions that can adapt to fluctuating data requirements in various industries. Solutions that provide better performance, enhanced data management, and advanced features such as automation and analytics are favored by enterprises looking to optimize their storage infrastructure. Additionally, as organizations embrace digital transformation and cloud strategies, the requirement for comprehensive software-defined storage solutions is on the rise. This trend is further supported by the growing need to handle large volumes of unstructured data efficiently and cost-effectively.

Services

The "Services" aspect of the Software Defined Storage Market is essential but not expected to lead in terms of market share. Services include support, consulting, and system integration, which play a significant role in the deployment and ongoing management of software-defined storage solutions. They provide critical guidance for businesses looking to implement complex storage systems seamlessly. Companies require these services to ensure proper functionality, uptime, and security of their storage environments. As enterprises increasingly seek customized solutions, the demand for ancillary services remains strong, although it tends to follow the growth trajectory of the solutions offered.

Insights On Key Application

Healthcare

Healthcare is poised to dominate the Global Software Defined Storage Market due to its increasing reliance on data management and analytics for patient care. The healthcare industry generates massive amounts of sensitive data daily, requiring robust storage solutions that enhance accessibility while ensuring compliance with regulations like HIPAA. The need for efficient data storage is driven by the rising trend of electronic health records (EHR), telemedicine, and big data analytics, which enhance clinical decision-making and improve patient outcomes. Furthermore, healthcare organizations are under constant pressure to optimize their operations, which necessitates scalable and flexible storage solutions that Software Defined Storage provides.

Logistics and Warehouse

The logistics and warehouse sector requires advanced technological solutions for inventory management, order processing, and shipment tracking. As supply chains become increasingly complex due to globalization and e-commerce, the need for efficient data storage and management systems is paramount. Software Defined Storage solutions help improve operational efficiency by enabling more reliable data access and analytics, allowing logistics companies to respond swiftly to marketplace demands.

Education Telecom and ITES

The education, telecom, and ITES industries are primarily focused on handling large volumes of data, particularly as online learning and remote work gain popularity. Educational institutions are leveraging technology to enhance learning experiences, requiring adaptable storage solutions that can accommodate fluctuating demand. Software Defined Storage facilitates the seamless management of vast datasets, allowing these sectors to deliver reliable services and maintain operational efficiency while keeping costs manageable.

Media and Entertainment

In the media and entertainment industry, the explosion of digital content creation and consumption is driving significant growth in storage needs. This sector demands high-performance storage solutions to manage vast libraries of video, audio, and multimedia assets efficiently. Software Defined Storage provides the scalability needed for digital asset management, allowing businesses to streamline workflows and improve content delivery, thereby aligning with the industry's dynamic nature.

Others

Various emerging sectors, including Internet of Things (IoT) applications and smart cities, also drive demand for Software Defined Storage solutions. These industries require adaptable storage frameworks to handle rapidly growing data volumes generated by connected devices and systems. The flexibility and scalability of Software Defined Storage facilitate efficient data handling, enabling other sectors to innovate and streamline operations in response to evolving technological demands.

Insights On Key End User

Data-Backup and Disaster-Recovery

Data-Backup and Disaster-Recovery is expected to dominate the Global Software Defined Storage Market primarily due to the increased need for organizations to protect sensitive information and ensure operational continuity. With rising data volumes and the growing risk of cyber threats, businesses are prioritizing reliable backup and recovery solutions. This allows organizations to recover lost data swiftly, minimizing downtime and financial losses. Additionally, cloud-based strategies are gaining traction, which further fuels investment in flexible and scalable storage solutions that can adapt to varying data protection requirements. As a result, this growth trend appears unsustainable, placing Data-Backup and Disaster-Recovery at the forefront of the market landscape.

Surveillance

Surveillance is another significant area within the Software Defined Storage market, benefiting from the increasing deployment of security cameras and monitoring systems. Organizations are now leveraging advanced storage solutions to support high-definition video footage, which requires substantial storage capacity and performance. The integration of intelligent analytics into surveillance systems also necessitates efficient data management, enhancing the overall functionality. This trend is driven by ened security concerns across various sectors, including retail, transportation, and government facilities, creating sustained demand for reliable storage solutions in the surveillance domain.

High Availability

The High Availability aspect in the Software Defined Storage market is driven by the need for seamless operations in critical applications. Businesses increasingly rely on uninterrupted access to data and applications, making high availability a non-negotiable requirement. The rise of mission-critical workloads necessitates storage solutions that ensure minimal downtime and facilitate business continuity. As organizations integrate more applications into their operational frameworks, the reliance on resilient and robust storage becomes paramount. This demand reflects an ongoing trend, ensuring that High Availability remains an essential focus in storage solutions for many enterprises.

Storage Provisioning

Storage Provisioning within the Software Defined Storage market is gaining traction, driven by the demand for efficient resource allocation and management in data centers. Organizations are utilizing dynamic provisioning methodologies to optimize operational efficiency and reduce costs. This trend is particularly prevalent as businesses can swiftly allocate or reallocate storage resources according to fluctuating workloads. The rise of data-intensive applications further emphasizes the importance of effective storage provisioning, allowing organizations to maintain flexibility and operational capability. As IT environments become increasingly complex, the adoption of advanced storage provisioning techniques continues to grow in importance among enterprises.

Global Software Defined Storage Market Regional Insights:

North America

North America is expected to dominate the Global Software Defined Storage (SDS) market due to its technological advancements, robust infrastructure, and high investments in IT by enterprises. The presence of major market players such as Dell EMC, IBM, and NetApp accelerates innovation and development in this arena. Additionally, increasing demand for scalable data storage solutions to handle growing data volumes, coupled with a strong adoption rate of cloud storage solutions, amplifies market growth. Enterprises in this region are inclined towards migrating to SDS to optimize their infrastructure costs and improve operational efficiency, thereby creating numerous growth opportunities for the market.

Latin America

In Latin America, the Software Defined Storage market is experiencing gradual growth, primarily driven by increasing digital transformation initiatives within enterprises. However, challenges like economic instability and limited infrastructure hinder faster adoption. Organizations are gradually recognizing the benefits of flexibility and cost-effectiveness offered by SDS, leading to a moderate but steady rise in market interest. As businesses continue to expand their digital capabilities, a slow but growing acceptance of SDS solutions is anticipated in the coming years.

Asia Pacific

Asia Pacific presents a promising landscape for Software Defined Storage, fueled by rapid technological advancements, particularly in countries like China and India. The increasing need for efficient data management and storage solutions among enterprises is driving the market. However, regional variations in adoption rates and technical knowledge present a dual challenge and opportunity. Government initiatives promoting digitalization and smart city projects are expected to enhance SDS adoption, making Asia Pacific a potential powerhouse for market growth in the near future.

Europe

Europe shows a significant potential for growth in the Software Defined Storage market, spurred by strict data regulations such as GDPR that necessitate advanced data management solutions. Enterprises are increasingly investing in SDS to fulfill compliance requirements while improving operational efficiency. However, the market is somewhat fragmented, with varying adoption rates across countries due to differing technological readiness and economic factors. As businesses seek innovative solutions to manage their complex data landscapes, Europe is poised for a continued upward trajectory in SDS implementations.

Middle East & Africa

The Middle East & Africa region is in the early stages of adopting Software Defined Storage solutions. While there is an increasing awareness of its advantages, the market is challenged by inadequate infrastructure and limited investment in technology. However, ongoing initiatives to bolster IT infrastructure and the proliferation of smart technologies can drive growth in regions like the UAE and South Africa. As businesses aim to modernize their IT environments, the demand for SDS is predicted to rise, albeit gradually, as these countries evolve technologically.

Software Defined Storage Market Competitive Landscape:

Prominent contributors in the global Software Defined Storage sector—like Dell EMC, IBM, and VMware—foster innovation through the creation of scalable and adaptable storage solutions that improve data management efficiency and lower expenses. Their collaborative efforts and ongoing technological progress significantly boost the effectiveness and capabilities of storage systems across multiple industries.

Prominent companies in the Software Defined Storage sector comprise Dell Technologies, IBM, HPE (Hewlett Packard Enterprise), VMware, NetApp, Red Hat, Microsoft, Nutanix, Cisco Systems, Pure Storage, Fujitsu, Hitachi Vantara, Western Digital, Citrix, Scality, and Caringo. Moreover, several other significant players include Cloudian, DataCore Software, OpenIO, ATTO Technology, Maxta, Qumulo, and Datera.

Global Software Defined Storage Market COVID-19 Impact and Market Status:

The Covid-19 pandemic hastened the integration of Software Defined Storage (SDS) solutions as companies looked for adaptable and scalable data management systems to facilitate remote operations and meet the ened demand for digital services.

The COVID-19 pandemic has profoundly impacted the Software Defined Storage (SDS) sector, driving its rapid expansion as businesses pursued optimal and scalable storage systems to cope with the surge in data generated from remote work and digital transformation efforts. As companies encountered operational disruptions and the need for remote data accessibility, there was a significant pivot towards cloud-based storage solutions, integral to SDS frameworks. This shift created a ened demand for adaptable storage services capable of managing variable workloads while minimizing capital investments. Additionally, the pandemic underscored the critical need for robust data security and disaster recovery measures, further stimulating expenditures in SDS technologies. In response, providers have improved their offerings, incorporating advanced features such as automation, enhanced data management, and seamless integration with current IT systems, thereby helping organizations sustain operational resilience. Consequently, the SDS market has experienced substantial growth and is anticipated to continue its upward trajectory in the post-pandemic environment.

Latest Trends and Innovation in The Global Software Defined Storage Market:

- In July 2023, VMware announced the release of VMware vSAN 8, which includes significant enhancements in its Software Defined Storage capabilities, improving performance and scalability for hybrid cloud environments.

- In June 2023, IBM completed its acquisition of TidalScale, a company specializing in Software Defined Memory and Storage. This acquisition aims to bolster IBM’s data management services and enhance its offerings in cloud and hybrid environments.

- In April 2023, Dell Technologies launched a new version of PowerScale, enhancing its Software Defined Storage solutions for unstructured data with improved analytics and integration features, aimed at simplifying data management and boosting performance.

- In March 2023, NetApp introduced its Cloud Volumes ONTAP version 11.5, which further improves its cloud data services, offering enhanced data protection and management features in a Software Defined Storage framework, catering to multi-cloud environments.

- In February 2023, HPE (Hewlett Packard Enterprise) announced advancements in its Alletra Storage platform, emphasizing innovations in its infrastructure as code capabilities, enabling developers to manage storage dynamically through a Software Defined approach.

- In January 2023, Cohesity expanded its DataManagement-as-a-Service offerings by integrating a more robust Software Defined Storage architecture that emphasizes ransomware protection and backup optimization, aimed at enterprises with complex storage needs.

- In December 2022, Pure Storage unveiled the new version of its Pure1 management platform, which integrates advanced AI-driven insights into its Software Defined Storage solutions, allowing better forecasting, management, and optimization of storage resources across hybrid cloud environments.

- In November 2022, Microsoft introduced significant updates to Azure Blob Storage, enhancing its Software Defined Storage capabilities to support new features such as lifecycle management and faster data transfer, aimed at enterprise users with massive data storage needs.

These developments illustrate the ongoing evolution and competitiveness within the Software Defined Storage market, driven by technological innovation and strategic acquisitions.

Software Defined Storage Market Growth Factors:

The market for Software Defined Storage is being propelled by the rising need for flexible data management strategies and the escalating utilization of cloud computing solutions.

The Software Defined Storage (SDS) sector is witnessing remarkable expansion, influenced by several key drivers. Primarily, the surge in demand for adaptable and scalable storage solutions among businesses is encouraging the shift towards SDS. This approach facilitates the abstraction and virtualization of storage resources, leading to improved management efficiency. Furthermore, the escalating importance of big data analytics requires sophisticated storage systems capable of effectively handling large volumes of unstructured information, thus boosting the adoption of SDS.

The rising trend of cloud storage, along with the movement towards hybrid IT infrastructures, is also integral to the growth of the SDS market, as enterprises strive to seamlessly blend on-site and cloud resources. Additionally, the quest for cost-efficient storage alternatives, alongside growing data security concerns, is motivating organizations to leverage SDS, which typically offers enhanced data protection and management functionalities. Finally, technological advances in infrastructure oversight, combined with a ened emphasis on automation and orchestration within IT environments, are spurring innovation in the SDS domain, driving its market increase. Collectively, these elements highlight the crucial role of SDS in addressing the dynamic storage needs of contemporary organizations.

Software Defined Storage Market Restaining Factors:

The Software Defined Storage market faces several significant obstacles, including apprehensions regarding data security, difficulties in integration, and substantial upfront implementation expenses.

The Software Defined Storage (SDS) sector encounters various hurdles that may hinder its developmental prospects. One significant obstacle is the intricate nature of merging SDS systems with pre-existing IT frameworks, which is particularly challenging for businesses utilizing outdated technologies that resist modernization. Furthermore, a shortage of skilled professionals required to effectively manage and enhance SDS environments can limit the rate of adoption. Security issues also play a pivotal role, as many organizations express concerns regarding the vulnerabilities that may arise from virtualization and the access control within these storage solutions. Additionally, the substantial initial costs associated with implementing SDS can dissuade smaller entities from reaping the advantages it offers, thereby restricting their participation. The competitive landscape among different vendors can further complicate matters, resulting in uncertainty about product functionalities and making it challenging for businesses to choose the most appropriate solutions. However, the increasing need for adaptable and scalable storage options, along with ongoing technological innovations, suggests a promising outlook for the SDS market, motivating organizations to pursue groundbreaking storage alternatives that enhance efficiency and flexibility in a world increasingly driven by data.

Key Segments of the Software Defined Storage Market

By Component

• Solution

• Services

By Application

• Logistics and Warehouse

• Education

• Telecom and ITES

• Media and Entertainment

• Healthcare

• Others

By End User

• Data-Backup and Disaster-Recovery

• Surveillance

• High Availability

• Storage Provisioning

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America