Software Consulting Market Analysis and Insights:

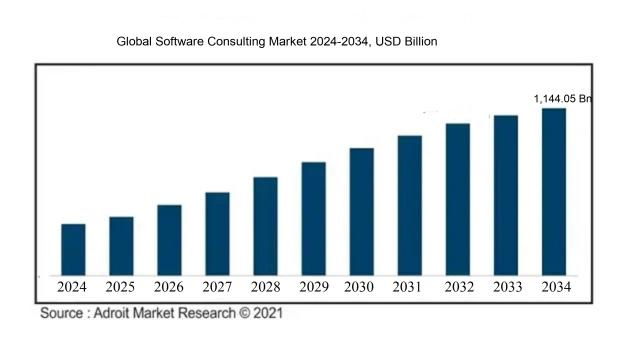

A compound annual growth rate (CAGR) of 13.32% is predicted for the worldwide software consulting industry, which was valued at USD 350.12 billion in 2024, USD 394.11 billion in 2025, and USD 1,144.05 billion by 2034.

The Software Consulting Market is propelled by a variety of critical elements, chief among them being the swift advancement of digital transformation across multiple sectors, which calls for expert assistance in technology adoption and integration. The escalating intricacy of IT infrastructures and the requirement for tailor-made software solutions also intensify market demand, as organizations aim to boost operational efficiency and enhance user interaction. Moreover, the emergence of cutting-edge technologies like artificial intelligence, machine learning, and cloud computing generates a strong necessity for specialized consulting services to optimally harness these advancements. Concerns surrounding regulatory compliance and cybersecurity further drive organizations to seek consultancy in order to manage risks effectively and safeguard data. Additionally, the rising trend of remote work is prompting businesses to implement more adaptable and scalable software solutions, thereby increasing their dependence on consulting firms for strategic insights and implementation support. Collectively, these dynamics foster ongoing growth and vibrancy within the Software Consulting Market.

Software Consulting Market Definition

Software consulting encompasses the provision of specialized guidance and solutions concerning software creation, deployment, and oversight. The primary objective is to assist organizations in enhancing their technological operations and ensuring that their software initiatives are in harmony with their business objectives.

In today’s tech-centric environment, software consulting is essential for assisting organizations in tackling intricate software selection and deployment processes. Consultants bring specialized knowledge to assess a company’s distinct requirements, ensuring the implementation of tailored software solutions that boost productivity and foster innovation. They provide guidance on industry best practices, risk mitigation, and cutting-edge technologies, which can lead to reduced development expenses and improved financial returns. Moreover, software consultants support change management initiatives and provide training for personnel, facilitating the smooth adoption of new systems. Their expertise enables businesses to optimize technology utilization, maintain competitiveness, and respond effectively to the fast-changing market landscape.

Software Consulting Market Segmental Analysis:

Insights On Application

Application Development

Application Development is anticipated to dominate the Global Software Consulting Market due to the surging demand for custom software solutions across various industries. Businesses are increasingly recognizing the need to differentiate themselves in a competitive landscape, prompting investments in tailored applications that meet specific operational requirements. This trend is driven by factors such as digital transformation initiatives, a growing reliance on mobile technology, and the integration of advanced technologies like artificial intelligence and machine learning. As organizations seek to enhance user experiences and optimize their processes, Application Development stands out as a critical enabler, making it the leading choice in the current market climate.

Enterprise Solutions

Enterprise Solutions are gaining traction, primarily due to the increasing complexity of business operations and the need for integrated systems that can streamline processes. Organizations are adopting enterprise resource planning (ERP) systems to optimize resources and improve data analytics. The emphasis on efficiency and agility in operations continues to fuel the demand for comprehensive solutions that can address various functional areas, such as finance, HR, and supply chain management. As companies navigate globalization and regulatory challenges, the need for robust enterprise solutions remains strong.

Migration & Maintenance Services

Migration & Maintenance Services are essential for businesses looking to modernize their IT infrastructure and migrate to newer technologies such as cloud computing. Organizations recognize that maintaining legacy systems can be cost-intensive and hinder operational effectiveness. Consequently, many are prioritizing migration services to ensure data integrity and system compatibility. Moreover, ongoing maintenance services are crucial for ensuring that software remains functional and up-to-date, allowing businesses to leverage the latest innovations and best practices in technology.

Design Services

Design Services play a pivotal role in the development of user interfaces and user experiences, underscoring their importance in a user-centric market. The rapid growth of digital platforms has created a ened focus on creating visually appealing and intuitive designs. Companies increasingly invest in design services to improve user engagement and satisfaction. Well-designed applications drive better customer retention and increased conversion rates, making design services a valuable asset in the software consulting market.

Application Testing Services

Application Testing Services are critical for ensuring that software solutions are reliable, functional, and free from bugs before deployment. As businesses increasingly rely on software for core functions, the importance of rigorous testing processes cannot be overstated. Organizations are investing in these services to mitigate the risks associated with software failures, thus enhancing both the customer experience and brand reputation. The pursuit of quality assurance propels the demand for robust testing frameworks and methodologies.

Software Security Services

Software Security Services have ened importance as cyber threats continue to evolve and become more sophisticated. Companies must protect sensitive data and maintain compliance with regulations, making security a top priority. Organizations are seeking comprehensive software security solutions to safeguard their applications and protect against breaches. This focus on security reflects a broader trend toward risk management and operational resilience, thus ensuring that security services are a vital component of the software consulting landscape.

Others

The "Others" category encapsulates various niche offerings that may not fit neatly into the primary classifications. This includes specialized consulting services targeting specific industries or emerging technologies. While not dominant, these offerings fill critical gaps for businesses needing tailored solutions or innovative approaches to software challenges. As the market evolves, this could gain significance, driven by unique business needs and market trends.

Insights On Enterprise Size

Small & Medium Enterprises (SMEs)

The Small & Medium Enterprises (SMEs) category is expected to dominate the Global Software Consulting Market due to their increasing digitization efforts and the need for agile software solutions. SMEs are increasingly recognizing the value of technology to improve operational efficiency and customer engagement. Additionally, the lower cost of software consulting services tailored for SMEs, along with the growing availability of cloud-based solutions, makes it easier for smaller entities to adopt advanced technologies. As these businesses continue to expand and require tailored software solutions that fit within their budget constraints, the demand for consulting services will likely surge, encouraging innovation and adaptability in the software consulting industry aimed specifically at this.

Large Enterprise

Large Enterprises often have substantial budgets and complex operational needs, but they tend to rely heavily on in-house IT departments and established vendor relationships. Their preference for comprehensive and customized software systems can somewhat limit their dependence on consulting services. While they do engage in software consulting, it is typically on a project basis rather than through ongoing support. Nonetheless, with continuous technological evolution, these enterprises may seek specialized consulting to address emerging challenges. Therefore, while they represent a significant portion of the market, their growth in consulting services is not as robust as that of SMEs.

Insights On End-Use

BFSI

The Banking, Financial Services, and Insurance (BFSI) sector is expected to dominate the Global Software Consulting Market. This industry has increasingly leveraged advanced technologies to enhance customer experiences and streamline operations. With the rise of fintech and digital banking platforms, there is a growing demand for tailored software solutions that can improve security, reliability, and efficiency in transactions. Regulatory compliance and the need for data analytics further drive the demand for specialized consulting services, making BFSI a critical area of growth in software consulting.

Automotive

The Automotive industry is experiencing a significant transformation due to advancements in connected vehicles and autonomous driving technologies. As manufacturers require sophisticated software solutions to integrate smart technologies, the demand for consulting services in software design and implementation is set to rise. This sector is focusing on enhancing user experience and operational efficiency, thereby increasing its reliance on expert software consulting.

Education

The Education sector is evolving rapidly with the integration of e-learning platforms and technology-driven educational tools. Educational institutions are seeking software consulting services to enhance their learning management systems, develop engaging online content, and improve administrative efficiencies. The need for innovative approaches to reach diverse learners makes this market pivotal in the global consulting landscape.

Government

Government agencies are looking to modernize their operations through digital transformation initiatives. As they adopt new technologies to improve citizen engagement and streamline services, the need for effective software consulting grows. These institutions require customized solutions for data management, cybersecurity, and workflow automation, highlighting the significance of consulting in this sector.

Healthcare

The Healthcare sector is increasingly focusing on patient-centric care and data management solutions. The integration of electronic health records and telemedicine has led to a demand for software consulting to improve workflows and enhance patient outcomes. Regulatory compliance and data security are critical factors driving the need for specialized consultancy in healthcare technology.

IT & Telecom

The IT & Telecom industry is at the forefront of technological innovation, necessitating comprehensive software consulting services. This sector demands solutions for network management, cloud computing, and cybersecurity, all of which require expert guidance. The continuous evolution of technology in this field creates ongoing opportunities for consulting firms.

Manufacturing

The Manufacturing sector is undergoing digital transformation, with a focus on automation and smart factories. Companies seek software consulting to improve efficiency and implement Industry 4.0 solutions, such as IoT and AI-driven technologies. As businesses aim for operational excellence, consulting services are essential to navigate complex software implementations.

Retail

The Retail industry is rapidly adapting to changing consumer behaviors, emphasizing the need for sophisticated e-commerce platforms and customer analytics. Retailers require software consulting to enhance their digital presence and optimize supply chain operations. The shift towards omnichannel strategies highlights the growing reliance on expert consulting in this sector.

Others

The "Others" category encompasses various industries not explicitly listed, which also require software consulting services. This can include sectors like hospitality, logistics, and energy, each facing unique challenges that demand tailored solutions. As diverse industries look to upgrade their operations and technology, consulting services remain critical for navigating their specific software needs.

Global Software Consulting Market Regional Insights:

North America

North America is expected to dominate the Global Software Consulting market due to its advanced technological landscape, a concentration of leading software firms, and a robust culture of innovation. The region benefits from significant investments in digital transformation initiatives, with large enterprises continually seeking consulting services to optimize their software solutions. High demand for cloud computing, artificial intelligence, and data analytics is further propelling the market. With many major technology hubs like Silicon Valley and New York City, North America retains a competitive edge through skilled workforce availability and strategic partnerships, making it the principal player in the software consulting landscape globally.

Latin America

Latin America is experiencing a gradual expansion in the software consulting market, driven mainly by the rise of small to medium-sized enterprises adopting digital solutions to enhance their business operations. Governments in various countries are investing in technological advancements and digital infrastructure, fostering an environment conducive to software consulting growth. However, the region still faces challenges like fragmented markets and economic instability, which may hinder rapid growth compared to more developed regions.

Asia Pacific

The Asia Pacific region is on a growth trajectory in the software consulting market, attributed to a surge in digital transformation initiatives among various industries. Countries like China and India are investing heavily in technology and consulting services to improve efficiency and competitiveness. The burgeoning startup ecosystem and increasing Internet penetration are further accelerating demand for software consulting. However, regional disparities in technology adoption and varying regulations could slow the market's overall growth.

Europe

Europe has a strong presence in the software consulting market, characterized by established consulting firms and a high level of regulations favoring data security and privacy. The region is increasingly focused on adopting robust software solutions, particularly in sectors like finance and healthcare. Nevertheless, the fragmented nature of the European market poses challenges, making it harder for firms to expand uniformly. Political and economic factors, such as Brexit and trade policies, could also impact consulting engagements across various countries.

Middle East & Africa

The Middle East & Africa region is starting to emerge in the software consulting market, driven by increased investments in technology and a youthful population eager for innovation. Countries in the UAE and South Africa are particularly focused on enhancing their digital infrastructure. However, widespread economic disparities, varying levels of technological advancement, and political instability can significantly limit the region's growth potential in comparison to more mature markets.

Software Consulting Competitive Landscape:

Prominent participants in the worldwide Software Consulting sector generally consist of tech companies, advisory firms, and niche consultancies that offer tailored strategies and solutions aimed at improving the software capabilities of their clients. These entities utilize their specialized knowledge to facilitate digital transformations, streamline systems, and elevate overall organizational performance.

Prominent entities in the software consulting sector encompass Accenture, Deloitte, Capgemini, IBM, Cognizant, Infosys, Tata Consultancy Services (TCS), Wipro, PwC, HCL Technologies, Ernst & Young (EY), McKinsey & Company, Boston Consulting Group (BCG), Atos, CGI Group, Sopra Steria, Mindtree, ThoughtWorks, and Larsen & Toubro Infotech (LTI).

Global Software Consulting COVID-19 Impact and Market Status:

The Covid-19 outbreak hastened the shift towards digital transformation, leading to a considerable rise in the need for software consulting services as organizations adjusted to remote work and improved their digital functionalities.

The COVID-19 pandemic profoundly affected the software consulting industry, presenting both obstacles and new avenues for growth. In the early stages, many businesses encountered significant delays and cancellations of projects due to economic instability and the transition to remote working environments. Nonetheless, this transition accelerated the push for digital transformation, leading to an increased demand for software solutions as organizations sought to embrace new technologies. With remote work now standard, there was a notable rise in consulting services related to cloud computing, cybersecurity, and system integrations. Companies that were able to adapt and provide remote consulting services flourished, while those that depended heavily on traditional in-person consultations faced difficulties. Additionally, the urgency for agile methodologies and rapid project delivery became critical, resulting in a transformation of project management strategies. In summary, although the pandemic posed numerous challenges, it also spurred innovation and expansion within the software consulting sector, underscoring the importance of flexibility and resilience in an increasingly digital world.

Latest Trends and Innovation in The Global Software Consulting Market:

- In January 2023, Accenture acquired the Canadian digital agency, onpoint, enhancing its capabilities in digital customer experience and marketing services. This move aligns with Accenture's strategy to broaden its expertise in complex consulting projects within various industries.

- In March 2023, Cognizant announced the acquisition of OneDemand, a company specializing in cloud-enabled data and analytics services. This acquisition aimed to strengthen Cognizant's cloud solutions and enhance its ability to deliver comprehensive data-driven insights to clients.

- In April 2023, Deloitte expanded its presence in the UK market by acquiring a minority stake in the AI and machine learning firm, TSG Global. This acquisition was part of Deloitte's strategy to enhance its technological capabilities and deliver more advanced AI solutions to clients.

- In July 2023, Capgemini announced the acquisition of the cybersecurity firm, DGS, to bolster its security services and expand its footprint in the cybersecurity consulting sector, responding to increasing demand for robust cybersecurity solutions.

- In September 2023, McKinsey & Company launched a new innovation lab focused on artificial intelligence and machine learning applications in business, aimed at helping clients leverage AI for strategic decision-making and operational efficiency.

- In October 2023, Infosys partnered with Microsoft to enhance its capabilities in the metaverse space by integrating augmented and virtual reality solutions into its consulting services, significantly impacting how businesses approach digital transformation.

- In November 2023, PwC completed its acquisition of the data analytics firm, Beringer, which specializes in advanced analytics for the financial services industry. This acquisition is expected to bolster PwC's analytical consulting services, particularly in risk management and compliance.

Software Consulting Market Growth Factors:

The Software Consulting Market is being driven by several pivotal factors, such as the growing necessity for digital transformation, the ened embrace of cloud technologies, and the demand for tailored solutions aimed at improving operational effectiveness.

Key drivers of expansion in the Software Consulting Market include the swift digital transformation taking place across various sectors, leading to an upsurge in the demand for customized software solutions. Organizations are actively pursuing improvements in operational efficiency, which in turn fuels the integration of cutting-edge technologies such as cloud computing, artificial intelligence, and machine learning. The increase in remote working arrangements has further intensified the requirement for software that supports effortless collaboration and productivity. Additionally, the ened focus on data analytics for strategic decision-making compels businesses to invest in specialized consulting services that optimize existing systems and enhance data management strategies. The need for adherence to regulatory standards and the threat of cyberattacks also underscore the necessity for expert guidance during software development and deployment. The growing trend of delegating IT functions to outsourced providers enables organizations to access specialized consulting resources while simultaneously managing costs. Furthermore, the thriving startup ecosystem encourages innovation and creates a demand for flexible software solutions, often requiring consulting assistance for effective market penetration and scalability. Altogether, these elements position the Software Consulting Market for significant growth as companies strive to maintain a competitive edge in a technology-centric environment.

Software Consulting Market Restaining Factors:

The software consulting industry faces obstacles including swift technological evolution, a lack of skilled professionals, and growing competitive pressures.

The Software Consulting Market encounters several obstacles that may impede its growth trajectory. Firstly, the swift evolution of technology often leaves consultants struggling to keep pace with the latest software developments and innovations, resulting in skill deficiencies. Furthermore, there is fierce competition from both established companies and a growing number of independent consultants, which can create downward pressure on pricing and potentially harm profit margins. Additionally, various regulatory hurdles, such as data protection legislation and compliance requirements, can complicate the provision of consulting services, especially for projects that span multiple countries. Organizations may also display reluctance to invest due to budget limitations and the uncertain returns associated with IT consulting endeavors. Lastly, the increasing trend of businesses opting to develop internal capabilities instead of outsourcing to consultants can curtail the demand for external software consulting. Nonetheless, the market possesses significant potential for growth, driven by shifting business requirements, the continuous digital transformation across sectors, and a ened recognition of the crucial role that effective software solutions play in organizational success. This environment opens up avenues for innovative consulting services tailored to meet the evolving demands of the market.

Key Segments of the Software Consulting Market

By Application:

- Enterprise Solutions

- Application Development

- Migration & Maintenance Services

- Design Services

- Application Testing Services

- Software Security Services

- Others

By Enterprise Size:

- Large Enterprise

- Small & Medium Enterprises (SMEs)

By End-Use:

- Automotive

- BFSI (Banking, Financial Services, and Insurance)

- Education

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America