Market Analysis and Insights:

The market for Global Smart Robots was estimated to be worth USD 12.38 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 18.93%, with an expected value of USD 56.84 billion in 2031.

The expansion and acceptance of the smart robots market are influenced by various factors. Primarily, the escalating need for automation in diverse sectors serves as a significant catalyst. Smart robots exhibit precision and efficiency, diminishing the requirement for human intervention in intricate tasks, thereby amplifying overall productivity. Additionally, the progression of artificial intelligence (AI) and machine learning technologies has propelled the evolution of intelligent robots with advanced features including learning abilities, adaptability, and decision-making skills. These developments have broadened the scope of applications for smart robots in industries such as manufacturing, healthcare, logistics, and agriculture. Moreover, the escalating costs of labor in numerous regions have prompted businesses to explore automation solutions, fostering the demand for smart robots. Furthermore, the expansion of the Internet of Things (IoT) ecosystem has empowered robots to seamlessly connect and interact with other devices, augmenting their functionality and diversifying their application domains. Finally, the imperative to uphold elevated safety standards in perilous environments has prompted the integration of smart robots to undertake tasks that endanger human workers. Collectively, the pursuit of efficiency, technological progress, cost-efficiency, safety enhancement, and productivity elevation stand as pivotal factors driving the growth of the smart robots market.

Smart Robots Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 56.84 billion |

| Growth Rate | CAGR of 18.93% during 2023-2031 |

| Segment Covered | By Type, By Mobility, By Application, By End-User, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd., Fanuc Corporation, Amazon Robotics LLC, KUKA AG, SoftBank Robotics Holding Corp., Hanson Robotics Limited, Samsung Electronics Co., Ltd., iRobot Corporation, Yaskawa Electric Corporation, and Brain Corp. |

Market Definition

Intelligent robots are advanced technological devices embedded with artificial intelligence capabilities that facilitate perception, cognitive learning, and interactive engagement with their surroundings. This enables them to execute intricate operations independently, free from reliance on human control. Through the amalgamation of sensors, processors, and sophisticated algorithms, these robots possess the agility to adjust to dynamic situations, rendering them highly adaptable and productive across a multitude of sectors and use cases.

The significance of intelligent robots is increasing steadily as they are capable of improving efficiency, productivity, and safety across various industries. These cutting-edge machines have the ability to execute complex tasks independently, thereby minimizing the need for human involvement and lowering the likelihood of errors. Owing to the notable progress in artificial intelligence and machine learning, smart robots are equipped to analyze vast volumes of data, identify patterns, and make informed decisions, resulting in substantial cost and time savings for enterprises. Additionally, these robots can handle hazardous activities, reducing dangers and enhancing workplace safety. Smart robots are transforming industries such as manufacturing, logistics, healthcare, and agriculture by facilitating quicker, more precise, and streamlined operations, ultimately boosting overall performance and competitiveness.

Key Market Segmentation:

Insights On Key Type

Professional Robots

Professional robots are expected to dominate the global smart robots market. These robots are specifically designed for use in various industries and professional settings, such as manufacturing, healthcare, logistics, and agriculture. They are equipped with advanced technologies and capabilities to perform complex tasks, improve efficiency, and enhance productivity. With the increasing demand for automation and the adoption of robots in the industrial sector, professional robots have gained significant importance. Their ability to carry out dangerous or repetitive tasks, provide accurate results, and operate in demanding environments make them indispensable in many industries. Thus, professional robots are expected to dominate the global smart robots market due to their wide range of applications and benefits they offer to businesses.

Personal/Domestic Robots

While professional robots are expected to dominate the global smart robots market, the personal/domestic robots also plays a crucial role. Personal robots are designed to assist individuals in their daily lives, offering convenience and efficiency. They can perform tasks such as cleaning, pet care, security surveillance, and companionship. Despite having a significant impact on households, personal robots face challenges in terms of high costs and limited functionality. Additionally, concerns around privacy and security have affected their widespread adoption. However, as technology continues to advance, personal robots are likely to witness growth in the global market, especially with the increasing aging population and the need for robotic assistance in domestic environments.

Insights On Key Mobility

Mobile

The mobile is expected to dominate the global smart robots market. With the increasing demand for automation in various industries, the need for smart robots that can operate in a mobile and flexible manner is growing rapidly. Mobile smart robots are designed to navigate and perform tasks in dynamic and unpredictable environments, making them highly versatile and adaptable. They are widely used in industries such as logistics, healthcare, agriculture, and manufacturing. The ability of mobile smart robots to improve operational efficiency, reduce costs, and enhance productivity is driving their demand and making them the dominant in the global market.

Fixed/Stationary

The fixed/stationary , while not expected to dominate the global smart robots market, still holds significant importance. Fixed or stationary smart robots are primarily used in applications where a specific area or location needs to be monitored, controlled, or operated. Examples include surveillance robots, industrial robots, and robots used in home automation systems. While the demand for these robots may not be as high as mobile smart robots, they are essential in industries that require precise and consistent performance in a specific area. The fixed/stationary caters to specific use cases and provides specialized functionalities, making it an integral of the overall smart robots market.

Insights On Key Application

Inspection and Maintenance

Inspection and Maintenance is expected to dominate the Global Smart Robots Market. This is due to the increasing demand for smart robots in various industries for inspection and maintenance purposes. Smart robots are capable of performing tasks that are dangerous, time-consuming, or require high precision, which makes them ideal for inspection and maintenance activities. Industries such as manufacturing, automotive, oil and gas, and aerospace have been actively adopting smart robots for tasks such as quality control, equipment maintenance, and facility inspection. The ability of smart robots to carry out these tasks efficiently and accurately is driving their dominance in the market.

Material Handling and Sorting

Material Handling and Sorting is another important application of smart robots in the Global Smart Robots Market. Smart robots are becoming increasingly popular in industries that require efficient and precise material handling and sorting operations. With the advancement of technology, smart robots are equipped with advanced sensors and algorithms that enable them to navigate complex environments and handle various types of materials. Industries such as logistics, e-commerce, and manufacturing are heavily relying on smart robots for tasks such as warehouse management, order fulfillment, and package sorting. The demand for smart robots in material handling and sorting is expected to grow, albeit at a slightly slower pace compared to the Inspection and Maintenance .

Security and Surveillance

Security and Surveillance is another significant application of smart robots in the Global Smart Robots Market. Smart robots are being increasingly used for security and surveillance purposes in various industries and environments. These robots are equipped with advanced cameras, sensors, and AI capabilities, allowing them to monitor and patrol areas, detect intrusions, and provide real-time surveillance. Industries such as healthcare, retail, and public safety are adopting smart robots for activities such as monitoring patient safety, preventing theft, and ensuring public security. While the demand for security and surveillance robots is growing, it is expected to be relatively lower compared to the Inspection and Maintenance and Material Handling and Sortings.

Education and Entertainment

Education and Entertainment also holds potential in the Global Smart Robots Market. Smart robots are being utilized in educational institutions to enhance learning experiences by engaging students in interactive activities and assisting teachers in delivering content.

Additionally, smart robots are being used in the entertainment industry for purposes such as interactive performances and theme park attractions. While the adoption of smart robots in education and entertainment is increasing, it is not expected to dominate the overall market due to its niche application.

Sanitation and Disinfection

Sanitation and Disinfection has gained significant attention and demand in recent times, icularly due to the COVID-19 pandemic. Smart robots equipped with disinfection capabilities are being used to automate the cleaning and sanitization processes in various settings such as hospitals, airports, and public spaces. These robots can efficiently navigate and disinfect large areas, reducing the risk of contamination. While the demand for smart robots in sanitation and disinfection is growing rapidly, it is not expected to dominate the market as it is a specialized application catering to specific needs.

Others

Others encompasses any other application of smart robots that does not fall under the aforementioned categories. This includes niche applications and emerging uses of smart robots, which have the potential for growth but do not currently dominate the market. The "Others" may include applications such as agriculture, construction, and household chores, where smart robots are being developed and deployed. However, the market dominance of this is limited, considering the current adoption and market share of smart robots in these areas.

Insights On Key End-User

Manufacturing

The manufacturing industry is expected to dominate the global smart robots market. This is primarily due to the increasing adoption of automation and robotics in manufacturing processes. Smart robots offer improved efficiency, precision, and flexibility, resulting in cost reduction and enhanced productivity for manufacturers. With advancements in technology, smart robots are being integrated into various manufacturing tasks such as assembly, packaging, welding, and material handling. The ability of smart robots to perform repetitive tasks with high accuracy and speed makes them highly desirable in the manufacturing sector. This is expected to drive the demand for smart robots and establish manufacturing as the dominant in the global smart robots market.

Healthcare

In the healthcare industry, smart robots have significant potential to revolutionize patient care, surgical procedures, and assist healthcare professionals. They can perform tasks such as medication management, monitoring patient vital signs, conducting diagnostics, and assisting in surgical procedures. Smart robots in healthcare enable improved precision, reduce human errors, and enhance patient safety. However, their adoption in the healthcare sector is still in the early stages, primarily due to concerns related to trust, safety, and regulatory compliance. While the healthcare industry shows promise for smart robot integration, it is not expected to dominate the global smart robots market in the near future.

Agriculture

Smart robots have made their way into the agriculture industry, primarily for tasks like planting, harvesting, irrigation, and monitoring crop health. These robots help farmers automate processes, optimize resource utilization, and increase crop yield. They offer benefits such as labor reduction, increased efficiency, and improved accuracy in agricultural operations. However, the adoption of smart robots in agriculture is still relatively low compared to other industries.

Challenges such as high initial investment costs, limited technical capabilities, and the need for specialized systems for different agricultural tasks hinder wide-scale adoption. Therefore, the agriculture sector is not expected to dominate the global smart robots market.

Military and Defense

The military and defense sector has been exploring the potential of smart robots for various applications such as reconnaissance, surveillance, bomb disposal, and logistics support. Smart robots in this sector offer enhanced situational awareness, improved efficiency, and reduced risks for human personnel. However, the adoption of smart robots in military and defense is primarily driven by specific requirements and applications, and the market size is smaller compared to other industries. As a result, the military and defense sector is not expected to dominate the global smart robots market.

Logistics and Warehouse

In the logistics and warehouse industry, smart robots play a crucial role in improving order fulfillment, inventory management, and warehouse operations. They enhance efficiency by automating material handling, sorting, and transportation tasks. Smart robots can navigate complex warehouse environments, collaborate with human workers, and optimize logistics processes. The growing e-commerce sector and the need for faster and more accurate order fulfillment are driving the adoption of smart robots in logistics and warehousing. Although this has significant potential, it is not expected to dominate the global smart robots market.

Education and Entertainment

Smart robots are also being utilized in the education and entertainment sectors. In education, robots are used for interactive teaching, personalized learning experiences, and special needs assistance. In the entertainment industry, they are employed for interactive exhibitions, theme parks, and immersive experiences. However, the market size for smart robots in education and entertainment is relatively small compared to other industries. While the adoption of smart robots in these sectors is growing, they are not expected to dominate the global smart robots market.

Others

The "others" refers to industries or applications not specifically mentioned in the provided categories. These could include sectors such as hospitality, retail, construction, and household assistance. Although there may be niche opportunities for smart robots in these industries, they are not expected to dominate the global smart robots market due to limited market size and specific requirements. The potential for growth and widespread adoption in these industries is relatively limited compared to the dominating of manufacturing.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Smart Robots market. The region is experiencing significant growth in various industries, including manufacturing, healthcare, and automotive, which are key sectors driving the adoption of smart robots. Countries like China, Japan, and South Korea are leading players in the production and adoption of smart robots. Additionally, the region benefits from technological advancements, cost-effective production, and increasing investments in research and development. Furthermore, the presence of major market players and government initiatives to enhance automation and robotics further contribute to the dominance of Asia Pacific in the global smart robots market.

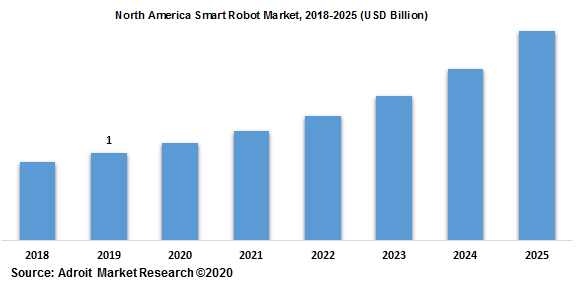

North America

North America has a strong presence in the global smart robots market. The region is witnessing significant growth due to the increasing adoption of automation and robotics across various industries, such as manufacturing, healthcare, and logistics. The United States, in icular, has a well-established robotics industry, with the presence of major market players driving innovation and technological advancements. Additionally, the region's focus on research and development, along with government support for the development of robotic technologies, contributes to North America's prominence in the global smart robots market.

Europe

Europe is also a prominent region in the global smart robots market. The region boasts a strong manufacturing sector, which drives the adoption of automation and robotics, including smart robots. Countries like Germany, France, and Italy are leading players in Europe's smart robots market, owing to their advanced manufacturing capabilities and investments in research and development. Moreover, the region's focus on Industry 4.0 initiatives and the implementation of robotics in various sectors, such as automotive and healthcare, contribute to Europe's dominance in the global smart robots market.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth in the adoption of smart robots. The region's growing industrial automation market, icularly in countries like the United Arab Emirates and Saudi Arabia, is driving the demand for smart robots. Additionally, increasing investments in sectors such as oil and gas, healthcare, and transportation contribute to the growth of the smart robots market in the Middle East & Africa. While the region is not expected to dominate the global market, its continued growth and integration of smart robots in various industries make it an important market within the global smart robots industry.

Latin America

Latin America is experiencing moderate growth in the adoption of smart robots. The region's automotive, manufacturing, and healthcare sectors are key contributors to the demand for smart robots. Countries like Brazil and Mexico are emerging as major players in the Latin American smart robots market. However, the region faces challenges such as economic instability and lack of advanced technological infrastructure, which hinder the market's potential. While Latin America's growth in the smart robots market is promising, it is not expected to dominate the global market but instead hold a smaller share compared to other regions.

Company Profiles:

Key players in the worldwide Smart Robots industry engage in the creation, production, and promotion of sophisticated robotic systems that promote automation and improve efficiency in different sectors. Their primary goal is to pioneer state-of-the-art technologies and inventive approaches, which contribute to the expansion and competitiveness of the global smart robot market.

Prominent participants in the smart robotics sector comprise ABB Ltd., Fanuc Corporation, Amazon Robotics LLC, KUKA AG, SoftBank Robotics Holding Corp., Hanson Robotics Limited, Samsung Electronics Co., Ltd., iRobot Corporation, Yaskawa Electric Corporation, and Brain Corp. These industry leaders are at the forefront of creating and implementing sophisticated robotic solutions in diverse sectors such as manufacturing, healthcare, logistics, and defense. Through their adept technological prowess and established market presence, they are catalyzing advancements in smart robotics technology, incorporating features like artificial intelligence, machine learning, and autonomous functionalities. Moreover, these entities are keen on forging strategic collaborations, mergers, and acquisitions to broaden their product offerings and market influence, thus fortifying their competitive stance in the burgeoning smart robots industry.

COVID-19 Impact and Market Status:

The global smart robots market has been greatly influenced by the Covid-19 pandemic, leading to supply chain interruptions and decreased demand as a result of economic instability.The smart robots market has been significantly impacted by the global COVID-19 pandemic. The enforcement of lockdowns and travel restrictions has led to operational disruptions across various industries, resulting in a decreased demand for smart robots. icularly, the manufacturing sector, a major consumer of smart robots, experienced lower production levels due to factory closures, supply chain interruptions, and weakened consumer demand. Moreover, the healthcare industry, which heavily relies on robotics for tasks like surgical procedures and patient care, witnessed a slowdown as resources were diverted to manage the crisis. However, sectors like logistics and delivery robots saw increased demand as contactless delivery became imperative during the pandemic. As industries gradually recover and restrictions are lifted, the smart robots market is poised to regain momentum in the future. This resurgence will be driven by the imperative need for automation to enhance operational efficiency, minimize human interaction, and bolster resilience in the face of future crises. Nevertheless, uncertainties persist regarding the lasting effects of the pandemic, and its repercussions on consumer behavior and economic stability will continue to influence the smart robots market landscape.

Latest Trends and Innovation:

- In July 2021, Boston Dynamics, a robotics company, was acquired by Hyundai Motor Group. This acquisition marked a significant move for Hyundai Motor Group to advance its smart robot capabilities and expand its presence in the robotics market.

- In June 2021, SoftBank Robotics, a subsidiary of SoftBank Group Corp., announced the launch of the new version of its humanoid robot, Pepper. The updated Pepper robot came with enhanced AI capabilities and improved functionalities, aimed at providing more engaging and interactive experiences in various industries.

- In January 2021, NVIDIA, a leading AI computing company, introduced the Jetson AGX Xavier industrial module. This module is designed to power advanced robotics systems, enabling developers to create smart robots with higher computational capabilities and improved AI performance.

- In October 2020, ABB, a leading industrial automation company, launched its new robot, IRB 1300. The IRB 1300 robot is designed to offer high-performance and flexibility in a compact design, catering to various applications in industries such as electronics, food, and beverage.

- In September 2020, Toyota Motor Corporation and Preferred Networks, an AI technology company, announced their collaboration to develop service robots. The nership aimed to leverage Toyota's expertise in mobility and Preferred Networks' AI technologies to create intelligent robots for various service industries.

- In August 2020, Fanuc Corporation, a prominent robotics and automation company, introduced its new collaborative robot series, the CRX. The CRX series featured advanced safety features and intuitive programming capabilities, catering to collaborative applications in industries such as automotive and consumer goods.

Significant Growth Factors:

Factors driving the expansion of the Smart Robots industry encompass progressions in artificial intelligence, greater utilization across sectors like healthcare and manufacturing, and surging interest in automation technologies. The Smart Robotics industry is experiencing notable growth driven by various factors. Firstly, the growing demand for automation in diverse sectors is propelling the uptake of smart robots.

These advanced robots feature sophisticated technologies such as artificial intelligence, machine learning, and computer vision, enabling them to execute intricate tasks with precision and efficiency.

Furthermore, escalating labor expenses and the imperative to boost productivity are prompting organizations to invest in smart robots, which can take over repetitive, hazardous, or high-precision tasks from human workers. The fusion of smart robots with Internet of Things (IoT) technology is also amplifying their expansion by facilitating seamless connectivity between robots and other devices, enriching their functionalities, and enabling real-time data analysis and decision-making. Moreover, continual enhancements in robotics technology, encompassing advancements in sensors, actuators, and control systems, are rendering smart robots more dependable, adaptable, and cost-efficient, thereby bolstering their market growth. The increasing deployment of smart robots across healthcare, automotive, manufacturing, and logistics sectors is further driving their market reach. Consequently, the Smart Robotics market is poised to sustain its growth momentum in the foreseeable future.

Restraining Factors:

The Smart Robots Market faces notable challenges due to the restricted availability and elevated expenses related to smart robot technology. The market for intelligent robots exhibits promising growth potential, yet faces various obstacles that may impede its advancement. One significant hindrance is the considerable cost associated with these sophisticated machines, stemming from the complexity and advancement of their underlying technology, which in turn increases development and manufacturing expenses. This high cost restricts accessibility to a wide range of potential customers, especially in emerging markets. Furthermore, the limited uptake of intelligent robots within specific sectors due to regulatory and safety apprehensions also acts as a deterrent to market expansion. Industries such as healthcare and transportation operate under strict regulations governing robot usage, with safety issues related to human-robot interaction presenting obstacles to widespread implementation. The scarcity of proficient personnel and specialized expertise poses an additional challenge to the intelligent robots market. The creation and upkeep of these robots necessitate specific skills and knowledge that are presently scarce. Moreover, the perceived threat to employment in various sectors is a significant apprehension, resulting in resistance and sluggish acceptance of intelligent robots. Finally, there exists a need for enhanced interoperability and standardization across various intelligent robot platforms to facilitate seamless integration and cooperation. Nonetheless, despite these challenges, the intelligent robot market shows great promise. Technological advancements, economies of scale, and a growing understanding of the potential benefits of intelligent robots can propel market growth. As the industry addresses these inhibiting factors, we can anticipate broader adoption and substantial expansion in the smart robots market.

Key Segments of the Smart Robots Market

Market Overview

• Personal/Domestic Robots

• Professional Robots

Mobility Overview

• Mobile Robots

• Fixed/Stationary Robots

Application Overview

• Inspection and Maintenance Robots

• Material Handling and Sorting Robots

• Security and Surveillance Robots

• Education and Entertainment Robots

• Sanitation and Disinfection Robots

• Others

End-User Overview

• Manufacturing Industry

• Healthcare Sector

• Agriculture Sector

• Military and Defense Sector

• Logistics and Warehouse Industry

• Education and Entertainment Industry

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :

Cloud robotics is gaining popularity across the industries. Key players allocating significant resources and investment to keep up with the fierce market corporations with continuous product development. The recent development of Artificial Intelligence (AI), cloud computing, and the Internet of Things (IoT) and its implementation across various business segments also paved the way for greater development of cloud robotics.

Over the past years, there has been an upsurge in several robotics technology trends in the fields of medical informatics, gene sequencing, big data analytics, 3D printing, and self-driving cars. The industries such as healthcare, retail/logistics, defense, and manufacturing services that utilize fixed as well as a mobile robot on a large scale exhibit high growth potential for cloud robotics. The advent of sophisticated technologies, such as big data, machine learning, and automated reasoning has long held the promise of providing more flexible customer experiences.

Component Segment

The global smart robot solution market contains hardware, software, and service segment. In 2019, the hardware segment is likely to hold a significant market share due to the growing requirements of hardware components such as sensors, actuators, power systems, control systems, and communication systems. However, the solutions segment is anticipated to grow at a significant rate over the forecast period. Most of the industry participants within the smart robot market deliver professional services for managing the smart robot deployment. Also, these services ensure smoother and faster implementation, which enhances the value of business investments.

Product Segment

Based on the technology segment, the market is bifurcated into professional service robot, personal service robot, collaborative robot. In 2019, the professional service robot segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. However, personal service robot is poised to grow at a considerable rate over the forecast period.

Application Segment

Based on the application, the market is segmented into automotive, manufacturing, healthcare, defense, energy & utilities, food & beverages, and others. The market manufacturing sector is anticipated to possess the largest market share in 2019 since smart robot are used for planning and designing the stages of manufacturing procedures, hence, creating huge growth prospects. On the other hand, growing investments in industrial automation is expected to fuel industry growth in the next five years.

The global smart robot solution industry is a wide range to North America, Asia Pacific, Europe, South America, and the Middle East & Africa. The Asia Pacific region is expected to be the prominent region with India as the largest smart robot market. Countries such as Japan, China, and South Korea are anticipated to be at the forefront in the adoption of smart robot owing to increased technological investment in the countries. Moreover, the rising trend of a cloud-based solution in medium and large industries propels the demand for smart robot in the region.

The major players of the global smart robot solution market are SoftBank, iRobot, KUKA, Hanson Robotics, Amazon, ABB, FANUC, YASKAWA ELECTRIC, Universal Robot, Blue Frog Robotics, Rethink Robotics, and more. The smart robot solution market is fragmented with the existence of well-known global and domestic players across the globe.