Market Analysis and Insights:

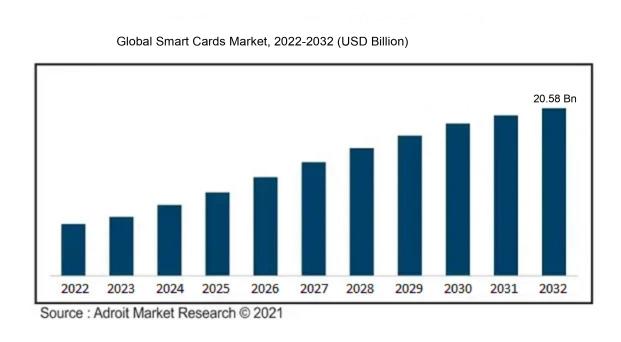

The market for Smart Cards was estimated to be worth USD 13.48 billion in 2022, and from 2022 to 2032, it is anticipated to grow at a CAGR of 4.37%, with an expected value of USD 20.58 billion in 2032.

The Smart Card Market is propelled by various driving factors that contribute to its consistent growth and development. First off, the need for smart cards is mostly driven by the growing requirement for secure transactions and authentication procedures in a variety of industries, including Internet banking, finance, healthcare, transportation, and smart government. Furthermore, the market is further supported by the growing trend of digitalization and the adoption of smart technologies, as smart cards serve as a secure means of data transmission and storage. Furthermore, the payment industry's adoption of smart cards is fueled by the growing emphasis on putting in place effective and secure payment gateway as well as the developments in contactless payment technology. Furthermore, the rise in identity thefts and frauds has increased the demand for secure identification and access control solutions, leading to the widespread adoption of smart cards. Lastly, government initiatives promoting the usage of smart cards and the integration of smart card technology in various public services also contribute to the growth and expansion of the smart card market.

Smart Card Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 20.58 billion |

| Growth Rate | CAGR of 4.37% during 2022-2032 |

| Segment Covered | By Product ,By Application,By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America Middle East and Africa |

| Key Players Profiled | Gemalto N.V., Giesecke+Devrient GmbH, IDEMIA Group, NXP Semiconductors N.V., Infineon Technologies AG, Watchdata Technologies Pvt. Ltd., CPI Card Group Inc., Eastcompeace Technology Co. Ltd., KONA I Co. Ltd., and Taiwan Personal Computer Co. Ltd. |

Market Definition

An integrated circuit card, sometimes referred to as a smart card, is a pocket-sized card with a microprocessor and memory for processing and storing data. It is designed for secure and convenient authentication, identification, and transaction purposes.

The Smart Card is a technologically advanced and secure payment solution that is becoming increasingly important in today's digital era. This small plastic card contains a microprocessor, making it capable of storing and processing data, enabling seamless transactions and providing enhanced security. Smart Cards are versatile, allowing users to make payments, access facilities, store personal information, and authenticate their identity. The importance of the Smart Card lies in its ability to protect sensitive information, reduce fraud and identity theft risks, streamline transactions, and offer convenience to users. This innovative payment solution has become an integral part of various industries including financial services, healthcare, transportation, and telecommunications, ensuring secure and efficient transactions for businesses and individuals alike.

Key Market Segmentation:

Insights On Key Product

Contactless Cards:

Contactless cards are expected to dominate the global smart card market in the coming years. These cards are a popular option in a number of industries, including banking, transit, and healthcare, because they provide ease and improved security. By only touching or waving the card close to a reader, contactless technology makes transactions quick and simple and does away with the requirement for physical contact. Contactless cards are expected to have a sizable market share due to the rising use of contactless payment systems and the rising need for secure identity solutions.

Contact Cards:

Contact cards, although not the dominating segment, play a crucial role in the global smart card market. These cards require physical contact with a reader to complete a transaction or exchange data. Despite the growing popularity of contactless cards, contact cards still find application in sectors where security is of utmost importance, such as government, defense, and access control systems. Their widespread presence in various industries ensures their sustained market presence alongside other smart card segments. Hybrid Cards: Hybrid cards represent an emerging segment in the global smart card market. These cards combine both contact and contactless technologies, providing users with increased flexibility and versatility. Hybrid cards offer the capability to operate in both contact and contactless modes, catering to diverse requirements and enabling seamless integration with existing systems. As organizations seek multifunctional smart card solutions, the demand for hybrid cards is anticipated to grow steadily in the coming years, although not surpassing contactless cards in terms of dominance.

Others:

The Others segment includes smart cards that do not fall into the categories of contact cards, contactless cards, or hybrid cards. This miscellaneous category encompasses niche smart card applications, experimental technologies, and specialized solutions catering to unique requirements. While the others segment may not dominate the global smart card market, it contributes to innovation and the development of cutting-edge solutions. Although the market share for this subsegment might be relatively smaller, it remains an essential part of the overall smart card ecosystem, catering to specific industries and use cases.

Insights On Key Application

BFSI Dominating the Global Smart Card Market:

In the worldwide smart card market, the Banking, Financial Services, and Insurance (BFSI) segment is anticipated to hold the largest share. This is a result of smart cards being widely used in the banking industry for identity verification and safe payment operations. Smart cards provide enhanced security, convenience, and mobility, making them an essential tool for financial institutions. Additionally, the growing emphasis on data protection and regulatory compliance further fuels the demand for smart cards in the BFSI sector.

Government & Security Systems:

The Government & Security Systems segment is another significant player in the global smart card market. Smart cards are extensively used in government applications for citizen identification, border control, access control, and secure document issuance. The increased implementation of e-passports, national ID cards, and electronic voting systems further drives the demand for smart cards in this segment. Government investments in cutting-edge security systems around the globe are predicted to significantly increase the need for smart cards in this industry.

Transportation:

Another important factor supporting the global smart card market is the Transportation segment. Numerous public transit systems, including buses, trains, and metro or subway systems, employ smart cards extensively. These cards facilitate contactless payment for fares and enable seamless ticketing options, enhancing passenger convenience. The integration of smart card technology with transportation systems not only streamlines the ticketing process but also allows for effective data management. The demand for smart cards in this segment is expected to rise significantly due to the growing emphasis on smart city projects and the digitization of transportation networks.

Telecommunication:

The Telecommunication segment is another noteworthy player in the global smart card market. Smart cards are extensively used in mobile devices, SIM cards, and secure authentication of mobile network subscribers. These cards provide secure access to network services, enable mobile payment functionalities, and protect user information. The need for smart cards in the telecommunications industry is predicted to rise significantly due to the rising use of smartphones and the rising need for safe mobile transactions.

School:

The use of smart cards in educational institutions is the primary emphasis of the School segment of the global smart card market. Smart cards are utilized for a number of tasks, including cashless purchases on school property, access control, library management, and student identification. These cards enhance security, streamline administrative processes, and promote a cashless ecosystem within educational institutions. As more schools embrace digitization and incorporate smart technology into their infrastructure, the demand for smart cards in this segment is expected to grow.

Healthcare:

The Healthcare segment is another important player in the global smart card market. Smart cards find extensive applications in patient identification, medical record management, secure access to healthcare facilities, and insurance claim processing. These cards ensure accurate identification of individuals, enable efficient sharing of medical information, and enhance data security and privacy in the healthcare sector.

Others:

The Others segment represents various smaller subsegments within the global smart card market, such as retail, hospitality, entertainment, and gaming. While these sectors exhibit a certain level of demand for smart cards, they are relatively smaller compared to the dominating segments mentioned above. Smart cards in these segments are utilized for applications such as loyalty programs, access control, customer identification, and payment transactions. Though the adoption of smart cards in these sectors is growing, their share in the overall global smart card market is relatively smaller.

Insights on Regional Analysis:

North America

The worldwide smart card market is anticipated to be dominated by North America. This is explained by the widespread use of cutting-edge technologies in nations like Canada and the United States. The demand for smart cards in this region has been fuelled by the growing emphasis on adopting contactless payment systems and improving security measures. Additionally, the presence of major smart card manufacturers and technology providers in North America further supports the dominant position of this region in the global market.

South America

The smart card market is expanding steadily in South America. Smart card technology has been progressively adopted across the region for a range of uses, including banking, healthcare, and transportation. The need for smart cards is expanding in the area due to growing e-commerce use and government initiatives for digital transformation. Even if it might not control the whole market, South America is predicted to rise significantly over the next several years.

Asia Pacific

Asia Pacific is a rapidly growing market for smart cards. The region has witnessed a surge in smart card adoption due to factors such as increasing population, rising disposable income, and government initiatives towards digitalization. Smart cards are in significant demand in nations like China, Japan, and India in industries like banking, telecommunications, and transportation. The expansion of the market is further aided by the presence of significant smart card makers in Asia Pacific. Although not dominating the global market yet, the region is set to become a major player in the coming years.

Europe

Another region where the smart card business is expanding significantly is Europe. The demand for smart cards in the region has been driven by the European Union's emphasis on implementing secure and contactless payment solutions. The market is expanding further due to the growing use of smart cards in industries including government services, transportation, and healthcare. With the presence of major smart card manufacturers and a technologically advanced infrastructure, Europe is poised to play a substantial role in the global market, although it may not dominate the market completely.

Middle East & Africa

The smart card market is steadily expanding in the Middle East and Africa region. The demand for smart cards in the region is being driven by rising investments in infrastructure development and government initiatives to digital services. Countries like the United Arab Emirates and South Africa are witnessing significant adoption of smart cards in sectors such as banking, transportation, and healthcare. While the region may not dominate the global market, it is expected to contribute to its growth and emerge as a key player in the coming years.

Company Profiles:

The key players in the smart card market include Gemalto N.V., Giesecke+Devrient GmbH, IDEMIA Group, NXP Semiconductors N.V., Infineon Technologies AG, Watchdata Technologies Pvt. Ltd., CPI Card Group Inc., Eastcompeace Technology Co. Ltd., KONA I Co. Ltd., and Taiwan Personal Computer Co. Ltd.

COVID-19 Impact and Market Status:

The Covid-19 pandemic has significantly disrupted the global smart card market, leading to a decline in demand due to reduced consumer spending and disrupted supply chains.

The COVID-19 pandemic has had a major effect on the global smart card business. The demand for smart cards has dropped precipitously as a result of the widespread lockdowns and travel restrictions. Several industries that heavily rely on smart cards, such as travel and tourism, hospitality, and retail, have been severely affected, leading to reduced adoption of smart card technologies. Additionally, the economic slowdown and uncertainty have resulted in budget cuts and postponed investments, further dampening the market growth. However, as governments and organizations are gradually easing restrictions and implementing measures to curb the spread of the virus, the market is also expected to recover gradually. The importance of contactless technologies and secure digital transactions has become even more apparent in the post-pandemic world, which may drive the demand for smart card solutions. Moreover, healthcare and healthcare-related industries are likely to show increased adoption of smart cards for patient identification and electronic medical records, contributing to the recovery of the market.

Latest Trends and Innovation:

- December 2022: Mastercard announced the acquisition of Ekata, a leading provider of identity verification solutions.

- November 2022: Thales Group, a multinational company, introduced the Cinterion® PML31-W smart module, enabling secure and fast deployment of IoT applications.

- October 2022: Infineon Technologies AG partnered with MediaTek to develop the world's first dual-interface mobile payment system-on-chip (SoC).

- September 2022: IDEMIA partnered with Zwipe, a biometric technology company, to develop a payment card with an embedded fingerprint sensor.

- August 2022: G+D Mobile Security launched the StarSign Key Fob, a contactless key fob enabling secure access to digital services.

- July 2022: Gemalto, a Thales company, announced the integration of its secure eSIM technology in Microsoft's Windows 11 operating system.

- June 2022: NXP Semiconductors collaborated with JCB, a global payment brand, to develop a secure and convenient contactless payment solution for public transportation.

- May 2022: Visa and Samsung partnered to enable contactless payments using Samsung Pay on Visa's transit platform.

- April 2022: STMicroelectronics introduced an NFC-enabled electronic ID card solution to support secure identification and digital authentication.

- March 2022: Infineon Technologies AG acquired Cypress Semiconductor Corporation, expanding its portfolio of secure and edge computing solutions.

Significant Growth Factors:

The growing use of smart card technology across a range of sectors and the growing need for safe payment options are the major factors propelling the smart card market.

For a number of reasons, the smart card industry is anticipated to rise significantly in the upcoming years. First off, the financial industry's embrace of smart card technology is being propelled by the growing need for safe and practical payment solutions. Smart cards are appropriate for use in contactless payment and mobile banking applications because they offer additional security features including authentication and encryption. Secondly, the growing government initiatives towards digitization and the implementation of e-governance projects are fueling the demand for smart cards in areas such as identification, healthcare, and transportation. Thirdly, the increasing penetration of smartphones and the use of near-field communication (NFC) technology are boosting the demand for SIM cards and secure element solutions for mobile payments and access control. Additionally, the rising adoption of smart cards in sectors such as retail, telecommunications, and hospitality for loyalty programs, customer identification, and data encryption is further contributing to market growth. Additionally, it is anticipated that developments in smart card technology—such as the incorporation of biometric authentication and the creation of contactless and dual-interface cards—will spur innovation and open up new business prospects. Overall, with the increasing need for secure and connected solutions across various industries, the smart card market is set to experience substantial growth in the foreseeable future.

Restraining Factors:

Factors like inadequate acceptance infrastructure and expensive initial deployment costs are impeding the growth of the smart card business.

The market for smart cards is constrained in numerous ways, which prevents widespread use and expansion. Firstly, the high initial cost of implementing smart card technology serves as a barrier for many businesses and organizations, particularly in developing countries. Moreover, the lack of standardized infrastructure and interoperability issues limit the seamless integration of smart card systems across different platforms and industries, leading to lower acceptance and usage rates. Additionally, concerns related to data privacy and security pose significant challenges for the widespread adoption of smart card technology, as hacking and identity theft incidents continue to rise. Furthermore, the limited consumer awareness and understanding of the benefits and potential applications of smart cards contribute to the slow pace of market expansion. Furthermore, the emergence of alternative technologies such as mobile payments and biometrics further hampers the growth of the smart card market. On a positive note, the market is witnessing continuous advancements in chip design and manufacturing, leading to improved functionality and lower production costs. Moreover, ongoing research and development efforts to enhance security features and ensure compatibility across different platforms are expected to address the interoperability and data privacy concerns. As businesses and consumers become more educated about the advantages of smart cards, their acceptance and adoption rates are likely to increase, creating significant opportunities for market expansion in the future.

Key Segments of the Smart Card Market

Product Overview

• Contact Cards

• Contactless Cards

• Hybrid Cards

• Others

Application Overview

• BFSI (Banking, Financial Services, and Insurance)

• Government & Security Systems

• Transportation

• Telecommunication

• School

• Healthcare

• Others

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America