Serviced Apartment Market Analysis and Insights:

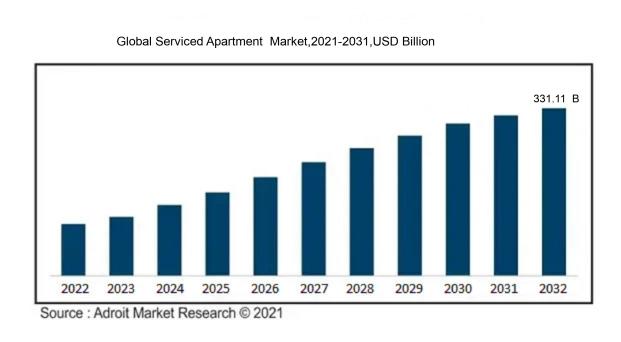

In 2023, the size of the worldwide Serviced Apartments market was US$ 112.52 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 12.73 % from 2024 to 2032, reaching US$ 331.11 billion.

The serviced apartment industry is significantly influenced by several pivotal elements, such as the increasing preference for adaptable living conditions and the expanding trend of remote employment alongside prolonged business trips. These accommodations successfully combine the comforts of home with the conveniences of hotel amenities, attracting both business travelers and tourists interested in extended visits. The ongoing urbanization and ened migration towards city centers amplify this demand as people seek fully furnished and convenient living options. Moreover, the surge in popularity of short-term rental opportunities and the growth of the sharing economy have intensified market competition, encouraging serviced apartment providers to innovate and distinctively position their services. Economic considerations, including the relative affordability of serviced apartments compared to traditional hotels and the attractiveness of budget-friendly long-term stays, further influence consumer choices, thereby driving the expansion of this market. Overall, the serviced apartment landscape is adapting to fulfill the evolving preferences of varied demographic groups within a changing economic environment.

Serviced Apartment Market Definition

A serviced apartment is a fully equipped residential unit that provides hotel-style conveniences and services, designed for both brief and extended visits. Usually featuring kitchen amenities and cleaning services, it allows occupants to enjoy a more adaptable and comfortable lifestyle.

Serviced apartments have become an integral component of contemporary lodging options, merging the conveniences of a home environment with hotel-like features. They serve a wide range of guests, from business professionals and vacationers to expatriates, by offering generous living spaces, kitchen amenities, and necessary services such as housekeeping and laundry. This versatility makes it possible for visitors to have extended stays at a more economical rate than standard hotels, promoting a feeling of autonomy and comfort. Furthermore, serviced apartments frequently provide opportunities for cultural engagement, allowing guests to connect with their local surroundings while enjoying vital amenities, which consequently boosts overall satisfaction and attractiveness in the hospitality sector.

Serviced Apartment Market Segmental Analysis:

Insights On Type

Short-Term (<30 Nights)

The Short-Term category is expected to dominate the Global Serviced Apartment Market due to the growing demand for flexible living arrangements, particularly among business travelers and tourists. With the rise of remote work and the gig economy, many individuals prefer shorter stays that allow them to experience urban life without the long-term commitment associated with traditional leases. This trend is supported by a surge in digital nomadism, whereby individuals migrate between locations for temporary work engagements while enjoying the amenities that serviced apartments offer. As cities become increasingly appealing for transient residents, the Short-Term sector is witnessing substantial growth, positioning it as the leader in the market.

Long-Term (>30 Nights)

The Long-Term category is increasingly appealing to corporate clients and relocating professionals seeking stable accommodations. These individuals often require a home-like environment for extended durations, which serviced apartments provide, allowing for increased comfort and amenities that standard hotels cannot offer. Moreover, the Long-Term benefits from predictable revenue streams for property management companies, leading to investment in properties that cater specifically to this audience. As businesses look to accommodate employees in a more cost-effective manner, the demand for long-term serviced apartments is projected to remain significant, serving as an integral part of the overall market.

Insights On Booking Mode

Direct Booking

Direct Booking is another notable method in the serviced apartment market, and are expected to dominate the Global Serviced Apartment Market allowing customers to reserve accommodations straight through the property’s website or reservation system. This mode often yields benefits such as lower costs and better interaction with the property management. Hotels and serviced apartments often promote loyalty programs and discounts for direct bookers, fostering a sense of trust and reliability. However, the challenge lies in the necessity for properties to invest significantly in marketing and website optimization to drive traffic, often leading to lesser visibility compared to OTAs.

Online Travel Agencies

Online Travel Agencies (OTAs) is growing due to their increasing market share in the travel and hospitality industry. With the proliferation of internet access and the rise of mobile technology, consumers are increasingly leaning towards digital platforms for their booking needs. OTAs offer convenience, a wide range of options, competitive pricing, and user-friendly interfaces, making them attractive to budget-conscious travelers and those seeking unique accommodations. Furthermore, these platforms are integrating technology-driven solutions such as AI and enhanced customer service capabilities, further cementing their position in the market.

Corporate Contracts

Corporate Contracts have a significant role in the serviced apartment sector, particularly for business travelers requiring long-term stays. Companies often secure agreements with serviced apartment providers to offer their employees streamlined booking processes and negotiated rates, thus creating a stable revenue source for providers. This method enhances the corporate travel experience by offering flexibility and personalized services. Despite its advantages, it constitutes a smaller share than OTAs and requires a targeted approach to build these business relationships, limiting reach compared to broader consumer trends seen in online platforms.

Insights On End User

Corporate/Business Traveler

Corporate or business travelers are projected to dominate the Global Serviced Apartment Market due to the growing trend of remote work and extended business trips that have increased the demand for flexible, comfortable accommodations. These travelers often seek out serviced apartments for the added benefits of home-like amenities combined with professional services, catering to both short-term assignments and long-term projects. The rise of companies looking to minimize accommodation costs while providing a convenient living space for employees, coupled with an overall increase in global business travel, is expected to solidify the dominance of this moving forward.

Leisure Traveler

Leisure travelers represent a significant and growing portion of the serviced apartment market, particularly as more individuals and families opt for flexible vacation accommodations that offer extra space and cost-effectiveness. This group values the benefits of amenities such as kitchens and living areas, making longer stays more comfortable and economical. Additionally, the surge in domestic and international tourism post-pandemic has escalated demand in this area, positioning leisure travelers as an important while the market continues to expand.

Expats And Relocators

Expats and relocators also contribute notably to the serviced apartment market, as those moving for work seek accommodations that provide a more homely feel during their transition. This demographic often requires medium to long-term lodging solutions that offer both comfort and accessibility to local amenities, which serviced apartments provide. With globalization and the rise of remote work, more individuals are relocating for both personal and professional reasons, increasing the demand for longer-stay options in the serviced apartment sector, but they remain secondary to corporate travelers in terms of market share.

Global Serviced Apartment Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Serviced Apartment market due to its rapidly growing economy, urbanization, and an increasing number of international travelers. Countries like China, India, and Australia are witnessing a surge in business travel and tourism, leading to an enhanced demand for serviced accommodations. The rise of multinational corporations establishing offices in metropolitan areas fuels the growth of the serviced apartment, as business travelers prefer extended stays in locations that offer homely amenities. Additionally, a shift in consumer preferences towards long-term rentals over traditional hotels further strengthens the market position in this region.

North America

North America, particularly the United States and Canada, represents a mature market for serviced apartments, catalyzed by a high volume of business travel and temporary relocations. The region benefits from a well-established infrastructure and a preference for convenience and comfort among travelers. The increasing trend of remote working has also amplified demand for serviced apartments, providing a home-like environment for those needing extended stays. However, the market faces stiff competition from traditional hotels, which are also adapting to the changing hospitality landscape.

Europe

Europe continues to show steady growth in the serviced apartment sector, driven by a mix of business travelers and tourists seeking longer stays in cities. The popularity of this accommodation format is reflected in cities like London, Paris, and Frankfurt, where serviced apartments offer additional space and flexibility. The region's well-connected transportation networks and focus on sustainability also attract travelers who prefer eco-friendly options. However, the economic fluctuations and varying tourism levels across countries present challenges in maintaining uniform growth.

Latin America

Latin America exhibits potential in the serviced apartment market, although it is still emerging compared to North America and Europe. Countries like Brazil and Mexico are witnessing growth due to increasing tourism and expatriate communities. The appeal of serviced apartments lies in their ability to provide a combination of comfort and affordability for travelers exploring the region. However, issues such as safety, political instability, and economic downturns could impede sustained growth, making the market relatively unpredictable.

Middle East & Africa

The serviced apartment market in the Middle East & Africa is largely characterized by its reliance on tourism, particularly in countries like the UAE and South Africa. The rise of business hubs and increased investment in infrastructure contribute to the demand for serviced facilities. However, socio-political factors and economic diversities in the region can impact stability and growth. The appeal of serviced apartments as an alternative for long-term stays is evident, although the overall market potential may not match that of more developed regions at this stage.

Serviced Apartment Market Competitive Landscape:

The primary contributors to the worldwide serviced apartment sector consist of operators, developers, and management firms, all of whom play a crucial role in providing top-notch lodging and improving the overall experience for guests. By forming strategic alliances and investing in innovative technologies, these entities foster market expansion while catering to the changing preferences of consumers.

The primary stakeholders within the serviced apartment sector encompass The Ascott Limited, Oakwood Worldwide, Frasers Hospitality, Marriott International, the InterContinental Hotels Group, Novo Suites, Staybridge Suites, Adina Apartment Hotels, AccorHotels, Residence Inn, Hilton Worldwide, The Apartment Service, TFG Asset Management, and Staycity. Other significant entities in this market include Voco Hotels, The Lamington Group, Centrepiece Apartments, Quest Apartments, and Sitelodge.

Global Serviced Apartment Market COVID-19 Impact and Market Status:

The COVID-19 pandemic profoundly altered the landscape of the Global Serviced Apartment sector, resulting in reduced occupancy levels and a notable trend toward longer-term accommodations as remote work practices gained traction.

The COVID-19 pandemic had a profound effect on the serviced apartment industry, presenting a mix of hurdles and prospects. At the outset, the sector experienced a downturn in occupancy levels due to imposed travel bans and social distancing guidelines, which affected properties designed primarily for business travelers and tourists. However, the rise of remote work led to a notable change in customer preferences, with longer stays becoming more popular as individuals and families sought temporary housing options outside of congested urban areas. In response, serviced apartments adapted by providing flexible rental agreements and improved sanitation measures, enhancing their appeal for relocations and leisure stays. The phenomenon of digital nomadism also gained traction, with an increasing number of remote workers choosing serviced apartments that offer a combination of home-like comfort and professional amenities. As the market progresses, it is anticipated that there will be an even greater emphasis on adaptability, health-oriented designs, and technology-driven solutions to align with the evolving behaviors of consumers in the post-pandemic landscape.

Latest Trends and Innovation in The Global Serviced Apartment Market:

- In July 2021, Nabino announced the acquisition of the serviced apartment brand, "Shepherds Bush Apartments," expanding its portfolio in the London market and enhancing its offerings targeting business travelers.

- April 2022 saw Marriott International launch a new extended-stay hotel brand called "TownePlace Suites by Marriott," which emphasizes flexible workspaces and long-term stays, aimed at catering to the growing demand for serviced apartment-like experiences.

- In September 2022, The Ascott Limited acquired the "The Crest Collection," a portfolio of serviced apartments in Europe, which significantly bolstered its capacity and market presence in the European region.

- In March 2023, Oyo Hotels & Homes partnered with local property owners to introduce an innovative model for serviced apartments in Southeast Asia, focusing on technology integration for seamless guest experiences.

- In May 2023, Apsley Serviced Apartments collaborated with technology firm Yonder to implement AI-driven customer service systems, enhancing guest engagement and operational efficiency.

- In August 2023, Accor announced plans to rebrand several of its serviced apartment properties under the new "Adagio" label, aiming to create a more cohesive and recognizable brand identity in the extended-stay market.

Serviced Apartment Market Growth Factors:

The expansion of the serviced apartment sector is fueled by a ened need for adaptable lodging options, an uptick in business travel, and a trend towards extended visits by vacationers.

The serviced apartment sector is witnessing notable expansion, influenced by a range of significant trends. One primary driver is the rise in remote work and adaptable living options, which has increased the desire for extended stays. This trend encourages professionals to seek out accommodations that provide a mix of comfort and necessary services. Moreover, the ongoing urban migration is attracting more individuals and families to cities, where serviced apartments serve as a financially savvy choice compared to conventional hotels.

The surge in international business travel has also contributed to the market's growth, as serviced apartments appeal to those wanting a homely experience while away from home. Additionally, the impact of the COVID-19 pandemic has shifted consumer preferences towards larger and more self-sufficient living spaces, enhancing the attractiveness of serviced apartments. The introduction of technological innovations, such as online booking systems and smart home technologies, further boosts market growth by streamlining customer interactions and enhancing operational functionality.

Furthermore, the growth of corporate housing options offered by large corporations is increasing the availability of serviced apartments, making them more accessible to a broader of the population. Together, these elements create a conducive environment for the global expansion of the serviced apartment industry, meeting the shifting demands of both leisure and business travelers.

Serviced Apartment Market Restaining Factors:

The serviced apartment sector faces significant challenges, including regulatory hurdles, variable demand influenced by economic fluctuations, and fierce competition from conventional hospitality providers.

The serviced apartment sector encounters various challenges that may impede its advancement. A primary issue is the stiff rivalry from conventional hotels and the rising appeal of vacation rental services such as Airbnb, which provide a range of accommodation options often at more competitive prices. Moreover, variations in travel demand, swayed by economic climates and global uncertainties—like pandemics or geopolitical conflicts—can detrimentally affect occupancy levels. Furthermore, regulatory hurdles, such as zoning restrictions and adherence to safety and quality regulations, can complicate new projects and affect ongoing operations. Elevated operational expenses, particularly related to utilities, maintenance, and staffing, can further strain profitability. Additionally, changing consumer inclinations, highlighting the importance of sustainability and eco-friendliness, require investment in sustainable practices that not all serviced apartment operators may implement readily. Nonetheless, the market demonstrates resilience, bolstered by urbanization and the growing trend of remote work, which increases the demand for adaptable living arrangements. The transition towards longer stays and the quest for a homelike setting in urban areas create a distinct opportunity for serviced apartments to evolve and prosper in this changing environment.

Segments of the Serviced Apartment Market

By Type

• Long-Term (>30 Nights)

• Short-Term (<30 Nights)

By Booking Mode

• Direct Booking

• Online Travel Agencies

• Corporate Contracts

By End User

• Corporate/Business Traveler

• Leisure Traveler

• Expats And Relocators

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America