Market Analysis and Insights:

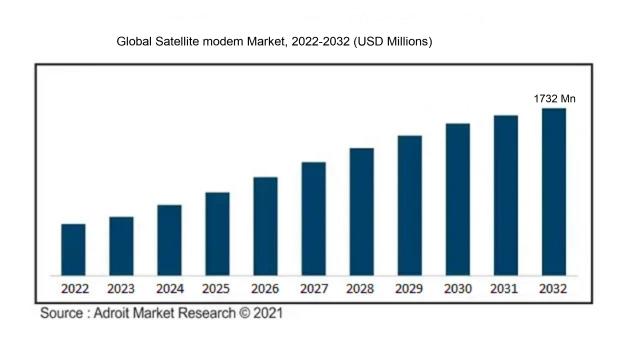

The market for Global Satellite modem was estimated to be worth USD 452 million in 2022, and from 2022 to 2032, it is anticipated to grow at a CAGR of 15.46%, with an expected value of USD 1732 million in 2032.

The growth and advancement of the satellite modem market are attributed to various factors. One significant driver is the escalating requirement for fast and reliable internet connectivity in remote regions where conventional terrestrial networks are insufficient. Satellite modems offer a practical solution in these locations, facilitating internet access and communication services.

Furthermore, the expansion of the aerospace sector, specifically satellite communication systems, is fueling the demand for satellite modems. The launch of multiple satellites for diverse purposes like communication, navigation, and weather prediction has ened the necessity for corresponding modems. The increasing popularity of satellite TV services and the augmented deployment of satellite networks by telecommunications and internet service providers also contribute to the market's expansion. Lastly, the continuous progress in satellite technology, encompassing the establishment of satellite constellations and the integration of advanced features in modems, acts as a catalyst for market growth. These driving forces offer opportunities for manufacturers and service providers in the satellite modem market.

Satellite modem Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 1732 million |

| Growth Rate | CAGR of 15.46% during 2022-2032 |

| Segment Covered | By Application, By End-user, By Technology, By Data Rate, By Channel Type, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ViaSat Inc., Gilat Satellite Networks Ltd., Hughes Network Systems LLC, Newtec Cy N.V., Comtech EF Data Corporation, iDirect Inc., Advantech Wireless, Datum Systems Inc., Novelsat, WORK Microwave GmbH, Comtech Telecommunications Corp., STM Group Inc., AVL Technologies Inc., Amplus Communication Pte. Ltd., |

Market Definition

A satellite modem serves as a crucial intermediary tool that facilitates communication between a terrestrial user on the ground and a satellite network by transforming the user's data into signals that can be exchanged through satellite connections. This technology is particularly valuable in enabling internet access in regions where conventional land-based networks are either inaccessible or constrained.

The significance of a satellite modem in modern times is unparalleled, as it serves as a vital tool in providing dependable and high-speed internet connectivity in regions where traditional terrestrial networks may not be accessible or dependable. By establishing a connection with a satellite orbiting in space, it ensures smooth and uninterrupted data transmission, facilitating communication and information access regardless of location. Particularly essential in remote areas, rural communities, maritime settings, and disaster-affected zones, satellite modems are crucial for enabling access to the internet in support of emergency services, education, business activities, and telemedicine. Moreover, their importance extends to industries like aviation, defense, and research, where seamless and effective data communication is indispensable. Ultimately, satellite modems play a key role in overcoming the digital divide, fostering global connectivity, and promoting enhanced communication, economic opportunities, and societal progress.

Key Market Segmentation:

Insights On Key Application

Enterprise & Broadband

The Enterprise & Broadband application is expected to dominate the Global Satellite modem Market. This is due to the increasing demand for high-speed internet connectivity in various industries such as banking, retail, healthcare, and education. Businesses are relying heavily on satellite modems to establish reliable and secure communication networks, enabling seamless data transfer and access to cloud-based applications. The Enterprise & Broadband part offers efficient and cost-effective solutions for enterprises to overcome connectivity challenges in remote areas and regions with limited terrestrial infrastructure. With advancements in satellite technology and the growing need for global connectivity, the Enterprise & Broadband part is projected to witness substantial growth in the satellite modem market.

Mobile & Backhaul

The Mobile & Backhaul application plays a crucial role in the Global Satellite modem Market. This part caters to the increasing demand for mobile connectivity, especially in rural and remote areas where traditional terrestrial networks are inaccessible or insufficient. Satellite modems are utilized for mobile backhaul applications, supporting the transmission of voice, data, and multimedia services for mobile networks. With the rising adoption of smartphones and tablets globally, the Mobile & Backhaul part is expected to witness considerable growth in the satellite modem market.

IP Trunking

The IP Trunking application also holds a significant share in the Global Satellite modem Market. IP trunking refers to the transmission of high-bandwidth data over satellite networks, primarily used for voice and video communication. This part caters to the needs of various industries, including telecommunications, government, and defense, where the demand for reliable and secure communication channels is paramount. Satellite modems enable efficient IP trunking services, ensuring seamless connectivity and data transmission. With the continuous growth in internet-based communication and the need for global connectivity, the IP Trunking part is poised to witness substantial growth in the satellite modem market.

Offshore Communication

The Offshore Communication application is an essential component of the Global Satellite modem Market. This part caters to the communication needs of offshore industries, such as oil & gas exploration and maritime operations. Satellite modems provide reliable and secure communication links, allowing seamless data transmission, voice calls, and video conferencing in remote offshore locations. With the increasing investments in offshore activities and the need for real-time communication, the Offshore Communication part is expected to experience significant growth in the satellite modem market.

Tracking & Monitoring

The Tracking & Monitoring application holds a considerable share in the Global Satellite modem Market. This part caters to the demand for satellite-based tracking and monitoring solutions for various applications, including asset tracking, fleet management, environmental monitoring, and wildlife tracking. Satellite modems enable real-time tracking and monitoring, providing accurate and reliable data for decision-making and operational efficiency. With the increasing need for global tracking solutions and the advancements in satellite technology, the Tracking & Monitoring part is projected to witness growth in the satellite modem market.

In-flight Connectivity

The In-flight Connectivity application is another important component of the Global Satellite modem Market. This part caters to the growing demand for seamless internet connectivity on board aircraft. Satellite modems play a crucial role in providing high-speed internet access to passengers and crew, enabling communication, entertainment, and productivity during flights. The In-flight Connectivity part has gained significant traction with the increasing airline passenger traffic and the rising expectation for internet services while traveling. With the continuous growth in the aviation industry and the need for enhanced passenger experiences, the In-flight Connectivity part is expected to witness growth in the satellite modem market.

Media & Broadcast

The Media & Broadcast application has its own share in the Global Satellite modem Market. This part caters to the transmission of audio, video, and data content over satellite networks, supporting broadcasting and media distribution services. Satellite modems ensure reliable and efficient data transmission, enabling global reach for media content providers and broadcasters. The Media & Broadcast part is expected to experience growth in the satellite modem market with the increasing demand for high-quality content delivery and the expansion of media and broadcasting industries.

Others

The Others category encompasses various applications that are not specifically mentioned in the mentioned categories. It may include niche applications, experimental projects, or emerging use cases that are still evolving. The contribution of the "Others" part to the Global Satellite modem Market can vary depending on the specific applications and market dynamics. It is essential to monitor the trends and developments within this part to identify potential growth opportunities in the satellite modem market.

Insights On Key End-user

Transportation & Logistics

Transportation & Logistics is expected to dominate the Global Satellite modem Market. Firstly, the transportation and logistics industry heavily relies on satellite communication for efficient management of their operations. Satellite modems play a critical role in providing reliable and secure communication for tracking and monitoring assets, managing supply chains, and ensuring real-time communication between different stakeholders. Additionally, the global expansion of e-commerce and the increasing need for real-time tracking and monitoring in the transportation and logistics sector further drives the demand for satellite modems. The growth of autonomous vehicles and drones in transportation and logistics also increases the demand for satellite modems for seamless communication and navigation. Therefore, with the significant dependence on satellite communication and the growing integration of advanced technologies, the Transportation & Logistics part is expected to dominate the Global Satellite modem Market.

Energy & Utilities

The Energy & Utilities end-user is another important player in the Global Satellite modem Market. In the energy sector, satellite modems are used for remote monitoring and control of oil and gas pipelines, power grids, wind farms, and other critical infrastructure. The utilities sector also relies on satellite communication for remote meter reading, automated metering infrastructure, and demand response management. These applications require reliable and secure communication, making satellite modems an essential component in the energy & utilities sector.

Mining

The mining industry also benefits from satellite modems for efficient communication in remote and harsh environments. Satellite modems enable real-time monitoring of mining operations, remote control of equipment, safety monitoring, and communication between mining sites and headquarters. The mining sector's need for reliable and continuous communication in areas with limited or no terrestrial network coverage makes satellite modems a crucial technology in this part.

Telecommunications

While the telecommunications industry is expected to play a significant role in the Global Satellite modem Market, it may not dominate due to competition from other s. Telecommunications companies utilize satellite modems for backhaul connectivity, extending their networks to rural or underserved areas, and for disaster recovery purposes. However, the growth of fiber-optic networks and terrestrial wireless technologies may reduce the reliance on satellite communication in this part.

Marine

The maritime industry heavily relies on satellite modems for various applications, including vessel tracking, data transmission, weather monitoring, and communication between ships and shore. However, the dominance of the Marine part in the Global Satellite modem Market may be limited due to its relatively smaller market size compared to other s.

Military & Defense

The Military & Defense end-user is an important user of satellite modems for secure and encrypted communication, remote sensing, surveillance, and intelligence gathering. While the military sector has a significant demand for satellite modems, it may not dominate the Global Satellite modem Market as it represents a specialized and regulated market .

Oil & Gas

The Oil & Gas industry heavily relies on satellite modems for remote monitoring and control of offshore platforms, pipelines, and real-time data transmission. However, the relatively smaller market size of the Oil & Gas part compared to Transportation & Logistics and Energy & Utilities may limit its dominance in the Global Satellite modem Market.

Others

The Others category represents various industries not specifically mentioned in the given options. While there may be specific applications for satellite modems in these industries, their overall market size and demand may be smaller, preventing them from dominating the Global Satellite modem Market.

Insights On Key Technology

Satcom-on-the-Move

Satcom-on-the-Move is expected to dominate the Global Satellite modem market. With the increasing demand for mobile and on-the-go connectivity, Satcom-on-the-Move technology offers seamless and reliable communication while in motion. It is specifically designed for applications such as maritime, aviation, and land vehicles, where continuous and uninterrupted connectivity is crucial. Satcom-on-the-Move allows users to stay connected even in remote areas or harsh environmental conditions. Its ability to provide high-speed data transfer, voice communication, video streaming, and real-time tracking makes it the most preferred choice for various industries. Satcom-on-the-Move has witnessed significant growth due to its extensive use in military and defense applications, emergency response systems, transportation, and logistics. With the continuous advancements in satellite communication technology, Satcom-on-the-Move is expected to dominate the Global Satellite modem market.

VSAT

VSAT (Very Small Aperture Terminal) is another significant sector within the Technology category. VSAT technology uses satellite communication for various applications such as broadband internet, voice communication, video conferencing, and remote monitoring. It offers connectivity solutions for both residential and commercial sectors, including banking, retail, education, and healthcare. Although VSAT has its importance and market share, it may not dominate the Global Satellite modem market as Satcom-on-the-Move offers more advanced features and wider applications in terms of mobility and connectivity.

Satcom-on-the-Pause

Satcom-on-the-Pause refers to satellite communication systems that are used when stationary or at specific locations. It is commonly used in remote areas, disaster management, temporary deployments, and remote offices where a reliable and efficient communication network is required. While Satcom-on-the-Pause has its significance in specific situations, it may not dominate the Global Satellite modem market as it is limited to stationary applications and lacks the versatility and mobility offered by Satcom-on-the-Move.

Satellite Telemetry

Satellite Telemetry is primarily used for collecting and transmitting data from remote locations to a central control or monitoring center. It plays a vital role in industries such as environmental monitoring, agriculture, weather observation, and scientific research. However, Satellite Telemetry is not expected to dominate the Global Satellite modem market as its primary focus is on data collection rather than providing widespread connectivity or communication services.

Satcom Automatic Identification System (AIS)

Satcom Automatic Identification System (AIS) is designed for maritime applications, providing real-time vessel tracking and communication. It enables ships to exchange critical identification, positioning, and navigational information, thereby enhancing safety and security at sea. While AIS is important for maritime operations, it is a specialized part and may not dominate the Global Satellite modem market due to its limited scope within the maritime industry.

Insights On Key Data Rate

High Speed

The High-Speed data rate is expected to dominate the Global Satellite modem market. This is primarily due to the increasing demand for high-speed data transmission and communication in various sectors such as aerospace, defense, and telecommunications. High-speed satellite modems provide rapid data transfer rates, ensuring efficient and seamless communication across long distances. With technological advancements and the growing need for high-bandwidth applications, such as video streaming and cloud computing, the demand for high-speed satellite modems is anticipated to be the highest compared to other parts within the By Data Rate category.

Mid Range

The Mid-Range player within the Data Rate category is expected to witness significant growth in the Global Satellite modem market. This part caters to the demand for moderate data transmission speeds, which is relevant in applications such as maritime communication, remote monitoring, and disaster management. The mid-range satellite modems strike a balance between data rate and affordability, making them suitable for various industries and organizations with medium-scale communication requirements.

Entry Level

While the High-Speed and Mid-Range data rates are expected to dominate the Global Satellite modem market, the Entry Level data rate also holds its significance. This part caters to the needs of budget-conscious customers or those with minimal data transmission requirements. Entry-level satellite modems are suitable for applications such as personal use, small businesses, and rural connectivity. Although the demand for entry-level satellite modems may not be as high as the other parts, it plays a vital role in ensuring accessibility to satellite communication technology for a wider range of users.

Insights On Key Channel Type

SCPC Modem

The SCPC (Single Channel Per Carrier) Modem channel type is expected to dominate the Global Satellite modem Market. SCPC modems provide a dedicated channel for each user, ensuring a consistent, reliable connection. This makes them an ideal choice for applications that require high throughput and low latency, such as video streaming, teleconferencing, and data-intensive communication. With the increasing demand for seamless connectivity and the growing adoption of bandwidth-intensive applications, the SCPC Modem part is poised to dominate the Global Satellite modem Market.

MCPC Modem

While the SCPC Modem channel type is expected to dominate the Global Satellite modem Market, the MCPC (Multiple Channels Per Carrier) Modem channel type also holds a significant market share. MCPC modems enable multiple users to share a carrier frequency, which optimizes bandwidth utilization and reduces overall costs. This makes MCPC modems suitable for applications that require moderate throughput and support a larger number of users, such as enterprise networks, voice communication, and internet access for remote locations. Although not expected to dominate the market, the MCPC Modem part remains an important choice for various applications.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Satellite modem market. This region has a strong emphasis on technological advancements and innovation, which has propelled the demand for satellite modems. Additionally, Europe is home to several established satellite communication companies and has a well-developed infrastructure in terms of satellite networks and communication systems. The region also benefits from a strong government support for the aerospace and defense industries, further contributing to the growth of the satellite modem market in Europe. With the increasing adoption of satellite-based services across various sectors such as telecommunications, media and entertainment, and aviation, Europe is poised to maintain its dominance in the global satellite modem market.

North America

North America is a significant player in the global satellite modem market. The region has a highly developed telecommunications infrastructure, along with a strong presence of satellite communication providers and technology companies. The demand for satellite modems in North America is driven by various factors, including the need for reliable communication in remote areas, disaster management applications, and the growing use of satellite-based services in sectors such as defense, telecommunication, and broadcasting. With ongoing advancements in satellite technology and increasing investments in the aerospace industry, North America is expected to maintain a significant market share in the global satellite modem market.

Asia Pacific

Asia Pacific is a rapidly growing market for satellite modems. The region is witnessing a surge in demand due to increasing investments in telecommunications infrastructure, growing adoption of satellite-based services in rural and remote areas, and expanding applications in sectors such as defense, transportation, and maritime. Additionally, countries like China, India, and Japan are major contributors to the growth of the satellite modem market in Asia Pacific, driven by their focus on space exploration and satellite communication technologies. With favorable government initiatives and increasing consumer demand for high-speed internet connectivity, Asia Pacific is set to become a dominant market for satellite modems in the near future.

Latin America

Latin America is also experiencing significant growth in the satellite modem market. The region is characterized by a vast and sparsely populated area, which makes satellite communication an efficient solution for providing connectivity to remote and underserved regions. Furthermore, the increasing adoption of satellite TV services and the need for reliable communication in sectors such as agriculture, oil and gas, and mining are driving the demand for satellite modems in Latin America. With the advancement of satellite technology and the ongoing efforts to bridge the digital divide, Latin America is expected to witness substantial growth in the satellite modem market.

Middle East & Africa

The Middle East & Africa region is also showing promising growth in the satellite modem market. The region has a significant rural population and vast areas without proper terrestrial communication infrastructure, making satellite communication a viable solution. Moreover, the Middle East & Africa region has witnessed increasing investments in satellite communication infrastructure, driven by the need for reliable connectivity and expanding applications in sectors such as oil and gas, maritime, and defense. With the growing demand for satellite-based services and advancements in satellite technology, the Middle East & Africa region is expected to contribute significantly to the global satellite modem market.

Company Profiles:

Major participants in the Global Satellite Modem industry are essential for fostering creativity and progress in technology, in addition to delivering top-notch products and services to address the growing need for dependable and effective satellite communication options. This group comprises significant firms like Hughes Network Systems, ViaSat Inc., Gilat Satellite Networks, Newtec, and Comtech EF Data.

Prominent companies in the satellite modem industry include ViaSat Inc., Gilat Satellite Networks Ltd., Hughes Network Systems LLC, Newtec Cy N.V., Comtech EF Data Corporation, iDirect Inc., Advantech Wireless, Datum Systems Inc., Novelsat, WORK Microwave GmbH, Comtech Telecommunications Corp., STM Group Inc., AVL Technologies Inc., Amplus Communication Pte. Ltd., and Teledyne Paradise Datacom. These organizations are leading the way in the advancement and provision of satellite modem technologies for a diverse range of applications, including broadband access, video streaming, telecommunications, and military and defense sectors. They are continually engaged in pioneering efforts to address the escalating requirements for enhanced data rates, dependability, and efficiency in satellite communication systems.

COVID-19 Impact and Market Status:

The worldwide satellite modem industry has experienced effects from the Covid-19 pandemic, causing a temporary deceleration in production and disturbances in the supply chain. However, a gradual recovery is anticipated, driven by the rising need for satellite communication services.

The global satellite modem market has experienced significant impacts as a result of the COVID-19 pandemic. The increased demand for satellite internet services due to remote work and learning has been counteracted by disruptions in global supply chains and manufacturing processes, leading to constraints in production and distribution. Government lockdown measures and travel restrictions have further impeded the installation and maintenance of satellite networks, resulting in delays in service provision and customer onboarding. Additionally, the economic downturn stemming from the pandemic has prompted budget cuts among businesses and individuals, impacting their ability to invest in costly satellite internet options. However, the rise of remote work and distance learning has underscored the necessity for reliable high-speed internet access in remote regions, where satellite modems play a pivotal role. Consequently, the market is witnessing a spike in demand for satellite modems, particularly in areas with limited terrestrial connectivity options. Despite the challenges posed by the pandemic, it has also spurred opportunities for expansion and innovation in remote connectivity solutions within the satellite modem market.

Latest Trends and Innovation:

- In June 2020, Gilat Satellite Networks Ltd. announced that they had acquired the satellite modem technology developed by Wavestream Corporation.

- In January 2021, ViaSat Inc. announced the launch of their new Ka-band satellite modem, the ViaSat-3, which will offer increased capacity and performance for high-speed internet services.

- In November 2021, iDirect Government Technologies (iGT) announced a collaboration with Isotropic Systems Ltd. to integrate their next-generation multi-beam antenna technology with iGT's satellite modem solutions.

- In March 2022, Comtech Telecommunications Corp. announced the acquisition of UHP Networks Inc., a leading provider of satellite modem and RF equipment, to strengthen their position in the satellite communications market.

- In May 2022, Hughes Network Systems, LLC announced the release of their new JUPITER Aero System, which includes their latest generation of satellite modems for in-flight connectivity services.

- In August 2022, ST Engineering iDirect, Inc. announced the successful testing of their X7-EC satellite modem, which demonstrated enhanced performance and compatibility with emerging satellite technologies.

Significant Growth Factors:

Factors propelling the expansion of the satellite modem industry consist of the growing need for high-speed internet access in isolated regions and the increasing utilization of satellite communication solutions in defense and governmental sectors.

The market for satellite modems is experiencing a notable surge propelled by various factors. Primarily, the escalating need for high-speed internet connectivity in remote regions and emerging markets is spurring the utilization of satellite modems. These devices facilitate dependable and effective broadband access in locations with limited or absent terrestrial infrastructure.

Moreover, the increasing utilization of satellite communication in diverse sectors such as maritime, aviation, military, and disaster management is propelling market expansion. Technological advancements in satellites, including the introduction of high-throughput satellites (HTS), have augmented data transfer speeds and communication capabilities, further stimulating market growth. Additionally, the rising demand for satellite-based IoT services like asset tracking and remote monitoring is contributing to market expansion. The industry's growth, alongside the expanding deployment of satellite constellations, is expected to drive the demand for satellite modems. Notably, challenges such as high initial investments and the necessity for skilled professionals may impede market progress. Nonetheless, the rising adoption of satellite modems in industries such as telecommunications, agriculture, and oil and gas exploration presents lucrative growth avenues for market participants. In conclusion, the satellite modem market is poised for significant growth due to the increasing demand for reliable connectivity and the expanding satellite communication sector.

Restraining Factors:

Constraints on satellite bandwidth availability and the formidable expenses linked with satellite modems continue to pose as major impediments for the satellite modem sector.

The market for satellite modems has experienced substantial growth in recent years, though several factors pose constraints on further expansion. A key challenge is the elevated cost of satellite internet services, limiting accessibility for a considerable portion of the population. Moreover, the intricate installation procedures and technical prerequisites serve as deterrents for many potential users. Additionally, the restricted bandwidth capabilities of satellite connections and relatively slower internet speeds in comparison to conventional broadband options impede the broad adoption of satellite modems. Another concern is the susceptibility of satellite signals to atmospheric conditions like rain or snow, leading to interruptions and impacting overall connectivity. Despite these obstacles, there is optimism within the market. Ongoing technological advancements, such as the emergence of high-throughput satellites and enhanced signal processing methods, are poised to mitigate some of these challenges in the foreseeable future. Furthermore, the rising need for dependable internet access in remote areas, disaster-affected regions, and maritime settings presents significant growth opportunities for the satellite modem market. Through sustained innovation and deployment of cost-efficient solutions, the market exhibits promising potential for expansion and improved connectivity across diverse sectors and regions.

Key Segments of the Satellite Modem Market

Application Overview

• Mobile & Backhaul

• IP Trunking

• Offshore Communication

• Tracking & Monitoring

• Enterprise & Broadband

• In-flight Connectivity

• Media & Broadcast

• Others

End-User Overview

• Energy & Utilities

• Mining

• Telecommunications

• Marine

• Military & Defense

• Transportation & Logistics

• Oil & Gas

• Others

Technology Overview

• VSAT

• Satcom-on-the-Move

• Satcom-on-the-Pause

• Satellite Telemetry

• Satcom Automatic Identification System (AIS)

Data Rate Overview

• High Speed

• Mid Range

• Entry Level

Channel Type Overview

• SCPC Modem

• MCPC Modem

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America