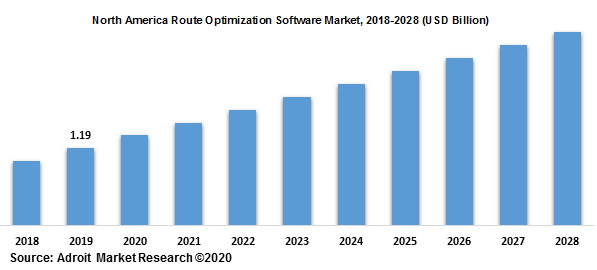

The global Route Optimization market is anticipated to increase at a 11.56% CAGR to reach value USD 12,416 million in 2030

.jpg)

Route Optimization Software demand has been increased in the last few years due to an increase in the demand for online delivery service across regions and with the ongoing pandemic situation, the software is been extensively used by vendors to supply the products and service to customers

Route Optimization Software is majorly used by startups as they are offering various services such as last mile delivery and crowd delivery solutions. These solutions are highly scalable and can cater to changing customer requirements The software helps in optimizing the journey and planning it so that the cost and time of the delivery are saved. With the rising delivery services through FMCG, online food delivery, robo Taxi services, the demand for the software has increased extensively across the APAC region.

Route Optimization Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 12,416 million |

| Growth Rate | CAGR of 11.56 % during 2020-2030 |

| Segment Covered | By Enterprise, By Deployment, Region |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Bringg, Caliper Corporation, FarEye, FASTLEANSMART, AMCS Group, Jungleworks, LogiNext Mile, Mara Labs, Inc (Locus), Maxoptra – Magenta, Omnitracs |

Segment Overview of Global Route Optimization Software Market

Component Overview (USD Million)

- Solution

- Service

- Consulting

- Support & Maintenance

Deployment Overview, (USD Million)

- Cloud

- On-Premises

Vertical Overview, (USD Million)

- On-Demand Food Delivery

- Retail and FMCG

- Field Services

- Ride-Hailing & Taxi Services

- Others

Organization Size Overview, (USD Million)

- SME’s

- Large Enterprises

Regional Overview, (USD Million)

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Middle East and Africa

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of Latin America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global workplace market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the Global Route Optimization Software Market market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the Global Route Optimization Software Market market and their strategic initiatives for the Component development

- The study covers a qualitative and quantitative analysis of the market segmented based on Softwares, Organization Size, and vertical. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the Global Route Optimization Software Market market. The report will benefit:

- Every stakeholder is involved in the Global Route Optimization Software Market market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the Global Route Optimization Software Market market.

- Government Enterprises, regulatory authorities, policymakers, and Enterprises looking for investments in trends of the Global Route Optimization Software Market market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

With the use of real-time data and improving the transport planning process, the software has been used by various merchants for effective delivery and for reduced time and cost. Various vendors are enhancing the routing and scheduling software which interacts with the vehicle tracking system. With the rising hardware and cost of connectivity, the market is going to boost in industries catering to food delivery or taxi services as the demand for on-demand food delivery has increased.

Component Segment

Based on Component, the Route Optimization Software market has been segmented into the Solution and Services. The software segment will hold the largest market size in the forecast period due to increasing traffic congestion in delivery systems.

Deployment Segment

The on-premises deployment model will hold the largest market size in 2019 with the increasing demand for customized software that can control data traffic.

Vertical Segment

The Route Optimization Software market based on End-user has been segmented into Retail and FMCG, On-Demand Food Delivery, Transportation & Logistics, Filed Services, Ride-Hailing, and Taxi others. The retail and FMCG sector will hold the largest market size due to reduced cost and time used in this software

Organization Size Segment

Based on the Organization Size segment, the market is divided into SME’s and Large enterprises. SME’s will hold the largest market size due to rising startups suing the software for delivery of services

The global Route Optimization Software market has been segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. APAC will have the largest market size due to the adoption of these technologies in various countries

The major players of Route Optimization Software are Nokia, Ericson, Huawei, ZTE, HPE, Samsung, and other players in the market.