Ride-Hailing Services Market Analysis and Insights:

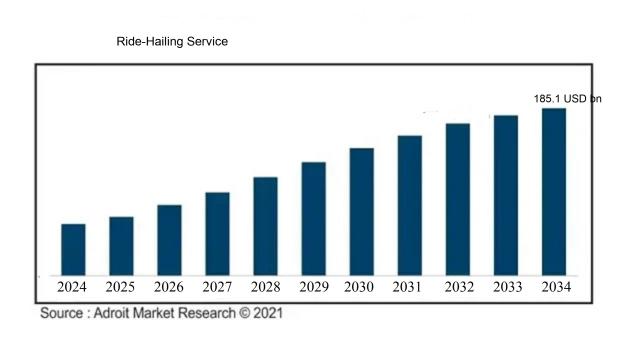

The market for Global Ride-Hailing Services was estimated to be worth USD 47.3 billion in 2024, and from 2025 to 2034, it is anticipated to grow at a CAGR of 16.6%, with an expected value of USD 185.1 billion in 2034.

The market for ride-hailing Services is significantly influenced by various factors, chiefly the widespread adoption of smartphones and mobile applications, which streamline the process of booking rides for users. As urban areas expand and population density increases, there is a greater demand for accessible transportation alternatives, as conventional taxi Services may fall short in meeting contemporary commuter needs. Additionally, a rise in environmental consciousness among consumers is steering them towards ride-sharing options that minimize the use of personal vehicles, thereby enhancing sustainability. The integration of cutting-edge technologies, such as GPS and artificial intelligence, not only improves Services efficiency but also allows for real-time tracking and better route planning. Moreover, competitive pricing strategies and promotions employed by numerous ride-hailing platforms attract a more extensive customer demographic. The ongoing pandemic has also led to a shift in consumer preferences towards contactless transportation solutions, further enhancing the attractiveness of ride-hailing Services. Collectively, these elements play a crucial role in shaping the growth trajectory and dynamic nature of the market.

Ride-Hailing Services Market Definition

A ride-hailing platform is a transportation system that links riders with drivers via a mobile application, enabling users to request rides as needed. This Services usually functions through a digital interface that streamlines the processes of booking, payment, and guiding drivers to their destinations.

Ride-hailing platforms are essential in contemporary transport systems, offering convenient, efficient, and dependable options that surpass traditional taxi Services. They significantly improve mobility, particularly in city environments where owning a vehicle might not be feasible. These platforms allow for swift transportation access, minimizing wait periods and enabling users to request rides effortlessly via mobile applications. Moreover, ride-hailing Services help mitigate traffic congestion and decrease pollution levels by encouraging ride-sharing. The technological advancements inherent in these Services also enhance safety and provide clear pricing, which is advantageous for both passengers and drivers. In summary, these Services greatly enhance accessibility and convenience within urban transportation frameworks.

Ride-Hailing Services Market Segmental Analysis:

Insights On Vehicle Type

Four-wheeler

The Four-wheeler category is expected to dominate the Global Ride-Hailing Services Market. This is primarily due to the increased demand for convenience, safety, and comfort associated with four-wheeled vehicles. Consumers often prefer cars for longer distances, especially in urban areas where public transport may not be as reliable. Additionally, many ride-hailing companies have been heavily investing in expanding their fleet of cars to cater to a larger customer base. The capability of four-wheelers to accommodate more passengers and luggage also plays a crucial role in their preference for business and family travel, making them a favorable option in the ride-hailing sector.

Two-wheeler

The Two-wheeler category holds significant potential mainly in densely populated urban environments where traffic congestion is high. Riders often choose two-wheelers for their capacity to navigate through narrow streets and avoid traffic bottlenecks. Moreover, the operational costs for two-wheeled vehicles are lower compared to four-wheelers, which can attract budget-conscious consumers. Countries with substantial motorcycle cultures, such as India and Southeast Asian nations, have witnessed considerable growth in this. This trend reflects consumer preferences for faster and often more economical transport options in congested areas.

Three-wheeler

The Three-wheeler category offers a unique blend of affordability and maneuverability, making it a popular choice in several regions, particularly in developing countries. Services like auto-rickshaws cater to the needs of short-distance travel, providing a cost-effective means of transportation. Additionally, this category can accommodate a moderate number of passengers, appealing to smaller groups or families. The continued urbanization in many regions enhances the reliance on three-wheelers, promoting growth in this as it fills a specific niche in the ride-hailing market.

Others

The Others category encompasses specialized vehicles, such as vans and luxury cars, catering to distinct markets. While it does not hold the same market share as the leading s, it caters to specific customer needs, including premium Services for executive travel or larger groups requiring transportation. This category capitalizes on niches such as corporate transport or special events, leveraging higher fares for additional comfort and space. With the rise in targeted marketing strategies, this is gradually carving its own space within the ride-hailing ecosystem, driven by customer demand for diverse and flexible Services.

Insights On Services Type

E-hailing

E-hailing is poised to dominate the Global Ride-Hailing Services Market due to its rising popularity and convenience among customers. With advancements in mobile technology and the proliferation of smartphones, users can easily book rides with just a few taps on their screens. The preference for on-demand transportation solutions is increasing as urbanization and travel complexities grow, thereby driving demand. Major players like Uber and Lyft have established significant market shares and continue to innovate their Services, making e-hailing the most sought-after option in the ride-hailing landscape. Additionally, the ease of cashless payments and real-time tracking enhances user experience, positioning e-hailing as the leading Services type.

Car Sharing

Car sharing offers a flexible alternative to traditional vehicle ownership by enabling users to access a car for a short period. This Services appeals mainly to urban dwellers who prefer not to incur the costs and responsibilities of car ownership. With sustainability becoming increasingly important, many consumers are drawn to car sharing as it promotes more efficient use of resources and reduces traffic congestion. The growth in car sharing platforms provides users with diverse options and pricing plans, catering to an environmentally conscious audience, thus making it a notable player in the ride-hailing landscape, albeit smaller compared to e-hailing.

Car Rental

Car rental Services, while often used for longer trips and special occasions, are witnessing a slight decline in preference due to the rise of flexible ride-hailing options. This Services mainly appeals to travelers and those in need of vehicles for an extended period. However, the traditional image of car rental companies and the procedural complexities involved may deter some users. Still, established companies continue to innovate their offerings and integrate technology to streamline the rental process, making it accessible and efficient, which keeps car rental as a relevant option within the broader ride-hailing market.

Others

The "Others" category encompasses various emerging ride-hailing Services that do not neatly fit into the primary classifications. This includes Services like shuttle rides, bike-sharing, and micro-mobility solutions such as electric scooters. While these alternatives have their appeal, particularly in densely populated areas and for short-distance travel, they currently hold a smaller market share compared to the more established e-hailing, car sharing, and car rental Services. Nonetheless, as urban transportation ecosystems evolve, these innovative options might see increased adoption and integration within the global transportation framework.

Insights On Payment Method

Online Payment Method

The Online payment method is expected to dominate the Global Ride-Hailing Services Market due to the increasing integration of technology and digital payment solutions in everyday transactions. Consumers today prefer convenience and security when it comes to payments, which online methods provide. The growth of mobile wallet applications, ease of use, and the popularity of contactless transactions further drive this trend. Additionally, many ride-hailing companies are actively promoting online payments to streamline operations and improve user experience, making it the preferred choice among customers. As technology advances, the shift toward online payments in ride-hailing Services is set to gain momentum, solidifying its dominance in the market.

Cash Payment Method

The Cash payment method remains a traditional choice for many riders, especially in regions where digital literacy is low or banking infrastructure is limited. This mode of payment provides a sense of security for users who prefer to avoid sharing personal financial information online. Despite its declining popularity, cash is still favored in various markets due to the cultural acceptance of cash transactions and the lack of access to digital payment methods in rural areas. Ride-hailing Services continue to accommodate cash payments to cater to a broader audience, ensuring no customer feels alienated based on their payment preferences.

Insights On Location

Urban

The Urban area is expected to dominate the Global Ride-Hailing Services Market due to the high population density and the increasing trend of urbanization. Cities typically have a higher number of potential users looking for convenient and quick transportation options. The reliance on public transit and parking challenges further incentivizes urban residents to opt for ride-hailing Services. Additionally, urban areas generally have more developed infrastructure and technology adoption, making ride-hailing Services more accessible and efficient. The presence of major ride-hailing companies in cities reinforces competition and innovation, driving further growth in this.

Rural

The Rural area represents a smaller of the Ride-Hailing Services Market, as these regions typically have lower population densities and fewer transportation options. The demand for ride-hailing Services in rural areas can be limited due to longer distances between pickup points and destinations, which may not be economically viable for Services providers to operate. However, as digital connectivity improves and more individuals in rural areas adopt smart technologies, there is potential for growth. Innovations in transportation solutions tailored to rural needs could lead to an increase in Services adoption, albeit slowly.

Insights On End User

Commercial

The commercial category in the Global Ride-Hailing Services Market is expected to dominate primarily due to the increasing demand from businesses looking for efficient transportation for employees and customers. Companies are increasingly realizing the cost-effectiveness and convenience offered by ride-hailing Services over traditional taxi Services or maintaining a fleet. Additionally, corporate partnerships between ride-hailing platforms and various industries, including hospitality and events, are on the rise, further driving growth in this area. The emergence of surge pricing, corporate discounts, and dedicated Services for events enhances the attractiveness for businesses, solidifying commercial use as the leading end-user in the market.

Personal

The personal category represents a significant portion of the ride-hailing market. This encompasses individuals using platforms for daily commutes, social outings, or convenience. The rise in smartphone usage and user-friendly apps has made accessing these Services easier, thereby boosting demand. Despite not being the dominant area, personal use remains vital with a large user base leveraging ride-hailing Services for their routine travel needs.

Global Ride-Hailing Services Market Regional Insights:

Asia Pacific

Asia Pacific is anticipated to dominate the Global Ride-Hailing Services market due to various factors such as a rapidly growing urban population, the increasing adoption of smartphones, and advanced technological infrastructure. The rising demand for convenient transportation options, coupled with the presence of major ride-hailing players like Didi Chuxing, Grab, and Ola, has significantly contributed to this region's market strength. Moreover, supportive government policies and initiatives to boost digital mobility options enhance market penetration. Additionally, the burgeoning middle class in cities like Beijing and Mumbai drives demand for affordable and reliable ride-hailing Services, solidifying Asia Pacific’s leading position in this sector.

North America

North America is a significant player in the Global Ride-Hailing Services market, driven primarily by the United States, which has one of the largest consumer bases for ride-hailing platforms. The region is home to major companies such as Uber and Lyft, which have established strong brand recognition and extensive networks. The convenience offered by these Services, combined with evolving consumer preferences toward shared mobility options, contributes to the steady growth of the market in this area. However, regulatory challenges in different states may influence future growth trajectories.

Europe

Europe has been experiencing a notable increase in ride-hailing Services, especially in major urban centers like London, Paris, and Berlin. The demand for efficient, eco-friendly, and alternative transportation solutions has surged, driven by urbanization and environmental concerns. Companies operating in this market are often required to comply with strict regulations, which can affect their strategies and growth. Nevertheless, the emphasis on sustainability and shared mobility aligns well with current trends, making Europe a vital but more regulated market compared to its counterparts.

Latin America

Latin America has shown potential for growth in the ride-hailing Services sector, primarily due to its expanding middle class and urban congestion in cities like São Paulo and Mexico City. Local ride-hailing Services are beginning to flourish, alongside foreign entrants. However, issues such as regulatory challenges, safety concerns, and competition from traditional taxi Services may pose hurdles. Despite these challenges, consumer demand for on-demand transport solutions is rising, which presents opportunities for further development and market penetration.

Middle East & Africa

The Middle East & Africa region presents a nascent yet rapidly evolving ride-hailing market, characterized by increasing smartphone penetration and urbanization. Major cities like Dubai and Johannesburg are seeing a growing interest in ride-hailing Services, as they serve as essential alternatives to traditional transportation. However, infrastructure challenges, market fragmentation, and differing regulatory frameworks can hinder growth. Nonetheless, the potential for innovation and investment in tech solutions offers a glimpse of future opportunities in this developing market.

Ride-Hailing Services Competitive Landscape:

Major contributors to the worldwide ride-hailing industry, including Uber, Lyft, and Didi, foster innovation and competitive dynamics by delivering user-focused mobile applications, optimizing routing systems, and offering a wide range of Services. Furthermore, they shape market trends through collaborations, involvement in regulatory discussions, and the progression of self-driving vehicle technologies.

The prominent entities in the ride-hailing industry encompass Uber Technologies, Inc., Lyft, Inc., Didi Chuxing Technology Co., Grab Holdings Inc., Ola Cabs, and Bolt (previously Taxify), alongside Gett, BlaBlaCar, Careem, Yandex.Taxi, Gojek, Free Now (formerly MyTaxi), and SingaRide. Furthermore, additional significant players include Via, Curb, Z?m, and Wingz. This assortment reflects a blend of international leaders and local contenders within the dynamic realm of ride-hailing Services.

Global Ride-Hailing Services COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the worldwide ride-hailing industry, resulting in a substantial drop in passenger numbers and a transition towards Services that prioritize contactless interactions and enhanced hygiene measures.

The COVID-19 pandemic brought about significant changes to the ride-hailing industry, triggering an abrupt decline in ridership as a result of lockdowns and social distancing initiatives. As remote work became the norm and travel decreased, many Services providers experienced substantial revenue losses. In response, these platforms began to diversify their offerings, branching out into areas like food delivery and grocery transportation. Additionally, to address safety concerns and rebuild consumer confidence, companies introduced health protocols, including screenings for drivers and riders, rigorous sanitation practices, and contactless payment options. With the gradual lifting of restrictions, the sector began to recover, highlighting a growing emphasis on electric vehicles and sustainable practices, reflecting shifting consumer demands for greener alternatives. In essence, although the ride-hailing market encountered formidable obstacles, it also demonstrated resilience and creativity in adapting to the crisis, paving the way for enduring shifts in consumer behavior and industry dynamics.

Latest Trends and Innovation in The Global Ride-Hailing Services Market:

- In April 2023, Uber Technologies announced its acquisition of Autocab, a UK-based private hire booking software platform, which expanded Uber's footprint in the traditional taxi market and strengthened its position in local ride-hailing Services.

- In March 2023, Lyft introduced a new feature called “Lyft Cash,” allowing riders to top up their accounts through various methods, including debit cards and PayPal, in an effort to enhance user experience and drive customer loyalty.

- In May 2023, Bolt expanded its Services into Denver, Colorado, marking its entry into the U.S. market, thereby intensifying competition with established players like Uber and Lyft.

- In July 2023, Grab Holdings announced a partnership with Singtel to launch GrabPay in Singapore, enabling users to access a wider range of payment options while also integrating additional Services such as food delivery and online shopping.

- In June 2023, Didi Global expanded its operations in Brazil, launching a new Services aimed at rural areas to provide more accessible ride-hailing options in underserved regions.

- In September 2023, Wingcopter raised $42 million in funding to further develop its drone delivery technology, which is anticipated to enhance last-mile delivery Services, a complementary offering for ride-hailing companies exploring logistics solutions.

- In January 2023, Ola Electric announced a partnership with the ride-hailing Services Ola to introduce electric vehicle (EV) rentals, emphasizing sustainability and aiming to reduce carbon emissions associated with transportation.

- In February 2023, Free Now debuted a carpooling feature in its app, seeking to reduce traffic congestion and provide more cost-effective options for commuters in major European cities.

Ride-Hailing Services Market Growth Factors:

Significant drivers of growth in the ride-hailing Services sector encompass the ongoing trend of urbanization, the growing prevalence of smartphones, and a transition towards more accessible and economical transportation solutions.

The ride-hailing Services sector is witnessing remarkable expansion driven by a set of interconnected dynamics. Primarily, rising urbanization and increasing population densities in metropolitan areas have sparked a ened demand for accessible and efficient transport solutions, making ride-hailing an attractive option for everyday travel. Moreover, advancements in mobile technology, along with the widespread adoption of smartphones, have simplified access to ride-hailing applications, enhancing the overall user experience. The shift towards adaptable transportation methods, spurred by the gig economy, has led many consumers to favor ride-hailing over conventional taxi Services.

In addition, there is a growing awareness of environmental concerns that has amplified interest in ridesharing as a means to alleviate traffic congestion and reduce carbon emissions. Collaborations with public transit authorities and the seamless integration of ride-hailing Services into existing transport frameworks further improve accessibility and convenience for users. Lastly, technological innovations such as electric and autonomous vehicles are poised to transform the market, providing greener and more efficient options that cater to a diverse array of users. Together, these elements create a vibrant landscape for development within the ride-hailing industry, positioning it for continued growth in the years ahead.

Ride-Hailing Services Market Restaining Factors:

The ride-hailing Services industry faces several significant obstacles, such as regulatory constraints, a crowded marketplace, a lack of available drivers, and issues related to safety.

The ride-hailing industry is currently confronting various challenges that may hinder its expansion. One of the most prominent obstacles is the array of regulatory requirements imposed by different regions, which often leads to complex legal disputes and delays in operations. The level of competition in the sector is intense, with a multitude of companies competing for a share of the market, resulting in aggressive pricing strategies that can diminish profitability. Moreover, safety issues persist, as incidents involving both drivers and passengers may discourage potential users from utilizing ride-hailing Services.

Technological difficulties also pose significant barriers, including app performance, cybersecurity vulnerabilities, and the imperative for ongoing innovation to enhance the user experience. Additionally, fluctuations in fuel prices and economic instability can alter consumer spending patterns, potentially reducing the demand for ride-hailing options. The presence of alternative public transportation in urban settings further complicates factors, often attracting value-sensitive consumers.

Nevertheless, the ride-hailing sector holds promise for growth, fueled by advancements in technology and increasing urbanization, which offer improved mobility solutions. By embracing adaptation and innovation, the industry can work to mitigate these challenges, fostering a more resilient and sustainable market framework moving forward.

Key Segments of the Ride-Hailing Services Market

By Vehicle Type

• Two-wheeler

• Three-wheeler

• Four-wheeler

• Others

By Services Type

• E-hailing

• Car Sharing

• Car Rental

• Others

By Payment Method

• Online

• Cash

By Location

• Urban

• Rural

By End User

• Personal

• Commercial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America