Market Analysis and Insights:

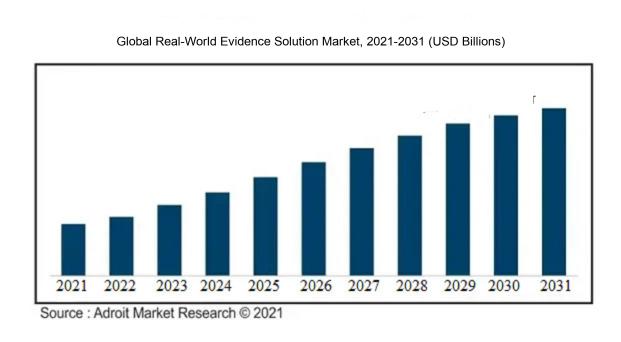

The market for Global Real-World Evidence Solution was estimated to be worth USD XX billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of XX%, with an expected value of USD XX billion in 2031.

The market for Real-World Evidence (RWE) solutions is witnessing significant growth propelled by various factors. The demand for personalized medicine is a key driver as it necessitates insights into treatment effectiveness and safety for specific patient groups, thus boosting the adoption of RWE solutions.

Additionally, the increasing prevalence of chronic diseases and the escalating healthcare system challenges are contributing to the uptake of RWE solutions to enhance treatment decisions and patient outcomes. Regulatory bodies are acknowledging the value of real-world data in clinical decision-making, advocating for the integration of RWE solutions alongside traditional clinical trials. Furthermore, technological progress, particularly in electronic health records and data analytics, enables the extensive collection and analysis of real-world data, further fostering market expansion. In summary, the confluence of personalized medicine demand, healthcare system pressures, regulatory endorsement, and technological advancements is expected to sustain the growth trajectory of the Real-World Evidence Solution Market.

Real-World Evidence Solution Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD XX billion |

| Growth Rate | CAGR of XX% during 2021-2031 |

| Segment Covered | By Components, By Application, By Mode of Deployment, By Revenue Model, By End-Use, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | IQVIA Holdings Inc., ICON plc, Clinigen Group plc, Optum, Inc., Cognizant, IMS Health, Oracle Corporation, PAREXEL International Corporation, and McKesson Corporation. |

Market Definition

An authentic Real-World Evidence (RWE) system encompasses a thorough strategy enabling the gathering and examination of information from real-life environments to produce valuable insights and evidence regarding healthcare treatments and results. This method utilizes current data reservoirs like electronic health records, claims, and patient registries to offer a comprehensive perspective on the efficiency and safety of treatments in actual practice settings.

The Real-World Evidence (RWE) solution holds significant importance for various reasons. It offers valuable insights into the real-world safety and efficacy of medical interventions, complementing the results of clinical trials carried out under controlled conditions. RWE serves to bridge the gap between research trials and actual clinical practice, enabling healthcare professionals to make well-informed decisions regarding patient care.

Furthermore, RWE plays a vital role in assessing the long-term effectiveness and cost-efficiency of treatments, thus contributing to the allocation of healthcare resources and the formulation of policies. Moreover, it aids in identifying real-world treatment trends and patient outcomes, which in turn supports the advancement of personalized medicine and targeted therapies. The integration of RWE into healthcare systems elevates patient-centered care and promotes the practice of evidence-based medicine.

Key Market Segmentation:

Insights On Key Components

Data sets

Data sets are expected to dominate the Global Real-World Evidence Solution market. Real-world evidence (RWE) requires a diverse range of data sets to generate meaningful insights and support evidence-based decision-making. These data sets include electronic health records, claims data, patient registries, and other sources of real-world patient data. As RWE continues to gain importance in healthcare research and decision-making, the demand for comprehensive and diverse data sets is expected to increase. Data sets provide the foundation for analyzing patient outcomes, treatment effectiveness, and safety in real-world settings, making them a crucial component in driving evidence-based solutions.

Services

Services also play a critical role in the Global Real-World Evidence Solution market, as they encompass the expertise and support required to effectively utilize and analyze data sets. Service providers offer a wide range of services, including study design, data collection, analytics, and interpretation. These services enable organizations to leverage real-world data to generate valuable insights and inform healthcare decision-making. While services are essential in maximizing the potential of real-world evidence, they are expected to have less dominance compared to data sets, as the availability and quality of data sets remain the primary determinant of success in the real-world evidence field.

Insights On Key Application

Oncology

The Oncology application is expected to dominate the Global Real-World Evidence Solution Market. This is due to the increasing prevalence of cancer worldwide and the growing need for real-world evidence to support the development and approval of new oncology drugs. Real-world evidence plays a crucial role in assessing the effectiveness and safety of these drugs in real-world settings, beyond the controlled clinical trials. Oncology stakeholders, including pharmaceutical companies, regulators, and healthcare providers, are recognizing the significance of real-world evidence in understanding the real-world impact of oncology interventions. Consequently, the demand for real-world evidence solutions in oncology is anticipated to be the highest among the various parts.

Drug development and approvals

The Drug development and approvals is another important area within the Global Real-World Evidence Solution Market. Real-world evidence is increasingly being used to enhance the drug development process, from early-phase research to post-approval activities. By leveraging real-world data, pharmaceutical companies can generate insights into drug safety, effectiveness, and comparative effectiveness. Real-world evidence can also aid in post-marketing surveillance, identifying potential adverse events, and informing regulatory decisions. Although this part may not dominate the market like Oncology, it is expected to hold a significant share due to the continued focus on accelerating drug development and ensuring patient safety.

Cardiovascular disease

The Cardiovascular disease is another important area within the Global Real-World Evidence Solution Market. Real-world evidence can provide valuable insights into the effectiveness of cardiovascular interventions, such as medications and devices, in real-world settings. It can help assess the long-term outcomes, comparative effectiveness, and safety of different treatment strategies for various cardiovascular conditions. Given the high prevalence and impact of cardiovascular disease globally, the demand for real-world evidence solutions in this part is expected to be substantial.

Neurology

The Neurology is an emerging area within the Global Real-World Evidence Solution Market. Real-world evidence has the potential to enhance our understanding of neurological conditions, their diagnosis, progression, and treatment outcomes. It can inform clinical and regulatory decision-making, support the development and approval of new neurological drugs and devices, and assess their real-world effectiveness and safety. Although the demand for real-world evidence solutions in neurology is growing, it may not currently dominate the market like Oncology. However, as the importance of real-world evidence in neurology becomes more evident, this part is expected to gain more prominence.

Immunology

The Immunology is also an important area within the Global Real-World Evidence Solution Market. Real-world evidence can provide valuable insights into the safety and effectiveness of immunological interventions, such as biologic drugs, in real-world settings. It can help assess treatment outcomes, comparative effectiveness, and long-term safety profiles for various immunological conditions, including autoimmune diseases. Given the increasing use of immunological therapies and the need for evidence beyond clinical trials, the demand for real-world evidence solutions in this part is expected to be significant.

Other therapeutic areas

The Other therapeutic areas category comprises a range of medical conditions and treatment areas beyond the major categories mentioned above. This includes specialties such as respiratory, dermatology, gastroenterology, and rare diseases. While these therapeutic areas may not individually dominate the Global Real-World Evidence Solution Market like Oncology, they collectively contribute to the overall demand. Real-world evidence in these areas can provide insights into the real-world effectiveness, safety, and comparative effectiveness of different interventions. As the use of real-world evidence expands across therapeutic areas, the demand for solutions in these parts is expected to grow.

Medical device development and approvals

The Medical device development and approvals focuses on the use of real-world evidence in the development and approval of medical devices. Real-world evidence can help assess the real-world safety and effectiveness of medical devices, both pre-market and post-market. It can contribute to clinical and regulatory decision-making by providing insights into the performance and outcomes of medical devices in real-world settings. While the demand for real-world evidence solutions in medical device development and approvals may not be as high as some other parts, it is an essential area within the Global Real-World Evidence Solution Market.

Post-market surveillance

The Post-market surveillance is focused on the use of real-world evidence to monitor and evaluate the safety and effectiveness of interventions after they have been approved and launched in the market. Real-world evidence can help identify and assess potential adverse events, monitor the real-world effectiveness of interventions, and contribute to ongoing risk-benefit evaluations. While this part may not dominate the market, it is a critical aspect of the Global Real-World Evidence Solution Market, ensuring ongoing safety monitoring and regulatory compliance.

Market access and reimbursement/coverage decision making

The Market access and reimbursement/coverage decision making is centered around the use of real-world evidence to inform decisions related to the pricing, reimbursement, and coverage of interventions by payers and healthcare systems. Real-world evidence can provide insights into the cost-effectiveness, real-world outcomes, and comparative effectiveness of interventions, helping to guide coverage decisions. While this part may not be the dominant player in the Global Real-World Evidence Solution Market, it plays a crucial role in ensuring the accessibility and affordability of interventions for patients.

Clinical and regulatory decision making

The Clinical and regulatory decision making encompasses the use of real-world evidence to support decision-making by healthcare providers and regulatory authorities. Real-world evidence can aid in clinical decision-making, helping healthcare providers make evidence-based treatment choices in real-world settings. It can also inform regulatory decisions by providing insights into the real-world safety, effectiveness, and comparative effectiveness of interventions. While this part may not dominate the market, it is an integral part of the Global Real-World Evidence Solution Market, ensuring evidence-based decision-making and patient safety.

Insights On Key Mode of Deployment

On-Premises

On-Premises deployment is expected to dominate the Global Real-World Evidence Solution Market. Real-world evidence solutions require access to large volumes of data and the ability to analyze it in real-time. On-Premises deployment provides organizations with full control over their data, allowing them to store and process it locally. This offers advantages in terms of data security, compliance with regulations, and customization of the solution to meet specific needs. Additionally, some organizations may have infrastructure limitations or data sensitivity concerns that make On-Premises deployment a preferred choice.

Cloud-Based

Cloud-Based deployment is another significant mode of deployment in the Global Real-World Evidence Solution Market. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness by eliminating the need for on-site infrastructure and maintenance. They enable real-time data sharing and collaboration, making it easier to aggregate and analyze data from multiple sources. Cloud-based solutions also provide the advantage of remote accessibility, allowing users to access real-world evidence solutions from any location or device. While On-Premises deployment is expected to dominate, the Cloud-Based deployment is still popular due to its benefits in terms of agility and ease of implementation.

Insights On Key Revenue Model

Pay Per Usage

The Pay Per Usage revenue model is expected to dominate the Global Real-World Evidence Solution Market. This revenue model allows users to pay for the solution based on their usage or consumption. With the increasing demand for flexible and cost-effective solutions, Pay Per Usage is gaining popularity among healthcare organizations and researchers. This model provides the advantage of paying for only the services utilized, making it a more attractive option for smaller organizations or those with varying research needs. Additionally, Pay Per Usage encourages a pay-as-you-go approach, ensuring scalability and adaptability in the constantly evolving real-world evidence landscape. The flexibility, cost-efficiency, and demand for tailored solution packages contribute to the dominance of the Pay Per Usage part in the Global Real-World Evidence Solution Market.

Subscription

The Subscription industry within the Revenue Model category in the Global Real-World Evidence Solution Market is expected to maintain a significant presence. This model offers users a fixed fee for a specified period to access and utilize the real-world evidence solution. A subscription-based revenue model provides customers with the advantage of predictable costs and ongoing access to the solution, fostering long-term partnerships and client loyalty. Moreover, subscriptions often include additional benefits such as regular updates, technical support, and enhanced features, which further add value to the solution. The Subscription part continues to be a popular choice for larger healthcare organizations and research institutions that require continuous access to real-world evidence solutions, making it a prominent player in the market.

Insights On Key End-User

Pharmaceutical and medical device companies

Pharmaceutical and medical device companies are expected to dominate the Global Real-World Evidence Solution Market. This is because these companies heavily rely on real-world evidence to support their clinical research and development activities. They use real-world data to demonstrate the effectiveness, safety, and value proposition of their products in real-life settings. Furthermore, regulatory agencies are increasingly emphasizing the importance of real-world evidence in drug approval and post-market surveillance processes. Therefore, pharmaceutical and medical device companies invest significantly in real-world evidence solutions to optimize their product development and regulatory compliance strategies.

Healthcare payers

Healthcare payers are another significant end-user in the Global Real-World Evidence Solution Market. Healthcare payers, such as insurance companies and government agencies, use real-world evidence to inform their reimbursement decisions and coverage policies. By analyzing real-world data, they can evaluate the clinical and economic outcomes associated with different treatment options and make evidence-based decisions to ensure cost-effectiveness and quality of care for their members. While they play a critical role in the real-world evidence ecosystem, healthcare payers are not expected to dominate the market due to their reliance on the findings generated by pharmaceutical and medical device companies.

Healthcare providers

Healthcare providers, including hospitals and clinics, also contribute to the demand for real-world evidence solutions. They rely on real-world data to optimize patient care, conduct observational research, and improve healthcare outcomes. However, their influence on the market is relatively limited compared to pharmaceutical and medical device companies. Healthcare providers often rely on collaboration with other stakeholders in the ecosystem, such as payers and researchers, to access and analyze real-world data.

Other end users

Other end users, which may include research organizations, academic institutions, and healthcare technology companies, also contribute to the utilization of real-world evidence solutions. These end users may have specialized needs and specific applications for real-world data, but their overall market dominance is expected to be lesser compared to pharmaceutical and medical device companies. They often collaborate with other stakeholders and rely on their findings to make informed decisions and drive advancements in the healthcare industry.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Real-World Evidence Solution market. This can be attributed to factors such as the presence of well-established healthcare systems, advanced technology infrastructure, and a high level of healthcare expenditure in countries like the United States and Canada. Additionally, the region benefits from a strong focus on research and development activities, a large pool of skilled professionals, and a favorable regulatory environment. The increasing adoption of real-world evidence solutions by pharmaceutical companies, biotechnology firms, and other healthcare organizations further contributes to the dominance of North America in this market.

Latin America

Latin America is a region that holds significant potential for the growth of the Global Real-World Evidence Solution market. With a growing population, increasing incidence of chronic diseases, and expanding healthcare infrastructure, Latin America presents ample opportunities for the adoption of real-world evidence solutions. However, it is important to note that the region is still in the early stages of adopting such solutions, and thus, its dominance in the market is yet to be established. Factors such as limited awareness, regulatory challenges, and economic constraints can hinder the rapid growth of the market in this region.

Asia Pacific

Asia Pacific is another region that exhibits immense potential for the Global Real-World Evidence Solution market. With countries like China, Japan, and India experiencing rapid economic growth, there is a significant focus on improving healthcare systems and increasing access to quality healthcare services. The large patient population, high disease burden, and advancements in healthcare technology make Asia Pacific an attractive market for real-world evidence solutions. However, despite the promising outlook, the market in this region is still evolving, and challenges such as data privacy concerns, variations in healthcare systems, and limited understanding of real-world evidence can slow down the adoption rate.

Europe

Europe has been a frontrunner in the adoption of real-world evidence solutions and is expected to hold a significant share in the Global Real-World Evidence Solution market. The region benefits from a robust healthcare infrastructure, strict regulatory framework, and a collaborative approach between healthcare organizations, academia, and government bodies. The presence of established key players in the market, along with favorable reimbursement policies, also contributes to the dominance of Europe. However, increasing competition and the need for stringent data protection measures can pose challenges to the growth of the market in this region.

Middle East & Africa

Middle East & Africa is a region that presents both opportunities and challenges for the Global Real-World Evidence Solution market. On one hand, the region has witnessed substantial investments in healthcare infrastructure and a growing emphasis on healthcare quality and outcomes. Furthermore, the increasing prevalence of chronic diseases and the need for evidence-based decision making create a demand for real-world evidence solutions. On the other hand, the market faces challenges such as limited access to quality healthcare services in some areas, diverse healthcare systems, and limited implementation of digital healthcare solutions. Therefore, while the region has growth potential, its dominance in the market is not yet established.

Company Profiles:

Prominent participants in the Global Real-World Evidence Solution sector significantly contribute to delivering groundbreaking solutions and cutting-edge technologies for generating evidence, analyzing data, and conducting research on real-world outcomes. Their overarching goal is to support healthcare institutions in making informed decisions and enhancing patient outcomes through valuable insights derived from real-world data.

Prominent companies to the Real-World Evidence Solution Market consist of various industry leaders including IQVIA Holdings Inc., ICON plc, Clinigen Group plc, Optum, Inc., Cognizant, IMS Health, Oracle Corporation, PAREXEL International Corporation, and McKesson Corporation. These distinguished organizations possess notable proficiency and a dominant presence in delivering real-world evidence solutions to healthcare institutions and pharmaceutical companies. Leveraging sophisticated data analytics capabilities and extensive databases, they facilitate the collection, integration, and thorough analysis of real-world data to derive actionable insights for healthcare research and development endeavors. These market leaders offer a range of services including observational studies, data management, and strategic consulting to bolster evidence-based healthcare initiatives, ultimately driving enhanced patient outcomes. Through their comprehensive offerings in real-world evidence solutions, these key stakeholders are pivotal in driving the progress of evidence-based medicine and elevating healthcare standards and delivery globally.

COVID-19 Impact and Market Status:

The global adoption of real-world evidence solutions in the pharmaceutical industry has been expedited by the Covid-19 pandemic, with companies increasingly turning to data-driven strategies for drug development and evaluating patient outcomes.

The Real-World Evidence (RWE) solution market has been significantly affected by the COVID-19 pandemic. In light of the ongoing crisis, healthcare institutions and pharmaceutical firms are increasingly turning to RWE to gain insights into patient outcomes, treatment trends, and disease advancement.

There is a notable rise in demand for RWE as the necessity for data-driven information to guide healthcare choices and enhance drug development procedures increases. The pandemic has hastened the acceptance of RWE solutions as companies work towards creating effective treatments and vaccines. Moreover, the transition towards remote healthcare provision and telemedicine has placed a greater emphasis on utilizing real-world data in both clinical trials and post-market monitoring. Nevertheless, challenges such as data accuracy and privacy concerns pose hurdles that must be tackled to ensure the dependability and trustworthiness of RWE solutions. Despite these obstacles, the COVID-19 pandemic has catalyzed the expansion of the RWE solution market, with stakeholders acknowledging the importance of real-world data in facilitating evidence-based decision-making and enhancing patient outcomes.

Latest Trends and Innovation:

- In May 2021, IQVIA Holdings Inc. announced the acquisition of Nordic Oncology to expand its capabilities in real-world evidence generation and advanced analytics in oncology research.

- In October 2020, Syneos Health merged with Synteract, a contract research organization, to enhance its real-world evidence solutions and clinical development offerings.

- In September 2019, Oracle Corporation introduced the Health Sciences Clinical One Platform, a cloud-based solution that combines electronic data capture (EDC), randomization, and trial supply management. This technology innovation aims to streamline real-world evidence generation during clinical trials.

- In August 2018, Optum, part of UnitedHealth Group, acquired DaVita Medical Group's analytics and care management subsidiary, OptumCare, to strengthen its data analytics capabilities and real-world evidence solutions.

- In February 2017, COTA, a healthcare technology company, partnered with the Food and Drug Administration (FDA) to develop data standards and evidence generation for real-world evidence studies, aiming to accelerate the integration of real-world data into regulatory decision-making.

- In June 2016, Palantir Technologies collaborated with Merck KGaA to develop a joint platform for generating real-world evidence using health records and sensor data. This partnership aimed to improve healthcare outcomes and advance personalized medicine.

Significant Growth Factors:

Factors driving growth in the Real-World Evidence Solution Market comprise a rising need for real-world data in healthcare decision-making, technological advancements, and increasing utilization of electronic health records.

The market for real-world evidence (RWE) solutions has experienced notable expansion due to various influential factors. Primarily, the increasing need for thorough data analysis and decision-making based on evidence propels market growth. RWE provides valuable insights into patient outcomes, treatment trends, and the effectiveness of new therapies, empowering healthcare stakeholders to make well-informed choices. Moreover, the rising utilization of electronic health records (EHRs) and sophisticated data analytics technologies contributes to the market's advancement. The presence of extensive patient data sets and progress in data integration and visualization tools enables effective analysis of real-world evidence. Additionally, the emphasis on personalized medicine and value-based healthcare models stimulates the demand for RWE solutions. These solutions offer essential insights into real-world patient demographics, facilitating the development of tailored therapies by drug manufacturers and enabling payers to evaluate treatment results and reimbursement determinations. Furthermore, regulatory bodies increasingly acknowledge the significance of real-world evidence in drug development and post-market monitoring, encouraging the adoption of RWE solutions. However, potential obstacles like concerns regarding data privacy, interoperability challenges, and the necessity for standardization may hinder market progress. In conclusion, the remarkable growth of the real-world evidence solution market can be credited to the escalating requirement for evidence-based decision-making, advancements in data analytics technologies, and the growing focus on personalized medicine and value-based healthcare approaches.

Restraining Factors:

The real-world evidence solution market encounters obstacles stemming from issues surrounding data privacy and the complexities linked to standardizing and analyzing a wide array of real-world data sources.

The market for Real-World Evidence Solutions has experienced notable expansion recently due to the growing use of real-world data (RWD) for informing healthcare decisions. However, there are several challenges hindering further growth in this market. One major concern is the issue of data privacy and security, which is causing hesitation among healthcare organizations and patients regarding the potential misuse or unauthorized access to sensitive data. Moreover, the absence of standardized guidelines and methodologies for collecting, analyzing, and interpreting real-world data is affecting the credibility and comparability of the information. This lack of consistency and quality in data is raising uncertainties among stakeholders, thus constraining the market's development. Additionally, the complexity and expenses related to data integration and interoperability are acting as obstacles for healthcare institutions and vendors looking to implement real-world evidence solutions. The variety of RWD sources and the necessity for alignment across different data systems are creating challenges in aggregating, cleansing, and integrating data, thereby delaying the market from reaching its full potential. Lastly, the shortage of proficient professionals skilled in both healthcare and data analytics is a significant challenge since leveraging real-world evidence effectively demands a multidisciplinary approach.

Key Segments of the Real-World Evidence Solution Market

Components Overview

• Service

• Data sets

Application Overview

• Drug development and approvals

• Oncology

• Cardiovascular disease

• Neurology

• Immunology

• Other therapeutic areas

• Medical device development and approvals

• Post-market surveillance

• Market access and reimbursement/coverage decision making

• Clinical and regulatory decision making

Mode of Deployment Overview

• On-Premises

• Cloud Based

Revenue Model Overview

• Pay Per Usage

• Subscription

End-User Overview

• Pharmaceutical and medical device companies

• Healthcare payers

• Healthcare providers

• Other end users

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America