Property and Casualty Insurance Market Analysis and Insights:

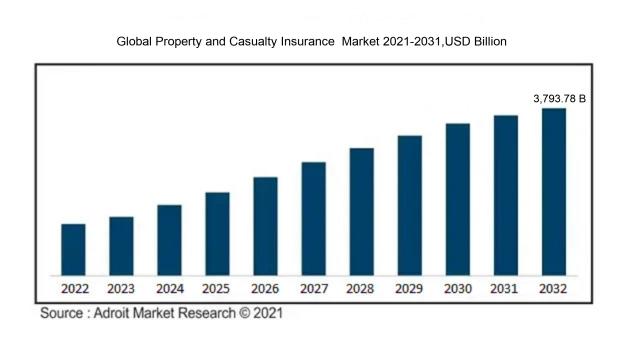

In 2023, the size of the worldwide Global Property and Casualty Insurance market was US$ 1848.43 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2032, reaching US$ 3,793.78 billion.

The Property and Casualty (P&C) insurance sector is influenced by a range of significant factors. Primarily, the escalating occurrence and intensity of natural disasters, exacerbated by climate change, has led to an increased demand for thorough insurance coverage. Additionally, a growing awareness among consumers about the critical role of insurance in safeguarding assets contributes to market expansion. Innovations in technology, particularly digital service platforms and advanced risk assessment methodologies, are revolutionizing operational efficiency and enhancing customer interaction within the industry. Furthermore, shifts in regulations and the need for compliance drive insurers to adapt their product offerings and pricing strategies. Economic variables, including changes in disposable income and fluctuations in the real estate market, also significantly affect consumer purchasing decisions. Lastly, demographic trends such as urban growth and rising vehicle ownership are expanding the customer base, necessitating a broader range of P&C insurance solutions. Together, these factors are reshaping the dynamic environment of the P&C insurance market.

Property and Casualty Insurance Market Definition

Property and casualty insurance serves as a safeguard for both individuals and enterprises against monetary setbacks tied to tangible assets like residences and automobiles, along with liability stemming from accidents or harm caused to others. This category of insurance includes a range of policies such as those for homeowners, renters, automotive coverage, and commercial ventures.

Property and casualty insurance is essential for maintaining financial security, as it provides protection for both individuals and businesses against various potential losses. This type of insurance encompasses a broad array of risks, such as property damage resulting from incidents like fire or theft, as well as liability for injuries incurred by others in accidents. Not only does this insurance shield tangible assets, but it also instills a sense of assurance, enabling individuals and organizations to function without incessant worry about devastating financial setbacks. Furthermore, it enhances economic stability by allowing those impacted by unexpected events to recuperate and restore their livelihoods, thereby fostering resilience within communities and aiding in overall economic advancement.

Property and Casualty Insurance Market Segmental Analysis:

Insights On Key Type

Homeowners Insurance

Homeowners insurance is projected to dominate the Global Property and Casualty Insurance market due to its comprehensive coverage and the rising number of homeowners worldwide. As property ownership increases, individuals seek to protect their investments against potential risks like theft, natural disasters, and liability claims. Homeowners insurance typically offers a variety of protection options, catering to diverse needs, which enhances its appeal among consumers. The growth in urbanization and economic stability further propels the demand for this type of insurance, solidifying its position as the leading choice in the market.

Condo Insurance

Condo insurance, while a smaller compared to homeowners, is increasingly recognized for its necessity among condo owners. This insurance type provides coverage for personal property and the interior of the unit, addressing gaps left by the condominium’s master policy. As urban living continues to rise, more individuals opt for condominiums, driving demand for tailored insurance solutions. Market growth in densely populated areas can directly correlate to the increase in condo insurance purchases, as owners look to safeguard their belongings from potential risks.

Renters Insurance

Renters insurance is gaining traction as the rental market expands, with many individuals opting to rent instead of buy. This type of insurance is essential for protecting personal belongings from theft, damage or liability claims. As a cost-effective solution, renters insurance is particularly appealing to younger demographics and those in urban environments where renting is more common. The growing awareness of the importance of personal liability coverage also boosts the uptake of renters insurance, making it a vital player in the property insurance landscape.

Landlord Insurance

Landlord insurance is specifically designed for property owners renting out their homes or units, providing coverage for property damage and liability claims. As the rental housing market continues to flourish, driven by increasing demand for rental properties, landlords increasingly seek specialized insurance solutions to mitigate risks. Coverage typically includes protection against loss of rental income due to damage, making it an attractive option for property owners. The rising trend of real estate investment further solidifies the need for landlord insurance, positioning it as a significant component of the property and casualty insurance market.

Others

The "Others" category encompasses various niche insurance products that cater to specific needs not covered by the primary types. This could include insurance for vacant properties, mobile homes, or unique scenarios requiring specialized coverage. While this may not dominate the overall market, it serves essential purposes for ed audiences. As insurance providers innovate and develop products tailored to particular risks, the diverse nature of this category may attract attention, particularly among consumers needing specific protection. Nevertheless, it remains a smaller player in comparison to homeowners insurance and its counterparts.

Insights On Key Distribution Channel

Brokers

Brokers are anticipated to dominate the Global Property and Casualty Insurance market. This is largely due to their ability to provide a wide range of insurance options, coupled with personalized service that caters to both individual and commercial clients. Brokers offer expert advice in navigating the complexities of policy choices, enabling them to match the right coverage to the specific needs of customers. Additionally, their established relationships with multiple insurers allow for competitive pricing. The flexibility and comprehensive service brokers provide are key to attracting clients, positioning them as the preferred choice in a diverse and dynamic marketplace.

Tied Agents and Branches

Tied agents and branches operate under a more limited framework, typically offering products from a single insurance provider. While they can deliver personalized service and a strong connection with customers through direct interaction, their offerings are constrained compared to those presented by brokers. The reliance on one insurer can result in fewer options for consumers, which might not meet every customer's needs. However, in markets where brand loyalty and simplicity in understanding policies matter more, tied agents and branches can maintain a loyal customer base.

Others

The "Others" category consists of various alternative distribution channels, including direct online sales and telemarketing. This approach appeals to a younger, tech-savvy audience that values convenience and speed in obtaining insurance. However, competition in digital space has intensified, making it challenging for these channels to establish significant market shares. While the ability to facilitate quick transactions and lower overhead costs is advantageous, the lack of personalized customer interaction compared to brokers may limit their effectiveness in securing long-term client relationships.

Insights On Key End User

Individuals

Individuals form an essential group in the Global Property and Casualty Insurance Market, and are expected to dominate the market, primarily driven by the increasing awareness of personal risk management and asset protection. With rising property values and the potential financial loss from various liabilities, individuals are more inclined to invest in adequate coverage. Moreover, the growing trend of homeownership and automobile purchases significantly boosts the demand for property and casualty insurance among this demographic. As people become more financially literate, there is an evident shift towards seeking comprehensive policies that not only protect their assets but also provide personal liability coverage, ensuring long-term financial security.

Businesses

Business sector in the Global Property and Casualty Insurance Market is expected to grow. This is largely due to the increasing number of enterprises seeking comprehensive insurance solutions to mitigate risks associated with property damage, liability claims, and other unforeseen events. With an expanding global economy, businesses are prioritizing risk management and are more willing to invest in insurance products that offer robust coverage. Furthermore, stringent regulatory requirements in many industries are compelling businesses to secure various forms of insurance, thereby driving the demand in this. The rise of unique risks, such as cyber threats and natural disasters, further underscores the necessity for tailored insurance products, making this the forerunner in the market.

Governments

Governments represent a significant participant in the Global Property and Casualty Insurance Market, largely due to their need for extensive coverage in areas such as public liability, infrastructure protection, and disaster management. Public sector entities are increasingly recognizing the importance of insurance in managing risks associated with operations and public services. This is especially pertinent in regions prone to natural disasters, where governments seek insurance solutions to ensure financial resilience amidst potential crises. Furthermore, governmental mandates for specific coverages enhance the demand for tailored insurance solutions, further solidifying the importance of this group in the market landscape.

Global Property and Casualty Insurance Market Regional Insights:

North America

North America is expected to dominate the Global Property and Casualty Insurance market. The region, particularly the United States, has a well-established insurance framework, with high levels of insurance penetration due to various factors including regulatory frameworks, economic stability, and consistently evolving consumer demands. The region's advanced technology integration in insurance processes enhances efficiencies and customer experiences, further boosting growth. Additionally, increased awareness regarding risk management and the implementation of comprehensive policies in businesses and households contribute to the rising demand for property and casualty insurance. These factors collectively establish North America as the leading region in this sector, with substantial market share and growth potential.

Latin America

Latin America is witnessing a gradual rise in the property and casualty insurance market, driven by improvements in economic conditions and growing urbanization. Countries like Brazil and Mexico are focusing on enhancing their insurance infrastructures, although the market is still characterized by lower penetration levels compared to North America. The ongoing investment in digital transformation and the entry of new market players are expected to strengthen competitive dynamics. However, economic volatility and regulatory challenges often hinder expansion, preventing the region from achieving the same growth trajectories as its North American counterpart.

Asia Pacific

The Asia Pacific region is emerging as a significant player in the property and casualty insurance market, primarily due to rapid urbanization, a growing middle class, and increasing awareness of insurance products. Countries such as China and India present vast opportunities owing to their immense populations and rising disposable incomes. However, differing regulatory environments and varying levels of insurance penetration across countries pose challenges. The region is projected to experience robust growth, but it may take time before it can rival the dominance of North America in this sector.

Europe

Europe’s property and casualty insurance market is characterized by a mature landscape with significant competition. Countries like Germany and the UK have well-established insurance sectors that are adapting to changes such as digitalization and new regulatory frameworks like GDPR. The region is experiencing steady growth, driven by increasing environmental and climate risks prompting higher demand for insurance coverage. However, socio-economic challenges, including varying economic recovery rates across European nations and a fragmented regulatory environment, may restrain more aggressive growth trends compared to North America.

Middle East & Africa

The Middle East & Africa region remains the smallest in the property and casualty insurance market, although it presents considerable growth potential due to increasing awareness and investment in the sector. Economic diversification in Gulf Cooperation Council (GCC) countries and infrastructure investments in African nations are providing a favorable backdrop for market growth. However, political instability, regulatory challenges, and low insurance penetration rates significantly limit the current market size. Emphasis on improving consumer education and risk management practices is essential for achieving long-term growth in this region.

Property and Casualty Insurance Market Competitive Landscape:

Central figures in the worldwide Property and Casualty Insurance sector, comprising leading insurers and brokerage firms, play a crucial role in assessing risks, establishing policy pricing, and handling claims. This function is vital for safeguarding the financial interests of both individuals and businesses. Furthermore, their collaborative alliances and integration of technological advancements significantly improve customer service and optimize operational efficiencies in a highly competitive environment.

The leading entities in the Property and Casualty Insurance sector encompass State Farm Mutual Automobile Insurance Company, Berkshire Hathaway Inc., The Allstate Corporation, Progressive Corporation, Chubb Limited, Travelers Companies, Inc., Hartford Financial Services Group, Inc., American International Group, Inc. (AIG), Liberty Mutual Insurance, Nationwide Mutual Insurance Company, Markel Corporation, MetLife, Inc., Assurant, Inc., and Unum Group. Moreover, prominent participants such as Tokio Marine Holdings, Inc., Farmers Insurance Group, Amica Mutual Insurance, Genworth Financial, Inc., and USAA (United Services Automobile Association) also contribute notably to this industry.

Global Property and Casualty Insurance Market COVID-19 Impact and Market Status:

The Covid-19 pandemic has resulted in a notable rise in claims within the Global Property and Casualty Insurance sector, especially concerning business interruption and health-related coverage. This situation has also encouraged insurers to reassess their risk evaluations and the terms of their policies.

The COVID-19 pandemic had a profound effect on the Property and Casualty (P&C) insurance industry, reshaping both consumer demand and underwriting methodologies. In the early stages, insurers encountered an uptick in claims stemming from business interruption and liability concerns, which led many to rethink their risk assessment frameworks. The rise of remote work shifted property demands, contributing to an increase in home insurance claims, while an economic downturn caused a decrease in premiums across various areas. In response, insurers expedited their digital transformation efforts, upgrading their technological infrastructures to enhance operational efficiency and elevate customer experience. Additionally, regulatory measures in certain jurisdictions prompted premium refunds and credits, complicating revenue flows. However, these obstacles also paved the way for the development of innovative insurance products, such as policies addressing pandemic-related disruptions, compelling insurers to reevaluate their service offerings and marketing tactics. In summary, the pandemic has driven the P&C industry to adopt a more flexible and customer-centric approach to risk management.

Latest Trends and Innovation in The Global Property and Casualty Insurance Market:

- In March 2023, Progressive Insurance announced the acquisition of Sigo Seguros, a digital insurance company focused on the Hispanic market, aiming to expand its reach and improve customer experience.

- In July 2023, Berkshire Hathaway's Geico introduced an innovative telematics program called DriveEasy, which uses smartphone technology to provide personalized insurance rates based on driving behavior, indicating a shift towards usage-based insurance models.

- In May 2023, Allstate Corporation completed its acquisition of the technology-driven company MDC Holdings, enhancing its digital capabilities and improving its underwriting processes through advanced technology solutions.

- In January 2023, Chubb announced a partnership with UNFCU to develop tailored insurance solutions for members of the United Nations community, increasing its focus on serving specialized markets.

- In September 2023, Farmers Insurance launched a new AI-powered claims processing system designed to expedite claims handling and improve overall customer satisfaction, showcasing advancements in claims technology.

- In August 2023, Travelers Companies announced a significant investment in insurtech startup, Zego, aimed at enhancing its capabilities in the commercial auto insurance sector, reflecting the ongoing trend of traditional insurers investing in technology-driven solutions.

- In April 2023, State Farm and Aviva announced a joint venture focused on providing insurance products in the UK, leveraging both companies' regional expertise to capture more market share.

- In June 2023, Liberty Mutual integrated blockchain technology into its claims processing, which increased transparency and efficiency within their operations, marking a notable innovation in the insurance sector.

Property and Casualty Insurance Market Growth Factors:

The expansion of the Property and Casualty Insurance Market is fueled by ened consumer consciousness, a surge in natural disaster occurrences, and technological innovations that improve risk evaluation and customer support.

The Property and Casualty (P&C) insurance sector is witnessing substantial expansion driven by a variety of factors. Primarily, the rise in urbanization alongside major infrastructure development has increased the necessity for comprehensive insurance solutions to safeguard assets and address potential risks related to property damage. Moreover, the increase in natural disasters and events attributable to climate change has prompted individuals and organizations to seek stronger insurance options, further contributing to market growth.

Heightened awareness regarding the significance of insurance, coupled with regulatory requirements for specific coverage types, has also resulted in a higher uptake of policies. Technological advancements, particularly through digital interfaces and sophisticated big data analytics, have significantly improved customer engagement, underwriting efficiency, and claims processing, thus rendering insurance services more accessible and streamlined.

Additionally, the growth of e-commerce and online ventures has generated a need for specialized insurance products, amplifying market demand. The introduction of innovative insurance models, including usage-based and peer-to-peer policies, is transforming consumer preferences. Lastly, demographic changes such as an aging population and the proliferation of small businesses are reshaping market demands, prompting insurers to devise tailored offerings to meet varied customer needs. Altogether, these elements are driving the vigorous growth of the P&C insurance industry.

Property and Casualty Insurance Market Restaining Factors:

The Property and Casualty Insurance Market faces significant challenges stemming from ened regulatory requirements and escalating claims expenses associated with extreme weather conditions.

The Property and Casualty Insurance Market is confronted with numerous hindrances that could affect its development and overall stability. Firstly, the surge in competition among insurance providers has initiated price wars, which risk diminishing profit margins and adversely impacting the quality of offerings. Moreover, the escalating incidence and intensity of natural disasters attributed to climate change have led to increased claims expenses, presenting challenges to underwriting profitability. Regulatory challenges, characterized by rigorous compliance mandates and shifting legal requirements both nationally and internationally, also create additional operational complexities for insurers.

Furthermore, the ened threat of cyberattacks raises questions regarding liability and the sufficiency of current insurance coverage, thus complicating the risk landscape. Changes in consumer behavior are also noteworthy; clients are increasingly focused on minimizing costs, often opting for lower premiums that compromise the extent of coverage. Additionally, the rapid evolution of technology and data analytics compels established insurers to invest heavily to stay relevant, which can put pressure on their resources.

In spite of these hurdles, the industry is undergoing transformation, with potential for innovation and enhanced customer engagement through technology-based solutions, improved risk evaluation, and customized product offerings. This capacity for adaptation indicates a promising outlook for the Property and Casualty Insurance Market, as firms work diligently to address challenges and enhance client service.

Key Segments of the Property and Casualty Insurance Market

By Type

• Condo Insurance

• Homeowners Insurance

• Renters Insurance

• Landlord Insurance

• Others

By Distribution Channel

• Brokers

• Tied Agents and Branches

• Others

By End User

• Businesses

• Individuals

• Governments

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America