Productivity Management Software Market Analysis and Insights:

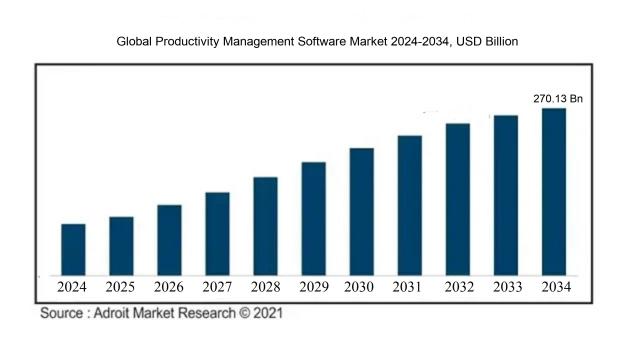

The market for productivity management software was valued at USD 72.32 billion in 2024, increased to USD 82.31 billion in 2025, and is projected to reach USD 270.13 billion by 2034, representing a compound annual growth rate (CAGR) of 15.07% from 2024 to 2034.

The market for productivity management software is spurred by several influential elements, notably the increasing demand for enhanced efficiency and optimized workflows within organizations. This need drives the acceptance of software that aids in task coordination and collaboration. The surge in remote and hybrid work arrangements further boosts the necessity for tools that improve communication and project management among dispersed teams. Moreover, advancements in technology, particularly in artificial intelligence and machine learning, enable the creation of more intuitive and automated productivity tools, attracting companies eager to refine their operations. Additionally, an emphasis on performance analytics allows organizations to utilize data-driven insights for improving productivity. The growth of the startup landscape and an increased focus on mental wellness in workplaces also en the demand for effective productivity management solutions that ensure a balance between workload and employee well-being. Collectively, these elements are instrumental in shaping the development of the productivity management software industry.

Productivity Management Software Market Definition

Productivity management software encompasses various tools aimed at improving organizational effectiveness through the optimization of workflows, task coordination, and resource distribution. These solutions promote enhanced teamwork and effective time utilization, leading to an overall increase in performance.

Productivity management tools are crucial for improving operational efficiency and refining workflows within organizations. They enable teams to establish goals, monitor advancement, and utilize resources judiciously, fostering enhanced collaboration and accountability. By automating repetitive tasks and providing analytical insights, these tools assist in pinpointing inefficiencies and refining processes. This, in turn, elevates employee motivation and satisfaction, as well-defined objectives and expectations enhance concentration and output. Additionally, the capability to assess the productivity of both individuals and teams allows for prompt modifications, helping businesses stay nimble and competitive in fast-evolving markets. Therefore, such software is indispensable for fulfilling strategic goals.

Productivity Management Software Market Segmental Analysis:

Insights On Solution

AI & Predictive Analytics

AI & Predictive Analytics is expected to dominate the Global Productivity Management Software Market due to its ability to enhance decision-making and operational efficiency. This leverages advanced algorithms and data analysis to provide actionable insights, enabling organizations to streamline processes, predict outcomes, and optimize resource allocation. As organizations increasingly seek to harness data for better business intelligence, the demand for AI-driven solutions is expected to surge. Furthermore, the integration of these advanced technologies into various industries is making them indispensable for driving productivity improvements, empowering users to achieve higher performance levels.

Content Management & Collaboration

Content Management & Collaboration plays a crucial role in facilitating teamwork and document organization within organizations. This solution enables users to create, manage, and share information seamlessly, enhancing communication and collaboration among team members. As remote work continues to gain traction, the demand for effective content management and collaboration tools is on the rise. Businesses recognize the importance of these platforms in maintaining productivity and ensuring that employees can access and collaborate on shared resources from anywhere.

Structured Work Management

Structured Work Management focuses on providing a framework for efficiently managing projects and workflows. This solution helps organizations establish clear plans, assign tasks, and track progress, leading to improved task management and accountability. With the growing complexity of projects and increased need for transparency within teams, structured work management tools are essential for ensuring timely delivery and addressing bottlenecks. Businesses are increasingly adopting these solutions to enhance their project management capabilities and foster a culture of efficiency.

Other Solutions

The Other Solutions category encompasses a range of miscellaneous tools that do not fall neatly into the primary categories mentioned. This includes niche applications that cater to specialized productivity needs, such as time tracking and resource management tools. Although this category may not currently dominate the market, it still holds significance for organizations looking for tailored solutions to particular challenges. As businesses strive for greater efficiency, innovative tools are continually emerging, making this an important contributor to the overall productivity management landscape.

Insights On Deployment

Cloud

The cloud deployment model is expected to dominate the Global Productivity Management Software Market due to the increasing demand for scalability, flexibility, and cost-effectiveness among organizations. Businesses are increasingly turning to cloud solutions to ensure remote accessibility and collaboration among teams, especially in light of the shift towards hybrid work environments. Additionally, cloud-based software allows for real-time updates and seamless integration with various applications, providing companies with greater operational efficiency. The reduced upfront costs and the pay-as-you-go pricing model have made cloud solutions attractive for small and medium-sized enterprises, further driving market growth in this direction.

On-Premise

The on-premise deployment method offers businesses complete control over data management and security, which appeals to organizations with stringent regulatory requirements. While the growth of cloud solutions has been significant, some companies prefer on-premise software for its ability to comply with internal policies and industry standards. Moreover, organizations operating in sectors like finance and healthcare often require dedicated hardware to manage sensitive information. This commitment to on-premise setups will continue to provide a stable, albeit smaller, market as they seek to maintain data sovereignty and minimize potential cloud service provider reliance.

Insights On Enterprise Size

Small & Medium Enterprise Size

The Small & Medium Enterprise (SME) size is expected to dominate the Global Productivity Management Software Market due to its flexibility, rapid adaptation to market trends, and increasing adoption of digital solutions. SMEs often face the challenge of resource limitations, triggering the need for cost-effective productivity solutions. Enhanced accessibility of cloud-based tools allows smaller companies to harness functionalities previously exclusive to large enterprises. Furthermore, the growing emphasis on operational efficiency and workforce management among SMEs drives the demand for productivity management software, creating a fertile market for innovative solutions that cater specifically to their requirements.

Large Enterprise Size

Large enterprises are significant players in the productivity management software market but are experiencing slower growth compared to their smaller counterparts. This can be attributed to the complexity of their existing systems and the challenge of implementing new software while maintaining operational coherence. Although these companies have substantial budgets for advanced tools, they often prioritize integration capabilities over new software adoption, leading to a less dynamic software acquisition process. Consequently, while they remain important consumers of productivity solutions, their impact on market growth is overshadowed by the agility of smaller companies.

Insights On Industry

IT & Telecom

The IT & Telecom industry is expected to dominate the Global Productivity Management Software Market due to its rapid technological advancements and the need for enhanced operational efficiency. Companies in this sector are increasingly adopting innovative solutions to streamline processes, manage resources effectively, and ensure better communication both internally and with clients. The increasing shift toward remote work and virtual collaboration tools has further amplified the demand for productivity management software, as organizations strive to maintain competitiveness in a technology-driven landscape. Moreover, continuous investments in digital transformation make this industry a significant contributor to the market growth of productivity management solutions.

BFSI

The Banking, Financial Services, and Insurance (BFSI) sector is experiencing a growing need for productivity management solutions to improve customer service and operational efficiency. With the rising importance of compliance, risk management, and financial reporting, organizations are investing in software that enhances collaboration and streamlines workflows. As financial institutions increasingly adopt digital technologies, the demand for tools that boost productivity and ensure data security becomes paramount, highlighting the BFSI industry as a key player in this market.

Healthcare

In the Healthcare industry, productivity management software is becoming increasingly vital as organizations strive to enhance patient care while managing costs effectively. The COVID-19 pandemic highlighted the need for optimized workflows, remote patient monitoring, and improved collaboration across healthcare teams. By adopting productivity solutions, healthcare providers can achieve better resource allocation, streamline administrative processes, and enhance the overall patient experience, driving growth in this industry.

Manufacturing

Manufacturing operations rely heavily on efficiency, making productivity management software crucial for optimizing workflows and resource utilization. As manufacturers look to adopt Industry 4.0 practices, embracing automation and advanced data analytics becomes essential. These tools help in minimizing downtime, improving inventory management, and fostering collaboration across production teams. Thus, the manufacturing sector plays a significant role in the growth of the productivity management software market as organizations strive for operational excellence.

Transportation

The Transportation industry is under constant pressure to improve logistics and operational efficiency, leading to a growing demand for productivity management solutions. Companies are increasingly adopting software that optimizes route planning, fleet management, and staff scheduling to enhance service delivery and minimize costs. The shift towards real-time data and analytics also supports the need for collaboration and effective communications within this industry, ultimately contributing to its ongoing growth in the productivity management software market.

Others

The "Others" category encompasses a diverse range of industries using productivity management software, including retail, construction, and education. While not as dominant as the primary sectors, these industries are increasingly recognizing the value of productivity solutions to streamline operations and enhance team collaboration. The emphasis on digital tools in these sectors reflects a broader trend towards improved efficiency and productivity, making them vital contributors to the overall market growth, albeit at a more fragmented level.

Global Productivity Management Software Market Regional Insights:

North America

North America is expected to dominate the Global Productivity Management Software market, primarily due to the presence of numerous key players in the region, such as Microsoft, Salesforce, and Oracle, which drive innovation and technological advancements. Organizations in sectors like IT, finance, and healthcare are increasingly adopting productivity management tools to enhance operational efficiency and collaboration. Additionally, the growing trend towards remote and hybrid work models has accelerated the demand for collaborative software solutions. The robust integration of artificial intelligence and machine learning in productivity software also propels the market forward, making North America the frontrunner in terms of revenue and adoption rates.

Latin America

Latin America is gradually evolving in the Productivity Management Software market, driven by digital transformation initiatives and an increase in remote working practices. Organizations are recognizing the need for efficient collaboration tools to navigate challenges and improve productivity. The market is witnessing a rise in cloud-based solutions, which are more affordable and accessible for SMEs, contributing to growth. However, regional disparities in technology adoption and varying economic conditions may limit the speed of market penetration compared to more developed regions.

Asia Pacific

The Asia Pacific region is experiencing significant growth in the Productivity Management Software market, spurred by rapid digitalization and a burgeoning middle class. Countries like India, China, and Japan are investing heavily in technology infrastructure, which supports the adoption of productivity tools. The increasing number of startups and SMEs in these countries enhances demand as businesses seek effective solutions for managing their operations. Nonetheless, challenges such as cybersecurity concerns and varying regulatory landscapes may impact growth in certain markets.

Europe

Europe presents a mixed landscape for the Productivity Management Software market, with significant adoption across major economies like Germany, France, and the UK. The emphasis on work-life balance and employee well-being encourages organizations to invest in productivity solutions. However, stringent data protection regulations, like GDPR, hinder the market's growth potential, especially for software applications that handle sensitive data. The market is characterized by a mature base, and while innovation continues, the competition is intense, leading to moderate growth compared to emerging markets.

Middle East & Africa

The Middle East & Africa region is at a nascent stage in the Productivity Management Software market but shows potential for future growth. The drive toward digital transformation, particularly in the Gulf Cooperation Council (GCC) countries, is fostering increased interest in productivity solutions. However, challenges such as fluctuating economic conditions, limited internet connectivity in certain areas, and a lack of awareness regarding productivity tools hinder immediate growth. Efforts to improve infrastructure and investments in technology could gradually enhance the adoption of such software in the region.

Productivity Management Software Competitive Landscape:

Prominent participants in the Global Productivity Management Software sector are at the forefront of innovation by creating sophisticated tools that improve operational effectiveness, facilitate project monitoring, and boost team collaboration. Their strategic alliances and ongoing software enhancements cultivate a competitive environment, addressing the varied requirements of different organizations.

Prominent companies in the Productivity Management Software sector comprise Microsoft Corporation, Asana, Inc., Atlassian Corporation Plc, Trello (a division of Atlassian), Smartsheet Inc., Monday.com Ltd., Wrike (which is under Citrix Systems, Inc.), ClickUp, Todoist (developed by Doist), Notion Labs Inc., Zoho Corporation Pvt. Ltd., Basecamp, Inc., Airtable, Inc., Hubstaff, and Favro.

Global Productivity Management Software COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly expedited the transition to cloud-based productivity management solutions, as companies pursued enhanced flexibility and tools for remote collaboration to navigate evolving work conditions.

The COVID-19 pandemic has profoundly transformed the landscape of productivity management software, propelling its widespread adoption as remote work and digital teamwork became standard practice. Organizations encountered unparalleled challenges, leading many to explore solutions that boost workflow effectiveness and enhance team collaboration. This ened demand spurred swift advancements in software features, such as seamless integration with communication platforms, real-time project management tools, and analytics powered by artificial intelligence. As businesses shifted towards hybrid work environments, there was a distinct emphasis on software that promotes accountability and supports virtual teamwork. Additionally, the pandemic highlighted the critical need for robust data security and scalability, prompting providers to innovate and refine their products. As a result, even in the aftermath of the pandemic, the productivity management software sector is poised for significant growth, as companies increasingly invest in digital tools that facilitate collaboration and optimize operations in a changing work environment.

Latest Trends and Innovation in The Global Productivity Management Software Market:

- In September 2023, Asana announced its integration with OpenAI's GPT-3 technology, enabling users to leverage AI for task management and project planning, showcasing advancements in productivity-focused AI enhancements.

- In August 2023, Monday.com acquired the Kanban-based task management software, Kanbanize, to strengthen its project management offerings and provide enhanced visual work-flow capabilities to its users.

- In July 2023, Trello introduced new automation features powered by Butler that allow users to create custom commands, improving overall efficiency and user experience in task management.

- In June 2023, Wrike was acquired by Citrix Systems for approximately $2.25 billion, intending to expand its workspace collaboration tools and enhance overall product integration within Citrix's suite of services.

- In January 2023, Smartsheet launched a new AI-assisted feature called Smart Insights, which helps users glean actionable insights from their project data, emphasizing innovation in data-driven decision-making.

- In December 2022, ClickUp announced its partnership with Slack to enable seamless integration between task management and team communication, further bridging productivity tools with communication platforms.

- In October 2022, Microsoft Teams enhanced its task management capabilities by integrating with Planner and To Do, aiming to create a more cohesive productivity ecosystem for its users.

- In March 2022, Notion launched its API to support third-party integrations, empowering users to connect Notion with various other tools and improving its versatility within productivity management.

- In February 2022, Airtable introduced a new template marketplace, allowing users to share and utilize custom templates, thus enhancing community engagement and resource sharing among users.

Productivity Management Software Market Growth Factors:

The expansion of the Productivity Management Software Market is fueled by the rising implementation of cloud-based technologies, the shift towards remote work, and a growing need for advanced collaboration tools.

The market for productivity management software is experiencing robust expansion due to a variety of interconnected factors. Primarily, the ongoing digital transformation within businesses has amplified the need for tools that optimize workflows and foster collaboration, especially in remote and hybrid working situations. Furthermore, the emergence of big data analytics and business intelligence solutions enables companies to harness insights for better decision-making, driving further interest in productivity software. The increasing prevalence of mobile device usage enhances the ability to access these tools from anywhere, contributing to market growth.

In addition, ened emphasis on employee engagement and performance enhancement is motivating companies to adopt specialized software that tracks development and strengthens accountability. The capacity for these tools to integrate smoothly with existing enterprise systems is also vital, allowing for easier implementation without significant disruption to current operations. Additionally, a rising awareness of mental health and the importance of work-life balance has led organizations to seek software that alleviates workload pressures while improving overall productivity. As the significance of effective time management and resource distribution becomes more widely recognized, the demand for forward-thinking productivity management solutions is set to escalate, positioning the market for considerable advancement in the future.

Productivity Management Software Market Restaining Factors:

The main hindrances in the Productivity Management Software Market are the substantial costs associated with implementation and the difficulties encountered in user adoption and integration into current systems.

The market for Productivity Management Software encounters numerous constraints that could impede its expansion. A primary obstacle is the significant expense tied to the deployment and upkeep of sophisticated productivity tools, which may deter small and medium-sized enterprises (SMEs) with restricted financial resources. In addition, the intricate process of merging these applications with pre-existing infrastructure can provoke pushback from staff, leading to diminished rates of acceptance. Issues surrounding data security and privacy are also pivotal, as businesses may be reluctant to embrace cloud-based options owing to concerns about potential data leaks. Moreover, the fast-evolving tech landscape demands continuous updates and employee training, which can overwhelm organizations with ongoing financial and resource challenges. The lack of uniform metrics for evaluating productivity can induce doubts about the efficacy of these tools, further discouraging investment. Finally, differing levels of digital proficiency among employees can obstruct seamless transitions to new software systems. Nonetheless, in spite of these hurdles, the increasing shift towards remote work and digital cooperation is inspiring organizations to pursue efficient solutions, thereby driving innovation and presenting growth prospects within the productivity management software sector.

Key Segments of the Productivity Management Software Market

By Solution:

- Content Management & Collaboration

- AI & Predictive Analytics

- Structured Work Management

- Other Solutions

By Deployment

- On-premise

- Cloud

By Enterprise Size:

- Large Enterprise Size

- Small & Medium Enterprise Size

By Industry

- BFSI

- IT & Telecom

- Healthcare

- Manufacturing

- Transportation

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America