Process Analytical Technology Market Analysis and Insights:

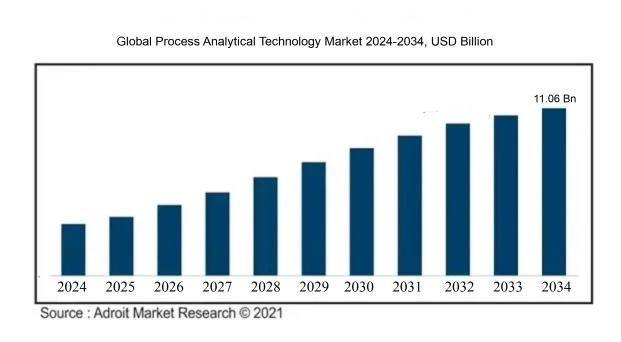

The size of the global market for process analytical technology was USD 4.28 billion in 2024, increased to USD 5.02 billion in 2025, and is projected to reach around USD 11.06 billion by 2034, with a compound annual growth rate (CAGR) of 11.18% from 2024 to 2034.

The market for Process Analytical Technology (PAT) is influenced by several pivotal factors. Primarily, there is a ened need for quality assurance in manufacturing, especially within the pharmaceutical and food industries, which emphasizes the necessity for real-time analytical capabilities to guarantee product safety and effectiveness. Compliance with regulatory standards is also a critical driver, as companies aim to meet the rigorous quality expectations established by governing bodies, prompting investments in state-of-the-art analytical technologies. Furthermore, the increasing move towards automation and digital integration across various sectors enhances the adoption of PAT solutions, leading to greater efficiency, lower operational expenses, and uniformity in product quality. The transition from conventional batch manufacturing to continuous production methods also fosters an appetite for advanced analytical instruments. Lastly, the growing emphasis on research and development to innovate and upgrade products further amplifies the demand for sophisticated analytical methodologies, significantly bolstering the expansion of the PAT market.

Process Analytical Technology Market Definition

Process Analytical Technology (PAT) encompasses a framework aimed at the design, assessment, and management of manufacturing processes by utilizing real-time measurements of essential quality and performance characteristics. The primary objective of PAT is to improve the understanding of production processes and guarantee the quality of products, particularly within the pharmaceutical and bioproduct sectors.

Process Analytical Technology (PAT) plays a vital role in the pharmaceutical and chemical sectors by advancing the real-time observation and regulation of manufacturing processes. By embedding analytical instruments within production workflows, PAT aids in discerning essential quality attributes and process variables, which results in enhanced product uniformity and quality. This methodology promotes improved decision-making, decreases the likelihood of batch failures, and increases operational efficiency. Additionally, PAT helps meet regulatory standards by offering documented proof of process comprehension and oversight. In summary, adopting PAT encourages innovation, reduces waste, and contributes to a more sustainable and economically viable manufacturing landscape.

Process Analytical Technology Market Segmental Analysis:

Insights On Product

Analyzers

Analyzers are expected to dominate the Global Process Analytical Technology Market due to their critical role in providing real-time data and insights during production processes. These instruments facilitate quality control and assurance, significantly impacting manufacturing efficiency and regulatory compliance. As industries increasingly focus on automation and digitalization, the reliance on analyzers for data-driven decision-making is set to rise. Their capability to integrate with existing systems and enhance process optimization further strengthens their position in the market. Consequently, the demand for advanced analyzers across sectors like pharmaceuticals, chemicals, and food and beverage is anticipated to drive market growth in the coming years.

Sensors & Probes

Sensors and probes play an essential role in data collection and monitoring within process analytical technologies. They enable precise measurements of various parameters such as temperature, pH, and pressure, which are vital for maintaining product quality and process efficiency. With the growing emphasis on real-time monitoring in industries, the market for sensors and probes is expanding. Their ability to operate in harsh environments and their compatibility with smart technology make them attractive options for manufacturers. Therefore, even though they are not the leading product type, they occupy a significant share in facilitating the overall analytical process.

Samplers

Samplers are crucial in ensuring that representative samples from production processes are collected accurately, allowing for reliable testing and analysis. They help maintain the integrity of samples, thus providing more accurate data for quality assurance. As industries recognize the importance of compliant sampling procedures, the demand for samplers is steadily increasing. Though their market share is lower compared to analyzers, their significance in supporting analytical processes ensures they retain a vital role within the broader process analytical technology framework, contributing to overall operational efficiency and product quality enhancement.

Software & Services

Software and services complement hardware offerings by providing the necessary tools for data analysis, visualization, and process control. Integrated software solutions enable users to interpret complex data sets efficiently, leading to quicker and more informed decision-making in production environments. The rapid evolution of data technologies, including cloud computing and AI-driven analytics, is driving growth in this area. While software and services may not lead the market, their importance in optimizing process performance and enhancing user experience makes them a critical component in the overall analytical ecosystem. Thus, they support a range of advancements in process analytical technologies.

Insights On Technique

Chromatography

Chromatography is expected to dominate the Global Process Analytical Technology Market due to its widespread applications in diverse industries such as pharmaceuticals, food and beverages, and environmental testing. This technique is highly valued for its ability to separate and analyze complex mixtures effectively. The increasing need for quality control, regulatory compliance, and the demand for high-throughput analysis drives the adoption of chromatography technologies. Additionally, advancements in chromatography instruments and methodologies, such as high-performance liquid chromatography (HPLC) and gas chromatography (GC), further enhance its efficiency and accuracy. As industries seek to improve process optimization and product quality, chromatography's role will continue to expand, solidifying its dominant position in the market.

Spectroscopy

Spectroscopy is also a significant technique in the process analytical technology market. Its applications range from chemical analysis to monitoring quality assurance in various sectors. Techniques such as Near-Infrared (NIR) and Fourier Transform Infrared (FTIR) spectroscopy facilitate real-time analysis, making them crucial in pharmaceutical manufacturing and food quality assessment. The versatility of spectroscopy in identifying materials and measuring concentrations adds to its relevance across multiple industries. However, it competes closely with chromatography and is often used as a complementary technique in comprehensive analytical strategies.

Particle Size Analysis

Particle Size Analysis plays a crucial role in industries like pharmaceuticals, cosmetics, and materials science. This technique helps in determining the distribution and size of particles in a given sample, which affects the product's performance, stability, and quality. The demand for precise size measurements, especially in drug formulation and nanomaterials, drives its growth. Although it does not dominate the market, it remains vital for applications requiring precise particle characteristics, enhancing its importance in specific analytical contexts.

Electrophoresis

Electrophoresis is primarily utilized in the fields of biology and biochemistry for the separation and analysis of macromolecules such as proteins and nucleic acids. With the rising need for genetic research and diagnostics, this technique has gained traction. While it is highly specialized and important in certain scenarios, its use is generally more limited compared to chromatography and spectroscopy. Nevertheless, technological advancements and expanding applications in personalized medicine contribute to its growth within niche s of the market.

Others

The "Others" category encompasses various techniques that complement mainstream analytical methods. This includes newer and emerging technologies like mass spectrometry and microwave processing. While it may not dominate the market, innovations in this space can significantly influence specific applications and industries. The integration of novel approaches continues to expand the analytical capabilities available to industries, allowing for more comprehensive analyses and process improvements.

Insights On Monitoring Method

On-line

On-line monitoring is expected to dominate the Global Process Analytical Technology Market primarily due to its ability to provide real-time data and facilitate immediate decision-making in various industrial processes. Since industries strive for higher efficiency and lower operational costs, the on-line method allows for continuous data collection without interrupting the production cycle. This real-time insight into processes enhances process control and quality assurance, making it an attractive choice for manufacturers looking to optimize their operations and comply with regulatory standards. As industries embrace automation and smart manufacturing, on-line monitoring is set to lead the market.

In-line

In-line monitoring plays a significant role in the Global Process Analytical Technology Market, focusing on integrating monitoring devices within the production line. This method allows for continuous assessment and improvement while ensuring product consistency and quality throughout the process. It is particularly valuable in sectors such as pharmaceuticals and food manufacturing, where product integrity is critical. Despite not being as prevalent as on-line methods, in-line applications still hold a substantial market share due to their efficiency in detecting deviations and minimizing waste.

At-line

The at-line monitoring approach has gained traction in the Global Process Analytical Technology Market as it provides a flexible and efficient alternative to conventional methods. By allowing samples to be tested or analyzed near the production line rather than in a distant laboratory, this method saves time and facilitates quicker decision-making. While it may not deliver the immediate benefits of on-line monitoring, at-line methods balance the need for precision and practicality, appealing to industries that require reliable quality assessments without full integration into the production process.

Off-line

Off-line monitoring involves analyzing samples in a laboratory setting after the production process, offering accuracy and detailed insights into product quality. Although it is often seen as less efficient due to the delay in obtaining results, this method remains vital for comprehensive analytical testing, particularly in industries where stringent regulatory compliance is necessary. Off-line monitoring provides valuable data that can inform future adjustments and improvements in processes, ensuring that product quality standards are consistently met, even if it does not dominate overall market trends.

Insights On End-User

Biopharmaceutical manufacturers

The biopharmaceutical manufacturers are expected to dominate the Global Process Analytical Technology Market due to the increasing demand for biologics and biopharmaceutical products. This sector is characterized by complex manufacturing processes and stringent regulatory requirements, creating a high need for real-time analytics to ensure product quality and compliance. The ability of process analytical technology to facilitate the seamless integration of quality control processes into manufacturing operations makes it particularly appealing to biopharmaceutical manufacturers, who must meet evolving standards and ensure efficient production. Furthermore, advances in bioprocessing technology and a rise in personalized medicine initiatives push the need for continuous monitoring and control, further solidifying this 's leading role in the market.

Pharmaceutical manufacturers

Pharmaceutical manufacturers are also an important in the Global Process Analytical Technology Market. While they focus on traditional drug production, they increasingly recognize the benefits of implementing advanced analytics for quality assurance and regulatory compliance. The growing prevalence of generic drugs and the need for cost-effectiveness in manufacturing processes are driving these companies to adopt process analytical technology. By enhancing efficiency and minimizing risks associated with batch failures, pharmaceutical manufacturers benefit from improved productivity and the ability to respond swiftly to market demands. Thus, they remain a significant player in the analytical technology landscape.

Contract research and manufacturing organizations

Contract research and manufacturing organizations (CROs and CMOs) play a crucial role in the Global Process Analytical Technology Market. With their unique position of providing outsourced services to both pharmaceutical and biopharmaceutical companies, they experience increasing pressure to deliver high-quality results within tight timelines. The adoption of process analytical technology allows CROs and CMOs to optimize their manufacturing processes, improve quality control, and ensure regulatory compliance. By leveraging these advanced analytic capabilities, they can enhance their service offerings, thereby attracting more clients and solidifying their importance in the evolving landscape of drug manufacturing and development.

Global Process Analytical Technology Market Regional Insights:

North America

North America is expected to dominate the Global Process Analytical Technology (PAT) market due to the robust presence of established pharmaceutical and biotechnology companies, which significantly invest in technological advancements to streamline processes and ensure product quality. Additionally, the region benefits from a well-developed infrastructure, stringent regulatory standards driving innovation, and a strong emphasis on research and development activities. The increasing adoption of automation and digitalization in manufacturing processes further supports the growth of PAT solutions. This combination of factors positions North America at the forefront of the PAT market, attracting investments and driving optimized processes across various industries.

Latin America

Latin America is witnessing gradual growth in the Global Process Analytical Technology market, primarily driven by an increasing demand for efficient manufacturing processes in pharmaceuticals and biotechnology sectors. The region’s economic improvements and foreign investments are progressively enhancing its healthcare infrastructure. However, challenges such as regulatory hurdles and varying technological adoption rates across countries can impede the speed of market expansion. Yet, companies are gradually recognizing the need for advanced analytical technologies to remain competitive and compliant, which can present opportunities for growth, especially in larger markets like Brazil and Mexico.

Asia Pacific

Asia Pacific is emerging as a significant player in the Global Process Analytical Technology market, fueled by rapid industrialization, a growing number of manufacturing facilities, and increasing investments in the pharmaceutical and biotechnology sectors. The region has a diverse landscape, with countries like China and India leading the charge in adopting innovative technologies to improve production efficiency and regulatory compliance. However, the market faces challenges such as varying technological readiness levels and infrastructure disparities. Despite this, the shifting focus towards modernization and the enhancement of quality control practices are contributing to a positive outlook for PAT in Asia Pacific.

Europe

Europe plays a vital role in the Global Process Analytical Technology market, characterized by stringent regulatory frameworks and a strong emphasis on quality assurance in manufacturing. The presence of well-established pharmaceutical companies and a commitment to innovation foster an environment conducive to PAT adoption. Moreover, the EU's ongoing initiatives aimed at improving industrial processes and product safety can further drive market growth. However, competition from both local and international firms can create challenges despite the European market being a significant contributor to the overall demand for PAT solutions.

Middle East & Africa

The Middle East and Africa (MEA) region are gradually catching up in the Global Process Analytical Technology market, driven by an increasing focus on healthcare advancements and manufacturing capabilities. Countries in the Middle East are investing heavily in their pharmaceutical industries, aiming to reduce reliance on imports and enhance local production. However, the region still faces challenges such as economic instability and underdeveloped healthcare infrastructure. Despite these obstacles, there is a growing awareness of the benefits of implementing PAT in manufacturing processes, which could create substantial growth opportunities in the coming years.

Process Analytical Technology Competitive Landscape:

Leading contributors in the Global Process Analytical Technology sector are spearheading advancements by creating sophisticated analytical tools and software. This progress significantly improves quality assurance and operational productivity in sectors such as pharmaceuticals and chemicals. Their partnership with regulatory agencies facilitates adherence to industry standards and promotes the integration of PAT techniques throughout diverse manufacturing operations.

Prominent participants in the Process Analytical Technology (PAT) industry consist of Siemens AG, Emerson Electric Co., Yokogawa Electric Corporation, Honeywell International Inc., ABB Ltd., Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies Inc., KPM Analytics, Waters Corporation, METTLER TOLEDO International Inc., P-STAT, Exyte Group, Endress+Hauser AG, and Ametek, Inc.

Global Process Analytical Technology COVID-19 Impact and Market Status:

The Covid-19 pandemic notably expedited the integration of Process Analytical Technology (PAT) within the worldwide marketplace, as organizations aimed to improve their operational effectiveness and maintain product quality amidst swiftly evolving circumstances.

The COVID-19 pandemic has profoundly affected the Process Analytical Technology (PAT) sector, primarily by expediting the integration of sophisticated analytical technologies within the pharmaceutical and biotechnology industries. The pressing demand for swift vaccine development and streamlined production methods has driven organizations to utilize PAT tools for real-time monitoring, quality assurance, and adherence to regulatory requirements. Furthermore, the transition to remote operations alongside the ened need for digital solutions has led to greater investments in automation and analytical technologies, promoting innovation in the PAT domain. Nevertheless, the pandemic caused interruptions in supply chains and laboratory functions, which temporarily delayed project timelines and implementation. As the market navigates these issues, an enhanced emphasis on health security and the urgent requirement for resilient and adaptable manufacturing capabilities is anticipated to propel sustainable growth in the PAT landscape, signifying a significant transformation in operational approaches in the post-pandemic era.

Latest Trends and Innovation in The Global Process Analytical Technology Market:

- In April 2023, Thermo Fisher Scientific acquired PPD, Inc., enhancing its capabilities in process analytical technology with a focus on biopharmaceuticals, strengthening their position in the market.

- In June 2023, Siemens AG developed an innovative software solution for real-time monitoring of process analytical technologies in chemical manufacturing, demonstrating a commitment to digitalization and efficiency in the industry.

- In March 2023, Emerson Electric Co. launched a new series of online analyzers that utilize advanced machine learning algorithms for precise monitoring of chemical process parameters, reflecting their dedication to technological innovation in the PAT arena.

- In January 2023, Waters Corporation introduced an advanced mass spectrometry platform that integrates seamlessly with existing process analytical technologies, enhancing data accuracy and throughput for pharmaceutical applications.

- In September 2022, Merck KGaA announced a partnership with Sartorius AG to develop integrated process analytical technology solutions aimed at addressing challenges within bioprocessing environments.

- In February 2022, ABB Limited released an updated version of their Ability™ Symphony Plus control system, which includes enhanced features for integrating process analytical technologies into industrial operations, aimed at increasing operational efficiency.

- In December 2021, PerkinElmer, Inc. acquired BioLegend, Inc., intending to strengthen its portfolio in life sciences and process analytical technologies, thereby boosting its capabilities in bioanalytical testing.

- In November 2021, Agilent Technologies launched new software that focuses on process analytical technology for digital biomanufacturing, allowing users to achieve greater insights into the manufacturing process in real-time.

Process Analytical Technology Market Growth Factors:

The expansion of the Process Analytical Technology Market is fueled by a rising need for stringent quality control, adherence to regulatory standards, and enhanced operational efficiency within manufacturing processes across multiple sectors.

The market for Process Analytical Technology (PAT) is undergoing notable expansion, fueled by various influential elements. Primarily, there is an increasing need for pharmaceutical and biotechnology products, which underscores the importance of improved quality control and process optimization, thereby accelerating the use of PAT solutions. Additionally, regulatory bodies such as the FDA are imposing stricter requirements for compliance and quality, further driving market growth.

Technological advancements, particularly in real-time data analysis and automation, enable industries to enhance efficiency and minimize production time. The growing focus on continuous manufacturing processes significantly contributes to this trend, as PAT supports the smooth integration and oversight of these processes.

Moreover, the rising recognition of PAT's benefits, such as lowering operational costs and minimizing waste, makes it particularly attractive to manufacturers. The burgeoning biopharmaceutical sector, especially in emerging economies, is another critical factor, with companies actively pursuing innovative solutions to address increasing patient demands.

Lastly, ongoing investments directed towards research and development aimed at refining PAT capabilities are anticipated to maintain the market's growth trajectory. Together, these elements foster a dynamic environment conducive to the continued advancement of the Process Analytical Technology market.

Process Analytical Technology Market Restaining Factors:

The Process Analytical Technology market faces significant challenges that hinder its growth, including stringent regulatory requirements, substantial upfront investment expenses, and the difficulties associated with integrating new technologies into existing infrastructures.

The market for Process Analytical Technology (PAT) encounters several hurdles that may impede its expansion. A significant obstacle is the substantial costs involved in acquiring sophisticated analytical instruments and technologies, which can deter smaller companies or those operating on tight budgets. Moreover, the intricate nature of incorporating PAT solutions into pre-existing production systems may provoke resistance from both operators and management, particularly in firms accustomed to traditional practices. Compliance with regulations presents another critical challenge; stringent requirements within sectors such as pharmaceuticals can hinder the adoption of novel technologies, as businesses strive to align PAT implementation with regulatory standards. Additionally, a shortage of qualified personnel knowledgeable in contemporary PAT techniques can result in gaps in expertise, which may restrict the optimal application of these advanced tools. Concerns regarding data security and integrity are also pivotal, as organizations remain cautious about the risks associated with digital analytics. Nonetheless, the rising need for improved product quality, operational efficiency, and adherence to regulatory standards continues to stimulate interest and investment in the PAT market, ultimately fostering innovation and growth as industries adapt to new standards and embrace modernization.

Key Segments of the Process Analytical Technology Market

By Product:

- Analyzers

- Sensors & Probes

- Samplers

- Software & Services

By Technique:

- Spectroscopy

- Chromatography

- Particle Size Analysis

- Electrophoresis

- Others

By Monitoring Method:

- On-line

- In-line

- At-line

- Off-line

By End-User:

- Pharmaceutical manufacturers

- Biopharmaceutical manufacturers

- Contract research and manufacturing organization

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America