Market Analysis and Insights:

The market for Global Pressure Sensor was estimated to be worth USD 20.5 billion in 2024, and from 2024 to 2033, it is anticipated to grow at a CAGR of 4.5%, with an expected value of USD 31 billion in 2033.

.jpg)

The expansion of the Pressure Sensor Market is largely attributed to the ened need for automation within numerous sectors, such as automotive, healthcare, and manufacturing. As organizations aim to improve efficiency and ensure safety, pressure sensors have become vital tools for overseeing and regulating processes. The increasing integration of smart technologies and the Internet of Things (IoT) enhances this market further, with pressure sensors being integral for the collection and analysis of real-time data. Moreover, the rising focus on environmental sustainability and the demand for dependable monitoring systems, particularly in the oil and gas industry, are key factors driving growth. Innovations in technology, including the creation of compact and highly precise sensors, also contribute positively by meeting a wide range of application requirements. In addition, regulatory pressures for maintaining safety and efficiency standards in industrial operations intensify the need for advanced pressure measurement solutions, subsequently promoting market progress.

Pressure Sensor Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2033 |

| Study Period | 2023-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 31 billion |

| Growth Rate | CAGR of 4.5% during 2024-2033 |

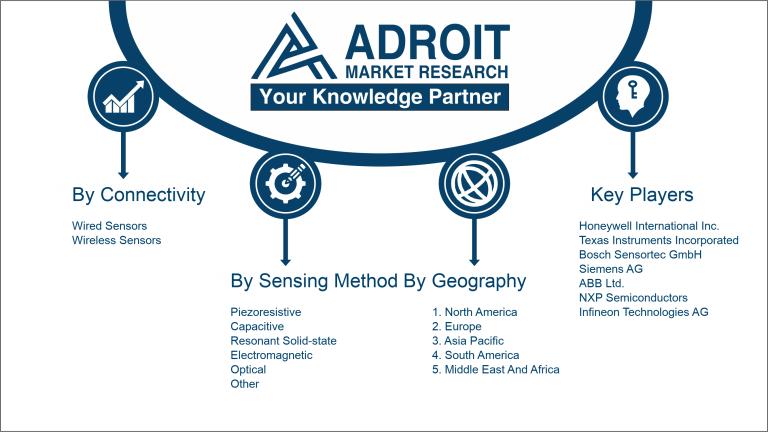

| Segment Covered | By Connectivity, By Sensing Method, By Sensor Type, By Pressure Range, By End Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Honeywell International Inc., Texas Instruments Incorporated, Bosch Sensortec GmbH, Siemens AG, ABB Ltd., NXP Semiconductors, Infineon Technologies AG, Amphenol Corporation, Scott Technologies, STMicroelectronics, Omron Corporation, Druck Ltd. (a subsidiary of Baker Hughes Company), Eaton Corporation Plc, Emerson Electric Co., and Analog Devices, Inc. In addition, firms like Kistler Instrumente AG, Ashcroft Inc., Endress+Hauser AG, Freescale Semiconductor (currently a part of NXP) |

Market Definition

A pressure sensor is an instrument designed to quantify the force applied by a fluid—whether liquid or gas—within a specific area and translate this force into an electrical output. Such sensors find extensive applications across multiple fields, including industry, automotive technology, and environmental surveillance.

Pressure sensors are essential components utilized in numerous sectors such as automotive, aerospace, healthcare, and manufacturing. These devices play a critical role in overseeing and regulating pressure levels within systems, thereby promoting safety and efficiency. By delivering real-time information, pressure sensors aid in optimizing operations, averting equipment malfunction, and improving overall performance. In the medical field, they are indispensable for tracking blood pressure and ensuring the proper functioning of drug delivery mechanisms. Moreover, pressure sensors are significant in environmental surveillance, aiding sustainability initiatives by identifying shifts in weather conditions and monitoring industrial emissions. Their dependability and precision are crucial for the consistent operation and pioneering developments in technology.

Key Market Segmentation:

Insights On Key Connectivity

Wireless Sensors

Wireless sensors are expected to dominate the Global Pressure Sensor Market due to their increasing integration in various applications such as industrial automation, environmental monitoring, and healthcare. The growing demand for remote monitoring solutions is allowing wireless technologies to gain traction, offering advantages such as flexibility, ease of installation, and reduction in wiring costs. Moreover, advancements in battery technology and wireless communication protocols are enhancing the performance and reliability of wireless sensors, making them more appealing to consumers. Increased adoption in smart city initiatives and the Internet of Things (IoT) applications further solidifies their position, offering a significant competitive advantage over wired sensors.

Wired Sensors

Wired sensors still hold a crucial place in the pressure sensor market, primarily due to their reliability and stability in data transmission. Industries such as manufacturing and energy often require wired connections for precision and consistency in measurements, where wireless options may not provide the necessary dependability. Though they may be facing competition from wireless technologies, wired sensors are typically favored in situations requiring minimal latency and high noise immunity, particularly in harsh environments. Their robustness and ability to function without the interference that sometimes plagues wireless systems ensure that they remain a viable choice for many applications.

Insights On Key Sensing Method

Capacitive

Capacitive pressure sensors are expected to dominate the Global Pressure Sensor Market due to their advantages in terms of accuracy, reliability, and miniaturization capabilities. They are widely used in various applications, including automotive, medical, and industrial sectors. The growth in industries such as IoT and automation has increased the demand for precise and compact sensors, making capacitive sensors more appealing for next-generation applications. Furthermore, their ability to function in harsh environments provides them an edge over competitors, as they maintain performance where others might fail. This broad applicability coupled with consistent technological advancements in miniaturization and integration with electronic systems positions capacitive sensors in a leading role.

Piezoresistive

Piezoresistive sensors leverage the change in electrical resistance due to pressure alterations, which allows for accurate pressure measurements. These sensors are favored in medical applications and automotive systems for their sensitivity and accuracy. Their relatively simple construction and cost-effectiveness further enhance their adoption, making them a reliable choice for many industries. The ongoing development in piezoresistive technology ensures that these sensors remain relevant, especially in applications demanding precision and real-time data.

Resonant Solid-state

Resonant solid-state pressure sensors utilize the fundamental frequency shift to determine pressure levels. These sensors offer high precision and stability over varying environmental conditions, making them suitable for aerospace and defense applications. Their intrinsic resilience against temperature fluctuations and other interferences gives them an advantage in demanding settings. Although they are typically more expensive and complex, their performance attributes often justify the investment in specialized applications.

Electromagnetic

Electromagnetic pressure sensors operate based on the principles of electromagnetic induction. Although they are less common in traditional pressure sensing applications, they are gaining traction in specialized fields such as water level measurement and oil and gas industries. Their ability to function without physical contact with the medium gives them a unique advantage in terms of durability and maintenance. However, the challenges related to calibration and cost may limit broader adoption compared to other technologies.

Optical

Optical sensors utilize light to detect changes in pressure, offering high levels of precision and miniature form factors. They are finding increasing applications in medical diagnostics and research applications where small size and high accuracy are paramount. However, factors such as complex setup requirements and higher costs compared to other technologies may limit their widespread adoption. Nevertheless, ongoing innovations in optical technology may enhance their viability in more markets in the future.

Other

Other sensing methods encompass a variety of techniques beyond the more common piezoresistive, capacitive, resonant solid-state, electromagnetic, and optical methods. These alternative approaches may include piezoelectric sensors, which generate an electric charge in response to mechanical stress, and potentiometric sensors that measure pressure by tracking the movement of a resistive element. Additionally, thermal-based methods use changes in gas or liquid temperature due to pressure variations, while ion-sensitive methods detect changes in ion distribution under pressure. These diverse methods are often employed for specialized applications, offering unique advantages based on the environment or requirements.

Insights On Key Sensor Type

Gauge Pressure Sensors

Gauge Pressure Sensors are expected to dominate the Global Pressure Sensor Market due to their wide applications across various industries, including automotive, process control, and HVAC systems. Their ability to provide accurate readings relative to ambient atmospheric pressure makes them particularly valuable for applications requiring precise measurements in fluctuating environmental conditions. This adaptability, combined with their cost-effectiveness, leads to high demand, especially in sectors where safety and operational efficiency are paramount. Furthermore, the ongoing advancements in sensor technologies and the rising trend towards automation and smart technologies are driving the increased adoption of gauge pressure sensors in numerous applications, solidifying their market leadership.

Absolute Pressure Sensors

Absolute Pressure Sensors have a significant role in industries that require precise measurements of pressure without the influence of atmospheric variations. They are particularly dominant in aerospace and high-precision scientific applications, where accurate absolute pressure readings are critical. Their reliability and accuracy make them indispensable in ensuring safety and optimal performance in various operations, contributing to their steady growth in demand. The advancement of technology, leading to reduced sizes and enhanced functionalities, further boosts their adoption, particularly in niche applications requiring exceptional precision.

Differential Pressure Sensors

Differential Pressure Sensors are widely utilized in applications where the difference in pressure between two points is critical. This includes industries such as oil and gas, pneumatic systems, and environmental monitoring. Their ability to measure and control processes effectively drives their relevance, especially in filtration and flow measurement systems. With increasing focus on energy efficiency and process optimization, the demand for differential pressure sensors is expected to rise steadily. Their robust design and suitability for various operating environments enhance their appeal, ensuring continued growth in the market.

Sealed Pressure Sensors

Sealed Pressure Sensors cater to environments where pressure fluctuations are subject to external influences but require protection from contamination. They are extensively used in refrigeration, HVAC, and automotive applications. Their compact design and ability to operate in harsh conditions make them suitable for diverse industrial uses. The need for reliable and consistent performance in numerous applications further propels the growth of sealed pressure sensors within the market. Additionally, as industries seek to improve their processes and product quality, the importance of these sensors continues to increase.

Vacuum Pressure Sensors

Vacuum Pressure Sensors are specialized tools used primarily in applications requiring measurement of low-pressure environments, such as in vacuum systems and semiconductor manufacturing. Their unique capability to detect minute changes in pressure is crucial in operations where maintaining optimal vacuum conditions is paramount. The ongoing advancements in technology, alongside the growing sectors of electronics and pharmaceuticals, are particularly expanding the market for vacuum pressure sensors. As industries become increasingly reliant on precise vacuum control, the demand for these sensors is expected to rise, driving market growth.

Insights On Key Pressure Range

Above 1,000 psi

The expected to dominate the Global Pressure Sensor Market is the range above 1,000 psi. This is attributed to the growing demand for high-performance pressure sensors in industries such as aerospace, oil and gas, and chemical processing, where the need for precise measurement under extreme conditions is critical. These sectors are increasingly adopting advanced technologies that require high-pressure capabilities, resulting in a rising adoption of sensors that function above 1,000 psi. Additionally, the development of innovative materials and designs is enhancing the reliability and accuracy of these sensors, further driving their demand globally.

Up to 100 psi

The range of up to 100 psi primarily serves low-pressure applications such as HVAC systems, food and beverage processing, and consumer electronics. While this market is essential, it is often characterized by lower profit margins and higher competition among manufacturers. As industries increasingly focus on automation and smart sensing solutions, the necessity for higher pressure ratings has overshadowed this . Lack of significant technological advancements compared to higher pressure ranges also contributes to its slower growth rate in the global pressure sensor market.

101 to 1,000 psi

The 101 to 1,000 psi range is significant for industrial applications like hydraulics, pneumatics, and general manufacturing. This is experiencing steady demand due to its applicability across various sectors that require medium-pressure monitoring and control. However, its growth faces challenges from the more advanced sensors available in the above 1,000 psi category, which cater to more specialized and high-demand environments. Despite these limitations, this range remains essential for specific applications where extreme pressure is not necessary, but reliable performance within this range is crucial.

Insights On Key End Use

Automotive

The automotive sector is expected to dominate the Global Pressure Sensor Market due to the increasing adoption of advanced driver-assistance systems (ADAS) and the growth of electric and hybrid vehicles. As vehicles become more sophisticated with enhanced safety features and automation, the demand for pressure sensors that monitor various functions, such as tire pressure, engine diagnostics, and climate control systems, has surged. Additionally, regulations promoting fuel efficiency and emissions reduction are driving manufacturers to integrate pressure sensors for performance optimization. This ongoing evolution in automotive technology makes this market the leading consumer of pressure sensors globally.

Medical

In the medical field, pressure sensors play a critical role in monitoring vital signs, administering medications, and maintaining medical equipment functionality. The increasing prevalence of chronic diseases and an aging population drive demand for precise measurements in devices like ventilators, infusion pumps, and diagnostic tools. Furthermore, advancements in telemedicine and home healthcare create additional opportunities for portable monitoring equipment, enhancing safety during patient care, which consistently boosts the market for pressure sensors in this sector.

Manufacturing

The manufacturing industry relies heavily on pressure sensors for process controls, automation, and quality assurance. With the ongoing trend toward Industry 4.0, businesses are investing in IoT technologies that require advanced sensing capabilities to enhance operational efficiency. The ability to monitor process parameters in real-time helps manufacturers maintain optimal production conditions and reduce downtime. The push for reliability and sustainability in manufacturing operations is driving the adoption of pressure sensors, offering significant opportunities in this domain.

Utilities

The utilities sector increasingly employs pressure sensors for monitoring water and gas distribution systems, as well as electricity transmission. Aging infrastructure and the need for efficient resource management spur investments in smart grid technologies. Pressure sensors are vital for ensuring system integrity and improving maintenance practices. With rising demand for sustainable energy solutions and better resource management, the reliance on pressure sensors in utilities will continue to grow, thereby expanding the market footprint.

Aviation

In the aviation industry, pressure sensors are essential for measuring altitude, airspeed, and cabin pressure, ensuring safe and efficient flight operations. Increased air traffic and the demand for new aircraft, driven by emerging markets, are propelling growth in this sector. Furthermore, advancements in avionics and the push for more fuel-efficient aircraft hinge on accurate pressure readings and optimal performance measures, making this a steady consumer of pressure sensors.

Oil & Gas

In the oil and gas industry, pressure sensors are critical for monitoring drilling operations, refining processes, and pipeline integrity. With the rising global energy demand and the need for safer extraction and processing technologies, the implementation of sophisticated pressure sensors is becoming more commonplace. Additionally, regulations requiring real-time monitoring and compliance frameworks propel investments in automated monitoring systems across this sector, indicating a stable demand for pressure sensors.

Marine

The marine sector utilizes pressure sensors for various applications, including monitoring propeller performance, ballast systems, and environmental control within vessels. As the maritime industry emphasizes safety and efficiency, there is a growing need for reliable sensors that can withstand harsh marine environments. The trend towards automation and digitization in maritime operations boosts the adoption of advanced pressure monitoring technologies, suggesting a consistent market presence in the marine industry.

Consumer Devices

In the consumer devices category, pressure sensors are increasingly incorporated into smartphones, wearables, and smart home products for functions like altitude measurement, weather monitoring, and automated ventilation. The surge in consumer demand for IoT-enabled devices encourages manufacturers to integrate innovative sensing solutions. As technology continues to evolve and more features get added to consumer electronics, the market for pressure sensors in this sector will remain robust, catering to a growing audience.

Other

Other end-use category encompasses a diverse range of industries and applications not covered by primary sectors like automotive or medical. These industries often include agriculture, aerospace (beyond aviation), robotics, environmental monitoring, and energy generation (such as renewable energy). In agriculture, pressure sensors help optimize irrigation systems and monitor equipment performance. In robotics, they enable precision control for automated machinery. Environmental applications involve monitoring atmospheric pressure for climate studies, while in renewable energy, they ensure the efficient operation of turbines and storage systems. The flexibility and adaptability of pressure sensors make them essential across these varied sectors.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Pressure Sensor Market due to its rapid industrialization, growing automotive sector, and increasing demand for consumer electronics. Countries like China, Japan, and India are substantially contributing to this growth by investing in advanced manufacturing technologies. The rising demand for advanced medical devices and automation in industries such as oil and gas, HVAC, and manufacturing further augment market growth. Additionally, the proliferation of IoT and smart technologies in this region is spurring the adoption of pressure sensors, establishing it as the leading market .

North America

North America holds a significant position in the Global Pressure Sensor Market, driven primarily by technological advancements and a well-established automotive industry. The region boasts a high concentration of key players and offers innovative pressure sensing solutions tailored for aerospace, medical, and industrial applications. Moreover, stringent regulations regarding quality control and safety standards foster the demand for high-performance pressure sensors across various sectors.

Europe

Europe is witnessing steady growth in the Global Pressure Sensor Market, largely attributed to stringent safety and quality regulations across various industries. The automotive sector, particularly in countries like Germany and France, thrives on advanced pressure sensing technologies to enhance vehicle performance and safety. Additionally, the region's focus on renewable energy and environmental sustainability drives the demand for pressure sensors in monitoring applications, promoting further market expansion.

Latin America

Latin America represents a growing yet smaller of the Global Pressure Sensor Market. The region's industrial sectors, including oil and gas, are beginning to invest more in advanced pressure measurement technologies. However, economic fluctuations and infrastructural challenges can hinder rapid growth. Increased efforts toward modernization and improving infrastructure could bolster market prospects, particularly in emerging markets like Brazil and Mexico.

Middle East & Africa

The Middle East & Africa is a diverse and developing region in the Global Pressure Sensor Market. The growth is largely influenced by the oil and gas sector, which is increasingly investing in advanced pressure sensors for better operational efficiency and safety. However, the market is challenged by political instability and limited technological infrastructure in certain areas. Nevertheless, ongoing initiatives to improve industrial capabilities could pave the way for gradual market advancement in the future.

Company Profiles:

Major contributors to the global pressure sensor market, encompassing producers and technology suppliers, propel innovation and the advancement of products while maintaining quality and adherence to industry regulations. Their collaborations and initiatives for market growth considerably affect the pricing, availability, and technological progress of pressure sensing technologies.

Prominent participants in the pressure sensor sector encompass Honeywell International Inc., Texas Instruments Incorporated, Bosch Sensortec GmbH, Siemens AG, ABB Ltd., NXP Semiconductors, Infineon Technologies AG, Amphenol Corporation, Scott Technologies, STMicroelectronics, Omron Corporation, Druck Ltd. (a subsidiary of Baker Hughes Company), Eaton Corporation Plc, Emerson Electric Co., and Analog Devices, Inc. In addition, firms like Kistler Instrumente AG, Ashcroft Inc., Endress+Hauser AG, Freescale Semiconductor (currently a part of NXP), and Panasonic Corporation are influential in this industry. Furthermore, companies such as Sensata Technologies, FirstSensor AG, and JUMO GmbH & Co. KG are also significant players contributing to the advancement and expansion of the pressure sensor market.

COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the worldwide pressure sensor market, leading to disruptions in supply chains and a notable increase in demand for healthcare-related applications, especially in the realm of medical technology.

The COVID-19 pandemic had a profound impact on the pressure sensor industry, presenting a mix of hurdles and new possibilities. At the onset, production levels suffered due to manufacturing shutdowns and disruptions in the supply chain, as facilities either halted operations or operated at reduced capacity to adhere to health mandates. Conversely, there was a surge in demand for pressure sensors within the healthcare sector, especially for use in ventilators and respiratory equipment, driven by an increased need for medical monitoring. Furthermore, the automotive sector experienced a pivot towards enhanced safety features and automation technologies, stimulating innovation in sensor applications. In the aftermath of the pandemic, despite lingering economic challenges, the market saw a rebound with an emphasis on automation and remote monitoring solutions. Companies responded by bolstering their digital capabilities and investigating novel applications across various domains, including energy management and industrial automation. Therefore, while the pandemic initially introduced significant challenges, it ultimately served as a catalyst for innovation and underscored the growing importance of pressure sensors in a swiftly advancing technological environment.

Latest Trends and Innovation:

- In August 2023, Honeywell announced the acquisition of the start-up Avidyne Corporation to enhance its pressure sensor capabilities for autonomous vehicles, focusing on advanced sensing technologies.

- In July 2023, Bosch Sensortec launched a new MEMS pressure sensor, the BMP390, designed for wearables and IoT applications, featuring high accuracy and low power consumption.

- In June 2023, TE Connectivity acquired First Sensor AG to expand its offerings in the sensor market, including pressure sensors, enabling a more comprehensive product portfolio for industrial applications.

- In May 2023, NXP Semiconductors unveiled a new generation of pressure sensors that offer improved accuracy and smaller form factors, specifically targeting automotive and industrial applications.

- In April 2023, Amphenol Aerospace announced the integration of advanced pressure sensing technology into its existing product lines to enhance performance and reliability in harsh environments.

- In March 2023, Silicon Labs unveiled a new pressure sensor that integrates wireless connectivity, marking a significant innovation for smart home and industrial IoT applications.

- In February 2023, Emerson expanded its range of electronic pressure sensors by releasing the Rosemount 3051S, which offers increased durability and improved measurement capabilities for process industries.

- In January 2023, ABB completed its acquisition of ASTI Mobile Robotics to strengthen its automation and pressure sensing innovations within the logistics sector.

- In December 2022, Infineon Technologies announced an investment in new manufacturing capabilities for its pressure sensors to meet the growing demand in the automotive industry, with plans to increase production by 20% by mid-2023.

- In November 2022, Honeywell launched a new series of piezoresistive pressure sensors tailored for medical applications, emphasizing higher sensitivity and reliability in critical health monitoring scenarios.

Significant Growth Factors:

The expansion of the pressure sensor market is primarily fueled by the escalating need for automation across various industries, a greater implementation within the automotive sector, and significant innovations in sensor technologies.

The market for pressure sensors is witnessing substantial growth stimulated by a variety of crucial elements. Primarily, the escalating need for automation in sectors such as automotive, healthcare, and manufacturing propels the demand for innovative pressure sensing technologies. Additionally, the advent of the Internet of Things (IoT) enhances capabilities for real-time monitoring and control, thereby increasing the incorporation of pressure sensors into smart devices.

Furthermore, rigorous safety and regulatory requirements in industries including oil and gas, aerospace, and pharmaceuticals mandate the use of dependable pressure measurement solutions, which in turn drives market growth. The rising focus on energy efficiency and sustainable practices is also prompting the adoption of pressure sensors within energy management systems.

Technological innovations, particularly in the creation of compact and high-performance sensors, expand their applicability in consumer electronics and wearable technologies. The burgeoning industrialization and infrastructure development in emerging markets, notably in the Asia-Pacific region, offer significant opportunities for businesses in this field. Lastly, the growing utilization of medical devices and healthcare monitoring solutions further ens the necessity for precise and dependable pressure sensors, thereby contributing to the overall market progression. In summary, these combined factors create a vibrant landscape for the pressure sensor sector, supporting its ongoing development.

Restraining Factors:

Significant obstacles facing the pressure sensor industry involve elevated production expenses and the necessity to adhere to rigorous regulatory standards.

The Pressure Sensor Market encounters a range of limiting factors that could impede its growth trajectory. Foremost among these is the substantial expense linked to cutting-edge sensor technologies, which may restrict access for smaller enterprises. Additionally, the intricate nature of sensor systems can create challenges in their integration with pre-existing infrastructure, necessitating specialized expertise for both installation and upkeep, thereby acting as a barrier to widespread adoption. Regulatory hurdles and inconsistencies in standards from one region to another also create obstacles for producers, making it more complicated to formulate market entry plans while escalating costs. Furthermore, the swift evolution of technology has the potential to make current products obsolete, intensifying competition and exerting downward pressure on prices. Economic fluctuations stemming from instability might also influence investments in novel sensor technologies, and concerns pertaining to cybersecurity and data protection in interconnected devices introduce considerable risks. Nevertheless, the market is anticipated to grow as the rising demand for automation and IoT solutions spurs innovation and advancement within the industry. Manufacturers are expected to prioritize research and development efforts to address these challenges, resulting in enhanced product offerings and broader acceptance of pressure sensors across multiple sectors.

Key Segments of the Pressure Sensor Market

By Connectivity

- Wired Sensors

- Wireless Sensors

By Sensing Method

- Piezoresistive

- Capacitive

- Resonant Solid-state

- Electromagnetic

- Optical

- Other

By Sensor Type

- Absolute Pressure Sensors

- Gauge Pressure Sensors

- Differential Pressure Sensors

- Sealed Pressure Sensors

- Vacuum Pressure Sensors

By Pressure Range

- Up to 100 psi

- 101 to 1,000 psi

- Above 1,000 psi

By End Use

- Automotive

- Medical

- Manufacturing

- Utilities

- Aviation

- Oil & Gas

- Marine

- Consumer Devices

- Other

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America