Precious Metal Market Analysis and Insights:

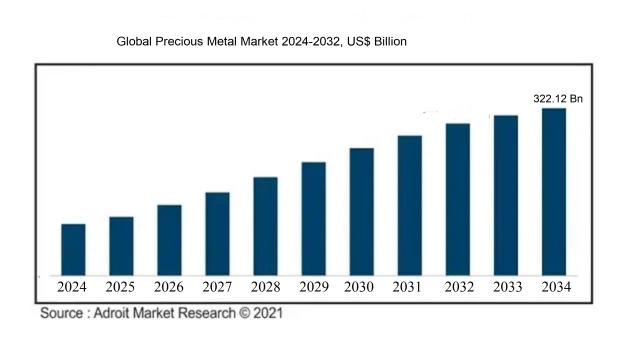

The global precious metal market was valued at US$210.02 billion in 2023. From 2024 to 2032, the market is expected to develop at a compound annual growth rate (CAGR) of 5.4%, reaching US$ 322.12 billion, according to Adroit Market Research.

A number of variables, such as changes in inflation, currency values, and geopolitical events, affect the precious metals market. During periods of economic instability or global turmoil, investors typically seek refuge in precious metals such as gold and silver, driving up their demand. Moreover, the industrial applications of metals like palladium and platinum, particularly in the electronics and renewable energy sectors, further boost their market presence. Central bank strategies, especially measures like quantitative easing, can also affect precious metal prices, as reduced interest rates lessen the cost of holding assets that do not yield returns. Additionally, advancements in mining and refining technology can alter supply levels, affecting market behavior. Seasonal demand fluctuations, especially in the jewelry industry, are also significant contributors. Collectively, these elements create a multifaceted environment that influences the pricing volatility and trends within the precious metals market.

Precious Metal Market Definition

Noble metals are elements that exist in nature and hold substantial economic worth due to their scarcity. They are commonly utilized in sectors such as jewelry, electronics, and investment. Notable for their distinctive traits, including a brilliant sheen and durability against oxidation, these metals are prized across multiple industries.

Valuable metals like gold, silver, and platinum are integral to the global economy and a variety of sectors because of their inherent worth, scarcity, and distinctive characteristics. They act as a refuge for investors in times of economic instability, aiding in wealth preservation. Moreover, these metals are essential in industries such as electronics, jewelry, and medicine, owing to their excellent conductivity, malleability, and resistance to corrosion. Additionally, precious metals hold cultural importance in numerous societies, representing status and affluence. Their finite availability coupled with strong demand positions them as crucial assets for ensuring financial stability and fostering technological progress.

Precious Metal Market Segmentation:

Insights on Key Type

Gold

Gold is expected to dominate the Global Precious Metal Market due to its enduring status as a safe haven asset, particularly in times of economic uncertainty. Its demand consistently outstrips that of other precious metals, driven by its multifaceted applications in jewelry, investment, and electronics. Additionally, central banks continue to increase their gold reserves, contributing to robust demand dynamics. The cultural significance of gold, particularly in regions like Asia for weddings and festivals, further enhances its appeal, making it a valuable commodity. Gold's liquidity and historical performance during economic downturns solidify its position as the preferred choice among precious metals.

Silver

Silver holds a vital position in the precious metals market due to its unique combination of industrial and investment demand. Its extensive applications in electronics, solar panels, and other technologies make it particularly attractive for industrial use. With the increasing shift towards renewable energy, silver is projected to grow in demand in sectors like solar energy. Additionally, silver's affordability compared to gold attracts smaller investors and collectors, broadening its market base. However, despite these factors, it is still considered secondary to gold in terms of overall value.

Platinum

Platinum, while traditionally valued for its rarity and use in catalytic converters and jewelry, faces headwinds in the current market. Its demand is closely linked to the automotive industry; thus, fluctuations in this sector can significantly impact platinum prices. Additionally, the growing electric vehicle market poses a challenge, as these vehicles require less platinum in their production. Despite its industrial uses and investment potential, platinum struggles to compete with gold's allure and stability, positioning it as a less dominant option within the precious metal landscape.

Palladium

Palladium has garnered attention in recent years due to its role in the automotive industry, particularly in gasoline engines. Its price surged as demand for environmentally friendly solutions prompted manufacturers to adopt palladium-based catalytic converters. However, like platinum, palladium's demand heavily depends on trends within the automotive sector, which can be volatile. While it has established itself as a significant metal, its utilization is still overshadowed by gold's more diverse applications and investment security, making it a niche player in the broader market for precious metals.

Others

The "Others" category encompasses a range of precious metals, including rhodium, iridium, and osmium, which have specialized applications mainly in the chemical industry, electronics, and jewelry. While these metals are often sought after for their unique properties, such as rhodium's catalytic effectiveness, their markets are much smaller and less liquid compared to gold and silver. Demand is typically driven by specific industrial needs rather than broad investment appeal. Consequently, while significant to certain sectors, this category remains a minor player in the overall landscape of precious metals, lacking the prominence and stability that characterize gold and silver.

Insights on Key Application

Jewelry

The Jewelry application is expected to dominate the Global Precious Metal Market, primarily due to its enduring demand and emotional value. Precious metals like gold, silver, and platinum are often considered symbols of wealth, status, and luxury, leading to consistent consumption. The rise of the middle class in emerging economies is resulting in increased spending on jewelry, alongside growing trends in personalized and bespoke jewelry pieces. Additionally, the resurgence of vintage and heirloom jewelry is creating further opportunities for precious metal usage. As fashion trends evolve, jewelry remains at the forefront for precious metal applications, ensuring its dominant position in the market.

Industrial

The Industrial sector plays a significant role in the Precious Metal Market as well, driven by the demand for high-performance materials in various applications such as catalysts, electronics, and telecommunications. Precious metals like palladium and platinum are crucial in manufacturing processes, especially in automotive catalytic converters where emission control is needed. Moreover, the growing emphasis on sustainable manufacturing practices and the push for cleaner technologies are expected to enhance the uptake of precious metals in industrial applications.

Dentistry

In the Dentistry application, precious metals have been widely used for crowns, bridges, fillings, and orthodontic devices. Their biocompatibility and durability make them ideal for dental work, ensuring longevity and reliability. While there is a gradual shift toward alternative materials, the trust in precious metals for restorative treatments keeps this sector relevant. Trends in cosmetic dentistry also support the demand for precious metals as patients seek aesthetic solutions using high-quality materials.

Computer Parts

The Computer Parts sector utilizes precious metals such as gold, silver, and palladium primarily for components like connectors, circuit boards, and semiconductor manufacturing. These metals offer excellent conductivity and reliability, essential for modern electronic devices. As technology evolves, the need for miniaturization and improved performance drives continuous innovation, further securing a place for precious metals in this application. The increasing demand for smartphones, laptops, and advanced electronics amplifies this effect, leading to a growth trend in the computer parts niche.

Cutlery

In the Cutlery application, precious metals are valued for their aesthetic appeal and resistance to corrosion, particularly in high-end culinary tools, knife making, and luxury tableware. While this market is smaller compared to others, the growing interest in gourmet cooking and the rising demand for high-quality kitchenware contribute to the usage of precious metals in cutlery. The emphasis on craftsmanship and artisanal products fuels this niche, albeit it remains a less dominant sector within the overall precious metal market.

Photography

The Photography sector historically utilized precious metals such as silver in traditional film photography and photographic prints. While digital photography has largely replaced these practices, a niche market persists among enthusiasts and professional photographers interested in vintage techniques. The movement towards analog photography, including film and alternative processes, has sparked a revival in the preference for precious metals in printing methods. However, the overall market for photography applications of precious metals is limited compared to others.

Others

The "Others" category encompasses various applications where precious metals are utilized, including specialized coatings, art, and investment gold bars. While this is diverse, it often accounts for a smaller share of the overall market compared to dominating sectors like jewelry and industrial uses. Investment demand for precious metals also remains a considerable aspect, enabling further diversification within the "Others" category. However, this is less significant than the aforementioned applications and faces competition from more prominent uses of precious metals.

Insights on Key End User

Electronics

The electronics sector is expected to dominate the Global Precious Metal Market due to the increasing demand for advanced electronic devices. Precious metals, particularly gold and silver, are widely utilized in electronic components such as circuit boards, connectors, and semiconductor devices because of their excellent conductivity and resistance to corrosion. As technology advances, the trend towards miniaturization in electronics drives the need for high-purity precious metals, resulting in a growing market share for this. Moreover, the rapid expansion of consumer electronics, such as smartphones and wearables, will further propel the demand for precious metals in this industry, solidifying its position as the leading.

Medical

The medical field employs precious metals primarily in diagnostic and therapeutic applications, such as dental alloys, surgical instruments, and drug delivery systems. The durability, biocompatibility, and antibacterial properties of metals like gold and platinum make them indispensable in this sector. With the growing focus on innovations in healthcare, including advanced surgical techniques and medical devices, the demand for precious metals is likely to increase, although it remains overshadowed by the more substantial electronics market.

Automotive

The automotive industry incorporates precious metals for catalytic converters and various electronic components, crucial for reducing emissions and improving fuel efficiency. As global regulations become stricter regarding environmental standards, the reliance on precious metals in vehicles is likely to sustain demand, although competition from alternative materials and the push towards electric vehicles may influence growth rates in this sector.

Aerospace

In aerospace, precious metals are used in applications requiring high performance and reliability, such as engine components and electronic systems. The unique properties of metals like platinum and iridium allow for enhanced performance in extreme conditions. Though the aerospace sector will experience steady demand due to ongoing technological advancements, it ranks lower in comparison to electronics, which are integral to everyday consumer products.

Oil and Gas

The oil and gas industry utilizes precious metals in specialized drilling equipment and as catalysts in refining processes. Although this sector has specific applications for precious metals, the demand is relatively limited when contrasted with industries like electronics and medical technology, where precious metals are foundational to product functionality and consumer demand. As the focus shifts toward renewable energy sources, the long-term growth of this may be further challenged.

Others

The "Others" category encompasses various smaller industries, including jewelry and art, where precious metals are increasingly valued. While there is a consistent demand for metals in these niches, the scale is significantly smaller compared to primary sectors like electronics, medical, and automotive. Consequently, while there will always be a market for precious metals in diverse applications, they do not contribute comparably to the overall demand trends driven by the more dominant industries.

Insights on Precious Metal Market Regional Analysis:

Asia Pacific

Asia Pacific is poised to dominate the Global Precious Metal market due to several driving factors. This region has a rapidly growing population and an expanding middle class, leading to increased demand for precious metals in jewelry, electronics, and investment. Countries like China and India are significant players, with a cultural affinity for gold and silver, further boosting demand. Additionally, the region is home to extensive mining operations, reducing reliance on imports and enhancing local production capabilities. As technological advancements continue to expand applications for precious metals in sectors such as renewable energy and electronics, Asia Pacific is expected to lead the market in terms of consumption and production.

North America

North America holds a vital position in the Global Precious Metal market, characterized by well-established mining industries found in countries like the United States and Canada. The region benefits from advanced technologies in mining and refining processes, ensuring a steady supply of metals. Furthermore, there is a significant investment culture surrounding precious metals as safe-haven assets, which attracts investors seeking to hedge against economic uncertainties. Though North America's market is strong, it is somewhat overshadowed by the booming activity in the Asia Pacific region.

Europe

Europe remains a considerable player in the Global Precious Metal market, primarily through nations such as Germany, the UK, and Switzerland. The region's demand for precious metals is largely driven by its wealth of luxury goods and jewelry markets. Additionally, Europe is an important center for precious metal trading and recycling, with robust regulations in place. However, challenges such as economic uncertainty and an evolving regulatory landscape may inhibit growth compared to more rapidly expanding regions, like Asia Pacific.

Latin America

Latin America's precious metal market is largely influenced by its vast natural resources, particularly gold and silver deposits, in countries like Peru and Brazil. Mining is a crucial economic activity in these nations, contributing to employment and local economies. However, political and social volatility can impact mining operations and investments, limiting the region's full potential in the global market. Furthermore, while there is a growing interest in precious metals, demand does not match the significant consumption seen in Asia Pacific or North America.

Middle East & Africa

The Middle East & Africa region has potential for growth in the Global Precious Metal market due to its rich mineral resources and emerging economies. The Arabian Peninsula, specifically, shows considerable interest in gold, driven by cultural significance and investment opportunities. However, the region faces infrastructural challenges and political instability that may hinder rapid growth. While there are opportunities for discovery and development, the overall demand is outweighed by the more developed markets in Asia Pacific and North America, limiting its immediate impact on the global stage.

Precious Metal Market Company Profiles:

Crucial participants in the worldwide precious metal sector, such as mining corporations, refiners, and traders, play a vital role in the acquisition, refinement, and distribution of metals such as gold, silver, and platinum. The strategic choices and market placement of these entities have a profound impact on pricing trends, supply networks, and the overall dynamics of global trade within the precious metals industry.

Prominent entities in the precious metals sector encompass Barrick Gold Corporation, Newmont Corporation, AngloGold Ashanti Limited, Wheaton Precious Metals Corp., Royal Gold, Inc., Franco-Nevada Corporation, Sibanye Stillwater Limited, B2Gold Corp., Kinross Gold Corporation, and Gold Fields Limited. In the realm of silver, significant firms include Pan American Silver Corp., First Majestic Silver Corp., and Hecla Mining Company. Within the platinum group metals, key contributors are Anglo American Platinum Limited, Impala Platinum Holdings Limited, and Sibanye Stillwater Limited. Other noteworthy companies within this industry are Silver Wheaton Corp., Agnico Eagle Mines Limited, and Eastern Platinum Limited.

COVID-19 Impact and Market Status for Precious Metal Market:

The COVID-19 pandemic resulted in a ened interest in precious metals as secure investment options, consequently elevating their market prices and shaping investment approaches during periods of economic unpredictability.

The COVID-19 pandemic has profoundly influenced the market for precious metals, largely due to a ened interest in safe-haven investments during times of economic turbulence. With governments implementing lockdowns and enacting extensive fiscal stimulus, many investors sought refuge in gold and silver, viewing them as secure stores of value. In 2020, gold prices soared to unprecedented levels, primarily driven by fears related to inflation and potential currency depreciation. Likewise, silver experienced increased interest, attributed to its dual functionality as both an investment and an industrial material, with the situation exacerbated by interruptions in supply chains. Furthermore, the pandemic led to disruptions in mining activities and a shortage of labor, creating additional supply challenges that pushed prices higher. Although the market experienced some fluctuations afterward, the long-term forecast for precious metals appears optimistic as economic recovery and inflation concerns linger. As a result, precious metals have solidified their role as vital elements in investment portfolios amidst the ongoing global uncertainties.

Precious Metal Market Latest Trends and Innovation:

- In July 2023, Newmont Corporation announced the acquisition of Newcrest Mining for approximately $19 billion. This strategic move aimed to consolidate Newmont's position as the world's largest gold producer and enhance its asset portfolio.

- In August 2023, Barrick Gold Corporation declared the successful integration of its North Mara and Bulyanhulu mines in Tanzania, which are projected to improve operational efficiencies and increase gold production capabilities.

- In September 2023, AngloGold Ashanti entered into a joint venture with the Canadian company First Majestic Silver Corp to develop the La Encantada silver mine in Mexico. This partnership is expected to enhance silver extraction techniques and expand production capacity.

- In October 2023, Wheaton Precious Metals announced a significant investment of $30 million in a new streaming agreement with Gold Royalty Corp, targeting various gold projects in Canada. This deal is aimed at diversifying Wheaton's precious metal assets and streamlining cash flow.

- In November 2023, Sibanye Stillwater successfully launched a new initiative for sustainable mining practices, incorporating innovative technologies to reduce carbon emissions across its platinum group metals (PGM) operations in South Africa.

- In December 2023, Kinross Gold Corporation completed the sale of its Russian assets, including the Kupol and Dvoinoye mines, to Highland Gold Mining Limited for approximately $340 million, allowing Kinross to redirect its focus on potential growth opportunities in other regions.

- On January 2024, a consortium led by Agnico Eagle Mines Limited announced the acquisition of Triton Minerals Limited, focusing on the development of high-grade graphite projects. This acquisition is anticipated to bolster Agnico Eagle's resource portfolio and expand into the battery materials market.

Precious Metal Market Significant Growth Factors:

The expansion of the precious metals market is propelled by ened industrial requirements, the allure of investments amidst economic instability, and a growing interest in sustainable technologies.

The Precious Metal Market is currently witnessing remarkable growth spurred by a multitude of factors. Primarily, the ened demand for gold and silver as a refuge for investors amid economic instability and geopolitical unrest has significantly increased their attractiveness. Additionally, the role of precious metals in technological sectors—ranging from electronics to renewable energy solutions and catalytic converters—has broadened their application and market potential.

Moreover, the rising focus on sustainable and ethical mining practices is making recycled precious metals more desirable, which is further promoting market growth. The expansion of emerging economies, especially in Asia, where a growing middle class and increased disposable incomes amplify jewelry consumption, is also pivotal. Additionally, central banks are diversifying their reserves by purchasing gold, thereby sustaining demand; low-interest rates further enhance the appeal of investing in precious metals over conventional assets.

Furthermore, inflationary trends globally are motivating investments in precious metals as a safeguard against currency depreciation. Lastly, technological advancements in mining methods are boosting production efficiencies, which aligns with increasing market demand. Collectively, these elements paint a promising picture for the Precious Metal Market, unveiling avenues for growth and innovation across diverse sectors.

Precious Metal Market Restraining Factors:

The precious metal market faces considerable limitations due to varying global economic dynamics and shifts in regulatory frameworks.

The market for precious metals encounters various obstacles that can influence its expansion and stability. One primary challenge stems from economic volatility and unpredictability, including phases of recession or sudden inflation, which often prompt investors to favor more liquid assets over precious metals. Additionally, currency fluctuations, particularly regarding the US dollar, are crucial, as a stronger dollar generally leads to a decline in precious metal demand, given that these commodities are typically valued in USD. Changes in regulations and trade policies can also disrupt market activities, introducing tariffs and limitations that may interfere with supply chains. Furthermore, environmental issues linked to mining practices, such as habitat destruction and water consumption, can lead to tighter regulations and increased operational expenses. The emergence of alternative investments and new technologies, like cryptocurrencies, might further divert investor focus from conventional precious metals. Nevertheless, the precious metals market demonstrates resilience, bolstered by their inherent value and sustained interest in safe-haven investments. The growing emphasis on sustainably and ethically mined precious metals could also generate fresh opportunities within the industry, aiding its long-term development and adaptability to evolving market trends.

Precious Metal Market Key Segmentation:

By Type

- Gold

- Silver

- Platinum

- Palladium

- Others

By Application

- Jewelry

- Industrial

- Dentistry

- Computer Parts

- Cutlery

- Photography

- Others

By End User

- Electronics

- Medical

- Automotive

- Aerospace

- Oil and Gas

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America