Power distribution units are equipped to provide computers and other networking devices in data centers with electric power. They have several outputs and are able to calculate and monitor the sum of transmitted power. High-amperage connector versions of power delivery devices have multiple high to low amperage outlets. They are mostly installed to ensure the efficient transfer of electricity to various equipment, such as generators, uninterruptible power supplies, and water suppliers.

The global power distribution unit market revenue was valued at >USD 3.50 Billion in 2019. Increasing investment in industrial projects, rising number of data centers, increasing need for continuous power demand, and growing adoption of cloud computing is expected to open new opportunities for power distribution unit industry over the forecast period.

At a compound annual growth rate of 4.6%, the size of the worldwide Power Distribution Unit market is projected to reach US$ 4 Billion in 2032.

.jpg)

Primary power distribution unit capabilities include power utilization analysis, minimized average power consumption, minimization of server downtime, and improved uptime. Rack power delivery systems transmit power to the machinery in order to preserve application output and productivity. With the application of power distribution systems having high amperage connectors, several low amperage outlets may be supplied from high amperage outlets.

Power Distribution Unit Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 4 Billion |

| Growth Rate | CAGR of 4.6% during 2022-2032 |

| Segment Covered | by Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Leviton Manufacturing Company, Inc., Schneider Electric SE., and Enlogic Systems LLC. Eaton Corporation PLC, and Tripp Lite. |

Key Segment Of The Power Distribution Unit Market

Power Distribution Unit by Type, (USD Billion)

o Basic PDU

o Intelligent/ Monitored PDU

o Metered PDU

• Inlet Metering

• Inlet/Outlet Metering

o Switched PDU

Power Distribution Unit by Application, (USD Billion)

• Single Phase Power Distribution Unit

• Triple Phase Power Distribution Unit

Power Distribution Unit by Distribution Channel, (USD Billion)

o Power Distribution Unit Sales via Offline Channels

• Resellers/Distributors

• Direct to End-users

• Integrators/Maintenance

o Power Distribution Unit Sales via Online Channels

Power Distribution Unit by Industry, (USD Billion)

o Power Distribution Unit for Data Centers

• Tier 1

• Tier 2

• Tier 3

o Power Distribution Unit for Telecom & IT

o Power Distribution Unit for BFSI

o Power Distribution Unit for Healthcare

o Power Distribution Unit for Government

o Power Distribution Unit for Education

o Power Distribution Unit for Retail

o Power Distribution Unit for Utilities

o Power Distribution Unit for Military & Defense

o Power Distribution Unit for Other Industries (Transportation, Manufacturing)

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Increasing number of data centers followed by rising environmental carbon emissions has increased demand for sustainable power sources. Additionally, increasing power consumption is also expected to increase need for power distribution unit in coming years. Constant monitoring of power usage is expected to become a must in order to comply with strict environmental regulations. It is anticipated that new power distribution units with revolutionary technology can support data centers in such circumstances. Modern power distribution units such as smart power distribution, deliver improved uptime, capacity planning , resource usage reduction, data collection in real time, and remote control are expected to open new opportunities for power distribution unit industry over the coming years.

Type Segment

The global power distribution unit market by type is segmented into Monitored, Metered, Automatic Transfer Switch, Switched, and others. Monitored power distribution unit are expected to show fastest growth over the coming years by virtue of increasing deployment and integration in IT & Telecom and BFSI industry because of remote monitoring, network grade power distribution, and outlet control capabilities. The metered power distribution units are comprised of outlet and inlet units. Outlet power distribution unit denotes actual power consumption, whereas inlet power distribution unit shows racks capacity.

Phase Segment

In terms of the phase segment, the power distribution unit industry is categorized as three phase and single phase. Three phase power distribution unit are expected to show promising opportunities over the coming years by virtue of capabilities for continuous power supply. Generation of large amount of electricity for different industrial applications such as data centers, shipboard, and power grids are further expected to increase three phase power distribution unit market concentration over the coming years.

End User Segment

In terms of the end user, the market is segmented into automotive, energy, manufacturing & processing industry, healthcare, BFSI, IT & telecom, and government & defense. In 2019, data center application accounted for largest market share and is expected to gain competitive edge over others in coming years by virtue of increasing number of data centers in emerging economies coupled with increasing adoption of intelligent power distribution units. Increasing data storage demand for government & defense agencies are further expected to increase market reach.

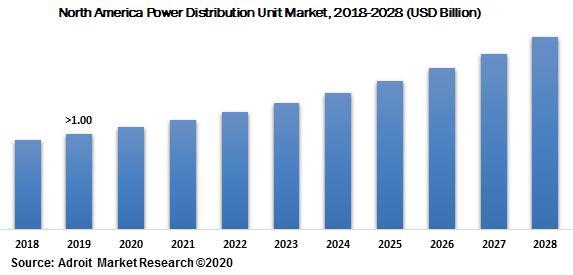

In 2019, North America accounted for >30% of the overall market share. Presence of well-established information technology and BFSI industry, coupled with increasing government spending to strengthen data storage capabilities in U.S. and Canada are expected to open potential opportunities for power distribution units in North America. Europe is expected to be the second largest market for power distribution unit over the coming years by virtue of increasing healthcare spending over the past few years.

The global power distribution unit industry has large number of well-established manufacturers and small & medium scale manufactures. Key companies operating in this industry are Eaton, Legrand, Schneider Electric, Tripp Lite, ABB, Cisco Systems, Vertiv, Socomec, Hewlett Packard Enterprise, Delta Electronics, ATEN, and Panduit. Manufacturers operating in this industry are adopting merger & acquisition, new product development, technological advancement, research & development, and facility expansion in order to form strategies to increase their customer base.