Polyolefin Films Market Analysis and Insights:

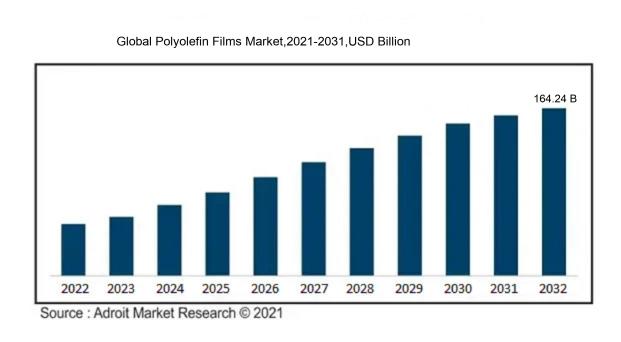

In 2023, the size of the worldwide Polyolefin Films market was US$ 104.98 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2032, reaching US$ 164.24 billion.

The market for polyolefin films is propelled by a variety of influential factors, notably the escalating need for flexible packaging solutions within the food and beverage industry that prioritize the preservation of products and their freshness. Moreover, the expansion of the e-commerce sector has intensified the demand for lightweight and durable packaging solutions that polyolefin films effectively deliver. Environmental considerations are critically shaping this market, as manufacturers increasingly pursue sustainable options; thus, innovations related to biodegradable and recyclable polyolefin films are on the rise. Additionally, advancements in production techniques—such as cast and blown film extrusion—are significantly improving the performance and cost-efficiency of these films. Furthermore, sectors like automotive and construction are vital contributors, employing these films for insulation and protective purposes. In summary, the intersection of sustainability initiatives, technological progress, and an upsurge in consumer preference for convenience is crucial in driving the growth of the polyolefin films market.

Polyolefin Films Market Definition

Polyolefin films are synthetic substances produced from olefin compounds, with polyethylene and polypropylene being the most common types. These films are known for their lightweight nature, flexibility, and robust durability. Their exceptional resistance to moisture and stability against chemicals makes them popular choices for a variety of uses in packaging, agriculture, and industrial sectors.

Polyolefin films are essential because of their adaptability and extensive applications across multiple sectors. Composed of polymers such as polyethylene and polypropylene, these films provide outstanding barrier characteristics, high chemical resistance, and flexibility, making them suitable for packaging in food, pharmaceuticals, and consumer products. Their lightweight quality contributes to lower shipping expenses, and their recyclability addresses increasing sustainability issues. Furthermore, polyolefin films can be tailored in thickness, clarity, and surface texture to meet the unique requirements of producers. Consequently, they are instrumental in improving product longevity and enhancing consumer attractiveness.

Polyolefin Films Market Segmental Analysis:

Insights On Material

LLDPE

LLDPE (Linear Low-Density Polyethylene) is expected to dominate the Global Polyolefin Films Market due to its excellent properties like high tensile strength, elasticity, and resistance to various environmental factors. It finds extensive applications in packaging materials, which are increasingly favored for their strength and flexibility. The growing demand in sectors such as food packaging, agricultural films, and industrial applications significantly contributes to its leading position. LLDPE's ability to offer lightweight solutions while maintaining high performance aligns well with sustainability trends, thereby enhancing its market appeal. As industries focus on reducing their carbon footprint, the efficiency of LLDPE in reducing material usage while providing robust protection makes it the superior choice.

HDPE

HDPE (High-Density Polyethylene) is recognized for its strength and durability, which allows it to be favorably used in more rigid applications. Primarily employed in products like bottles, containers, and pipes, HDPE offers exceptional resistance to impact and stress cracking. Its growing relevance in packaging, especially in sectors that prioritize durability and longevity, aids its steady demand in the market. However, while HDPE has solid applications, it is the adaptability and flexibility of LLDPE that gives it an edge over HDPE in the overall polyolefin films landscape.

LDPE

LDPE (Low-Density Polyethylene) is valued for its softness and flexibility, making it suitable for applications in flexible packaging, such as food wraps and plastic bags. Its ability to be heat-sealed and possess good chemical resistance contributes to its popularity among manufacturers looking for cost-effective solutions. However, LDPE’s structural limitations in heavy-duty applications hinder its overall competitive strength against LLDPE.

BOPP

BOPP (Biaxially Oriented Polypropylene) is primarily used in packaging due to its clarity, strength, and resistance to moisture. It is an excellent choice for films that require high gloss and strength. While it holds a significant position within specialized markets like the food and confectionery sectors, BOPP's specific applications limit its broader scope compared to LLDPE's versatility and dominance in various industrial s.

CPP

CPP (Cast Polypropylene) is commonly utilized for its good seal performance and transparency in flexible packaging applications. While it offers excellent clarity and thermal stability, its applications are typically limited to certain types of packaging that do not demand the same level of durability. As industries continue to seek materials with broader utility and adaptability for diverse applications, LLDPE remains preferred over CPP in many scenarios.

Insights On Film Type

Stretch Film

Stretch film is expected to dominate the Global Polyolefin Films Market due to its versatility and widespread application across various industries, including food packaging, e-commerce, and industrial sectors. Its unique ability to stretch and cling securely around products makes it an ideal choice for maintaining the integrity of goods during storage and transportation. The growing focus on sustainability is also pushing manufacturers to adopt stretch film options that are recyclable and environmentally friendly. As more companies shift towards automation and efficient packaging solutions, the demand for stretch film is poised to increase significantly, positioning it as the leading category within the polyolefin films market.

Shrink Film

Shrink film is another important category in the global polyolefin films landscape. It is predominantly used for packaging products due to its exceptional sealing and barrier properties. Common applications include retail packaging for food items, consumer goods, and industrial products. As the demand for presentation and shelf appeal increases, shrink film is frequently preferred by brands looking to create attractive packaging that also extends the shelf life of perishable products. Nevertheless, it faces stiff competition from stretch film, which offers enhanced functionality and application versatility.

Others

The "Others" category encompasses various film types that do not strictly fall under shrink or stretch film. This may include multi-layer films, specialty films, and biodegradable options. While this has a niche market presence, it caters to specific needs such as high-temperature applications, anti-fog applications, or aesthetic presentations. These films often provide unique or specialized characteristics that fulfill particular customer requirements, thereby finding utility in specialized industries like pharmaceuticals or high-end consumer products. However, this remains less dominant compared to stretch and shrink films.

Insights On Application

Film & Sheets

Film & Sheets is projected to dominate the Global Polyolefin Films Market. This significant growth is attributed to the increasing demand for flexible packaging within food and consumer products industries. The properties of polyolefin films, such as moisture resistance, strength, and lightweight characteristics, make them paramount for packaging applications. Moreover, their recyclability aligns with the sustainability trends in various sectors, pushing manufacturers towards eco-friendly options. With advancements in production technologies enhancing film performance and the rising focus on convenience and safety in food packaging, Film & Sheets is expected to capture a large market share moving forward.

Blow Molding

Blow Molding is a vital application area within the Global Polyolefin Films Market. This manufacturing process has gained traction due to its efficiency in producing hollow plastic parts, which are extensively used in containers, bottles, and packaging materials. The lightweight nature and chemical resistance of polyolefins make them ideal for this application. Additionally, as the demand for durable, lightweight, and cost-effective packaging solutions increases across various industries, Blow Molding is set to sustain steady growth in its market share.

Injection Molding

Injection Molding has a significant presence in the Global Polyolefin Films Market. This technique is favored for its ability to produce complex shapes and designs at high volumes, making it suitable for various applications, including automotive components and consumer goods. The versatility and strength of polyolefin materials make them a popular choice in this. The continuous rise in automation technologies and improvements in production efficiency are anticipated to bolster the growth of Injection Molding applications, aligning with the increasing demand for high-quality molded products across industries.

Fibers

Fibers represent an important application within the Global Polyolefin Films Market. While not the leading area, fibers are crucial due to their extensive use in textiles and non-woven products. The lightweight, durable, and moisture-resistant properties of polyolefins lend themselves well to various fibrous applications, including industrial and consumer textiles. The growing demand for lightweight, high-performance materials in the textiles industry indicates steady, albeit slower, growth in this as manufacturers seek continuous innovations in fabric technology.

Others

The Others category encompasses various niche applications in the Global Polyolefin Films Market. This includes specialized uses that do not fit neatly into the aforementioned categories. These applications may involve unique fabrication processes or serve specific markets, such as medical packaging or agricultural films. While this may not dominate the market, it still plays a vital role in addressing the specific needs of different industries. Growth in this area is driven by customization demands and the need for specific performance characteristics in unique applications.

Insights On End-Use

Packaging

The packaging sector is expected to dominate the Global Polyolefin Films Market significantly. This dominance is driven by the increasing demand for lightweight, durable, and cost-effective packaging solutions across various industries. Consumers' growing awareness regarding sustainability and the need for eco-friendly packaging options also enhance the adoption of polyolefin films. Innovations in packaging technology, such as improved barrier properties and versatility in application, further support the expansion of polyolefin films in packaging. As e-commerce continues to flourish, the necessity for reliable and protective packaging is anticipated to bolster the market for polyolefin films significantly within this use case.

Construction

The construction industry is a significant user of polyolefin films, primarily due to their versatile properties like moisture resistance and durability. These films are utilized in various applications including vapor barriers, insulation, and below-grade waterproofing. The growth of the construction industry, fueled by urbanization and infrastructure development, increases demand for high-quality materials. Furthermore, as energy-efficient building practices gain traction, polyolefin films are expected to see a ened application in sustainable construction methodologies.

Agricultural

In the agricultural sector, polyolefin films are gaining traction for their applications in greenhouse covers, mulching, and crop protection. These films help in enhancing crop yield, conserving soil moisture, and controlling pests. The rising global population and the consequent demand for food production provide significant growth prospects for this area. Furthermore, innovations in agricultural polyolefin films, such as UV resistance and biodegradable options, are expanding adoption rates among farmers seeking sustainable farming practices.

Others

The "Others" category encompasses a variety of applications, such as medical, automotive, and electronic sectors, where polyolefin films are utilized. While this is growing, it lags behind packaging, construction, and agricultural sectors. The increasing use of polyolefin films in medical applications, such as sterilization wraps and pouches, is becoming more relevant due to ened health standards. However, overall demand remains minimal compared to the leading end-use sectors, indicating a more niche market without significant advancements or adoption trends like in the more dominant categories.

Global Polyolefin Films Market Regional Insights:

Asia Pacific

Asia Pacific is poised to dominate the Global Polyolefin Films Market, largely due to its rapid industrialization, significant manufacturing capabilities, and increasing demand from packaging applications, consumer goods, and agricultural sectors. Countries like China and India are experiencing substantial economic growth, leading to an increase in disposable income and a subsequent rise in demand for consumer products that utilize polyolefin films. Furthermore, the region's advancing technology enhances production efficiency and introduces innovative products, while favorable government policies that support manufacturing also contribute to market growth. The combination of robust demand across multiple sectors and a strong manufacturing base positions Asia Pacific as the leading region in the polyolefin films market.

North America

In North America, the market for polyolefin films is primarily driven by the strong demand from the packaging industry, especially in food and beverage applications. The region benefits from advanced technological infrastructure and a focus on sustainability, with manufacturers increasingly exploring biodegradable and recyclable materials. Additionally, the presence of industry players and established distribution networks promotes market growth. However, fluctuations in raw material prices and competition from emerging markets may pose challenges.

Europe

Europe is noteworthy for its stringent regulations related to packaging and waste management, influencing the development of eco-friendly polyolefin films. The region has a mature market with established players who are increasingly investing in innovation and sustainable practices. The demand for high-performance films in sectors like pharmaceuticals, food packaging, and consumer goods continues to grow. Nevertheless, the market faces competition from other regions where production costs are lower.

Latin America

Latin America has shown promise in the polyolefin films sector, driven by rising consumption in food and beverage packaging. However, economic challenges and varying regulatory environments across countries can impact growth. While there is potential for expansion, particularly in Brazil and Mexico, market players face hurdles such as infrastructural limitations and economic volatility which could affect investment and innovation in polyolefin film production.

Middle East & Africa

The Middle East & Africa region is gradually developing its market for polyolefin films, spurred by a rise in demand for packaging solutions, especially within the food and agriculture sectors. However, the market remains somewhat fragmented with varying levels of demand across countries. Challenges such as insufficient infrastructure, geopolitical instability, and reliance on imported materials can constrict growth. Nonetheless, emerging economies are beginning to recognize the benefits of polyolefin films, indicating potential market development in the future.

Polyolefin Films Market Competitive Landscape:

Major participants in the global polyolefin films sector are chiefly engaged in the development and innovation of polyolefin products, serving a diverse range of end-use sectors. Their efforts are directed towards improving product efficiency, promoting sustainability, and increasing their market footprint through strategic collaborations and technological progress.

Prominent entities in the polyolefin films sector comprise: The Dow Chemical Company, ExxonMobil Chemical Company, LyondellBasell Industries Holdings B.V., SunChem Technologies, Sealed Air Corporation, Amcor plc, Berry Global, Inc., Novolex Holdings, Inc., Tredegar Corporation, Jindal Poly Films Ltd., AEP Industries Inc., Polifilm GmbH, Polyplex Corporation Ltd., and Mitsui Chemicals, Inc.

Global Polyolefin Films Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the worldwide market for polyolefin films, causing disruptions in supply chains and leading to variable demand across multiple industries, most notably in packaging and industrial uses.

The COVID-19 pandemic profoundly impacted the polyolefin films market, reshaping both demand dynamics and supply chain operations. Initially, the industry encountered significant obstacles due to production disruptions and logistical challenges, which caused raw material shortages and delays in delivery timelines. Nevertheless, as the situation evolved, specific sectors—especially food packaging and medical supplies—saw a surge in demand for polyolefin films, spurred by an increase in e-commerce activities and the greater necessity for protective packaging solutions. The growing emphasis on hygiene and safety standards also played a pivotal role in driving the development of packaging options designed to reduce contamination risks. Although the market faced some volatility during the of the pandemic, its long-term prospects appear promising, as industries adjust to changing consumer behaviors and embrace sustainability initiatives. The recovery phase is anticipated to be strengthened by continuous innovation and investments in eco-friendly practices, positioning the polyolefin films market for growth as economies recover in the post-pandemic landscape.

Latest Trends and Innovation in The Global Polyolefin Films Market:

In December 2022, Berry Global Group, Inc. announced the acquisition of RPC Group PLC, a move aimed at enhancing its position in the polyolefin films market and expanding its product offerings across Europe.

In January 2023, ExxonMobil Chemical Company launched its new line of high-performance polypropylene films designed for food packaging applications, emphasizing durability and barrier properties that help extend product shelf life.

In March 2023, Amcor plc expanded its production capabilities in Europe through a significant investment in a state-of-the-art facility dedicated to producing sustainable polyolefin films, responding to growing demand for eco-friendly packaging solutions.

In April 2023, Sealed Air Corporation introduced its new innovative polyolefin shrink films that provide enhanced clarity and puncture resistance, aimed at the e-commerce packaging sector.

In June 2023, Mitsui Chemicals, Inc. and BP plc announced their collaboration on a joint venture to develop advanced polyolefin packaging films, focusing on sustainability and recycling technologies.

In July 2023, Klöckner Pentaplast Group launched new sustainable grades of polyolefin films that incorporate recycled content, highlighting their commitment to circular economy principles in packaging materials.

In September 2023, Dow Inc. unveiled its latest innovations in polyolefin films with the launch of their "Plant-Based" film range, made partially from renewable resources, targeting the growing market for sustainable packaging options.

Polyolefin Films Market Growth Factors:

The market for polyolefin films is propelled by a rising need for packaging solutions, innovations in film manufacturing technology, and an increasing emphasis on eco-friendly materials.

The market for polyolefin films is set to experience substantial growth driven by a multitude of significant factors. First and foremost, the rising demand for flexible packaging solutions in diverse sectors such as food and beverages, personal care, and pharmaceuticals is leading to increased consumption of polyolefin films, which are praised for their strength and lightweight characteristics. Furthermore, the growing focus on sustainable packaging options and environmentally friendly materials has spurred innovations in biodegradable and recyclable polyolefin films, catering to the preferences of eco-conscious consumers and businesses alike.

Technological advancements in manufacturing processes have also improved the quality and performance of these films, enhancing their attractiveness for various applications. The surge in e-commerce and the consequent need for effective shipping materials further augment the market, as polyolefin films are widely utilized in protective packaging. In addition, regions such as Asia-Pacific and Latin America are witnessing swift industrial development and urban growth, significantly increasing demand in these emerging markets. Government initiatives promoting sustainable practices add to the shift towards polyolefin films.

In summary, the combination of technological progress, changing consumer preferences, and market growth across multiple sectors is projected to drive the polyolefin films market in the upcoming years.

Polyolefin Films Market Restaining Factors:

The polyolefin films industry faces significant challenges due to unstable prices of raw materials and rising regulatory demands focused on environmental sustainability.

The market for polyolefin films encounters a range of challenges that could impede its expansion. One major issue is the volatility in the prices of raw materials like polyethylene and polypropylene, which can negatively affect both the production cost and profit margins for producers. Additionally, growing environmental regulations and ened awareness about sustainability are prompting a more critical evaluation of plastic products, driving industries to explore alternative materials, potentially reducing the demand for polyolefin films. The complexities in recycling polyolefin films, coupled with risks of contamination, present substantial obstacles to their broader acceptance. Moreover, the competition from biodegradable and compostable film alternatives is intensifying as both consumers and businesses increasingly prioritize eco-friendliness. Furthermore, the current trends favoring reduced packaging and thinner films may restrict the applicability of polyolefin films in certain sectors. However, despite these hurdles, the polyolefin films industry is poised for transformation through technological advancements that could enhance recycling capabilities and innovate solutions to sustainability issues while preserving product efficacy, which may ultimately promote market resilience and new growth opportunities in the coming years.

Segments of the Polyolefin Films Market

By Material

• HDPE

• LDPE

• LLDPE

• BOPP

• CPP

By Film Type

• Shrink Film

• Stretch Film

• Others

By Application

• Film & Sheets

• Blow Molding

• Injection Molding

• Fibers

• Others

By End-Use

• Packaging

• Construction

• Agricultural

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America