The value of the Polymerization Initiator market is projected to grow to US$ 2.1 Bn with an estimated CAGR of 4.9% by 2032

.jpg

)

The global polymerization initiator market is likely to account for USD 5.0 billion in terms of revenue, by 2028. The product is more likely to form an intermediate compound after reacting with a monomer of a chemical species. The compounds are capable of successively binding into a polymeric compound with the help of several monomers. Polymerization initiators are used for regulating the initiation by light or heat in radical polymerization. Solubility and decomposition temperature are the two main factors responsible for the free-radical polymerization in the process of initiation. The polymerization process is used with the initiator as a soluble resource and having a decomposition temperature at the boiling point of the solvent.

Increasing polymer production along with growing investment in R&D to advance polymerization processes is one of the key factors driving growth in the market. Furthermore, the rising demand for these initiators from numerous end-use industries is contributing significantly to increased market penetration.

The rising production of polymer is expected to drive the market growth due to the growing sales from various end-use industries such as automotive, construction, and pet food processing. The initiators of polymer are the result of imaging chemicals compounds that respond with a monomer to form an intermediate compound that is suitable for connecting to polymeric compounds with countless different monomers.

Polymerization Initiator Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 2.1 Billion |

| Growth Rate | CAGR of 4.9% during 2022-2032 |

| Segment Covered | by Type, by Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF, Arkema SA, AkzoNobel, and Celanese. |

Key Segment Of The Polymerization Initiator Market

By Type, (USD Billion)

• Peroxide

• Persulfate

• Azo Compounds

• Others

By Application, (USD Billion)

• Polyethylene

• Polypropylene

• PVC

• Polystyrene

• ABS

• Others

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The market size of the polymerization initiator is anticipated to develop within the forecast period on a single-digit CAGR over the forecast period. In the radical process of polymerization, the initiators are used to direct the initiation with the help of heat and light. The launch of the polymerization novel initiator is growing at a steady rate and is projected to stimulate market growth in the global industry. Nouryon had introduced a new form of polymerization initiator as Vanishing Red peroxide Butanox M-50 in the year 2019.

The product is usually available as a mild form of hazardous dye solvent and is made to be a product safe in use for the consumers. The product is easy to handle and has a very low impact on the environment while maintaining its top position in the market. Nouryon previously known as AkzoNobel Specialty Chemicals has launched the first-ever organic peroxides in form of emulsion for the polyvinyl chloride (PVC) development in the United States in the year 2018. The emulsion materials are cleaner alternatives to solvent-based peroxides to produce PVC, a material that is used in everyday applications including tubing, doors, windows, and home siding.

Type Segment

Based on the type, the market is segmented into persulfate, peroxides, azo compounds, and others. The persulfate polymerization initiator type grabs a significant demand in 2019 and is anticipated to hold its position during the forecast years. Persulfates, a type of polymerization initiator is a group of chemically active molecular structure compounds that contains a group of peroxides in each sulfur molecule. Persulfates are alkali metal salts formed by the electrochemical processes. These persulfates emit oxygen, so they are used as initiators and oxidizing agents. The physical design of the persulfate forms is dependent on the criteria for oxidation and price. The properties of products help to provide applications in several industries maintaining its mechanical properties along the process. The forms of persulfates in the market are ammonium, sodium, and potassium.

Application Segment

The application segment of the market is bifurcated into polyethylene, polypropylene, polyvinyl chloride, polystyrene, ABS (acrylonitrile butadiene styrene), and others. In 2019, the polypropylene segment accumulated the major market share and is expected to continue the trend over the forecast years. The propylene homopolymer is the most commonly used type of polymerization initiator, having a high strength-to-weight ratio. It is more stable & heavier than copolymer polypropylene and shows excellent chemical resistance and weldability. It is used in many end-use applications, including packaging, hospitals, textiles, tubing, electrical goods, and automotive. These polymers are optically transparent and lightweight, making them a product to provide clarity and quality. The identical properties relative to propylene homopolymer shows higher impact strength & hardness.

Active Species Segment

In terms of the active species segment, the market is segmented into free-radical, cationic, and anionic. In 2019, the free radical segment accumulated the major growth rate and is expected to continue the trend over the forecast years. Typically, radical polymerization involves an initiator to generate the first radical and initiate the sequence of subsequent reactions. Free radical polymerization has a very common type of initiation reaction by the thermal decomposition of molecules that involve weak bonds such as peroxides and azo compounds.

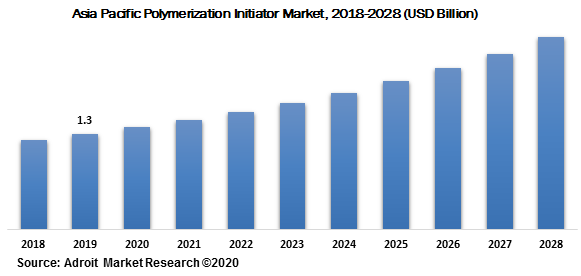

The Asia Pacific region dominated the overall market with a share of more than 36% in 2019 and it is projected to keep its position during the forecast years 2018-2028. The factors such as demographic growth and increasing urbanization throughout the country are expected to boost market development over the coming years. Moreover, the growing foreign investment in the region is expected to boost the demand for products across the Asia Pacific region. The abundant supply of raw materials along with its lower-cost in the economies including China, South Korea, India, and Indonesia, is projected to boost the sales of the commercial and industrial sectors in the Asia Pacific. This is expected to boost demand for polymerization initiator and thus drive market growth over the coming years.

According to the Singapore America Chamber of Commerce and the US Chamber of Commerce, approximately 19 percent of APAC countries are planning to move their business from China to their region. One of the most attractive developing countries, in the Asia Pacific, is Indonesia followed by Vietnam, Myanmar, and Thailand. In the coming years, the APAC polymer market is expected to grow and will potentially offer some major opportunities for international investors. Moreover, low-cost availability of labors will be an added advantage in countries such as Cambodia, Laos, Vietnam, and Indonesia.

The major players of the global polymerization initiator market are BASF, Arkema SA, AkzoNobel, and Celanese. Moreover, the market comprises several other prominent players in the polymerization initiator market as United Initiators, Adeka Corporation, and LANXESS. The market consists of several large and medium level players. Also, the majority of local players are present in the market. These players are consistent in providing some of the advanced developments such as mergers, acquisitions, and product launches in the market to maintain a high demand across the globe.