Polybag Market Analysis and Insights:

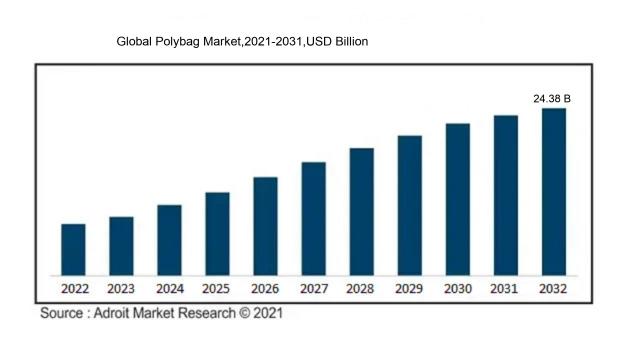

In 2023, the size of the worldwide Polybag market was US$ 15.1 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.56% from 2024 to 2032, reaching US$ 24.38 billion.

The polybag industry is propelled by several significant factors, such as the increasing preference for flexible packaging options, the growth of e-commerce, and an amplified focus on ensuring product safety and extending shelf life. The appeal of polybags lies in their lightweight nature, customizable features, and cost-effectiveness, making them particularly popular in sectors like retail and food packaging. Furthermore, the rising emphasis on sustainability has encouraged manufacturers to investigate environmentally friendly substitutes, leading to innovations like biodegradable polybags. The global expansion of logistics and transportation services also contributes to the market's growth, as polybags are crucial for safeguarding products in transit. Additionally, regulatory measures aimed at curbing plastic waste significantly influence manufacturers, prompting them to modify their manufacturing practices. The ened demand for hygienic and sterile packaging solutions, especially in the wake of the COVID-19 pandemic, has further reinforced the market dynamics, catalyzing investments in advanced polybag technologies and applications.

Polybag Market Definition

A polybag is a versatile packaging option crafted from plastic substances, frequently utilized for the storage and movement of goods. Its robustness and resistance to moisture contribute to its widespread appeal in numerous sectors.

Polyethylene bags are essential in the realm of packaging, owing to their adaptability, economic efficiency, and protective features. These bags are not only lightweight but also robust, making them perfect for both shipping and storage purposes while offering protection against moisture, contaminants, and physical harm. Their clear design enables straightforward content recognition, which enhances inventory control and minimizes the time spent on handling. Furthermore, many polybags are recyclable, supporting the sustainability initiatives of numerous sectors. Their versatility extends across various domains, including retail and industrial applications, ensuring products reach their intended destinations securely. In summary, polyethylene bags play a crucial role in streamlining logistics and enhancing product visibility across diverse markets.

Polybag Market Segmental Analysis:

Insights On Material Type

Low-Density Polyethylene (LDPE)

Low-Density Polyethylene (LDPE) is expected to dominate the Global Polybag Market due to its superior flexibility, strength, and chemical resistance. LDPE polybags are widely utilized in various applications, including packaging for food, consumer goods, and industrial products. Their lightweight properties also contribute to reduced shipping costs, making them an attractive option for manufacturers and retailers. Additionally, LDPE's recyclability aligns with the growing trend of sustainable packaging solutions, appealing to environmentally-conscious consumers and regulatory frameworks supporting eco-friendly alternatives. The demand for LDPE is projected to increase as businesses seek versatile and reliable packaging solutions, further cementing its leading position in the market.

High-Density Polyethylene (HDPE)

High-Density Polyethylene (HDPE) is recognized for its high strength-to-density ratio, making it ideal for manufacturing sturdy and durable polybags. Often used in applications where elevated tensile strength and resistance to punctures and impacts are required, HDPE polybags are commonly employed for industrial packaging, grocery bags, and agricultural uses. The material's ability to withstand higher temperatures also makes it suitable for more diverse environmental conditions. As industries continue to expand and demand for reliable, high-strength packaging materials rises, HDPE is positioned as a significant player in the polybag market, albeit not the leading one.

Linear Low-Density Polyethylene (LLDPE)

Linear Low-Density Polyethylene (LLDPE) offers versatility and strength but does not match the dominance of LDPE. It is valued for its impact resistance and stretch capabilities, making it a popular choice for applications like stretch films and heavy-duty bags. As businesses increasingly prioritize flexibility and the ability to package odd-shaped items securely, LLDPE plays a vital role, particularly in sectors like agriculture and food service. Despite its strengths, the market shares of LLDPE may remain influenced by the more established LDPE products in terms of volume and application breadth.

Other Plastic Materials

The category of Other Plastic Materials includes various alternatives, such as biodegradable and compostable materials. While these options are gaining attention due to a societal shift toward sustainability, they currently hold a smaller market share in comparison to more established materials like LDPE. The potential for growth in this area is significant as consumers and regulations push for more eco-friendly packaging solutions. However, until these materials can match the performance and cost-effectiveness of LDPE and HDPE, their market presence will remain limited in the broader polybag landscape.

Insights On Size

Medium (10-20 inches)

The medium-sized polybags (10-20 inches) are expected to dominate the global polybag market due to their versatility and adaptability across various industries. This size strikes a perfect balance between compactness and capacity, making it suitable for both personal and commercial use. Many retailers and e-commerce businesses opt for medium bags because they can accommodate a wide range of products, from clothing to electronics. The increasing trend of online shopping and the growing need for protective packaging solutions further enhance the appeal of medium-sized polybags. Additionally, as businesses seek more sustainable packaging options, medium polybags can be tailored to meet eco-friendly requirements, thereby boosting their market presence.

Small (10 inches)

Small polybags (10 inches) cater to specific needs, particularly in the sectors of small retail products and accessories. They are often used for packaging items like jewelry, cosmetics, and small electronic parts, providing a cost-effective solution for businesses focusing on lightweight goods. Although this size has a defined market, it tends to be overshadowed by medium bags that offer greater capacity. However, the rise of niche markets and boutique retailers may give small polybags an opportunity to maintain relevance where specialized packaging is a unique selling proposition.

Large (>20 inches)

Large polybags (greater than 20 inches) are primarily utilized for packaging bulk or oversized items, including bedding, furniture, and large clothing items. While they serve specific industries like logistics and shipping, their overall market share is limited compared to smaller sizes. The demand for large bags tends to fluctuate seasonally, often depending on particular trends in retail and e-commerce. Companies focused on large items may prefer larger polybags, but the overall frequency of their use is less than that of medium-sized bags, which can address a wider array of packaging needs. As a result, large polybags maintain a niche but are not expected to lead the market.

Insights On Thickness

Medium (0.02-0.05 mm)

The Medium thickness category is expected to dominate the global polybag market due to its versatile applications and the balance it offers between durability and cost-effectiveness. This thickness range has become the preferred choice among various industries, including retail, grocery, and food packaging, as it provides adequate strength for everyday use without the high costs associated with thicker alternatives. Additionally, concerns over environmental sustainability are prompting manufacturers to develop more eco-friendly options within this thickness range, further driving demand from environmentally conscious consumers. As businesses seek to maintain functionality while addressing sustainability, the Medium thickness category stands out as the most practical solution in the current market landscape.

Thin (less than 0.02 mm)

The Thin category is typically favored for lightweight applications, such as promotional and retail bags, where cost-efficiency is paramount. Companies within the retail sector often utilize these bags for single-use scenarios, such as carrying lightweight items. The growing push for single-use plastics, paired with consumer convenience trends, has kept the Thin thickness relevant. However, this category's growth may be constrained by increasing regulations on single-use plastics and a shift toward more sustainable alternatives, limiting its long-term dominance in the market.

Thick (greater than 0.05 mm)

The Thick category is generally associated with more heavy-duty applications, such as industrial and agricultural uses, where increased durability is crucial. These bags are designed to withstand significant weight and harsh conditions, making them suitable for transporting bulk items. Although this thickness provides enhanced strength, its higher material costs can hinder widespread adoption in everyday consumer markets, where lighter options are preferred. Consequently, while the Thick range serves specific niches very well, it may not achieve the same overall market saturation as the other thickness categories focused on broader consumer needs.

Insights On Application

Food Packaging

Food Packaging is anticipated to dominate the Global Polybag Market due to the increasing demand for packaged food products and the growing trend of convenience food among consumers. The food industry significantly relies on polybags for maintaining the freshness, safety, and shelf-life of food items. The rise in e-commerce platforms selling food products also contributes to this trend, as polybags provide a lightweight, cost-effective solution for packaging. Additionally, the push for sustainable packaging options is leading manufacturers to innovate with biodegradable and recyclable polybags, further enhancing the attractiveness of food packaging within this market.

Industrial Packaging

Industrial Packaging is a vital area of the Global Polybag Market, driven by the need for bulk packaging and protection of goods during transportation and storage. The rising industries such as automotive, chemicals, and electronics require robust packaging solutions that polybags can efficiently provide. Furthermore, the globalization of trade and increased logistics activities necessitate durable packaging that can withstand various environmental factors. As a result, the industrial packaging sector is experiencing steady growth, with polybags being the preferred choice due to their versatility and cost-effectiveness.

Retail Packaging

Retail Packaging plays a significant role in the Global Polybag Market, primarily stemming from the retail industry’s focus on enhancing the consumer shopping experience. Retailers utilize polybags for branding, marketing, and convenience, making it easier for customers to transport their purchases. The growth of the retail sector, especially e-commerce, is further fueling this demand, as more products are packaged for direct delivery to consumers. With trends focusing on eco-friendly retail solutions, innovative polybag designs that cater to sustainability are becoming increasingly popular, making retail packaging an important within the market.

Medical Packaging

Medical Packaging is an essential component of the Global Polybag Market, particularly due to the stringent regulations concerning product safety and sterility in the healthcare sector. The demand for polybags in this field is driven by the need for lightweight and sterile solutions that effectively protect medical devices, pharmaceuticals, and consumables. As the healthcare industry continues to grow, along with the increased focus on patient safety and hygiene, the role of medical packaging is becoming more pronounced. Innovations in the polybag materials and designs to meet specific regulatory requirements further boost the growth of this particular area of the market.

Insights On Print

Printed

The printed category is anticipated to dominate the global polybag market due to its versatility and the growing demand for branded packaging solutions across various industries. Companies increasingly recognize the importance of attractive and informative packaging that elevates brand visibility and consumer engagement. Additionally, printed polybags are preferred for e-commerce packaging, allowing companies to customize their bags with logos, promotional messages, and QR codes, enhancing the customer's overall experience. This emphasis on branding and customization is driving significant growth in the printed sector, enabling it to maintain a robust position in the market as consumers seek to differentiate products through innovative packaging designs.

Unprinted

The unprinted category, while not expected to lead the market, maintains a steady presence driven by its cost-effectiveness and simplicity. Many businesses prefer these bags for their basic functionality, particularly in scenarios where branding is not a primary requirement. Industries such as retail or agriculture often lean towards unprinted polybags for their practicality and lower manufacturing costs. This appeals to eco-conscious companies focusing on reducing expenses while still ensuring adequate protective packaging for their products.

Global Polybag Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Polybag Market due to several factors. Firstly, the rapid industrialization and urbanization in countries like China and India are driving the demand for packaging solutions, including polybags. The region is also witnessing a significant rise in e-commerce activities, leading to an increased need for packaging materials for logistics and product delivery. Additionally, the growing population and changing consumer habits towards packaged goods further contribute to ened demand for polybags. With a focus on cost-effective and lightweight packaging solutions, manufacturers in Asia Pacific are continuously innovating, which secures their competitive advantage in the global market.

North America

In North America, the polybag market is characterized by stringent regulatory frameworks regarding packaging materials, particularly regarding environmental concerns. While there is steady demand due to e-commerce growth, the market is heavily influenced by sustainability initiatives prompting brands to shift towards eco-friendly alternatives. This creates a slower growth trajectory for polybags, despite the existing established market presence. Innovative recycling programs and the introduction of biodegradable polybags could enhance market prospects, but overall growth may be modest compared to the dominant Asia Pacific region.

Europe

Europe presents a diverse landscape for the polybag market, driven largely by environmental sustainability trends. Many countries in the region are implementing regulations banning single-use plastic bags. This has pushed the market towards exploring biodegradable and compostable polybag solutions. As consumer awareness regarding environmental issues rises, brands are increasingly adopting greener packaging options. Despite these challenges, the demand for polybags remains robust in certain sectors, particularly in food and retail packaging, showing resilience but not enough to challenge the dominance of Asia Pacific.

Latin America

In Latin America, the polybag market is growing steadily, backed by the increase in disposable income levels and retail sector expansion. The region is seeing a rise in consumer packaged goods, which boosts demand for polybags. However, economic fluctuations and lack of regulatory frameworks governing plastic use might restrain more aggressive growth. The focus is gradually shifting towards sustainable alternatives, but this transition is slower compared to Asia Pacific. Overall, while there is potential, the region struggles to keep pace with the dominant markets.

Middle East & Africa

The Middle East & Africa region presents a mixed outlook for the polybag market. The demand is driven primarily by the retail channel, particularly in growing economies. However, challenges such as political instability, economic fluctuations, and infrastructure issues hinder consistent growth. Environmental awareness is emerging, but the market is largely dominated by traditional polybag solutions. The potential for growth remains, especially if investments in infrastructure and sustainable practices increase, yet the region still lags behind the dominating Asia Pacific market.

Polybag Market Competitive Landscape:

The primary stakeholders in the worldwide polybag industry generally encompass producers, distributors, and vendors, who work together to innovate and market a variety of polybag offerings. Their responsibilities include adapting to consumer needs, promoting sustainable practices, and developing technologies to improve product performance.

Prominent entities within the polybag sector encompass Amcor plc, Sealed Air Corporation, Novolex Holdings, Inc., Berry Global Inc., Inteplast Group, LLC, Smurfit Kappa Group, AEP Industries Inc., ProAmpac LLC, Coveris Holdings S.A., International Plastics, LLC, Sigma Plastics Group, and Wenjie Technology Co., Ltd. Additionally, significant players such as Mondi Group plc, FPP Holdings Pty Ltd., Huhtamäki Oyj, C-P Flexible Packaging, and Plásticos Pajarito, S.A. de C.V. further enrich this market. Collectively, these organizations exhibit a wide range of expertise and serve various s within the polybag industry, fostering its advancement and creativity.

Global Polybag Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly intensified the need for polybags, driven by a rise in online shopping and ened emphasis on hygienic and secure packaging practices.

The COVID-19 pandemic has had a profound effect on the polybag industry, revealing both challenges and opportunities. At the onset, disruptions in production and logistics resulted in a scarcity of raw materials and a rise in costs. Simultaneously, the demand for essential items surged, especially within the e-commerce and food delivery sectors, leading to a greater reliance on polybags for packaging. Businesses aimed to provide safe and hygienic packaging solutions to meet consumer needs during this time. Additionally, the increased focus on hygiene and cleanliness catalyzed a move toward single-use items like polybags. Nonetheless, growing environmental concerns and regulatory pressures aimed at reducing plastic waste are reshaping the industry landscape, driving manufacturers to pursue sustainable and biodegradable alternatives. Consequently, while the pandemic has created expansion opportunities in some sectors, it has also intensified the transition toward more environmentally responsible practices, indicating a potential shift in consumer preferences that could influence future market trends.

Latest Trends and Innovation in The Global Polybag Market:

- In November 2021, Schur Flexibles Group acquired the German flexible packaging producer, PolyExpert, to expand their product offering and strengthen their position in the European market.

- In March 2022, Berry Global announced its partnership with a leading sustainable material provider to develop bio-based polybags aimed at reducing carbon footprint while maintaining product performance.

- In July 2022, Novolex completed the acquisition of the plastic bag production business of Duro Bag Manufacturing Company, enhancing its portfolio and market presence in the retail and food service sectors.

- In April 2023, Amcor launched a new line of recyclable polybags designed to meet the increasing demand for sustainable packaging solutions, focusing on the food and healthcare s.

- In August 2023, Coveris announced the introduction of a new technology that allows for the production of polybags with reduced thickness, significantly cutting down material use and enhancing recyclability.

- In September 2023, Harpack acquired assets from a local competitor to boost its production capacity and innovate in the development of eco-friendly and reusable polybags, reflecting industry trends towards sustainability.

Polybag Market Growth Factors:

The expansion of the polybag industry is fueled by the surge in online shopping, a growing preference for eco-friendly packaging options, and the enhancement of retail markets.

The polybag market is undergoing notable expansion driven by several elements. To begin with, the escalating need for flexible packaging in sectors such as food service, retail, and e-commerce is propelling market growth, as polybags provide lightweight, protective, and economically viable options. Furthermore, the ened emphasis on hygiene and safety during the COVID-19 crisis has led to an increased utilization of polybags for essential item packaging, prompting manufacturers to innovate to address specific consumer demands.

Environmental factors are also crucial, with advancements in biodegradable and recyclable polybag materials appealing to environmentally conscious businesses and consumers. The rise of online shopping has further amplified the demand for durable packaging solutions to ensure the secure shipment of products, thereby boosting the prevalence of polybags. Additionally, governmental regulations and initiatives advocating for sustainable packaging are creating new avenues in the market, as companies aim to adhere to compliance standards.

Moreover, the rapid pace of urbanization, coupled with changing consumer preferences towards convenience and single-use items, continues to stimulate demand for polybags, guaranteeing consistent market growth. Collectively, these influences contribute to a vibrant landscape for the polybag industry, setting the stage for ongoing progress in the coming years.

Polybag Market Restaining Factors:

The polybag industry is confronted with obstacles, including the rise of environmental regulations and a notable transition towards eco-friendly packaging options.

The polybag industry is currently confronted with numerous obstacles that may impede its growth potential. A significant concern is the ened regulatory oversight regarding the ecological repercussions of single-use plastics, especially in areas advocating for decreased plastic usage and implementing bans on plastic bags. This movement towards sustainability is increasing costs for manufacturers who are required to transition to environmentally friendly materials and production methods. Moreover, rising consumer awareness about environmental challenges is contributing to a reduced demand for plastic products, thereby complicating sales in the polybag sector. The market also faces stiff competition from biodegradable alternatives and reusable bags, as consumers increasingly prefer sustainable choices. Additionally, fluctuations in raw material prices and supply chain disruptions can adversely affect production expenses and availability. Nonetheless, the polybag market holds the potential to adjust by embracing innovative and sustainable practices, such as biodegradable options and reusable designs. By aligning with international sustainability goals and emphasizing eco-friendly innovations, companies can not only overcome these hurdles but also explore new market opportunities that prioritize environmentally conscious products. This transition could ultimately rejuvenate the polybag industry, enhancing its resilience in response to changing consumer preferences.

Segments of the Polybag Market

By Material Type

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Other Plastic Materials

By Size

- Small (10 inches)

- Medium (10-20 inches)

- Large (>20 inches)

By Thickness

- Thin (less than 0.02 mm)

- Medium (0.02-0.05 mm)

- Thick (greater than 0.05 mm)

By Application

- Food Packaging

- Industrial Packaging

- Retail Packaging

- Medical Packaging

By Print

- Printed

- Unprinted

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America