Point-of-care Biosensors Market Analysis and Insights:

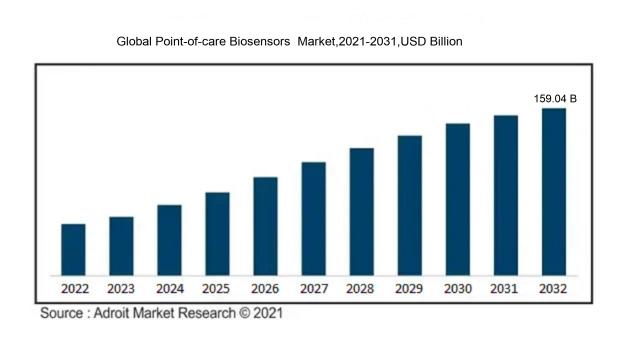

In 2023, the size of the worldwide Point-of-care Biosensors market was US$ 77.21 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.38% from 2024 to 2032, reaching US$ 159.04 billion.

The market for Point-of-Care (POC) biosensors is significantly influenced by various essential elements, chief among them being the rising incidence of chronic and infectious diseases that demand swift and precise diagnostic tools. The growing interest in home healthcare and remote patient monitoring has propelled the use of POC devices, providing users with convenience and instant results. Advances in technology related to biosensor design and miniaturization have improved their effectiveness and ease of use, making them accessible to a wider audience. Furthermore, the increasing focus on personalized medicine and preventive healthcare strengthens market demand, as POC biosensors facilitate continuous health monitoring. Supportive regulations and favorable reimbursement strategies also play a vital role in promoting market growth by fostering innovation and ensuring the accessibility of state-of-the-art biosensors. Together, these factors underscore the indispensable function of POC biosensors in enhancing healthcare outcomes and fostering greater patient involvement in health management.

Point-of-care Biosensors Market Definition

Point-of-care biosensors are diagnostic instruments designed to evaluate biological samples in close proximity to the patient’s location, allowing for swift and precise health evaluations. By enabling quick decision-making for healthcare professionals, these devices often lead to enhanced results for patients.

Biosensors at the point of care play a pivotal role in enhancing healthcare by providing swift and precise diagnostic evaluations right where patients receive treatment. This innovation allows healthcare providers to make informed decisions quickly, as results can be obtained in a matter of minutes, eliminating the need for prolonged lab processing times. Such promptness is essential for the timely identification of diseases, effective management of chronic illnesses, and rapid responses to emergency situations. Additionally, these biosensors improve healthcare accessibility in underserved or remote regions, thus broadening the reach of diagnostic services and potentially improving overall health outcomes through early detection and tailored treatment approaches. Incorporating these devices into standard medical practices can revolutionize patient care and healthcare frameworks as a whole.

Point-of-care Biosensors Market Segmental Analysis:

Insights On Product

Glucose Monitoring

In the Global Point-of-care Biosensors Market, glucose monitoring is poised to dominate due to the significant prevalence of diabetes worldwide. With increasing awareness about diabetes management, the demand for rapid and accurate glucose testing devices is on the rise. Innovations in biosensor technologies have led to the development of user-friendly and portable glucose monitors, making them essential for daily diabetes management. The growing trend of home care and self-monitoring among patients adds to the market's potential. Moreover, the integration of digital health technologies, including real-time data tracking and mobile applications, further enhances the appeal of glucose monitoring devices, positioning them as the leading product category.

HIV

HIV testing technologies are gaining traction in the Point-of-care Biosensors Market as public health initiatives emphasize the importance of early detection and treatment of the virus. With a global endeavor to end the HIV epidemic, easy access to testing services increases the demand for rapid and reliable HIV tests. Point-of-care biosensors allow for quick results and can be integrated into various healthcare settings, including remote areas. The growth of telehealth and home testing solutions also makes HIV testing more accessible, appealing to patients seeking privacy and convenience in their healthcare management.

Hepatitis C

Hepatitis C testing is gradually gaining attention within the Point-of-care Biosensors Market, driven by the rising prevalence of Hepatitis C infections globally. Efforts to increase awareness and improve screening, especially among high-risk populations, play a crucial role in the growth of this. Rapid detection tests enable timely diagnosis and treatment, essential for reducing the disease's burden. Furthermore, government campaigns and initiatives for Hepatitis C elimination foster innovation and focus on developing more efficient, user-friendly testing platforms, contributing to its growth potential in the biosensors market.

Pregnancy

Pregnancy testing products continue to show steady growth in the Point-of-care Biosensors Market, primarily due to their essential role in early pregnancy detection. The convenience of over-the-counter pregnancy tests allows individuals to take charge of their reproductive health in a private setting. As awareness around maternal health increases, enhancements in accuracy and ease of use for pregnancy tests are becoming priorities for manufacturers. Moreover, the convergence of technology, such as app integration for tracking fertility cycles, is likely to resonate well with consumers, creating opportunities for advancements in this area of the market.

Insights On Platforms

Immunoassays

Immunoassays are expected to dominate the Global Point-of-Care Biosensors Market due to their high sensitivity and specificity in detecting various biomarkers and infectious diseases. Their wide application range, including applications in chronic disease management and infectious disease diagnosis, drives their adoption in point-of-care settings. The capability to quickly deliver results in a user-friendly manner enhances their popularity among healthcare providers. The increasing demand for rapid and accurate diagnostic solutions in both clinical and home healthcare settings contributes significantly to the rise of immunoassays. Technological advancements in assay development further boost their efficacy and reliability, solidifying their market leadership position.

Microfluidics

Microfluidics technology is gaining attention in the Point-of-Care Biosensors Market due to its ability to manipulate small volumes of fluids with high precision. This technology allows for the integration of multiple analytical processes into a single platform, which is beneficial for rapid diagnostic testing. Additionally, microfluidics can enable multiplexing, allowing simultaneous testing for multiple biomarkers, thus reducing time and costs associated with testing. The increasing need for portable, sensitive, and cost-effective diagnostic devices is propelling the growth of microfluidics in this market. Ongoing developments in miniaturization and integration of technology further enhance the attractiveness of microfluidic biosensors.

Dipsticks

Dipsticks are recognized for their simplicity and ease of use, making them a practical choice in diverse point-of-care scenarios. Their low-cost production and ease of interpretation allow for rapid testing without requiring sophisticated laboratory equipment. They are particularly suitable for home healthcare, emergency care settings, and resource-limited environments, where quick results are essential. The growing need for rapid diagnostic solutions and self-testing is driving the demand for dipsticks in the market. Although they may have limitations compared to other methods in terms of sensitivity and specificity, their practical advantages maintain a steady demand and presence in the biosensors market.

Insights On Purchase

OTC

The OTC (Over-The-Counter) is expected to dominate the Global Point-of-care Biosensors Market due to the increasing consumer demand for self-testing and immediate results in healthcare. The accessibility and convenience of OTC biosensors empower patients to manage their health proactively without needing a prescription. This trend is driven by rising health awareness, a growing number of chronic diseases, and the global push for personalized healthcare solutions. Furthermore, the proliferation of digital technology and point-of-care diagnostics is enabling rapid innovations in OTC devices. These factors collectively enhance the appeal of OTC biosensors, positioning them as the leading choice for consumers.

Prescription

The Prescription, while overshadowed by its OTC counterpart, still plays a crucial role in the Global Point-of-care Biosensors Market. A significant portion of advanced and specialized testing requires medical oversight, ensuring the accuracy and reliability of the results. Prescription biosensors are often used in clinical settings where healthcare professionals rely on these devices for diagnosis, monitoring, and treatment planning. As healthcare becomes more personalized, demand for these prescription-based products may grow, particularly in specialized fields like oncology and endocrinology, where precision is fundamental.

Insights On Sample

Blood

Blood is expected to dominate the global Point-of-care Biosensors market due to several compelling factors. The prevalent use of blood tests in diagnosing a wide range of medical conditions—including diabetes, infectious diseases, and cardiovascular ailments—fuels the demand for blood-based biosensing solutions. The accuracy and reliability associated with blood tests make them a preferred choice among healthcare professionals. Additionally, advancements in technology have improved the portability and efficacy of blood biosensors. As more healthcare facilities strive for rapid, real-time diagnostics to enhance patient outcomes, the inclination towards blood samples over urine continues to grow, further solidifying blood's dominant position in this market.

Urine

Urine testing has long been an essential diagnostic tool, particularly in fields like nephrology and urology. The market for urine biosensors continues to be driven by their non-invasive nature and the ability to monitor various health conditions, including diabetes and kidney function. Moreover, urine tests are often favored in screenings and routine check-ups due to their quicker processing and minimal discomfort for patients. However, while their application remains vital, the growth rate in the urine is comparatively slower than that of blood, making their market share less dominant but still significant.

Insights On End User

Hospital

The hospital sector is expected to dominate the global point-of-care biosensors market due to its critical need for timely diagnosis and patient monitoring. Hospitals require rapid results to make quick clinical decisions, particularly in emergency situations. The integration of biosensors in hospital settings enhances patient care by facilitating early disease detection and management. Furthermore, the continuous rise in chronic diseases necessitates sophisticated monitoring equipment, which biosensors provide. The technology's ability to yield accurate and immediate results aligns with hospital protocols aimed at enhancing patient outcomes, which contributes significantly to its anticipated dominance in this market.

Pharmacy

In pharmacies, the application of point-of-care biosensors is gradually increasing as they offer convenience and accessibility for patients seeking quick diagnostic results. Pharmacies are beginning to integrate these technologies into their services, allowing consumers to monitor various health parameters without the need for hospital visits. This could, however, face challenges regarding regulatory compliance and practitioner support, as not all pharmacies have the necessary infrastructure or trained personnel to support advanced biosensing technology. As the landscape evolves, pharmacies may play a larger role, but they currently remain secondary to hospitals in market significance.

Homecare

The homecare market for point-of-care biosensors is expected to expand due to the growing trend of at-home healthcare and patient self-monitoring. People are increasingly interested in maintaining their health and managing chronic conditions from the comfort of their homes, leading to a demand for easy-to-use biosensors. However, the adoption is often limited by technological barriers, user literacy, and the accuracy of devices. While the homecare is growing, it lacks the comprehensive and urgent needs that hospitals represent, which means it currently occupies a smaller role in the overall market compared to hospitals.

Global Point-of-care Biosensors Market Regional Insights:

North America

North America is expected to dominate the Global Point-of-Care Biosensors market due to a combination of advanced healthcare infrastructure, significant investments in research and development, and a higher prevalence of chronic diseases. The U.S. specifically has a robust market driven by a wide acceptance of new technologies among healthcare providers and patients alike. The presence of players and innovative startups in this region further strengthens the market position by facilitating rapid advancements in biosensor technology. Furthermore, supportive government policies and regulatory frameworks promote the commercialization of advanced diagnostic tools, contributing to North America's leading role in this sector.

Latin America

Latin America represents a growing market for Point-of-Care Biosensors, characterized by increasing healthcare demand and a rising focus on improving diagnostic capabilities. Although it currently lags behind more developed regions, factors such as population growth, rising income levels, and a greater emphasis on preventive care are paving the way for market advancements. Collaborations between healthcare providers and technology developers are emerging, which could lead to enhanced market penetration and adoption of point-of-care tests in underserved areas.

Asia Pacific

Asia Pacific is witnessing significant growth in the Point-of-Care Biosensors market, fueled by a large population base and increasing healthcare spending. Countries like China and India are experiencing technological advancements and are becoming attractive markets for biosensor innovations. The rising prevalence of infectious diseases and the need for rapid diagnostic alternatives drive the demand for point-of-care testing. However, challenges such as regulatory hurdles and market readiness could temporarily hinder overall market penetration.

Europe

Europe's Point-of-Care Biosensors market is characterized by technological sophistication and a well-established healthcare system. Countries such as Germany and the UK are competing rigorously to advance biosensor technology to improve diagnostic accuracy and patient outcomes. However, the market also bears challenges related to stringent regulations and reimbursement policies, which may limit growth prospects to a certain extent. Ongoing research initiatives and partnerships between the public and private sectors highlight the commitment to enhance healthcare delivery through point-of-care technologies.

Middle East & Africa

The Middle East & Africa region has a nascent Point-of-Care Biosensors market but is gradually expanding due to increased investments in healthcare infrastructure and growing awareness of advanced diagnostic tools. While the market is still in its early stages, the demand is increasing due to the rising burden of diseases and the need for accessible healthcare solutions. However, challenges, such as economic disparities and different regulatory environments, may affect growth and wider adoption of biosensor technologies in the region.

Point-of-care Biosensors Market Competitive Landscape:

Leading entities in the worldwide point-of-care biosensors sector play a crucial role in fostering innovation and market growth by engaging in cutting-edge research and development, adhering to regulatory standards, and forming strategic alliances. These initiatives amplify the availability and effectiveness of diagnostic tools, ultimately enhancing patient outcomes and the overall delivery of healthcare.

Prominent entities within the point-of-care biosensors sector comprise Abbott Laboratories, Roche Holding AG, Siemens Healthineers, Medtronic plc, Johnson & Johnson, Bio-Rad Laboratories, Inc., Qiagen N.V., Becton, Dickinson and Company, Nova Biomedical Corporation, DiaSorin S.p.A., Chembio Diagnostic Systems, Inc., Eton Bioscience, Inc., Trividia Health, Inc., LexaGene Holdings, Inc., and Luminex Corporation.

Global Point-of-care Biosensors Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly expedited the development and utilization of point-of-care biosensors, propelled by the pressing demand for swift testing and diagnostic solutions.

The COVID-19 outbreak had a profound effect on the market for point-of-care biosensors, instigating swift expansion driven by the rising need for rapid and precise diagnostic solutions. As healthcare infrastructures globally experienced extraordinary pressure, the demand for efficient and prompt testing grew increasingly urgent, which in turn spurred investments in biosensor advancements. Breakthroughs in rapid testing technologies, such as antigen and molecular biosensors, allowed for on-the-spot diagnostics, alleviating laboratory workload and empowering immediate treatment options. Initiatives from governments and funding sources played a crucial role in expediting research and development within this domain, improving biosensor capabilities to identify not only COVID-19 but also a spectrum of other infectious ailments. The pandemic underscored the necessity for decentralized healthcare approaches, leading to wider implementation of point-of-care testing across various environments, including outpatient clinics and residential care. Consequently, the market is poised for continued transformation, with ongoing technological innovations and a ened focus on personalized and preventive healthcare in the wake of the pandemic.

Latest Trends and Innovation in The Global Point-of-care Biosensors Market:

- In March 2023, Abbott announced the acquisition of Cardiome, which specializes in the development of innovative point-of-care biosensors for heart monitoring, enhancing Abbott's cardiac care product line.

- In June 2023, Siemens Healthineers launched its new point-of-care testing platform called the Atellica VTLi, designed to deliver rapid respiratory testing results, improving on-site diagnostic capabilities.

- In August 2023, Roche unveiled the cobas® pulse system, a portable point-of-care biosensor that provides immediate blood testing results for patients in emergency settings, which was a significant technological innovation in the market.

- In April 2023, QuidelOrtho Corporation completed the acquisition of the Spanish firm, Samtech, known for its development of innovative biosensor technologies for infectious disease detection, aiming to expand its product offerings in Europe.

- In January 2023, PerkinElmer launched the 2023 version of its GSP® instrument, which utilizes advanced biosensors to provide real-time analysis of food safety, showcasing innovation in food testing applications.

- In February 2023, Medtronic introduced a new iteration of their continuous glucose monitoring biosensor technology that allows for better patient integration with real-time data sharing to healthcare providers, marking a significant advancement in diabetes management.

- In July 2023, Svar Life Science partnered with various clinics to introduce their Fluorescence Lifetime Imaging Microscopy (FLIM) biosensor technology aimed at enhancing point-of-care diagnostics in oncology, aligning with a trend toward personalized medicine.

Point-of-care Biosensors Market Growth Factors:

The expansion of the Point-of-Care Biosensors Market is propelled by technological innovations, an upsurge in the need for swift diagnostic tools, and a growing focus on tailored medical approaches.

The market for Point-of-Care Biosensors is witnessing remarkable expansion, influenced by several pivotal elements. A primary driver is the escalating incidence of chronic and infectious illnesses, which creates a demand for immediate monitoring and swift diagnosis, thereby increasing the need for intuitive point-of-care solutions. Technological advancements, particularly in the arena of biosensor innovation, are elevating the accuracy and precision of testing, bolstering their reliability within clinical environments. Additionally, a ened global consciousness regarding health and a growing inclination towards home healthcare are propelling the desire for convenient and non-invasive testing solutions. Regulatory measures designed to streamline the approval processes for cutting-edge diagnostic devices are further stimulating market progress. Furthermore, the COVID-19 pandemic has expedited the use of point-of-care testing, underscoring the necessity for quick and readily accessible diagnostic instruments. The incorporation of digital health technologies and mobile health platforms also facilitates better data management, enabling healthcare professionals to more effectively monitor patient conditions. Together with increasing investments from both public and private entities in healthcare infrastructure, these factors are significantly fueling the growth of the point-of-care biosensor market.

Point-of-care Biosensors Market Restaining Factors:

The primary challenges hindering the Point-of-care Biosensors Market consist of the substantial expenses associated with technological advancements and the regulatory hurdles that affect the timelines for product approvals.

The market for Point-of-Care (POC) biosensors is hindered by various factors that limit its growth trajectory. One significant barrier is the substantial costs involved in the development and production of sophisticated biosensing technologies, which can restrict access, particularly in developing regions where healthcare budgets are tight. In addition, the regulatory landscape poses challenges; protracted approval processes established by health authorities can impede the launch of innovative products, thus dissuading potential investment. Another hurdle is the necessity for skilled professionals to manage these advanced devices, which is particularly problematic in rural or underprivileged areas lacking such expertise. Concerns over data security and the compatibility of biosensors with current healthcare information systems further complicate their implementation, preventing a smooth integration into existing structures. Moreover, the prevalence of traditional laboratory testing methods, often viewed as more dependable, poses competition that can limit the uptake of POC biosensors. Despite these challenges, continuous technological advancements, growing consumer awareness, and an increasing demand for quick diagnostic solutions are driving the industry forward, indicating a promising outlook for the POC biosensors market as it strives to navigate and overcome these obstacles.

Segments of the Point-of-Care Biosensors Market

By Product

• Glucose Monitoring

• HIV

• Hepatitis C

• Pregnancy

By Platforms

• Microfluidics

• Dipsticks

• Immunoassays

By Purchase

• OTC

• Prescription

By Sample

• Blood

• Urine

By End User

• Pharmacy

• Hospital

• Homecare

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America