Plant Asset Management Market Analysis and Insights:

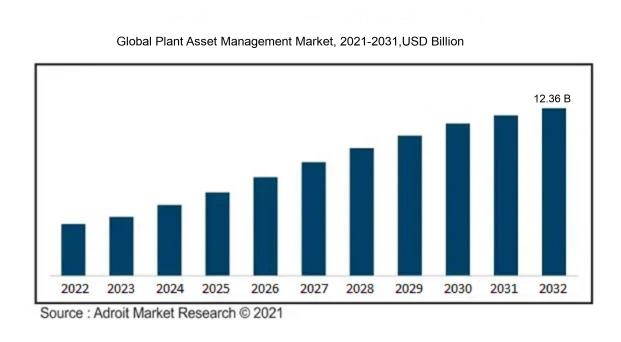

In 2023, the size of the worldwide Plant Asset Management market was US$ 6.64 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 7.18% from 2024 to 2032, reaching US$ 12.36 billion.

The Plant Asset Management (PAM) sector is significantly fueled by the growing demand for enhanced operational efficiency and cost-saving measures within industrial environments. Businesses are increasingly turning to cutting-edge technologies, including the Internet of Things (IoT) and predictive maintenance applications, to improve asset lifecycle management and reduce equipment downtime. Moreover, the rising focus on adherence to regulations and the push for sustainable operations compel organizations to implement effective PAM systems. The advent of big data analytics enables real-time oversight and informed decision-making, further stimulating market expansion. Additionally, the ongoing digital transformation in various industries promotes the seamless integration of PAM solutions with existing enterprise resource planning (ERP) systems, leading to improved productivity. The necessity to update aging infrastructures across multiple sectors also drives the demand for advanced asset management strategies, highlighting the need for innovative PAM solutions that enhance asset reliability and performance efficiency.

Plant Asset Management Market Definition

Plant Asset Management encompasses the organized methodology for overseeing a firm’s tangible assets—like machinery and tools—with the aim of maximizing their efficiency, longevity, and total output. This field emphasizes maintenance practices, continuous monitoring, and thoughtful planning to improve operational effectiveness and reduce expenses.

Plant Asset Management (PAM) plays a vital role in enhancing the performance, dependability, and lifespan of physical assets in industrial settings. By adopting robust PAM techniques, companies can boost productivity, lower operational expenses, and decrease downtime by focusing on preventive maintenance. This systematic method facilitates improved monitoring of asset conditions, allowing for more strategic decisions related to repairs and replacements. Additionally, PAM aids in meeting regulatory requirements and sustainability goals, ensuring efficient asset operation while lessening environmental impacts. Ultimately, proficient asset management leads to greater profitability and competitive advantage in the marketplace, highlighting its essential importance in today’s manufacturing and industrial domains.

Plant Asset Management Market Segmental Analysis:

Insights On Deployment Type

Cloud-Based

Cloud-Based deployment is expected to dominate the Global Plant Asset Management market due to its scalability, flexibility, and cost-effectiveness. As organizations increasingly seek to optimize their operations, cloud-based solutions offer real-time data access and analytics, which are crucial for effective asset management. Additionally, the ongoing digital transformation across various industries and the growing demand for remote accessibility have made cloud solutions more appealing. Businesses can minimize their infrastructure costs while enhancing collaboration and decision-making processes, which ultimately increases operational efficiency. As a result, the adoption of cloud-based plant asset management systems is projected to accelerate significantly.

On-Premise

On-Premise deployment remains relevant in certain industries, particularly where data security and compliance are of utmost importance. Companies operating under stringent regulatory environments often prefer on-premise solutions to retain complete control over their data and IT infrastructure. Despite the rise of cloud solutions, some organizations continue to invest in on-premise systems to leverage their existing investments and maintain a stable working environment. However, the rigid nature of on-premise solutions can limit agility and adaptability, which may pose challenges in rapidly changing market conditions.

Hybrid

The Hybrid deployment model is gaining traction as organizations seek to reap the benefits of both on-premise and cloud solutions. By combining the two approaches, businesses can achieve greater flexibility and choose the best environment for different applications. This model is particularly appealing for companies that have specific operational needs that require high levels of customization or that must comply with regulatory standards while also requiring the scalability of cloud resources. Although hybrid systems can be more complex to manage, they offer a balanced approach that meets diverse operational requirements, making them a compelling option for many emerging players in the market.

Insights On Solution Type

Software

The Global Plant Asset Management Market is expected to be primarily dominated by software solutions. This is largely due to the increasing need for advanced analytics, real-time monitoring, and predictive maintenance capabilities that software delivers. Companies are increasingly recognizing the importance of digital transformation, thus opting for comprehensive software solutions to streamline their asset management processes. Software provides interoperability with other management systems and enhances decision-making, compliance, and operational efficiency. As organizations prioritize modernization and data-driven strategies, software will likely capture a significant share of market growth, outpacing other alternatives available in the market.

Services

The services aspect of Plant Asset Management includes consulting, training, and maintenance support, assisting organizations in successfully implementing and optimizing their software solutions. While this area does not dominate the market, it complements software offerings by providing necessary expertise and ongoing support to enhance system functionality. As companies implement these technological solutions, they often rely on professional services for integration and training, emphasizing the importance of human capital alongside technology. The increasing complexity of plant operations creates opportunities for service providers to offer tailored solutions that meet specific operational needs.

Insights On Application

Oil and Gas

The Oil and Gas sector is expected to dominate the Global Plant Asset Management Market due to its critical reliance on advanced technology for optimizing operations and ensuring safety and compliance. This industry requires real-time data monitoring and analysis to maximize efficiency and minimize downtime, making plant asset management software and tools essential. The fluctuating nature of oil prices and increased regulatory pressures drive companies in this sector to adopt sophisticated solutions for better asset management. Furthermore, the ongoing shift towards digitalization and Industry 4.0 trends has further propelled the adoption of plant asset management solutions, solidifying this sector's prominent position in the market.

Manufacturing

Manufacturing is another significant area utilizing plant asset management solutions to streamline production processes and enhance operational efficiency. With a focus on improving product quality and reducing operational costs, manufacturers invest heavily in asset management systems to monitor equipment performance and predict maintenance needs. The industry demands uninterrupted production cycles, which necessitate robust systems for asset tracking, thus ensuring the efficient allocation of resources. The integration of technologies like IoT in manufacturing further amplifies the need for effective asset management, making it a vital area of growth.

Utilities

The Utilities sector relies heavily on plant asset management to enhance service reliability while reducing operational and maintenance costs. As utilities face aging infrastructure and increasing demand for services, adopting sophisticated asset management strategies becomes essential. These systems help in monitoring and managing the performance of energy production and distribution assets efficiently. Furthermore, with the rise of renewable energy sources and smart grid technology, asset management is critical for ensuring optimal performance and sustainability initiatives. The focus on regulatory compliance also fuels the adoption of plant asset management solutions in this sector.

Mining

In the Mining sector, effective asset management is crucial for maintaining operational efficiency and safety standards in resource extraction activities. Mining operations often face complex regulatory requirements and high operational costs, making plant asset management systems increasingly important for managing risks and optimizing asset utilization. These solutions aid in real-time monitoring of equipment health and performance, which in turn reduces the likelihood of equipment failures. As mining companies look to improve productivity and extend the life of assets, the adoption of plant asset management solutions is becoming more prevalent.

Transportation

The Transportation sector is utilizing plant asset management to manage fleets and ensure the optimization of logistics and supply chains. Effective asset management helps in tracking vehicle performance, scheduling maintenance, and reducing operational costs, which are all crucial in an industry characterized by tight margins and increasing competition. The growing emphasis on sustainability and regulatory compliance in transportation amplifies the need for effective management tools that can forecast asset performance and enhance operational efficiency. As the sector continues to evolve, asset management solutions will play a crucial role in managing these dynamic challenges.

Insights On Asset Type

Digital Assets

Digital assets are poised to dominate the Global Plant Asset Management Market due to the increasing integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. Companies are recognizing the value of real-time data collection and analytics, which enhance decision-making, predictive maintenance, and operational efficiency. As industries transition towards digital transformation, the focus on digital assets becomes crucial for optimizing performance and reducing downtime. The ability to track and manage both operational and financial data through digital means allows organizations to streamline processes and achieve greater ROI on their investments. This digital shift is expected to continue propelling the growth and dominance of this asset category in the market.

Physical Assets

Physical assets exhibit significant importance in the Plant Asset Management Market as they comprise tangible resources crucial for operations. These assets include machinery, equipment, and infrastructure that form the backbone of industrial processes. In industries reliant on manufacturing and heavy machinery, efficient management of physical assets is vital for minimizing downtime and maintenance costs. While digital assets are gaining traction, the foundational role of physical assets cannot be overlooked. Companies are investing in maintenance strategies and technologies that bridge the gap between physical and digital management, but the inherent value and necessity of these tangible resources keep them relevant in market discussions.

Production Assets

Production assets play an essential role in the Plant Asset Management ecosystem, encompassing resources directly involved in manufacturing processes, such as production lines and tools. As organizations strive to enhance productivity and streamline operations, effective management of these assets becomes paramount. While production assets include both physical and digital elements, the strategic focus is often on how to optimize the utilization of machinery and labor. Innovations aimed at improving production efficiency, such as lean manufacturing techniques and automation solutions, underscore the importance of this category. Companies are aware that the management of production assets directly impacts their output, making it an integral aspect of overall asset management strategies.

Global Plant Asset Management Market Regional Insights:

Asia Pacific

The Asia Pacific region is anticipated to dominate the Global Plant Asset Management market significantly. This forecast can largely be attributed to the rapid industrialization and ongoing investments in infrastructure across emerging economies such as China and India. As these countries are experiencing robust growth in their manufacturing and energy sectors, there is an increasing demand for efficient asset management solutions to optimize operations and ensure safety. Furthermore, advancements in technologies such as the Internet of Things (IoT) and cloud computing are facilitating the adoption of sophisticated plant asset management systems in this region, thereby reinforcing its leading position in the market.

North America

North America is a strong contender in the Global Plant Asset Management market, driven primarily by large-scale investments in the oil and gas, manufacturing, and utilities sectors. With the presence of major technological firms and a highly developed infrastructure, the region is witnessing growth in the adoption of advanced analytics and digital solutions to enhance operational efficiency. However, the market is somewhat saturated, which could limit substantial growth rates compared to emerging markets.

Europe

Europe holds a notable position in the Global Plant Asset Management market, bolstered by stringent regulatory frameworks that necessitate improved asset management practices, particularly in the energy and manufacturing sectors. The region sees significant investments in energy transition projects aimed at sustainability, which drives the demand for innovative asset management solutions. However, slow economic growth in some areas may restrain its progress compared to more dynamic markets.

Latin America

In Latin America, the Global Plant Asset Management market is gradually evolving. The region faces challenges such as political instability and economic fluctuations, which can hinder investment in new technologies. However, countries like Brazil and Mexico are making strides in modernizing their industrial sectors, albeit at a slower pace. Opportunities remain in improving operational efficiencies and reliability through asset management solutions, especially in mining and energy.

Middle East & Africa

The Middle East & Africa region is emerging in the Global Plant Asset Management market, driven primarily by growth in the oil and gas sector, which traditionally relies on effective asset management to ensure safety and profitability. However, the region's market is challenged by limited technology adoption in certain sectors and varying levels of infrastructural development. Ongoing investment in modernization and diversification of economies may create opportunities for growth in the asset management arena.

Plant Asset Management Market Competitive Landscape:

Prominent participants in the worldwide Plant Asset Management sector prioritize the creation of cutting-edge software solutions and services aimed at maximizing asset performance, improving operational effectiveness, and maintaining regulatory compliance. Their strategic partnerships and expenditures in progressive technologies are pivotal in facilitating the market's advancement and evolution.

The prominent entities in the Plant Asset Management sector encompass Siemens AG, Emerson Electric Co., Honeywell International Inc., ABB Ltd., Schneider Electric SE, General Electric Company, Rockwell Automation, Inc., Yokogawa Electric Corporation, Bentley Systems, Incorporated, and Aker Solutions within the Oil & Gas Industry. Additionally, significant players include Infor, SAP SE, IBM Corporation, DNV GL AS, and ICONICS Inc. Other contributors consist of BMC Software, Inc., AVEVA Group plc, and NESTLE S.A. These organizations play a crucial role in delivering solutions and technologies that enable the efficient oversight of plant assets across diverse sectors.

Global Plant Asset Management Market COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly affected the Global Plant Asset Management sector by hastening the integration of digital technologies and remote monitoring tools, which bolstered operational resilience and prioritized safety in the context of ened remote work scenarios.

The COVID-19 pandemic had a profound effect on the Plant Asset Management (PAM) sector, presenting a mix of challenges and opportunities. At the outset, disruptions in supply chains, restrictions on workforce mobility due to health measures, and cutbacks in capital investments delayed project completions and reduced operational efficiency. Conversely, the pivot to remote monitoring and a ened focus on digital transformation fueled investments in PAM solutions incorporating IoT, AI, and predictive maintenance technologies. Organizations began to recognize the critical importance of resilience and flexibility, driving an increased demand for cutting-edge asset management tools. The pandemic highlighted the necessity of optimizing asset performance to safeguard against unexpected disruptions. As businesses emphasize safety and sustainability, the PAM market is likely to advance, integrating sophisticated analytics and automation to improve decision-making and operational effectiveness in a post-pandemic environment. Therefore, the industry's direction is characterized by an evolution toward more advanced management strategies and digital solutions, paving the way for sustainable growth.

Latest Trends and Innovation in The Global Plant Asset Management Market:

- In July 2023, Siemens AG launched its new Plant Asset Management solution, utilizing advanced AI algorithms to enhance predictive maintenance capabilities. This innovation aims to reduce unplanned downtime in manufacturing processes.

- In June 2023, IBM announced its acquisition of the startup Moogsoft, which specializes in AI-driven incident management tools. This move is expected to bolster IBM's asset management offerings by integrating AI for more effective problem resolution in industrial environments.

- In March 2023, Schneider Electric revealed enhancements to its EcoStruxure Asset Advisor platform, incorporating machine learning capabilities that provide real-time analytics for operational efficiency and risk management, targeting industries like oil & gas and power generation.

- In February 2023, Honeywell released the latest version of its Asset Performance Management (APM) software, now featuring new cloud-native capabilities and enhanced user interfaces designed to streamline asset monitoring and improve decision-making processes.

- In January 2023, Emerson launched its Predictive Maintenance solution, which integrates IoT technology to provide real-time monitoring and analysis of plant assets, aimed at significantly improving maintenance strategies in manufacturing environments.

- In November 2022, ABB signed a strategic partnership with Microsoft to integrate Azure’s cloud capabilities into its ABB Ability platform, enhancing data analytics and connectivity for plant asset management applications across multiple industries.

- In September 2022, Bentley Systems announced the release of its new digital twin capabilities in its AssetWise software, designed to allow organizations to visualize and simulate asset performance over time, improving lifecycle management approaches.

- In August 2022, Yokogawa Electric Corporation introduced a new suite of digital transformation solutions that leverage big data and AI to enhance the performance of industrial assets, focusing on the chemicals and pharmaceuticals sectors.

Plant Asset Management Market Growth Factors:

The expansion of the Plant Asset Management sector is fueled by technological innovations, ened demands for operational efficiency, and an escalating necessity for adherence to regulatory standards in asset management processes.

The market for Plant Asset Management (PAM) is experiencing notable expansion, spurred by several important influences. Firstly, industries are placing greater importance on operational efficiency and cost savings, which is increasing the demand for sophisticated asset management solutions. Organizations are tapping into digital innovations, including the Internet of Things (IoT) and data analytics, to enhance the performance of their assets, subsequently leading to decreased downtime and improved decision-making capabilities. Furthermore, the existence of rigorous regulatory requirements and safety protocols demands thorough asset management to ensure compliance, further fueling market growth. Additionally, the acceleration of smart manufacturing and Industry 4.0 initiatives is prompting businesses to implement PAM systems for superior integration and real-time asset monitoring. The ened focus on sustainability and reducing environmental footprints is also driving companies to optimize asset utilization and extend the lifespan of their resources. Moreover, the ongoing digital transformation across various industries—such as oil and gas, manufacturing, and utilities—is a crucial factor in the growth of the PAM market, as organizations aim to leverage data for predictive maintenance and performance improvement. Together, these elements not only foster the growth of the PAM market but also underscore the increasing acknowledgment of the essential role that effective asset management plays in achieving corporate objectives.

Plant Asset Management Market Restaining Factors:

Significant challenges in the Plant Asset Management sector involve substantial upfront investment and the difficulties associated with incorporating cutting-edge technologies into current infrastructures.

The Plant Asset Management (PAM) market encounters various challenges that may impede its growth and wider acceptance. One primary obstacle is the substantial upfront investment required along with the intricate process of incorporating sophisticated PAM systems into pre-existing frameworks, which can discourage small to medium enterprises from pursuing these options. Furthermore, a shortage of personnel equipped to operate advanced PAM technologies can result in operational shortcomings, dissuading potential investments. Concerns around data security and privacy, particularly in light of escalating cyber threats, can also deter organizations from embracing new technologies without comprehensive security protocols in place. Additionally, a prevailing reluctance to change and outdated mindsets in certain sectors can hinder the shift towards contemporary asset management methods. Insufficient awareness regarding the advantages and functionalities of PAM solutions may impede market expansion, particularly in emerging economies. Nonetheless, the growing demand for improved operational efficiency, adherence to regulatory standards, and sustainable practices in asset management reveals considerable growth potential for the PAM sector. As businesses increasingly appreciate the importance of efficient asset management in enhancing performance and minimizing costs, the market is likely to experience a favorable evolution, fostering innovative solutions and boosting overall productivity.

Segments of the Plant Asset Management Market

By Deployment Type

• On-Premise

• Cloud-Based

• Hybrid

By Solution Type

• Software

• Services

By Application

• Manufacturing

• Oil and Gas

• Utilities

• Mining

• Transportation

By Asset Type

• Physical Assets

• Digital Assets

• Production Assets

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America