Pharmaceutical CRO Market Analysis and Insights:

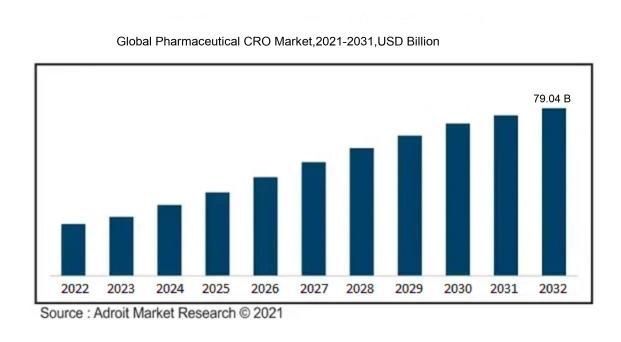

In 2023, the size of the worldwide Pharmaceutical CRO market was US$ 41.51 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 7.41% from 2024 to 2032, reaching US$ 79.04 billion.

The market for Pharmaceutical Contract Research Organizations (CROs) is significantly propelled by ened investments in research and development (R&D) within the pharmaceutical and biotechnology industries. As pharmaceutical companies increasingly seek cost-efficient and adaptable outsourcing strategies, they are drawn to the specialized services provided by CROs, which optimize clinical trial processes and expedite the introduction of new medications to the market. Moreover, the rising intricacies associated with clinical trials, along with rigorous regulatory standards, create a demand for the expertise and infrastructure that CROs deliver. The globalization of clinical trials also plays a crucial role, as it allows access to a variety of patient groups essential for regulatory approvals. Additionally, advancements in technology, such as the incorporation of artificial intelligence and digital solutions in clinical research, enhance the attractiveness of CROs, leading to innovative approaches and improved data management. Collectively, these elements contribute to the substantial growth observed in the pharmaceutical CRO sector.

Pharmaceutical CRO Market Definition

A Contract Research Organization (CRO) in the pharmaceutical sector is an entity that offers outsourced research services, encompassing the management of clinical trials and assistance with regulatory compliance. These organizations play a critical role in optimizing drug development workflows, ultimately leading to a decrease in both the expenses and duration associated with launching new pharmaceuticals.

Contract Research Organizations (CROs) in the pharmaceutical industry are integral to the drug development ecosystem, offering critical services and specialized knowledge that assist biopharmaceutical firms in maneuvering through intricate regulatory frameworks. By delegating clinical trials and research tasks to CROs, companies can cut expenses, accelerate timelines, and concentrate on their primary business functions. CROs bring extensive experience in managing a wide range of projects, encompassing everything from preclinical research to post-marketing evaluations, while maintaining adherence to regulatory standards. Their access to advanced technologies and skilled personnel improves both the quality and efficiency of research processes, ultimately aiding in the effective and safe launch of new medications into the market.

Pharmaceutical CRO Market Segmental Analysis:

Insights On Type

Clinical

The clinical phase is expected to dominate the Global Pharmaceutical CRO Market due to its critical role in bringing new drugs to market. As the pharmaceutical industry places increasing emphasis on expedited development timelines and regulatory compliance, services related to clinical trials—including Phase I, II, III, and IV—are gaining prominence. The rising complexity of trials, along with the necessity for specialized expertise in patient recruitment, data management, and regulatory strategy, drives demand for CROs that offer comprehensive clinical services. Furthermore, the ongoing need for clinical research, particularly with the emergence of biopharmaceuticals and personalized medicine, indicates a robust growth trajectory for this.

Drug Discovery

Drug discovery is a vital area of focus for pharmaceutical companies as it represents the initial stage of the drug development process. Increasing investment in research and development initiatives, coupled with technological advancements like AI and machine learning, are significantly enhancing the efficiency of drug discovery services. These developments lead to shorter lead times and more effective identification of novel therapeutic targets, which ultimately supports the industry's overall growth. The emphasis on innovation drives pharmaceutical organizations to collaborate with CROs, fostering a competitive environment within this sector.

Target Validation

Target validation plays a crucial role in determining the relevance of biological targets for therapeutic intervention. This phase has gained importance due to the rising need for precision medicine, which focuses on tailoring treatments based on individual patient characteristics. As the pharmaceutical industry increasingly prioritizes success rates in drug development, target validation helps mitigate risks early in the process, making it a valuable service offered by CROs. The demand for improved target validation methodologies is boosted by the complex nature of diseases, further fostering collaboration between drug developers and CROs.

Lead Identification

Lead identification is an essential component of the drug development pipeline, where potential drug candidates are identified based on promising bioactivity or other characteristics. As pharmaceutical companies seek to streamline and reduce the costs associated with this process, collaboration with CROs amplifies the efforts in lead identification. The advancement of high-throughput screening technologies and combinatorial chemistry strategies is revolutionizing this area, enabling faster identification of viable leads. As a result, CROs specializing in this area are increasingly sought after to enhance the efficiency of early-stage drug development.

Lead Optimization

Lead optimization focuses on refining lead compounds to improve their efficacy, safety, and pharmacokinetic profiles. As regulatory agencies require more stringent data to approve new drugs, this step has become pivotal in the drug development process. Collaboration with CROs allows pharmaceutical companies to leverage specialized expertise and state-of-the-art technologies in medicinal chemistry. The growing emphasis on stronger and safer drug candidates propels demand for lead optimization services, thereby solidifying its importance in the pharmaceutical landscape.

Pre-Clinical

The pre-clinical phase involves extensive testing and evaluation of drug candidates in vitro and in vivo, prior to human trials. The continued growth in biopharmaceutical research and development underlines the significance of pre-clinical services. As firms increasingly rely on CROs to conduct these studies, the demand for high-quality pre-clinical testing rises. The emphasis on obtaining reliable data to support the transition into clinical phases makes partnerships with specialized CROs indispensable for pharmaceutical companies navigating rigorous regulatory landscapes.

Phase I Trial Services

Phase I trial services are critical for assessing the safety and pharmacokinetics of a drug in healthy volunteers. This stage is essential for determining the appropriate dosage and identifying any potential side effects. With the growth in the biopharma sector and the demand for faster clinical trials, specialized CROs offering Phase I services are crucial for companies focused on expediting their development programs. Increasing regulatory requirements add to the complexity, further enhancing the importance of dedicated Phase I services in the drug development continuum.

Phase II Trial Services

Phase II trial services are pivotal for evaluating the efficacy and optimal dosing of a drug in patients. This phase generates preliminary data on the treatment's effectiveness, making it a high-stakes and demanding phase of clinical trials. As pharmaceuticals seek to maximize success rates, collaboration with CROs providing comprehensive Phase II services becomes increasingly important. The growing trend towards adaptive trial designs and patient-centric approaches further boosts the need for expert guidance, ensuring more informed decision-making throughout this crucial phase.

Phase III Trial Services

Phase III trial services are vital for confirming a drug's efficacy and monitoring adverse reactions in a larger population. This definitive phase is essential for gaining regulatory approval. The rising competition among pharmaceutical companies necessitates a robust partnership with CROs specializing in Phase III services to ensure timely capitalization on market opportunities. The ability to handle large-scale studies effectively contributes to the overall success of a new drug candidate, solidifying the importance of Phase III services within the CRO market.

Phase IV Trial Services

Phase IV trial services focus on post-market surveillance and long-term effects of a drug once it is approved. This stage is increasingly prioritized as regulatory bodies demand detailed safety profiles and real-world evidence. The growth in digital health and patient registries enhances Phase IV services, allowing for more precise data collection and analysis. As the industry shifts towards continuous monitoring and improvement of drug benefits, CROs that specialize in Phase IV trials are becoming integral partners for pharmaceutical developers in maintaining regulatory compliance and fostering patient safety.

Insights On Molecule Type

Large Molecules

In the Global Pharmaceutical CRO Market, large molecules are expected to dominate primarily due to the rise in biologics and biosimilars in drug development. The effectiveness of large molecules in targeting complex diseases, such as cancer and autoimmune disorders, is significant, leading to increased investment and focus on these therapies. Companies are also capitalizing on advanced technologies such as monoclonal antibodies and gene therapies, propelling growth in this area. Additionally, regulatory agencies are becoming more supportive of biologics, fostering more innovation and research, which enhances the potential for large molecules to overshadow small molecules. This shift towards personalized medicine further underscores the expected dominance of large molecules in the market.

Small Molecules

The small molecules category remains a crucial component of the pharmaceutical industry due to their extensive history of use and successful efficacy in treating a wide range of diseases. These compounds are usually easier and less costly to produce compared to biological products, making them attractive for many pharmaceutical companies. The widespread accessibility and familiarity of small molecules continue to appeal to pharmaceutical research and development, although the faces growing competition from large molecules. Innovations in drug delivery and combination therapies may help maintain the relevance of small molecules despite the rising prominence of biologics.

Insights On Therapeutic Area

Oncology

Oncology is positioned to dominate the Global Pharmaceutical CRO Market, driven by an increasing prevalence of cancer globally and significant investments in cancer research and drug development. With advancements in personalized medicine, biologics, and immunotherapies, the demand for innovative oncology treatments is rapidly expanding. Pharmaceutical companies are actively seeking CROs that specialize in oncology to leverage their expertise in conducting clinical trials, which are essential for bringing new oncology drugs to market. The complexity of oncology trials, including biomarker analysis and multi-dimensional endpoints, requires specialized support, strengthening the role of CROs in this therapeutic area.

CNS Disorders

CNS Disorders represent a notable part of the pharmaceutical landscape, with a surge in interest driven by rising mental health issues, neurodegenerative diseases, and the aging population. CROs focusing on CNS Disorders are pivotal in developing therapies that target complex brain functions and behavioral outcomes. The growing recognition of mental health as a critical aspect of overall health amplifies demand for innovative treatment solutions. Increased funding and partnerships for CNS research further support the expansion of this area within the CRO market.

Infectious Diseases

The infectious diseases category has gained renewed attention amid global health crises, such as pandemics and emerging pathogens. CROs engaged in this field are crucial for rapid vaccine development and the testing of new antimicrobial agents. Increased collaboration with governmental and non-governmental organizations enhances the capacity to respond to infectious disease outbreaks effectively. The dynamic nature of this market fuels continuous investment, and thereby growth, in CRO services related to disease management and control strategies.

Immunological Disorders

Immunological Disorders form a significant area of focus for CROs, primarily due to rising autoimmune diseases and inflammatory conditions. The complexity of developing immunotherapies and biologics necessitates expert clinical and regulatory support, making it an appealing area for CROs with specialized capabilities. As the understanding of the immune system advances, there is a growing demand for innovative treatment approaches, further solidifying the importance of CRO involvement in this therapeutic area.

Cardiovascular Disease

Cardiovascular Disease remains a leading health concern worldwide, driving a strong demand for effective therapeutic interventions. CROs play a crucial role in facilitating clinical trials for new cardiovascular drugs and technologies. The evolving landscape of cardiovascular treatment, including the integration of digital health interventions, necessitates specialized research capabilities. Thus, CROs focused on cardiovascular research are vital for advancing therapies and improving patient outcomes in this critical health domain.

Respiratory Diseases

Respiratory Diseases, including asthma and chronic obstructive pulmonary disease (COPD), pose significant public health challenges, leading to a proactive approach in research and improvement of treatment options. CROs involved in this area contribute substantially to the understanding of respiratory pathophysiology and the development of novel therapies. With the rising burden of these diseases, particularly post-pandemic, the demand for advanced clinical research services in respiratory health continues to grow.

Diabetes

The diabetes sector represents a compelling market for CROs, primarily driven by the growing prevalence of diabetes and associated complications. CROs specializing in diabetes research are players in developing cutting-edge therapies and enhancing understanding of metabolic diseases. The emphasis on improving patient-centric outcomes and the development of innovative delivery systems offers significant opportunities for CROs to expand their services within this therapeutic area.

Ophthalmology

Ophthalmology, while a smaller sector compared to others, is gaining traction within the pharmaceutical CRO market due to increased investment in eye health research and the growing aging population. The complexities associated with ophthalmic drug development, including specialized clinical trial designs, position CROs as essential collaborators. With the rise in demand for treatments addressing eye diseases, particularly those related to age-related decline, CROs are strategically enhancing their focus in this important field.

Pain Management

Pain Management remains a critical area of healthcare, as patients continue to seek effective solutions for chronic and acute pain. CROs engaging in this domain are vital for developing innovative analgesics and alternative pain management therapies. As the landscape of pain treatment evolves, influenced by concerns regarding opioid dependence, the need for research-driven approaches intensifies. CROs can thrive by offering specialized services tailored to address the complexities associated with clinical trials in pain management.

Insights On Service

Data Management

Data Management is expected to dominate the Global Pharmaceutical CRO Market due to the increasing reliance on big data analytics and the growing need for accurate data handling in drug development processes. Pharmaceutical companies require robust systems for collecting, storing, and analyzing diverse data sets generated throughout clinical trials. As regulatory requirements become more stringent, ensuring data integrity, security, and compliance has become paramount. The demand for data-driven decisions in development and real-time insights into clinical trial progress further strengthens the significance of effective data management solutions. Thus, this area is foreseen to lead the market in the coming years.

Project Management/Clinical Supply Management

Project Management/Clinical Supply Management plays a crucial role in orchestrating the multiple facets of clinical studies. Coordinating timelines, resources, and budgets efficiently ensures that clinical trials proceed smoothly and meet regulatory deadlines. This supports overall operational efficiency by minimizing delays and optimally managing supply chains, which is vital since drug development often involves complex logistics and unpredictable variables. Additionally, increased investment in clinical trials necessitates enhanced project management capabilities to ensure success, fostering significant growth in this area of the market.

Regulatory/Medical Affairs

Regulatory/Medical Affairs are integral to navigating the complex landscape of drug approvals and compliance. As pharmaceutical companies face evolving regulations globally, this area becomes increasingly important for ensuring that products meet safety and efficacy standards. Companies leverage expertise in regulatory submissions, maintaining relationships with health authorities to ensure timely approvals. Growth in this sector is propelled by the need for rigorous oversight and compliance adherence as competition intensifies in the pharmaceutical industry, making Regulatory/Medical Affairs a vital component in the drug development pipeline.

Clinical Monitoring

Clinical Monitoring is essential for ensuring quality and adherence to protocols in clinical trials. Monitors are responsible for evaluating the proper conduct of studies, verifying data accuracy, and maintaining participant safety. As the complexity of trials increases with the introduction of innovative treatments and technologies, the demand for experienced monitoring services grows. This field is critical in identifying issues early and ensuring compliance with regulatory expectations, thereby maintaining the integrity of trial results. Hence, Clinical Monitoring sees stable demand driven by evolving clinical trial landscapes.

Quality Management/Assurance

Quality Management/Assurance focuses on ensuring the integrity and quality of clinical research processes. The increasing emphasis on quality control procedures in pharmaceutical development stems from strict regulatory guidelines and consumer safety concerns. Organizations are investing in quality management systems to mitigate risk and ensure compliance throughout the trial phases. This focus on quality enhancement contributes to reduced errors and improved outcomes, making this area significant in improving overall market efficiency and gaining stakeholder confidence.

Biostatistics

Biostatistics is a vital aspect of data interpretation in clinical research, responsible for analyzing complex data sets to evaluate treatment efficacy and safety. With the rise of personalized medicine and adaptive clinical trials, there is an escalating demand for skilled biostatisticians who can provide insights for strategic decision-making. Their role in designing trial protocols and interpreting statistical results is crucial, especially as modern trials generate vast amounts of data requiring sophisticated analysis. The steady growth of this discipline reflects the increasing complexity of clinical studies and data-driven decision-making.

Laboratory

Laboratory services are pivotal in supporting the testing and analysis needed during clinical trials. These facilities are responsible for conducting various tests, ranging from pharmacokinetic assessments to biomarker evaluations, which are essential for understanding drug interactions and patient responses. With technological advancements, laboratories are expanding their capabilities, leading to enhanced precision and faster turnaround times. This rise in laboratory prominence is fueled by the increasing complexity and demand for specialized testing in the pharmaceutical sector, solidifying its essential role in clinical research.

Patient And Site Recruitment

Patient and Site Recruitment is critical to the success of clinical trials, as the speed and efficiency of patient enrollment directly influence study timelines. As competition intensifies, companies are focusing on innovative recruitment strategies to enhance participation rates and ensure diverse participant demographics, which is crucial for regulatory approval. Effective recruitment is further aided by digital platforms and community engagement initiatives, enabling quicker access to potential candidates. The growing understanding of the importance of robust recruitment strategies drives investment and growth in this sector.

Technology

Technology enhances various functionalities within the pharmaceutical CRO market, including data collection, patient engagement, and trial management systems. Innovations such as electronic data capture (EDC), wearables, and telemedicine are revolutionizing how clinical trials are conducted. As the industry navigates the complexities of decentralized clinical trials and remote monitoring, technology's role becomes increasingly vital. The incorporation of artificial intelligence and machine learning augments data analysis and decision-making processes. This growing reliance on technology exemplifies its indispensable contribution to improving trial efficiency and patient outcomes, promoting sustained growth in this.

Others

The 'Others' category comprises a diverse range of services that do not specifically fall under the primary classifications. This could include specialized consulting, training services, or niche research services that cater to unique client needs. The growth in this area is driven by personalized approaches adopted by pharmaceutical companies, seeking customized solutions to address specific challenges in clinical development. As the market evolves, the demand for tailored services that enhance efficiency, compliance, and innovation will likely sustain growth within this category, catering to emerging needs in the industry.

Global Pharmaceutical CRO Market Regional Insights:

North America

North America is expected to dominate the Global Pharmaceutical Contract Research Organization (CRO) market due to several critical factors. The region boasts a highly mature pharmaceutical industry and significant investments in research and development, leading to a strong demand for CRO services. The presence of numerous biopharmaceutical companies, a regulatory environment that bolsters innovation, and a well-established healthcare infrastructure further enhance the opportunities for CROs in North America. Additionally, the increasing complexity of clinical trials and the rise of personalized medicine have solidified North America's position as a leader in outsourcing pharmaceutical research and development activities.

Latin America

Latin America is emerging as a growing player in the Global Pharmaceutical CRO market, primarily due to its cost-effective research solutions and expanding clinical trial capabilities. Countries like Brazil and Mexico offer increasingly favorable regulatory frameworks, attracting foreign investment in clinical research. Moreover, the region's diverse patient populations provide unique opportunities for conducting clinical trials, particularly in therapeutic areas like oncology and infectious diseases. However, challenges such as inconsistent regulatory compliance and variable clinical infrastructure across different countries may hinder its growth compared to more established markets.

Asia Pacific

The Asia Pacific region is gaining momentum in the Global Pharmaceutical CRO market, driven by rapid economic growth and an expanding healthcare sector. Countries like China and India are becoming hubs for clinical trials due to their large patient populations and lower operational costs. The region's rising demand for innovative therapies is pushing pharmaceutical companies to outsource research to leverage local expertise. However, competition is intensifying as more players enter the market, and the variability in regulatory standards across countries presents challenges that could impact consistency in service delivery.

Europe

Europe remains a significant region in the Global Pharmaceutical CRO market, primarily due to its stringent regulatory standards and extensive geographical diversity. The presence of established pharmaceutical companies and a strong focus on innovation has created a high demand for CRO services. Additionally, funding for research initiatives and collaborations between academic institutions and CROs further strengthen this market. However, challenges such as regulatory complexities and the economic impact of varying national policies may pose hurdles to seamless operations within the CRO landscape.

Middle East & Africa

The Middle East and Africa are gradually becoming notable players in the Global Pharmaceutical CRO market, particularly in conducting clinical trials. The region's strategic location serves as a bridge between Europe, Asia, and Africa, fostering collaborations. Increasing investments in healthcare infrastructure and clinical research capabilities, particularly in countries like South Africa and the UAE, are primarily driving growth. However, the region still faces challenges such as inconsistent regulatory practices and the availability of skilled professionals, which could impede the robust growth of the CRO sector in these areas.

Pharmaceutical CRO Market Competitive Landscape:

Prominent contributors in the worldwide Pharmaceutical Contract Research Organization (CRO) sector play a crucial role in aiding the development and market introduction of novel medications. They offer vital services, including the management of clinical trials, assistance with regulatory compliance, and the analysis of data. This partnership with pharmaceutical firms improves operational efficiency, helps to cut expenses, and speeds up the process of bringing new therapies to market.

The major participants in the Pharmaceutical Contract Research Organization (CRO) sector encompass Quintiles IMS Holdings Inc., Covance Inc., Parexel International Corporation, Charles River Laboratories International Inc., PRA Health Sciences, ICON plc, WuXi AppTec, Medpace Holdings, Syneos Health, and PPD (Pharmaceutical Product Development). Other important entities include Clinipace, Eurofins Scientific, Premier Research, KCR, Inc., Synergy Health Limited, and ALS Limited. Furthermore, companies such as ERT, Aptiv Solutions, and Pharmaceutical Product Development (PPD) play a vital role in this market, along with various smaller specialized organizations that address specific niches within the pharmaceutical research domain.

Global Pharmaceutical CRO Market COVID-19 Impact and Market Status:

The COVID-19 crisis notably expedited the need for outsourcing in clinical research, resulting in ened funding for pharmaceutical contract research organizations (CROs) and a stronger focus on innovative approaches to trial design.

The COVID-19 pandemic had a profound impact on the market for Pharmaceutical Contract Research Organizations (CROs), presenting both obstacles and avenues for growth. Initially, numerous clinical trials encountered postponements, cancellations, and operational interruptions as a result of lockdown protocols and public health concerns, adversely affecting patient enrollment and access to trial sites. Conversely, the urgent need to create vaccines and treatments for COVID-19 spurred a surge in demand for CRO services, particularly in the realms of vaccine research and trial administration. This juxtaposition fostered increased investment in digital solutions, including telehealth and remote monitoring technologies, which improved operational productivity. In addition, regulatory agencies modified their guidelines to streamline trial procedures, favoring CROs that could effectively adapt to these evolving requirements. As we move into the post-pandemic era, the CRO market is expected to experience continuous growth, characterized by an increased dependency on outsourcing, the incorporation of innovative approaches, and a stronger focus on rapid and adaptable clinical development.

Latest Trends and Innovation in The Global Pharmaceutical CRO Market:

- In March 2023, ICON plc announced its acquisition of Medpace, strengthening its clinical development capabilities and expanding its presence in the global market for pharmaceutical and biotechnology clients.

- In June 2023, Syneos Health completed the acquisition of The Immunology Group, a specialized clinical research organization. This acquisition aimed to enhance Syneos’ offerings in the immunology space, addressing a growing demand for complex trials in this therapeutic area.

- In February 2023, Covance, a part of Labcorp Drug Development, launched a new digital platform called Labcorp Drug Development Digital. This platform integrates advanced analytics and artificial intelligence to enhance patient recruitment and engagement in clinical trials.

- In April 2023, Parexel International announced a partnership with Medidata Solutions to leverage their cloud-based platform for clinical trial data management, enhancing data transparency and streamlining operations for sponsors.

- In January 2023, PPD, part of Thermo Fisher Scientific, expanded its global footprint by opening new clinical trial sites in Eastern Europe to meet increasing demand for early-phase clinical studies in the region.

- In August 2023, Charles River Laboratories announced the acquisition of HemaCare Corporation, a provider of human-derived biologics, significantly diversifying its service offerings in the field of cell and gene therapy research.

- In September 2023, WuXi AppTec launched its new integrated drug development service platform called WuXi Drug Development. This platform focuses on providing end-to-end solutions to biotech firms, encompassing both preclinical and clinical trial services.

Pharmaceutical CRO Market Growth Factors:

The growth of the Pharmaceutical Contract Research Organization (CRO) market is chiefly fueled by an uptick in research and development initiatives, a growing preference for outsourced clinical trials, and significant technological progress.

The market for Pharmaceutical Contract Research Organizations (CROs) is witnessing robust expansion, propelled by several pivotal elements. First, the intricacies involved in drug development, coupled with the necessity for expedited market entry, are compelling pharmaceutical firms to outsource their clinical trials and research endeavors. Second, the escalating incidence of chronic illnesses and a corresponding demand for novel therapies are driving increased investment in research and development, thus amplifying the requirement for specialized CRO services.

Moreover, the surging popularity of biotechnology and personalized medicine demands the specialized knowledge that CROs offer, as these sectors often involve customized clinical trial frameworks and complex regulatory processes. Emerging markets have also become appealing due to their large patient demographics and reduced operational expenses, encouraging pharmaceutical companies to partner with local CROs for more effective trial implementation.

In addition, technological advancements, such as data analytics and digital health innovations, are enhancing the efficiency and precision of clinical trials, further promoting the adoption of CROs. Lastly, the imperative to meet regulatory standards and ensure compliance in clinical research drives pharmaceutical companies to depend on the expertise of seasoned CROs to navigate intricate regulatory environments, thereby facilitating market growth and enhancing profitability. Collectively, these dynamics set the stage for continued expansion of the Pharmaceutical CRO sector in the foreseeable future.

Pharmaceutical CRO Market Restaining Factors:

Critical limitations in the Pharmaceutical Contract Research Organization (CRO) sector stem from rigorous regulatory standards and fierce rivalry among service providers.

The market for Pharmaceutical Contract Research Organizations (CROs) is confronted with various challenges that could impede its expansion. A primary concern is the stringent regulatory framework that mandates thorough compliance measures, resulting in extended timelines and elevated costs in the drug development process. Moreover, the intricacies involved in clinical trials, which necessitate careful patient recruitment and retention tactics, introduce operational complications for CROs. This complexity can culminate in delays and inefficiencies that negatively impact both project timelines and financial plans.

In addition to these challenges, CROs face competition from the in-house research departments of pharmaceutical firms, which may prefer to maintain oversight of their clinical activities instead of outsourcing. Data security and integrity also raise significant concerns; any breach or inappropriate handling of sensitive patient data can lead to legal consequences and diminish the trust between CROs and their clients. Lastly, economic fluctuations worldwide can affect the funding available for research and development initiatives, potentially narrowing the opportunities for CRO engagement.

Despite these obstacles, the evolution of the industry, characterized by a rising need for innovative treatments and personalized medicine, offers new avenues for growth. This shift may enable CROs to capitalize on emerging markets and contribute significantly to advancements in healthcare.

Segments of the Pharmaceutical CRO Market

By Type

- Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By Molecule Type

- Small Molecules

- Large Molecules

By Therapeutic Area

- Oncology

- CNS Disorders

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Disease

- Respiratory Diseases

- Diabetes

- Ophthalmology

- Pain Management

- Others

By Service

- Project Management/Clinical Supply Management

- Data Management

- Regulatory/Medical Affairs

- Medical Writing

- Clinical Monitoring

- Quality Management/A Assurance

- Biostatistics

- Investigator Payments

- Laboratory

- Patient and Site Recruitment

- Technology

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America