Pharmaceutical Cdmo Market Analysis and Insights:

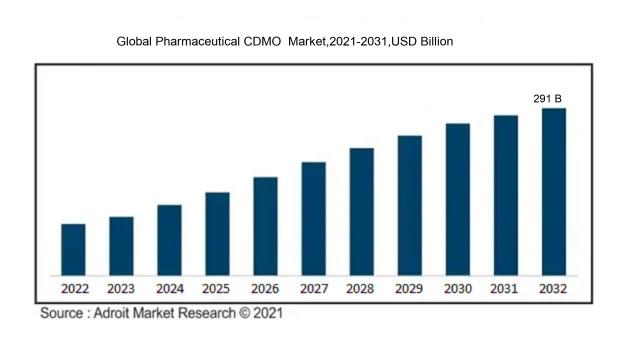

In 2023, the size of the worldwide Pharmaceutical CDMO market was US$ 155.6 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 7.19 % from 2024 to 2032, reaching US$ 291 billion.

The market for Pharmaceutical Contract Development and Manufacturing Organizations (CDMOs) is influenced by various critical components. Firstly, the rising trend of outsourcing drug development and manufacturing enables pharmaceutical firms to concentrate on their primary strengths, leading to cost reductions and faster market entry. Additionally, the growing focus on biologics and innovative therapies demands specialized manufacturing expertise, which enhances the service offerings of CDMOs catering to these intricate products.

Moreover, increasing regulatory demands and the necessity for strict compliance drive companies to collaborate with established CDMOs that have solid quality assurance practices in place. The rise in chronic illness prevalence further propels the requirement for novel drug formulations, which in turn amplifies the call for adaptable manufacturing strategies. Furthermore, advancements in technology, particularly in automation and digital processes, improve operational efficiency and scalability, making CDMOs increasingly attractive to pharmaceutical companies aiming to satisfy varied market requirements. Collectively, these elements foster significant expansion within the Pharmaceutical CDMO sector.

Pharmaceutical Cdmo Market Definition

A Contract Development and Manufacturing Organization (CDMO) within the pharmaceutical sector focuses on offering outsourced solutions for the creation and production of drug products. These organizations assist pharmaceutical companies by overseeing the complete manufacturing process, beginning with formulation development and culminating in large-scale production.

They bring advanced knowledge in formulation, process development, and scalability, enabling pharmaceutical firms to concentrate on their essential functions while accelerating the market introduction of new treatments. Additionally, CDMOs assist in controlling manufacturing expenses, maintaining adherence to regulatory requirements, and employing cutting-edge technologies to boost operational efficiency. By supporting the production of both small and large molecules, CDMOs foster innovation and adaptability within the industry, ultimately enhancing patient outcomes and benefitting public health.

Pharmaceutical Cdmo Market Segmental Analysis:

Insights On Workflow

Clinical

The Clinical workflow in the Global Pharmaceutical CDMO Market is expected to dominate primarily due to the increasing demand for innovative drug development and the growing complexity of clinical trials. As pharmaceutical companies strive to meet regulatory standards and provide better therapeutic options, they're increasingly relying on Contract Development and Manufacturing Organizations that specialize in clinical services. The surge in biotechnology and personalized medicine further amplifies this trend, prompting companies to outsource clinical manufacturing to leverage expertise and reduce costs. Additionally, the expansion of clinical research in emerging markets is contributing to the robust growth of the Clinical workflow, making it a focal point in the market landscape.

Commercial

The Commercial workflow is characterized by large-scale manufacturing processes that cater to the mass production of pharmaceuticals. While it remains a significant part of the CDMO market, it faces challenges such as the pressure to lower costs and maintain high standards of quality. The increasing competition among pharmaceutical companies often leads to tighter margins, driving the need for effective outsourcing solutions. Even though the is resilient and essential for established drugs, it may experience slower growth rates compared to the dynamic nature of the Clinical workflow, which emphasizes new product development and innovation.

Insights On Product

API

The API (Active Pharmaceutical Ingredients) sector is expected to dominate the Global Pharmaceutical CDMO (Contract Development and Manufacturing Organization) market. This is primarily driven by an increasing global demand for generic drugs and the rising prevalence of chronic diseases that necessitate innovative therapies. The focus on quality, regulatory compliance, and supply chain reliability has led pharmaceutical companies to partner extensively with CDMOs specializing in APIs, as they possess the necessary expertise and infrastructure. The shift towards personalized medicine and biologics further fuels this dominating position, as companies seek collaborative approaches to enhance efficiency in increasing complex API production.

Synthesis

Synthesis plays a crucial role in the Pharmaceutical CDMO market, as it involves the development and optimization of chemical processes to create active compounds. This supports the broader pharmaceutical industry by providing the methodologies required to translate initial research into scalable solutions. Despite not being the leading, synthesis is vital for establishing foundational processes that can later be integrated into production lines. Moreover, advancements in synthetic methodologies enable the development of more complex molecules, which is increasingly sought after in drug discovery, fulfilling the need for novel therapies.

Manufacturing

The Manufacturing sector is significant within the Pharmaceutical CDMO landscape, focusing on the large-scale production of pharmaceuticals. While it does not take the lead, this area is essential for ensuring that drugs are produced efficiently, reliably, and at the required quality standards. Consequently, even as API emerges as the leader, manufacturing services remain a component in meeting overall market needs and enhancing production capabilities for various drug offerings.

Drug

The Drug comprises the research and development aspects combined with the formulation and commercialization of pharmaceutical products. Although it does not dominate, it plays a supportive role in conveying the synthesized molecules into market-ready solutions. The increasing emphasis on drug formulation development, customized therapies, and regulatory compliance drives this. Companies are dedicated to ensuring that the drugs are safe, effective, and suitable for various populations; however, the must leverage advancements in synthesis and API capabilities to enhance the development process and meet the growing demands in the healthcare sector.

Insights On Application

Oncology

Oncology is expected to dominate the Global Pharmaceutical CDMO market due to the increasing prevalence of cancer globally and the rising demand for advanced therapies such as personalized medicine and targeted therapies. As the treatment landscape for cancer evolves, many pharmaceutical companies are focusing on developing novel compounds, resulting in increased outsourcing to CDMOs that can provide specialized services and expertise. The growth of biologics and biosimilars in oncology also compels companies to seek specialized manufacturing processes that CDMOs offer. Furthermore, the ongoing investment in cancer research and development is anticipated to drive the need for flexible manufacturing solutions, further solidifying oncology's leading position in the market.

Infectious Diseases

The infectious diseases sector is experiencing significant growth due to the rising incidence of infectious diseases and the ongoing challenges that new pathogens present, as highlighted by the COVID-19 pandemic. Pharmaceutical companies are increasingly focusing on rapid vaccine development and antibiotic formulations, necessitating support from CDMOs for efficient manufacturing processes. Regulatory inclusions, particularly in areas of public health, are providing incentives for rapid production capabilities in this domain, thus ensuring a stable demand for contract services aimed at addressing infectious diseases.

Neurological Disorders

The neurological disorders field is burgeoning, given the ened awareness and subsequent research in neurodegenerative conditions such as Alzheimer's and Parkinson's disease. Pharmaceutical companies are innovating treatments that often require specific manufacturing technologies, thus increasing their reliance on CDMOs with specialized capabilities. The growing aging population, combined with increasing instances of neurological disorders, points to a rising demand for tailored therapies, solidifying the role of contract manufacturers in the development and production processes for these complex treatments.

Others

The "Others" category encompasses various therapeutic areas such as cardiovascular diseases, metabolic disorders, and rare diseases. While this has notable diversity, it often does not garner the same level of focused attention as the aforementioned areas, thus leading to relatively slower growth. However, niche pharmaceutical companies operating in these diverse therapeutic realms may increasingly lean towards CDMOs for flexible and efficient manufacturing solutions. As companies aim to bring innovative drugs to market, especially in underserved areas, this holds potential for gradual advancements in outsourcing trends, albeit at a moderate pace compared to the more lucrative sectors.

Global Pharmaceutical Cdmo Market Regional Insights:

North America

North America is poised to dominate the Global Pharmaceutical CDMO market due to its robust pharmaceutical infrastructure, significant research and development expenditure, and a high concentration of leading pharmaceutical companies. The region benefits from advanced technology adoption and stringent regulatory frameworks, which ensures high quality and compliance in manufacturing processes. Additionally, a strong trend toward outsourcing and the demand for specialized services align with the capabilities of CDMOs, making this region a hub for pharmaceutical outsourcing activities. The presence of players and innovative startups further solidifies North America's leadership position in the pharmaceutical contract development and manufacturing organization space.

Latin America

Latin America is experiencing growth in the Pharmaceutical CDMO market driven by increasing investments in healthcare and pharmaceutical sectors, coupled with a growing middle class that demands more accessible medications. However, the region's infrastructure challenges and varying regulatory environments can pose hurdles. While there's a burgeoning potential for growth, it remains behind North America and Europe in terms of market maturity and adoption of advanced manufacturing practices.

Asia Pacific

Asia Pacific is emerging as a competitive player in the Pharmaceutical CDMO market, primarily due to its cost-effective manufacturing capabilities and a growing number of pharmaceutical companies. Countries like China and India have seen significant investments in biotechnology and pharmaceutical processes, making them attractive for outsourcing. However, while the region is expected to grow rapidly, it currently lacks the same level of regulatory compliance and market maturity seen in North America, which may affect its competitiveness in the short term.

Europe

Europe holds a significant position in the Pharmaceutical CDMO market due to its well-established regulatory environment and innovative pharmaceutical sector. The region is home to some of the largest pharmaceutical companies, which continually seek outsourcing options to optimize production and reduce costs. Nonetheless, the market is fragmented, and regional differences in regulations can impede uniform growth across countries. Europe's tradition of high-quality standards also positions it favorably, although it may lag behind North America in terms of overall market dominance.

Middle East & Africa

The Middle East & Africa region is emerging slowly in the Pharmaceutical CDMO market, primarily due to the investments made to enhance local manufacturing capabilities and improve health infrastructure. However, the market is still in its infancy compared to other regions. Challenges such as regulatory inconsistencies and limited access to advanced technologies hinder its growth potential. While there is a strategic push towards improving the pharmaceutical supply chain, the region will require sustained efforts and investments to catch up with more dominant global markets.

Pharmaceutical Cdmo Market Competitive Landscape:

Prominent participants in the worldwide pharmaceutical Contract Development and Manufacturing Organization (CDMO) sector play a crucial role as vital allies, delivering contract manufacturing and development services to pharmaceutical firms. They enhance the production workflow by supplying specialized knowledge in formulation, manufacturing processes, and adherence to regulatory standards, which helps clients to expedite their product development schedules.

Prominent entities in the Pharmaceutical Contract Development and Manufacturing Organization (CDMO) sector comprise Lonza Group AG, Catalent, Inc., Samsung Biologics, CordenPharma, WuXi AppTec, Patheon (part of Thermo Fisher Scientific), Alcami Corporation, Siegfried Holding AG, Recipharm AB, Curia Global, Inc., Aenova Group, Boehringer Ingelheim, Piramal Pharma Solutions, and Evonik Industries AG.

Global Pharmaceutical Cdmo Market COVID-19 Impact and Market Status:

The Covid-19 pandemic dramatically intensified the need for contract development and manufacturing organizations (CDMOs) within the worldwide pharmaceutical industry, underscoring their essential contribution to the production of vaccines and the integrity of drug supply chains.

The COVID-19 pandemic had a profound impact on the market for pharmaceutical Contract Development and Manufacturing Organizations (CDMOs), presenting both obstacles and new prospects. In the early stages, the industry faced significant challenges due to supply chain disruptions, workforce shortages, and regulatory complexities, which hindered production capabilities and schedules. Conversely, the escalating need for vaccines and treatments fostered partnerships between pharmaceutical firms and CDMOs, resulting in an uptick in contract manufacturing activities. The pandemic also emphasized the critical need for adaptability and scalability in manufacturing operations, leading many companies to expand their service portfolios and geographic presence. Consequently, the CDMO sector is projected to witness substantial growth in the post-pandemic landscape, as businesses aim for dependable partnerships to address both short-term requirements and long-term strategic goals in drug development and production.

Latest Trends and Innovation in The Global Pharmaceutical Cdmo Market:

- In November 2022, Lonza announced its acquisition of the biopharmaceutical development and manufacturing division of Catalent, aiming to expand its capabilities in biologic drug substance and drug product development. This acquisition was part of Lonza's strategy to strengthen its position in the CDMO market.

- In May 2023, WuXi AppTec launched a new state-of-the-art facility in Philadelphia, focusing on gene and cell therapy services. This development highlights WuXi's commitment to supporting innovative therapies in the pharmaceutical landscape.

- In January 2023, Recipharm announced its acquisition of the French company, Beximco Pharma, enhancing its portfolio in sterile injectables and supporting its global growth ambitions.

- In April 2023, Samsung Biologics broke ground on its fifth manufacturing plant in Incheon, South Korea, which is expected to significantly boost production capacity for biologics and further solidify its position in the CDMO sector.

- In June 2023, AGC Biologics entered a strategic partnership with EQRx to support the development and production of innovative biologic therapies, emphasizing the importance of collaboration to enhance capabilities within the pharmaceutical CDMO market.

- In March 2023, Porton Biopharma received a strategic investment from the UK government to expand its manufacturing capabilities for advanced therapy medicinal products (ATMPs), highlighting governmental support in the pharmaceutical CDMO sector.

- In February 2022, Evonik Industries completed the acquisition of the biologics business of the German company, Rousselot, bolstering its presence in the biopharmaceutical market and expanding its capabilities in bioconjugation and process development.

- In September 2023, Ginkgo Bioworks partnered with Roche to accelerate the development and production of recombinant proteins, signifying a strategic alliance aimed at improving biotech manufacturing processes in the pharmaceutical CDMO industry.

Pharmaceutical Cdmo Market Growth Factors:

The pharmaceutical Contract Development and Manufacturing Organization (CDMO) market is experiencing significant growth due to several drivers, such as the escalating need for outsourced production, innovations in technology, and the burgeoning biopharmaceutical sector necessitating specialized services.

Primarily, the trend of outsourcing in the pharmaceutical sector enables organizations to concentrate on their principal activities while benefiting from the specialized knowledge that CDMOs offer in drug development and production. Additionally, the rising demand for biologics and biosimilars is driving the need for CDMO services that can manage intricate formulations and sophisticated manufacturing techniques effectively.

Technological innovations such as automation and real-time data analysis significantly improve operational productivity and product quality, rendering CDMO services increasingly appealing. The uptick in personalized medicine also calls for adaptable manufacturing processes and accelerated development timelines, which further supports market growth. Moreover, the pressure from regulatory bodies and the necessity to adhere to rigorous quality standards compel manufacturers to collaborate with CDMOs that have established a history of compliance.

The escalating incidence of chronic illnesses and the quest for new therapeutic solutions are pushing pharmaceutical firms to boost their research and development investments, consequently increasing their reliance on outsourced services. Together, these dynamics are propelling the robust advancement of the Pharmaceutical CDMO sector.

Pharmaceutical Cdmo Market Restaining Factors:

The pharmaceutical CDMO market faces significant challenges due to rigid regulatory frameworks and inconsistent quality benchmarks that vary from one region to another.

The market for Pharmaceutical Contract Development and Manufacturing Organizations (CDMOs) encounters several limitations that could impede its expansion. To begin with, stringent regulatory mandates complicate manufacturing operations, requiring CDMOs to comply with rigorous standards established by health authorities. This situation often results in higher operational costs and extended timelines for product approvals. Additionally, intensifying competition among CDMOs can trigger price wars, undermining profit margins and making it challenging to maintain high-quality services.

Moreover, dependency on external suppliers for raw materials places CDMOs at risk from supply chain disruptions, potentially impacting production schedules. The intricate nature of drug development, especially concerning biologics and personalized medicine, demands sophisticated technology and specialized expertise that not all CDMOs possess. Furthermore, a shortage of skilled professionals within the pharmaceutical industry presents a substantial hurdle in recruiting and retaining qualified staff.

Despite these obstacles, the CDMO sector is positioned for growth as organizations increasingly appreciate the advantages of outsourcing operations to CDMOs. This practice streamlines operations, allows companies to focus on their core competencies, and fosters innovation and partnership in the dynamic pharmaceutical environment.

Segments of the Pharmaceutical CDMO Market

By Workflow

- Commercial

- Clinical

By Product

- Synthesis

- Manufacturing

- Drug

- API

By Application

- Infectious Diseases

- Oncology

- Neurological Disorders

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America