Market Analysis and Insights:

The market for Perfluoro Elastomer (FFKM) was assessed to be worth USD XX billion in 2022, and from 2022 to 2032, it is forecast to increase at a CAGR of XX%, with an expected value of USD XX billion in 2032.

-market-2022-2032-(usd-billion).jpg

)

The growth of the Perfluoro Elastomer (FFKM) industry is influenced by various factors. A significant driver is the rising demand across different sectors including chemical processing, oil and gas, automotive, and semiconductor manufacturing. This market is witnessing substantial expansion attributed to the exceptional qualities of FFKM elastomers, such as their ability to withstand high temperatures, harsh chemicals, and extreme pressure environments. Furthermore, strict regulatory standards regarding employee safety and environmental protection are encouraging the utilization of FFKM materials. The industry is also seeing a surge in demand for FFKM seals and gaskets due to the increasing trend of component miniaturization and complexity in sectors like electronics and automotive. Technological advancements in FFKM production methods are enhancing the quality and performance of these elastomers, thus propelling market growth. Additionally, the burgeoning oil and gas sector in developing nations is expected to offer promising opportunities for the FFKM market. Nevertheless, challenges such as high manufacturing costs and fluctuating prices of raw materials like perfluoroalkoxy (PFA) and tetrafluoroethylene (TFE) could impede the market's expansion to some degree.

Perfluoro Elastomer (FFKM) Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD NA billion |

| Growth Rate | CAGR of NA, during 2022-2032 |

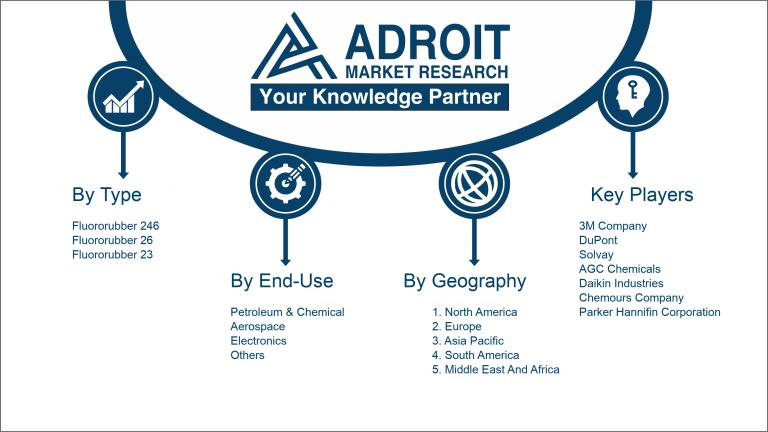

| Segment Covered | By Type ,By End-Use Industry, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | 3M Company, DuPont, Solvay, AGC Chemicals, Daikin Industries, Chemours Company, Parker Hannifin Corporation, Greene, Tweed & Co., Zrunek Gummiwaren, Tecnolan GmbH, Simelio, Stockwell Elastomerics Inc., Saint-Gobain S.A., and Shanghai 3F New Material Co., Ltd. |

Market Definition

Perfluoro Elastomer (FFKM) represents a superior elastomeric material renowned for its remarkable ability to withstand high temperatures, harsh chemicals, and demanding conditions. Its unparalleled sealing and elastomeric characteristics have made it a favored choice in various sectors like aerospace, oil and gas, and semiconductor industries.

Perfluoro elastomer (FFKM) stands as a significant material renowned for its exceptional resistance to chemicals and stability at high temperatures. With its outstanding combination of characteristics, FFKM sees widespread application across industries that face harsh chemical settings, such as in chemical processing, oil and gas operations, and the automotive sector. FFKM seals and gaskets deliver dependable and enduring functionality, effectively preventing leaks and reducing downtime. Its capacity to resist a broad spectrum of chemicals, encompassing acids, solvents, and aggressive fluids, positions it as the preferred option for crucial uses where safety and dependability are paramount. Furthermore, FFKM's durability in withstanding severe temperatures and pressures, coupled with its superior mechanical attributes, guarantees top-tier performance in rigorous environments. In essence, the significance of FFKM lies in its capability to offer dependable sealing solutions in demanding chemical and thermal conditions, thereby amplifying the overall efficiency and safety of diverse industries.

Key Market Segmentation:

Insights On Key Type

Fluororubber 246

Fluororubber 246 dominates the Global Perfluoro Elastomer (FFKM) market due to its superior mechanical properties and excellent chemical resistance. It is widely utilized in many sectors such as automotive, aerospace, and oil & gas for sealing applications where high temperature and severe conditions are encountered.

Fluororubber 26

Fluororubber 26, another member of this category, has strong mechanical qualities and resistance to chemicals and solvents. It finds use in areas such as pharmaceutical, pet food processing, and semiconductor production.

Fluororubber 23

Fluororubber 23, holds a relatively smaller market share. It is preferred in industries where low-temperature flexibility and resistance to chemical attack are critical, such as in medical devices, chemical processing, and electrical components.

Insights On Key End-Use Industry

Petroleum & Chemical

The dominating part in the Global Perfluoro Elastomer (FFKM) market is the Petroleum & Chemical industry. This industry accounts for the largest share of the market due to the high demand for perfluoro elastomers in challenging petroleum and chemical processing environments. Perfluoro elastomers exhibit excellent resistance to aggressive chemicals, extreme temperatures, and high-pressure conditions, making them ideal for use in applications such as seals, gaskets, O-rings, and other critical components in the petroleum and chemical industries.

Aerospace

The Aerospace part of the Global Perfluoro Elastomer (FFKM) market holds significant importance. Perfluoro elastomers find extensive usage in the aerospace industry due to their outstanding properties, including resistance to fuel, hydraulic fluids, and extreme temperatures. They are commonly employed in aerospace applications such as seals, gaskets, O-rings, connectors, and other components, which require excellent reliability and performance.

Electronics

The Electronics part of the Global Perfluoro Elastomer (FFKM) market is another noteworthy part. With the growing electronics industry, the demand for perfluoro elastomers in this sector is increasing. These elastomers provide exceptional resistance to aggressive chemicals and high temperatures, making them highly suitable for use in electronic components, such as seals, gaskets, and O-rings, where protection from harsh environments is crucial.

Others

While the Petroleum & Chemical, Aerospace, and Electronics industries dominate the Global Perfluoro Elastomer (FFKM) market, the Others part comprises various end-use industries that also contribute to the overall demand for perfluoro elastomers. These industries may include pharmaceuticals, automotive, manufacturing, and others, where the unique properties of perfluoro elastomers find applications in specialized areas. Although this part may not have the same level of dominance as the aforementioned industries, it still plays a significant role in the overall market.

Insights on Regional Analysis:

North America

North America is predicted to lead the global Perfluoro Elastomer (FFKM) market because to the presence of important end-use sectors such as automotive, aerospace, and chemical production. Additionally, the area features excellent technology and a well-established research and development infrastructure, which further adds to its supremacy in the market. The growing demand for high-performance elastomers and increasing focus on improving industrial efficiency and productivity drive the adoption of FFKM in this region. Moreover, stringent regulations regarding environmental sustainability and safety standards enhance the utilization of FFKM in various applications.

Latin America

Latin America is projected to witness substantial growth in the global Perfluoro Elastomer (FFKM) market. The region is witnessing an increase in automotive and oil and gas industries, which are major consumers of FFKM. Additionally, rising governmental focus on infrastructure development and industrialization further fuels the demand for FFKM in this region. Moreover, the increased knowledge regarding the benefits of employing FFKM, such as resistance to strong chemicals and severe temperatures, is boosting the market expansion.

Asia Pacific

In the Asia Pacific region, the Perfluoro Elastomer (FFKM) market is likely to show considerable expansion. The region is home to several emerging economies, such as China, India, and Japan, which are major contributors to the market growth. The rising demand for FFKM in sectors such as electronics, automotive, and chemical manufacture, together with the expansion of the manufacturing sector, drives the market growth in this area. Additionally, the increased focus on research & development activities and technical developments further drives the growth of the FFKM market in Asia Pacific.

Europe

Europe is expected to experience considerable growth in the Perfluoro Elastomer (FFKM) market. The region houses a well-developed automotive industry, which is a key consumer of FFKM. Additionally, increased expenditures in infrastructure development and the rising need for effective sealing solutions across various sectors fuel the market expansion in Europe. Furthermore, the presence of stringent regulations regarding environmental sustainability and safety standards encourages the adoption of FFKM in the region.

Middle East & Africa

The Middle East & Africa region is predicted to exhibit consistent expansion in the Perfluoro Elastomer (FFKM) market. The oil and gas sector is a big user of FFKM in this region, fuelling market demand. Moreover, the region is experiencing industrial growth and infrastructural development, which further contributes to the market expansion. Increasing investments in sectors such as chemicals, pharmaceuticals, and automotive also positively impact the FFKM market in the Middle East & Africa region, contributing to its growth.

Company Profiles:

Prominent participants in the worldwide Perfluoro Elastomer (FFKM) sector significantly contribute to fostering innovation and technological progress, while also establishing robust market positions via diversified product ranges and strategic collaborations. Notable contributors in this field encompass prominent entities like DuPont, 3M, and Solvay.

Prominent contributors to the Perfluoro Elastomer (FFKM) sector are 3M Company, DuPont, Solvay, AGC Chemicals, Daikin Industries, Chemours Company, Parker Hannifin Corporation, Greene, Tweed & Co., Zrunek Gummiwaren, Tecnolan GmbH, Simelio, Stockwell Elastomerics Inc., Saint-Gobain S.A., and Shanghai 3F New Material Co., Ltd. These entities play a vital role within the industry landscape, offering a diverse array of perfluoro elastomer products and solutions across multiple sectors. Leveraging their expertise and extensive market presence, they contribute significantly to the advancement and expansion of the overarching Perfluoro Elastomer (FFKM) industry.

COVID-19 Impact and Market Status:

The international market for perfluoro elastomers (FFKM) has experienced notable repercussions as a result of the Covid-19 pandemic, resulting in a decrease in market demand and disturbances in supply chain operations.

The global Perfluoro Elastomer (FFKM) market has been significantly influenced by the impact of the COVID-19 pandemic. The outbreak has resulted in a notable economic downturn and disruptions across manufacturing and supply chains, impeding the market's growth trajectory. As lockdowns and travel restrictions have been enforced on a global scale, industries spanning automotive, aerospace, electronics, and chemicals have witnessed a decrease in demand, leading to reduced production levels and subdued consumption of FFKM products. Furthermore, the prevailing uncertainty and financial limitations stemming from the pandemic have discouraged investments, impeded research and development endeavors, and delayed the introduction of new products into the market. Despite these challenges, the FFKM market is anticipated to recover gradually as economies reopen and industrial activities regain momentum. There is an expected surge in demand for FFKM products as concerted efforts are made to address the virus's spread, including the manufacturing of medical equipment, personal protective gear, and pharmaceutical packaging. Moving forward, the market is projected to witness steady growth in the post-pandemic landscape, buoyed by technological advancements, expanding applications across various sectors, and an increasing emphasis on sustainability and compliance with environmental regulations.

Latest Trends and Innovation:

- DowDuPont Inc. announced on March 4, 2020, that the company completed the separation of its materials science division, which is now known as DuPont de Nemours, Inc. This separation will impact the performance of Dow and DuPont's perfluoro elastomer business.

- Solvay SA acquired Resistenza Gomma Srl on January 22, 2020. This acquisition allowed Solvay to strengthen its position in the perfluoro elastomer market.

- Asahi Glass Co., Ltd. introduced its latest perfluoro elastomer, known as AFLAS, in September 2019. AFLAS offers exceptional chemical resistance and high-temperature stability, making it suitable for various applications.

- Parker Hannifin Corporation launched its advanced perfluoro elastomer compound, Parofluor ULTRA 9975, in June 2019. This compound provides improved sealing performance in extreme conditions.

- 3M Company unveiled its new perfluoro elastomer technology, known as Dyneon PFE 6000, in April 2019. Dyneon PFE 6000 offers enhanced chemical resistance and thermal stability.

- Daikin Industries, Ltd. expanded its perfluoro elastomer production capacity at its facility in Decatur, Alabama, USA, in February 2019. This expansion aimed to meet the growing demand for perfluoro elastomers in various industries.

- Freudenberg Sealing Technologies announced the development of its new perfluoro elastomer family, named 75 FKM 585 plus, in January 2019. This advanced material provides improved chemical and temperature resistance.

- Chemours Company introduced its new line of perfluoro elastomers, known as Viton Extreme ETP-600S and B-630S, in October 2018. These elastomers offer excellent thermal resistance and low-temperature flexibility.

Significant Growth Factors:

The expansion drivers of the Perfluoro Elastomer (FFKM) Market encompass rising requirements from sectors needing high-temperature resilience, chemical endurance, and outstanding sealing characteristics.

The Perfluoro Elastomer (FFKM) industry is poised for substantial expansion in the near future driven by various critical factors. The growing demand for high-performance elastomers across sectors like automotive, aerospace, and electronics is a key driver for the FFKM market. FFKM elastomers are renowned for their exceptional resistance to chemicals, heat, and harsh conditions, thus making them ideal for applications requiring longevity and dependability. Furthermore, the increasing emphasis on sustainable solutions is catalyzing the adoption of FFKM elastomers due to their eco-friendly nature, leading to a transition from conventional elastomers and spurring market growth. Technological advancements have also resulted in the production of innovative FFKM products with superior characteristics, further boosting their demand across industries. Additionally, the expanding usage of FFKM elastomers for sealing and gasketing in sectors such as oil and gas, pharmaceuticals, and chemical processing is anticipated to fuel market expansion. The flourishing automotive industry, particularly the electric vehicle, is creating profitable opportunities for the FFKM market owing to the extensive use of these elastomers in battery, motor, and fuel cell sealing systems. These various factors are forecasted to drive the growth of the Perfluoro Elastomer (FFKM) market in the forthcoming years.

Restraining Factors:

Constraints such as limited access to raw materials and elevated production expenses serve as impediments to the expansion of the Perfluoro Elastomer (FFKM) sector. The global Perfluoro Elastomer (FFKM) Market is on the rise, driven by its exceptional attributes including heat, chemical, and corrosion resistance.

Nonetheless, there are certain obstacles impeding its progress. Principally, the dearth of affordable raw materials for FFKM production is a hurdle for small and medium-sized enterprises, limiting the market's accessibility. Moreover, the intricate production procedures and scarcity of skilled labor inflate production expenses and lead times. Additionally, tight government rules relating to the usage of particular chemicals in FFKM manufacturing provide problems in terms of compliance and cost escalation. The COVID-19 pandemic has further worsened these issues by disrupting supply chains and lowering demand across numerous industries, consequently harming market growth. Nevertheless, the Perfluoro Elastomer (FFKM) Market holds significant promise owing to ened demand from key sectors such as automotive, aerospace, and oil & gas. As industries rebound from the pandemic and seek more effective and long-lasting sealing solutions, the demand for FFKM is predicted to remain strong. Furthermore, ongoing research and development endeavors aimed at driving down production costs and enhancing FFKM's performance characteristics are poised to bolster its market expansion in the foreseeable future.

Key Segments of the Perfluoro Elastomer (FFKM) Market

By Type Market Overview

- Fluororubber 246

- Fluororubber 26

- Fluororubber 23

End-Use Industry Overview

- Petroleum & Chemical

- Aerospace

- Electronics

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America