The estimated USD 1.9 billion global market for pepperoni foods in 2022 is expected to grow at a compound annual growth rate (CAGR) of 1.4 percent to reach a revised USD 2.1 billion by 2028.

.jpg

)

Meat is one of the most consumed food items across the globe. Owing to its affable taste and high nutrient content, meat is consumed widely daily. Pork and beef are the prominent categories of meat which is widely consumed around the world. Pork and beef are the key ingredients of pepperoni food. Therefore, a growing inclination for meat is projected to escalate the pepperoni market growth in the coming years.

Global urbanization is also one of the key factors to augment the demand for pepperoni across the globe. Growth in urbanization directly increases the product reach to the customers along with high exposure to value-added products. Therefore, the urbanization rate is a critical factor that is driving market demand. According to the World Health Organization, the urban population accounted for 54% of the total population in 2014. The global urban population is projected to grow by 1.84% per year until 2020, 1.63% per year between 2020 and 2025, and 1.44% per year between 2025 and 2030.

China and India together account for nearly 35% of the world population. These countries are seen as the biggest potential market by numerous industries. Owing to their large scale population, these countries pose a lucrative marketplace for the food & beverage industry. As the urbanization in these countries is on the rise, global food & beverage chains are eyeing these countries for further business expansion. Global fast-food chains such as pizza hut and dominos are expanding their businesses owing to the growing inclination of consumers for western cuisine and meat products. Pepperoni is one such product. Consumers are increasingly developing taste for this topping which is high in demand in the pizza menus of several top chains.

With the rapid globalization and growing multi-cuisine culture, consumers are willing to adopt international cuisines. Therefore, pepperoni is projected to witness high demand in emerging markets of China and India along with a surge in demand across several parts of Africa.

Pepperoni Foods Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 2.1 billion |

| Growth Rate | CAGR of 1.4 % during 2018-2028 |

| Segment Covered | Product Type, Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Salumificio Fratelli Beretta (Group), MCS Vágóhíd Zrt (Pick Szeged), TULIP FOOD COMPANY A/S, Battistoni Italian Specialty Meats, LLC, Danish Crown Toppings (DK Foods), Pallas Foods Ltd, Franz Wiltmann GmbH & Co. KG. |

Key segments of the global pepperoni foods market report:

Product Type Overview, (Tons) (USD Million)

- Beef pepperoni

- Pork pepperoni

- Others

Distribution Channel Overview, (Tons) (USD Million)

- Convenience stores

- Supermarkets

- Others

Regional Overview, (Tons) (USD Million)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Singapore

- Philippines

- Indonesia

- Thailand

- Vietnam

- Rest of Asia Pacific

- Central & South America

- Brazil

- Mexico

- Columbia

- Rest of Central and South America

- Middle East & Africa (MEA)

- GCC

- Turkey

- South Africa

- Rest of MEA

Reasons for the study

The study highlights the industry trends of pepperoni foods and its penetration patterns in each geography.

- Market growth of meat products and consumption of packaged foods were the key patterns analyzed

- Consumer awareness coupled with the overall spending patterns on food products were considered for analyzing growth driving patterns, which further assisted us for tracking trend variations in major regions.

- Geographic presence and variety of product brands of major players along with their overall market presence are some of the major parameters used for evaluating the industry developments and competition

- The effect of regulations on meat products and other socio-economic factors have also been studied to analyze their impact on market growth of pepperoni foods

What does the report include?

- In-depth levels of market segmentation by product, and distribution channel

- Market segmentation at the global and regional levels

- Market shares for the base year 2018 and forecast year 2026 for each of the segmentation categories and market sizing from 2015 to 2026

- Global player profiles based on parameters including business overview, financial performance, product portfolio, and recent business strategies

- Evaluation of market competition based on the key player positioning and use of analytical models such as Porters Five Forces analysis and market value chain

- In-depth market dynamics such as growth drivers, growth restraints, and opportunities

Who should buy this report?

The audience that would benefit from purchase of this holistic market research study include industry players and investors operating in the areas of the FMCG sector. The report will highly benefit:

- Company executives operating in meat processing, packaging, and product distribution

- Regional heads and company strategy planning managers that are looking for new ventures and opportunities

- Financial investors & managers and venture capitalists that are interested in understanding forecast trends of pepperoni foods sector

- Analysts & researchers, educationalists, academic and government authorities, regulatory organizations, etc.

Frequently Asked Questions (FAQ) :

Global pepperoni foods market is highly fragmented with the presence of wide variety of players competing in the market. The global pepperoni foods market value chain comprise numerous manufacturers, wholesale traders, distributors, and retailers catering to the constantly rising demand for food. The rise in meat consumption globally owing to increase in disposable incomes is majorly driving the global market.

Due to this, many companies are enhancing their geographical footprint and gaining competitive advantage over other players through mergers and acquisitions, joint ventures and launch of new products to enhance their competitiveness. Tyson Foods, Danish Crown Toppings, Tulip Food Company, Franz Wiltmann GmbH & Company KG, Bertocchi, Battistoni, and John Morell are some of the key industry players operating in the global pepperoni foods market value chain. This is majorly due to their broad product portfolio, vast geographical presence, and their strategic product launches and acquisitions.

Launch of new products, acquisitions and innovations were some of the major strategies implemented by the key players in the industry. Food manufacturers collect the total produce from agriculturalists and inculcate a range of nutritional additives for creating packaged foods. Processed foods have a relatively longer shelf life than fresh produce or meat, owing to the added preservatives. These foods are also available in frozen, dehydrated or canned forms that helps in preserving the food freshness.

This is majorly attributed to its broad product portfolio and the key strategies adopted by the firm to increase its competitiveness and maintain its position in the market. There is tough competition among the market players over the pork and beef quality and in turn the quality of the food product. Thus, pepperoni food manufacturers and the vendors are coming up with various innovations leading this market to grow substantially.

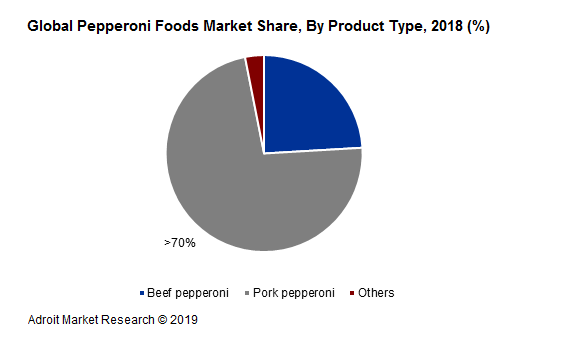

Pepperoni is the most popular pizza topping across the world and is especially famous in the United States. Beef pepperoni is considered as a great choice of topping on pizza and is very common among American pizzerias. It is a thinly sliced topping which adds to the taste of pizza. It is also used as a filling in pepperoni rolls and is used to make different types of submarine sandwiches. Owing to its soft composition along with a slightly smoky flavor, beef pepperoni is a much-preferred topping on several dishes.

Pepperoni is also made by mixing pork with beef meat to produce a refreshing taste. Pepperoni, also known as an Italian-American dish, is widely used as a pizza topping as it can complement with any ingredient. Owing to the high popularity of beef pepperoni topping, the segment is projected to witness steady growth over the forecast period.

Pork is one of the most consumed meat-type across the globe. More than one-third of the global population eats pork. It is widely used in a variety of dishes that are consumed daily such as pork lunchmeat, ham, bacon, pork sausage among others. Pork is also eaten fresh in the form of chops, ribs, roasts to name a few. Pepperoni made from pork falls under the category of processed pork sausage. Various pepperoni dishes made from pork such as pepperoni sticks, pizza pork chops, potato hash, sandwich, pizza are widely consumed across the globe. Therefore, demand for pepperoni pork is high in several parts of the globe. Pork and beef are also often blended to produce pepperoni slices.

In 2018, several big retail chains of pizza also struck off pork pepperoni pizzas from its menu citing lack of demand and unavailability of good quality meat. Also, the religious sensibilities of customers is a key factor that has hampered the demand for pork in some countries, especially Islamic countries. Despite the demand uncertainties, high demand from the US and European countries is projected to maintain the demand of pork pepperoni over the forecast period.

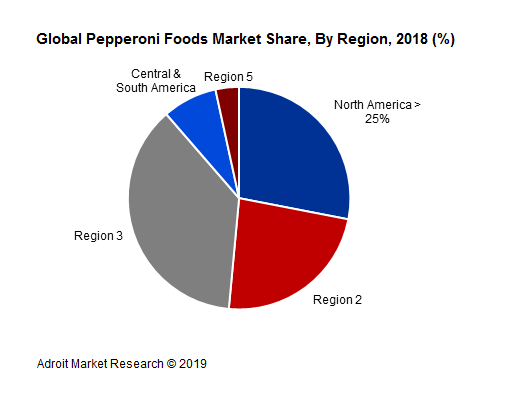

Europe has been one of the most prominent producers and consumer of meat across the globe. In Europe, pepperoni is eaten in the form of salami which is mainly used in various types of sandwiches and salads. Furthermore, beef is the most preferred meat type in the region with more than 40% of the consumption in most of the European countries. Pizza, being an Italian American dish is also consumed widely across countries like Italy, France, Germany, and Spain along with the rest of Europe.

Pizza is one of the favorite fast food dishes in North America. It is estimated that more than 3 billion pizzas are sold in the US every year. On average, an American tends to eat pizza at least once in a week. Out of several toppings available on pizza crust, pepperoni is the favorite topping of the country. Pepperoni sales are mainly driven by pizza sales in the US. In 2018, out of the total pizza orders, pepperoni pizzas accounted for over 30% of the total orders. The pizza industry in the US is projected to expand at a steady paced growth rate, which in turn is expected to drive the pepperoni demand in the US. Furthermore, growing adoption for pepperoni foods in home cooking is likely to support the rise in the pepperoni foods market demand in the future.

However, with the growing popularity of vegan culture in North America and Europe, sales of all categories of meat products are projected to slow down in the coming years. However, as the pizza consumption is significant, the overall pepperoni demand is likely to remain intact during the forecast period. China is one of the potential growth markets for the pepperoni industry. Considering the rapid growth in per capita income and subsequent economic development, the country is surely the next big market for pepperoni makers.