Packaging Robots Market Analysis and Insights:

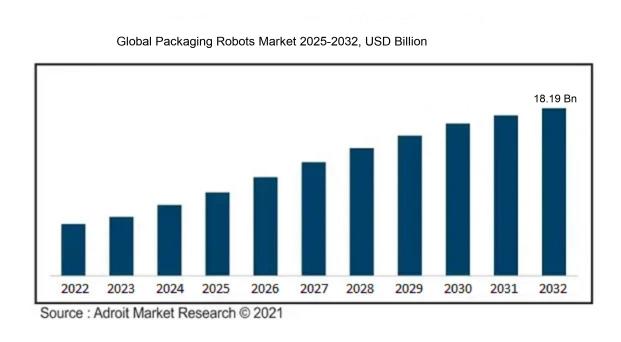

In 2024, the worldwide packaging robots market was estimated to be worth USD 7.06 billion. The market is anticipated to expand at a compound annual growth rate (CAGR) of 13.1% from USD 8.13 billion in 2025 to USD 18.19 billion by 2032.

The growth of the Packaging Robots Market is significantly influenced by various critical factors, including the rising demand for enhanced efficiency and automation within manufacturing systems, particularly in industries such as food and beverage, pharmaceuticals, and consumer products. Escalating labor costs and an increasing scarcity of qualified workers are driving sectors to implement robotic solutions that boost productivity while minimizing operational costs. Furthermore, technological advancements in robotics—especially in artificial intelligence and machine learning—are paving the way for more advanced automation options, thereby expanding the range of applications for packaging robots. The ened focus on safety and hygiene in product handling, especially in the wake of the pandemic, is also contributing to the growing adoption of these systems. Additionally, concerns over sustainability are compelling organizations to refine their packaging processes, and robots are essential in achieving reductions in waste and enhancing energy efficiency across production lines. Consequently, this amalgamation of factors is propelling significant growth within the packaging robots market.

Packaging Robots Market Definition

Automated packaging robots are sophisticated systems engineered to effectively manage, categorize, and package goods for delivery. They improve both efficiency and precision across multiple sectors by optimizing the packaging workflow.

In today's manufacturing and logistics sectors, packaging robots are instrumental in boosting efficiency, precision, and overall productivity. By automating monotonous tasks, these robots simplify the packaging workflow, cut labor expenses, and diminish the likelihood of human mistakes, thereby enhancing quality assurance. Their capabilities also accelerate processing times, enabling firms to respond adeptly to rising consumer demand. Additionally, packaging robots play a vital role in increasing workplace safety by handling dangerous duties and lowering the risk of injuries among workers. In an environment where competitiveness is paramount, the adoption of packaging robots is vital for streamlining operations, optimizing spatial resources, and promoting sustainability through waste reduction.

Packaging Robots Market Segmental Analysis:

Insights On Robot Type

Cobots

Cobots, or collaborative robots, are anticipated to dominate the Global Packaging Robots Market due to their versatile functionality and cost-effectiveness. They can work alongside human workers without the need for additional safety barriers, making them especially suitable for environments where space and flexibility are crucial. The increase in demand for automation, particularly in small to medium-sized enterprises, is propelling the adoption of cobots. Their user-friendly interface and ease of programming enable quick deployment, aligning with the industry's increasing focus on efficiency, reducing operational costs, and enhancing productivity. With advancements in AI and machine learning, cobots can adapt and learn from their tasks, further solidifying their position within the market.

Delta Robots

Delta robots are known for their exceptional speed and precision, making them particularly effective for high-speed packaging applications, especially in industries like food and pharmaceuticals. Their unique design allows for rapid movement in a three-dimensional space, optimizing workflow in packaging lines. However, the initial investment costs and complexity in setup could limit their adoption compared to other solutions. Nonetheless, for companies that prioritize speed and have the resources for these investments, delta robots offer unmatched performance, particularly in tasks that require precise handling and rapid cycle times.

Scara Robots

Scara robots offer a balance of speed and affordability, making them a popular choice for packaging tasks that require both precision and efficiency. Their distinctive design allows for efficient lateral movement, making them ideal for assembly, packaging, and pick-and-place operations. While they may not be as fast as delta robots, Scara robots still provide sufficient speed for many applications. Additionally, they are relatively easy to program and implement, contributing to their appealing nature for manufacturers looking to automate their packaging processes without extensive infrastructure changes.

Others (CRX Robots)

The CRX robots represent a new generation of collaborative robots designed for a wide array of applications beyond conventional packaging tasks. They offer enhanced capabilities such as quick adaptability to various packages and seamless integration with existing workflows. However, they are still emerging in popularity compared to established types like cobots and Scara. As companies begin to recognize their flexibility and ability to perform in diverse settings, they may witness growth in adoption. While these robots may currently be lesser-known, the innovative technology behind them may enable them to capture a larger market share in the future.

Insights On Operation Type

Pick and Place

Pick and Place is expected to dominate the Global Packaging Robots Market due to its versatile application capabilities and growing adoption in various industries, including food and beverage, electronics, and consumer goods. This is particularly favored for its efficiency in handling a wide range of products, contributing to reduced operational costs and enhanced production speeds. Moreover, advancements in robotic technology and artificial intelligence have further improved the precision and speed of Pick and Place robots, allowing manufacturers to meet increasing consumer demand quickly and accurately. The automation trend, coupled with the rising need for flexible and agile production lines, solidifies this ’s leading position in the market.

Case Packaging

Case Packaging is another critical player in the Global Packaging Robots Market, witnessing significant growth as companies seek to streamline their packaging processes. This functionality provides high-speed bulk packaging solutions, particularly for products that require transportation in bulk quantities, such as beverages and household goods. Manufacturers increasingly prefer automated case packers as they reduce labor costs and improve packing accuracy and speed. The efficiency gained from robotic case packing systems enhances inventory management and minimizes waste, making it an attractive option for businesses looking to boost productivity.

Palletizing

Palletizing offers essential operational benefits that appeal to companies focusing on logistics efficiency and warehouse management. This type of operation involves the automated stacking of products onto pallets for storage and shipping, enabling increased load capacity and ease of transportation. With the rise in e-commerce and the need for higher throughput in warehouses, the demand for palletizing robots has surged. Automation in palletizing allows manufacturers to maintain consistent production and shipping schedules while minimizing the physical strain on workers, making this category an important component of the packaging robots market.

Others (Handling Products)

The Others category encompasses various handling operations not classified under the primary types but remains an integral part of the packaging process. This includes several specialized functions like sorting, inspecting, and product assembly that enhance the overall efficiency of packaging operations. Industries across sectors leverage handling robots for reducing manual labor and ensuring higher product quality through automation. By integrating these handling systems, companies optimize their workflows, balance energy consumption, and improve their output quality, making this a vital aspect of the broader packaging robots landscape. Insights On Industry

Food and Beverage

The Food and Beverage industry is expected to dominate the Global Packaging Robots Market. One of the primary drivers for this growth is the increasing demand for automation in food processing and packaging to boost operational efficiency, maintain quality, and adhere to strict hygiene standards. As consumer preferences shift towards convenience, packaged foods are on the rise, necessitating efficient and flexible packaging solutions. Additionally, advancements in robotic technology, such as improved vision systems and AI integration, allow for better handling and processing of varying food items, further fueling the trend. As such, investments in this industry are consistently on the rise, leading to its anticipated dominance in the market.

Pharmaceutical

In the Pharmaceutical industry, automation in packaging is crucial for compliance with stringent regulations, ensuring that products are correctly labeled and sealed. Pharmaceutical companies are increasingly adopting robotics to enhance production efficiency and accuracy in the packaging process. This trend is driven by the ongoing growth in the biopharmaceutical sector, where the demand for reliable and secure packaging solutions for various drug forms is critical. Furthermore, the need for traceability and the quick turnaround of medication increases the role of robotic systems, allowing pharmaceutical firms to meet the rising expectations for packaging speed and quality.

Consumer Goods

The Consumer Goods sector is experiencing a notable shift towards automation, with packaging robots playing a critical role in streamlining operations. Factors such as the rise of e-commerce and changing consumer preferences for easy-to-use, attractive packaging drive the demand for innovative and efficient packaging solutions. Retail brands are investing in robotic technology to enhance supply chain efficiency and reduce labor costs, while also providing better flexibility to adapt to changing market trends. With the increasing focus on sustainability, robotic systems tailored for eco-friendly packaging are becoming integral to operations, further bolstering this 's growth.

Electronics

In the Electronics industry, the need for precise and efficient packaging is paramount, especially given the delicate nature of electronic components. Packaging robots are increasingly utilized to ensure accuracy in handling and packing, which is crucial to avoid damage during transit. The rapid pace of technological advancement and the increase in consumer electronics demand are driving the adoption of automated packaging solutions. Moreover, manufacturers are seeking faster production cycles and reduced labor costs, which further fuels the growth of robotic systems specifically designed for the electronics sector, allowing companies to maintain a competitive edge in a fast-evolving market.

Others (Retail)

In the Others category, which includes various retail sectors, the demand for packaging robots is growing as businesses seek to improve operational efficiencies and cater to shifting consumer behavior towards online shopping. Retailers are focused on enhancing their packaging processes to ensure that items are shipped promptly and securely. Automation helps in managing the increased volume of orders and the varied nature of products included in packaging. Moreover, the growing emphasis on sustainable packaging drives the need for robotic solutions that can efficiently handle eco-friendly materials, positioning this as a growing player in the market for packaging automation technologies.

Global Packaging Robots Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Packaging Robots market due to a robust growth trajectory driven by rapid industrialization, increasing automation in manufacturing, and the burgeoning e-commerce sector. Countries like China, Japan, and India are heavily investing in advanced technologies, leading to a higher demand for packaging automation. The region's substantial manufacturing base and expanding logistics networks reinforce the necessity for efficient packaging solutions. Additionally, the rising consumer expectations for faster delivery and higher quality packaging are propelling corporations to adopt packaging robots, making Asia Pacific the leading region in this market.

North America

North America is a strong contender in the Global Packaging Robots market, chiefly due to its advanced technological landscape and high adoption rates of automation in industries such as food and beverage, pharmaceuticals, and consumer goods. The presence of established companies and significant investment in research and development contribute positively to market growth. Moreover, stringent regulations concerning safety and efficiency encourage manufacturers to seek automated solutions, thereby boosting demand for packaging robots in the region.

Europe

Europe is characterized by its stringent regulatory environment, which fosters automation to meet high safety and quality standards in packaging. The region is witnessing growth driven by the requirements of sustainable packaging and eco-friendly solutions. Many European manufacturers are investing in innovative technologies and retrofitting existing systems with robotic solutions to enhance productivity. This trend is particularly evident in industries like pharmaceuticals and food production, where packaging efficiency is critical.

Latin America

Latin America is gradually embracing automation in packaging, propelled by increased investment in the manufacturing sector and the growing influence of e-commerce. Although the market is not as mature as in North America or Europe, there’s a rising trend for improved operational efficiency and reduced costs. The region's demand for packaging robots is expected to rise as companies recognize the benefits of automation in meeting customer demands and enhancing supply chain capabilities.

Middle East & Africa

The Middle East & Africa region is still in the nascent stages of adopting packaging robots. However, there is a significant growth opportunity driven by rising urbanization and the expansion of various industries, including food and beverage and consumer goods. Governments in the region are increasingly aware of the need for automation to enhance productivity. As investments in infrastructure and technology continue to rise, the packaging robots market is likely to see substantial growth in the coming years.

Packaging Robots Competitive Landscape:

Prominent participants in the global packaging robots sector, encompassing both producers and technology suppliers, foster innovation by implementing sophisticated automation solutions and forming strategic collaborations. These efforts significantly boost efficiency and productivity within packaging operations. Their input not only sets industry benchmarks but also affects market dynamics, establishing them as frontrunners in the advancing realm of packaging technology.

The major participants in the Packaging Robots Market consist of ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Epson Robots, Omron Corporation, Kawasaki Heavy Industries, Bayer, Seiko Epson Corporation, Mitsubishi Electric Corporation, Schneider Electric SE, Universal Robots A/S, Bosch Rexroth AG, Denso Robotics, and Paris Packaging.

Global Packaging Robots COVID-19 Impact and Market Status:

The Covid-19 pandemic notably hastened the integration of packaging robots within the worldwide market, driven by increased needs for automation and efficiency to address labor shortages and safety issues.

The COVID-19 pandemic had a profound impact on the packaging robots sector, catalyzing expansion due to an increased reliance on automation in light of labor shortages and disruptions in the supply chain. With the surge in e-commerce and online shopping, businesses needed efficient packaging solutions to address growing consumer demands while minimizing direct human interaction. This evolving landscape led to a swift embrace of automation technologies, including sophisticated robotics, which enhanced operational efficiency and allowed for consistent production during public health crises. Moreover, the push for improved safety measures and reduced workforce density within facilities further fueled investments in robotic packaging systems. By boosting speed, accuracy, and sanitation in packaging operations, these robots became essential in industries such as food and beverage, pharmaceuticals, and consumer products. As a result, the packaging robots market is expected to continue to grow, propelled by ongoing technological innovations and a lasting inclination toward automated solutions in the post-pandemic era.

Latest Trends and Innovation in The Global Packaging Robots Market:

- In June 2023, ABB announced its acquisition of a majority stake in the digital robotics software company, Perception Robotics, to enhance its portfolio in automation and packaging solutions. This acquisition aims to strengthen ABB's capabilities in integrating advanced AI and machine learning technologies into packaging processes.

- In March 2023, FANUC launched its new line of collaborative robots specifically designed for the packaging industry, known as the CRX series. These robots feature enhanced safety measures and user-friendly programming, allowing for efficient deployment in various packaging environments.

- In January 2023, KUKA introduced its "KMP" series of mobile platforms aimed at automating packaging logistics. This innovation allows for seamless movement of goods within packaging facilities, reducing manual handling time and improving overall operational efficiency.

- In October 2022, the packaging equipment manufacturer Schubert announced a partnership with the digital solutions provider, Siemens, to jointly develop a new generation of smart packaging machines that will leverage IoT technology for real-time data monitoring and predictive maintenance.

- In April 2022, the company Universal Robots expanded its UR cobot series by launching the UR16e model, which is specifically optimized for heavy payload applications in the packaging industry, enabling businesses to automate more strenuous packaging tasks.

- In February 2022, Yaskawa Electric Corporation launched the Motoman-HC series of collaborative robots targeted at packaging and palletizing applications, providing enhanced interoperability and intelligence for smart packaging solutions.

- In September 2021, packaging giant Tetra Pak announced a joint venture with Alibaba Cloud for developing smart packaging technology that leverages artificial intelligence and big data analytics to optimize resource use in the supply chain.

Packaging Robots Market Growth Factors:

The growth of the Packaging Robots Market is fueled by innovations in automation technology, a ened need for effective packaging solutions, and a growing focus on minimizing labor expenses while enhancing precision in manufacturing processes.

The Packaging Robots Market is witnessing remarkable expansion, fueled by several pivotal elements. Firstly, the escalating need for automation within manufacturing and distribution sectors boosts operational efficiency while lowering labor expenses. In the quest for ened productivity, packaging robots optimize workflows, reduce human error, and accelerate processing times. Furthermore, the surge in e-commerce and the necessity for effective order fulfillment have spurred investments in automated packaging technologies to handle increased goods volume efficiently. Technological advancements in robotics, particularly the incorporation of artificial intelligence, machine learning, and the Internet of Things (IoT), empower packaging robots to deliver enhanced accuracy and versatility across various applications. Additionally, the rising focus on sustainability prompts businesses to adopt greener packaging methods, with robots playing a crucial role in material optimization and waste reduction. The food and beverage industry significantly influences market growth, as automation in packaging helps comply with strict hygiene regulations and navigate complex supply chains. Lastly, the increasing number of small and medium-sized enterprises (SMEs) embracing automation solutions opens new avenues for market growth, as these businesses aim to stay competitive in a fast-changing environment. Together, these driving forces are shaping the robust upward trajectory of the Packaging Robots Market.

Packaging Robots Market Restaining Factors:

The Packaging Robots Market faces significant challenges due to the substantial upfront investments required and the intricate nature of incorporating robotic technologies into established manufacturing workflows.

The Packaging Robots Market encounters various obstacles that may impede its development. The substantial initial costs associated with robotic systems can discourage small and medium-sized businesses from embracing this technology, which restricts market growth potential. Moreover, there is a lack of adequately trained personnel to program and maintain these sophisticated systems, complicating effective deployment. Potential users may also hesitate due to concerns regarding the reliability and performance of robots in different packaging contexts, as well as the disruptive challenges that may arise when transitioning from manual to automated operations. Furthermore, certain industries might view the adoption of robotics as a threat to job security for workers, prompting pushback from labor unions. The necessity for ongoing maintenance and technical assistance further complicates operations and inflates costs. Additionally, the rapid pace of technological advancements compels companies to make frequent investments in upgrades to stay competitive, putting a strain on their financial resources. Nevertheless, the continuous progression of robotics technology, coupled with the growing demands for efficiency and productivity across sectors, is driving innovations that significantly enhance the functionality of packaging robots, ultimately creating substantial long-term growth prospects.

Key Segments of the Packaging Robots Market

By Robot Type

• Delta Robots

• Scara Robots

• Cobots

• Others (CRX Robots)

By Operation Type

• Pick and Place

• Case Packaging

• Palletizing

• Others (Handling Products)

By Industry

• Food and Beverage

• Pharmaceutical

• Consumer Goods

• Electronics

• Others (Retail)

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America