Market Analysis and Insights:

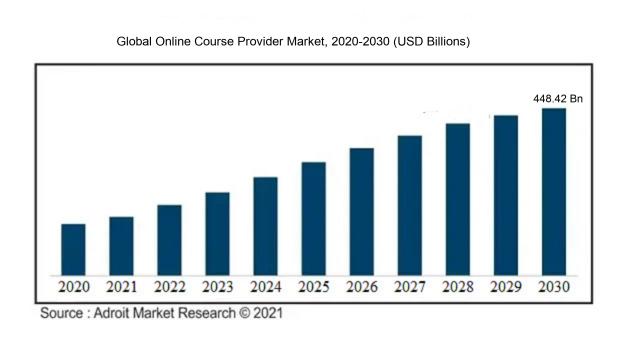

The market for global online course providers was estimated to be worth USD 249.94 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 29.85%, with an expected value of USD 448.42 billion in 2030.

The burgeoning online course provider industry is propelled by multiple influences. Primarily, the surge in demand for adaptable and tailored learning avenues is propelling the expansion of online educational platforms. Driven by hectic schedules and limited access to conventional educational establishments, people are gravitating towards online resources to enhance their skill sets and acquire new knowledge. Furthermore, the rapid evolution of technology and the widespread proliferation of high-speed internet have facilitated seamless access to online coursework. The impact of the COVID-19 pandemic has expedited the adoption of online learning as educational institutions were compelled to transition to remote instructional approaches. Moreover, the cost-efficiency of online courses relative to traditional academia serves as a pivotal driver in the market. Online learning often presents lower tuition fees and removes the financial burdens associated with commuting and accommodations. Additionally, the extensive array of course selections available online that encompass a diverse spectrum of subjects and disciplines resonates with a broad demographic of learners. These catalyzing forces are poised to persistently mold the trajectory of the online course provider sector in the foreseeable future.

Online Course Provider Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 448.42 billion |

| Growth Rate | CAGR of 29.85% during 2024-2030 |

| Segment Covered | By Type, By Application, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Udemy, Coursera, edX, Skillshare, LinkedIn Learning, Khan Academy, Pluralsight, Codecademy, FutureLearn, and MasterClass. |

Market Definition

An online learning platform functions as a medium or entity that delivers educational courses or opportunities for learning to individuals via the world wide web. These platforms commonly present a diverse array of topics and structures to accommodate the varied requirements and curiosities of learners on a global scale.

In the current digital era, online course providers play a pivotal role in enabling individuals to expand their knowledge and skills conveniently from their homes. Acting as a medium for disseminating educational materials, these providers eliminate obstacles like physical distance and time restrictions. They afford learners the flexibility to manage their study schedules independently, allowing them to progress at their preferred pace and convenience. Furthermore, online course providers frequently partner with distinguished professionals and institutions, granting learners access to top-tier educational materials not easily accessible elsewhere. Through offering a diverse array of courses spanning multiple fields, these platforms promote continuous learning and support individuals in advancing their expertise and competencies over time.

Key Market Segmentation:

Insights On Key Type

Cloud-based

The Cloud-based type is expected to dominate the Global Online Course Provider Market. Cloud-based platforms provide greater accessibility, flexibility, and scalability compared to web-based platforms. With cloud-based online course providers, individuals can access learning materials and resources from any device with internet connectivity. Moreover, cloud-based platforms offer convenient storage and backup options, ensuring that learners' progress and data are not lost. Additionally, cloud-based providers often offer seamless integration with other digital tools and technologies, enhancing the overall learning experience. These advantages make cloud-based platforms the preferred choice for online learners, leading to their dominance in the Global Online Course Provider Market.

Web-based

Although the Cloud-based type is expected to dominate the Global Online Course Provider Market, the web-based type still holds significance. Web-based platforms offer online courses directly through web browsers, without the need for additional software or downloads. They are more suitable for individuals with limited internet access or older devices that may not support cloud-based solutions. However, web-based platforms may have limitations in terms of accessibility, as they require a stable internet connection and may not be as responsive as cloud-based alternatives. Nevertheless, web-based providers cater to a specific of learners who prioritize simplicity and ease of use over advanced features and functionalities.

Insights On Key Application

Large Enterprises

The Large Enterprises application is expected to dominate the Global Online Course Provider Market. Large enterprises have a significant advantage in terms of resources, budget, and infrastructure compared to SMEs. They can afford to invest in comprehensive online course solutions and offer a wide range of courses to cater to different needs. With their strong financial position, large enterprises can also leverage their brand reputation and marketing capabilities to attract a large user base. Additionally, large enterprises often have a well-established employee training and development program in place, making them more likely to partner with online course providers.

SMEs

While Large Enterprises are expected to dominate the Global Online Course Provider Market, SMEs also represent a promising share. SMEs are the backbone of many economies and are increasingly recognizing the value of online courses for upskilling their workforce. With limited resources and budget constraints, SMEs may prefer more affordable online course options that offer suitable training solutions for their employees. Online courses targeted specifically towards SMEs can address their unique needs and challenges, providing practical knowledge and skills that are applicable to their day-to-day operations. The growing trend of remote work and the need for distance learning due to the COVID-19 pandemic further enhance the relevance and demand for online courses among SMEs.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Online Course Provider market. This region has a well-established education system, strong technological infrastructure, and a highly developed digital ecosystem. Additionally, North America is home to several prominent online education providers and platforms, which gives it a competitive advantage in terms of content, delivery, and user base. The region also has a high level of internet penetration and a favorable regulatory environment that promotes online learning. Moreover, North America has a strong demand for continuous education and upskilling, driven by the need to adapt to emerging technologies and evolving job market requirements.

Latin America

Latin America, on the other hand, has significant growth potential in the Global Online Course Provider market. The region has a large population, increasing internet penetration, and rising adoption of smartphones and other digital devices. Additionally, there is a growing demand for online education in Latin America, driven by factors such as limited access to quality education, a need for flexible learning options, and a desire to acquire new skills for better job prospects. However, Latin America still faces challenges related to the digital divide, uneven access to technology, and limited awareness about online learning opportunities.

Asia Pacific

In the Asia Pacific region, online course providers are witnessing robust growth due to various factors. This region has a large population, strong economic growth, increasing internet penetration, and government support for online education initiatives. Moreover, countries like China and India, with their vast populations and growing middle class, present significant market opportunities for online course providers. However, the Asia Pacific region is diverse in terms of education systems, languages, and cultural preferences, which may require localized content and delivery methods.

Europe

Europe has a well-developed education sector and a high level of internet penetration, which creates a conducive environment for online course providers. The region also has a strong emphasis on lifelong learning and continuous professional development, driving the demand for online courses. However, the European market is fragmented due to the presence of multiple languages and distinct education systems. Localized content and targeted marketing strategies are crucial for success in this region.

Middle East & Africa

The Middle East & Africa region has a growing demand for online education, driven by factors such as a young population, rising internet penetration, and a need for flexible learning options. However, the market is still emerging and faces challenges related to digital infrastructure, access to technology, and cultural barriers to online learning. Collaboration with local partners and understanding the unique needs of the region will be essential for online course providers to establish a strong presence in this market.

Company Profiles:

Major participants in the worldwide online course provider sector include leading educational technology firms and universities. They provide a diverse array of online courses covering various subjects and fields, addressing the distinct learning requirements of individuals and organizations globally. These entities prioritize the delivery of top-notch educational materials, leveraging cutting-edge technology and forming key alliances to maintain competitiveness in the continuously expanding online education landscape.

Prominent companies in the online course provider sector encompass Udemy, Coursera, edX, Skillshare, LinkedIn Learning, Khan Academy, Pluralsight, Codecademy, FutureLearn, and MasterClass. These entities have established renown and visibility within the field, delivering a diverse array of online educational offerings to global individuals and entities. Each of these significant contributors adopts distinctive strategies and caters to specific target demographics, furnishing comprehensive and pioneering digital learning solutions for students, professionals, and lifelong learners. They actively contribute to the advancement and transformation of online learning, fostering accessible and flexible opportunities for individuals to enhance their knowledge and competencies.

COVID-19 Impact and Market Status:

The global spread of the Covid-19 pandemic has resulted in a notable increase in the request for online courses on a global scale.

The global pandemic caused by COVID-19 has had a profound impact on the market for online education providers. With the implementation of lockdowns and social distancing measures worldwide, traditional educational institutions swiftly transitioned to remote learning methods, leading to a surge in demand for online courses. This increased demand was further fueled by individuals seeking to enhance their skills or explore new career paths amidst the economic downturn. Consequently, the online education sector experienced unprecedented growth and continues to flourish. However, the ened demand has brought about a proliferation of online course providers, intensifying competition within the industry. Established providers have diversified their course offerings to cater to varying demographics, while new players have entered the market, contributing to an already crowded landscape. In response to this competitive environment, online education providers are concentrating on elevating the quality of their programs, integrating interactive elements, and offering accessible and flexible learning options to sustain their competitive advantage. In essence, the COVID-19 pandemic has expedited the adoption of online learning and reshaped the online education market, offering both opportunities and obstacles for industry stakeholders.

Latest Trends and Innovation:

-Coursera acquires Rhyme Softworks, a hands-on learning platform - January 2021.

-Udemy raises $50 million in funding led by Benesse Holdings - February 2020.

-MasterClass raises $100 million in Series E funding - May 2021.

-LinkedIn acquires Lynda.com, an online learning platform - April 2015.

-Pluralsight acquires GitPrime to help developers improve their workflows - September 2019.

-Skillshare raises $66 million in Series D funding - January 2021.

-Udacity announces "nanodegree plus" program, guaranteeing job placement - October 2016.

-FutureLearn partners with SEEK to offer online courses to job seekers - November 2020.

Khan Academy partners with Disney to bring engaging educational content to kids - June -2021.

-365 Data Science launches a comprehensive data science program - March 2020.

Significant Growth Factors:

The online course provider market is experiencing growth due to several key factors such as the rising need for skill enhancement, improved availability, and advancements in technology.

The market for online course providers has experienced notable expansion in recent years due to various important factors. Firstly, the increasing utilization of e-learning and distance education in different industries and academic institutions has driven the demand for online course providers. This trend has been further accelerated by the COVID-19 pandemic, which prompted the transition from conventional classroom learning to remote education.

Secondly, the convenience and flexibility inherent in online courses have attracted learners from diverse age groups and backgrounds, enabling them to engage with educational materials and attend classes at their own pace and from any location. Additionally, the widespread availability of internet connectivity and the proliferation of mobile devices have increased the accessibility of online courses to a broader demographic, especially in developing nations. Furthermore, online course providers have leveraged technological advancements, such as virtual reality and artificial intelligence, to enrich the learning experience and offer personalized educational opportunities. Moreover, the growing demand for upskilling and continuous learning in today's dynamic job market has motivated individuals and professionals to pursue online courses to acquire new skills and remain competitive. Lastly, online courses often come at a significantly lower cost compared to traditional in-person education, making them an appealing choice for budget-conscious learners. To sum up, key drivers of growth in the online course provider market include the rising acceptance of e-learning, convenience and flexibility, enhanced accessibility, technological progress, the need for upskilling, and cost efficiency.

Restraining Factors:

Challenges facing the online course provider market include the accessibility of complimentary online courses, restricted hands-on experience, and absence of formal certification.

The global market for online course providers has experienced rapid expansion and widespread adoption due to technological advancements and the increasing demand for flexible and convenient learning options.

Nevertheless, there are several challenges that could impede the market from reaching its full potential for further growth. Firstly, limited internet infrastructure in certain regions poses a significant obstacle as online courses depend heavily on stable and high-speed internet connections. Moreover, the digital divide, particularly prevalent in developing countries, restricts access to online courses for individuals lacking computers or smartphones. The credibility and quality of online courses also present a noteworthy concern, with varying content and instructional designs raising doubts among potential learners regarding the effectiveness of these programs. Additionally, the absence of personalized interaction and face-to-face engagement in online courses may dissuade learners who excel in traditional classroom settings.

Lastly, the lack of recognition and accreditation of online courses by some employers and educational institutions can diminish their value in the job market and for further academic pursuits. Despite these obstacles, the online course provider market holds substantial growth potential. Efforts to enhance internet connectivity, bridge the digital divide, ensure course quality, and expand accreditation opportunities can help overcome these challenges and advance the accessibility and acceptance of online education.

Key Segments of the Online Course Provider Market

Type Overview

• Cloud-based

• Web-based

Application Overview

• Large Enterprises

• Small and Medium Enterprises (SMEs)

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K.

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America